Thousands

2k5pO0I

2k5pO0I

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Thousands</strong><br />

10:00<br />

10:15<br />

10:30<br />

10:45<br />

11:00<br />

11:15<br />

11:30<br />

11:45<br />

12:00<br />

12:15<br />

12:30<br />

12:45<br />

13:00<br />

13:15<br />

13:30<br />

13:45<br />

14:00<br />

14:15<br />

14:30<br />

14:45<br />

26-Jan<br />

29-Jan<br />

30-Jan<br />

31-Jan<br />

1-Feb<br />

2-Feb<br />

5-Feb<br />

6-Feb<br />

7-Feb<br />

8-Feb<br />

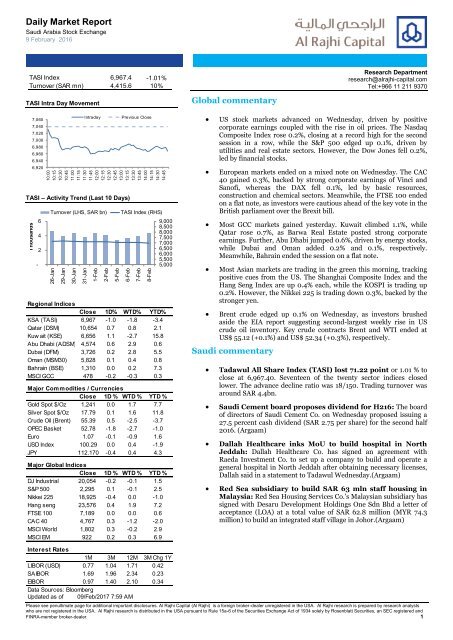

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

9 February 2016<br />

TASI Index 6,967.4 -1.01%<br />

Turnover (SAR mn) 4,415.6 10%<br />

TASI Intra Day Movement<br />

Global commentary<br />

Research Department<br />

research@alrajhi-capital.com<br />

Tel:+966 11 211 9370<br />

7,060<br />

7,040<br />

7,020<br />

7,000<br />

6,980<br />

6,960<br />

6,940<br />

6,920<br />

Intraday<br />

TASI – Activity Trend (Last 10 Days)<br />

-<br />

6<br />

4<br />

2<br />

Turnover (LHS, SAR bn)<br />

Previous Close<br />

TASI Index (RHS)<br />

9,000<br />

8,500<br />

8,000<br />

7,500<br />

7,000<br />

6,500<br />

6,000<br />

5,500<br />

5,000<br />

Regional Indices<br />

Close 1D% WTD% YTD%<br />

KSA (TASI) 6,967 -1.0 -1.8 -3.4<br />

Qatar (DSM) 10,654 0.7 0.8 2.1<br />

Kuw ait (KSE) 6,656 1.1 -2.7 15.8<br />

Abu Dhabi (ADSM) 4,574 0.6 2.9 0.6<br />

Dubai (DFM) 3,726 0.2 2.8 5.5<br />

Oman (MSM30) 5,828 0.1 0.4 0.8<br />

Bahrain (BSE) 1,310 0.0 0.2 7.3<br />

MSCI GCC 478 -0.2 -0.3 0.3<br />

Major Commodities / Currencies<br />

Close 1D % WTD % YTD %<br />

Gold Spot $/Oz 1,241 0.0 1.7 7.7<br />

Silver Spot $/Oz 17.79 0.1 1.6 11.8<br />

Crude Oil (Brent) 55.39 0.5 -2.5 -3.7<br />

OPEC Basket 52.78 -1.8 -2.7 -1.0<br />

Euro 1.07 -0.1 -0.9 1.6<br />

USD Index 100.29 0.0 0.4 -1.9<br />

JPY 112.170 -0.4 0.4 4.3<br />

Major Global Indices<br />

Close 1D % WTD % YTD %<br />

DJ Industrial 20,054 -0.2 -0.1 1.5<br />

S&P 500 2,295 0.1 -0.1 2.5<br />

Nikkei 225 18,925 -0.4 0.0 -1.0<br />

Hang seng 23,576 0.4 1.9 7.2<br />

FTSE 100 7,189 0.0 0.0 0.6<br />

CAC 40 4,767 0.3 -1.2 -2.0<br />

MSCI World 1,802 0.3 -0.2 2.9<br />

MSCI EM 922 0.2 0.3 6.9<br />

<br />

<br />

<br />

<br />

<br />

US stock markets advanced on Wednesday, driven by positive<br />

corporate earnings coupled with the rise in oil prices. The Nasdaq<br />

Composite Index rose 0.2%, closing at a record high for the second<br />

session in a row, while the S&P 500 edged up 0.1%, driven by<br />

utilities and real estate sectors. However, the Dow Jones fell 0.2%,<br />

led by financial stocks.<br />

European markets ended on a mixed note on Wednesday. The CAC<br />

40 gained 0.3%, backed by strong corporate earnings of Vinci and<br />

