The First 100 Days

The_First_100_Days_US-Canada_version

The_First_100_Days_US-Canada_version

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1/4/2017<br />

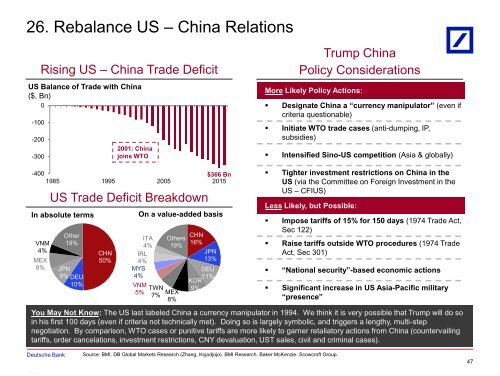

26. Rebalance US – China Relations<br />

Rising US – China Trade Deficit<br />

US Balance of Trade with China<br />

($, Bn)<br />

0<br />

-<strong>100</strong><br />

-200<br />

-300<br />

2001: China<br />

joins WTO<br />

Trump China<br />

Policy Considerations<br />

More Likely Policy Actions:<br />

• Designate China a “currency manipulator” (even if<br />

criteria questionable)<br />

• Initiate WTO trade cases (anti-dumping, IP,<br />

subsidies)<br />

• Intensified Sino-US competition (Asia & globally)<br />

-400<br />

$366 Bn<br />

1985 1995 2005 2015<br />

VNM<br />

4%<br />

MEX<br />

8%<br />

US Trade Deficit Breakdown<br />

In absolute terms<br />

Other<br />

19%<br />

JPN<br />

9% DEU<br />

10%<br />

CHN<br />

50%<br />

On a value-added basis<br />

ITA<br />

4%<br />

IRL<br />

4%<br />

MYS<br />

4%<br />

VNM<br />

5%<br />

TWN<br />

7%<br />

Others<br />

19%<br />

MEX<br />

8%<br />

CHN<br />

16%<br />

JPN<br />

13%<br />

DEU<br />

11%<br />

KOR<br />

9%<br />

• Tighter investment restrictions on China in the<br />

US (via the Committee on Foreign Investment in the<br />

US – CFIUS)<br />

Less Likely, but Possible:<br />

• Impose tariffs of 15% for 150 days (1974 Trade Act,<br />

Sec 122)<br />

• Raise tariffs outside WTO procedures (1974 Trade<br />

Act, Sec 301)<br />

• “National security”-based economic actions<br />

• Significant increase in US Asia-Pacific military<br />

“presence”<br />

You May Not Know: <strong>The</strong> US last labeled China a currency manipulator in 1994. We think it is very possible that Trump will do so<br />

in his first <strong>100</strong> days (even if criteria not technically met). Doing so is largely symbolic, and triggers a lengthy, multi-step<br />

negotiation. By comparison, WTO cases or punitive tariffs are more likely to garner retaliatory actions from China (countervailing<br />

tariffs, order cancelations, investment restrictions, CNY devaluation, UST sales, civil and criminal cases).<br />

Deutsche Bank<br />

Source: BMI. DB Global Markets Research (Zhang, Kojodjojo). BMI Research. Baker McKenzie. Scowcroft Group.<br />

47