Cybersecurity Market Review

2elXGia

2elXGia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

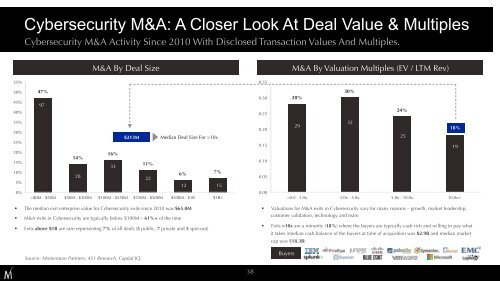

<strong>Cybersecurity</strong> M&A: A Closer Look At Deal Value & Multiples<br />

<strong>Cybersecurity</strong> M&A Activity Since 2010 With Disclosed Transaction Values And Multiples. <br />

M&A By Deal Size<br />

M&A By Valuation Multiples (EV / LTM Rev)<br />

55%<br />

0.35<br />

50%<br />

45%<br />

40%<br />

47%<br />

97<br />

0.30<br />

0.25<br />

28%<br />

30%<br />

24%<br />

35%<br />

30%<br />

25%<br />

$213M Median Deal Size For >10x<br />

0.20<br />

0.15<br />

29<br />

32<br />

25<br />

18%<br />

19<br />

20%<br />

15%<br />

10%<br />

5%<br />

14%<br />

28<br />

16%<br />

33<br />

11%<br />

22<br />

6%<br />

7%<br />

12 15<br />

0.10<br />

0.05<br />

22<br />

11<br />

0%<br />

>$0M - $50M $50M - $100M $100M - $250M $250M - $500M $500M - $1B $1B+<br />

0.00<br />

>0.0 - 3.0x 3.0x - 5.0x 5.0x - 10.0x 10.0x+<br />

§<br />

§<br />

The median exit enterprise value for <strong>Cybersecurity</strong> exits since 2010 was $65.0M<br />

M&A exits in <strong>Cybersecurity</strong> are typically below $100M – 61%+ of the time<br />

§<br />

Valuations for M&A exits in <strong>Cybersecurity</strong> vary for many reasons – growth, market leadership,<br />

customer validation, technology and team<br />

§<br />

Exits above $1B are rare representing 7% of all deals (5 public, 7 private and 3 spin-out)<br />

§<br />

Exits >10x are a minority (18%) where the buyers are typically cash rich and willing to pay what<br />

it takes (median cash balance of the buyers at time of acquisition was $2.9B and median market<br />

cap was $18.3B)<br />

Source: Momentum Partners, 451 Research, Capital IQ.<br />

Buyers<br />

38