Sanofi, whereas the DAX fell 0.1%, led by basic resources,<br />

construction and chemical sectors. Meanwhile, the FTSE 100 ended<br />

on a flat note, as investors were cautious ahead of the key vote in the<br />

British parliament over the Brexit bill.<br />

Most GCC markets gained yesterday. Kuwait climbed 1.1%, while<br />

Qatar rose 0.7%, as Barwa Real Estate posted strong corporate<br />

earnings. Further, Abu Dhabi jumped 0.6%, driven by energy stocks,<br />

while Dubai and Oman added 0.2% and 0.1%, respectively.<br />

Meanwhile, Bahrain ended the session on a flat note.<br />

Most Asian markets are trading in the green this morning, tracking<br />

positive cues from the US. The Shanghai Composite Index and the<br />

Hang Seng Index are up 0.4% each, while the KOSPI is trading up<br />

0.2%. However, the Nikkei 225 is trading down 0.3%, backed by the<br />

stronger yen.<br />

Brent crude edged up 0.1% on Wednesday, as investors brushed<br />

aside the EIA report suggesting second-largest weekly rise in US<br />

crude oil inventory. Key crude contracts Brent and WTI ended at<br />

US$ 55.12 (+0.1%) and US$ 52.34 (+0.3%), respectively.<br />

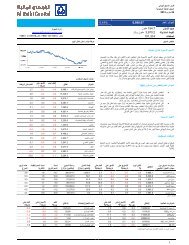

Saudi commentary<br />

<br />

<br />

<br />

<br />

Tadawul All Share Index (TASI) lost 71.22 point or 1.01 % to<br />

close at 6,967.40. Seventeen of the twenty sector indices closed<br />

lower. The advance decline ratio was 18/150. Trading turnover was<br />

around SAR 4.4bn.<br />

Saudi Cement board proposes dividend for H216: The board<br />

of directors of Saudi Cement Co. on Wednesday proposed issuing a<br />

27.5 percent cash dividend (SAR 2.75 per share) for the second half<br />

2016. (Argaam)<br />

Dallah Healthcare inks MoU to build hospital in North<br />

Jeddah: Dallah Healthcare Co. has signed an agreement with<br />

Raeda Investment Co. to set up a company to build and operate a<br />

general hospital in North Jeddah after obtaining necessary licenses,<br />

Dallah said in a statement to Tadawul Wednesday.(Argaam)<br />

Red Sea subsidiary to build SAR 63 mln staff housing in<br />

Malaysia: Red Sea Housing Services Co.’s Malaysian subsidiary has<br />

signed with Desaru Development Holdings One Sdn Bhd a letter of<br />

acceptance (LOA) at a total value of SAR 62.8 million (MYR 74.3<br />

million) to build an integrated staff village in Johor.(Argaam)<br />

Interest Rates<br />

1M 3M 12M 3M Chg 1Y<br />

LIBOR (USD) 0.77 1.04 1.71 0.42<br />

SAIBOR 1.69 1.96 2.34 0.23<br />

EIBOR 0.97 1.40 2.10 0.34<br />

Data Sources: Bloomberg<br />

Updated as of 09/Feb/2017 7:59 AM<br />

Please see penultimate page for additional important disclosures. Al Rajhi Capital (Al Rajhi) is a foreign broker-dealer unregistered in the USA. Al Rajhi research is prepared by research analysts<br />

who are not registered in the USA. Al Rajhi research is distributed in the USA pursuant to Rule 15a-6 of the Securities Exchange Act of 1934 solely by Rosenblatt Securities, an SEC registered and<br />

FINRA-member broker-dealer. 1

Energy<br />

Health Care<br />

Equipment & Svc<br />

Consumer Services<br />

Transport<br />

Food & Staples<br />

Retailing<br />

Diversified<br />

Financials<br />

Commercial &<br />

Professional Svc<br />

Pharma<br />

Consumer Durables<br />

& Apparel<br />

Media<br />

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

TASI – Large Cap (>10% Index weight) Sectors’ Performance<br />

TASI – Top Gainers / Losers<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

-3.0<br />

-3.5<br />

1D % (LHS) MTD % (LHS) YTD % (RHS)<br />

TASI Materials Banks Real<br />

Estate<br />

Telecom<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

-5.0<br />

-6.0<br />

-7.0<br />

-8.0<br />

-9.0<br />

-10.0<br />

Company Last Price Chg % Vol (mn) Value Trd (SAR mn)<br />

Al-Ahlia Coop Ins 6.93 9.7 11.966 79.59<br />

Solidarity Saudi 10.47 4.2 13.981 144.66<br />

Malath Insurance 8.76 3.7 3.812 32.96<br />

Saudi Enaya Coop 18.28 2.7 2.992 55.50<br />

Amana Coop Ins 9.22 2.7 5.299 48.55<br />

Company Last Price Chg % Vol (mn) Value Trd (SAR mn)<br />

Wataniya Ins 32.6 -5.3 1.126 37.48<br />

Sabb Takaful 30.4 -4.5 0.768 23.76<br />

Aljazira Takaful 31.7 -4.1 0.617 19.77<br />

Axa Cooperative 19.4 -4.1 2.600 51.36<br />

Sipchem 18.2 -3.7 1.030 18.89<br />

TASI – Mid Cap (5 -10% index weight) Sectors’ Performance<br />

TASI – Top Index Movers / Losers (Heavy weight stocks)<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

Insurance<br />

1D % (LHS) MTD % (LHS) YTD % (RHS)<br />

Food &<br />

Beverages<br />

Capital<br />

Goods<br />

Utilities<br />

Retailing<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

-2.0<br />

-4.0<br />

-6.0<br />

Company Last Price Chg % Index Imp Value Trd (SAR mn)<br />

Saudi Elec 23.38 1.5 2.5 5.46<br />

Savola 38.38 1.4 2.1 0.33<br />

Emaar Eco City 18.64 2.0 1.1 2.82<br />

Makkah Const 90.25 0.8 0.8 0.05<br />

Al Othaim 102.69 1.2 0.4 0.09<br />

Company Last Price Chg % Index Imp Value Trd (SAR mn)<br />

Jabal Omar 67.27 -2.1 -8.2 10.04<br />

Samba 21.13 -2.9 -6.3 16.83<br />

Sabic 95.57 -0.8 -5.1 279.27<br />

Almarai 67.02 -1.4 -2.9 15.85<br />

STC 65.21 -1.2 -2.6 30.22<br />

TASI – Small Cap (

26-Jan<br />

26-Jan<br />

26-Jan<br />

29-Jan<br />

29-Jan<br />

29-Jan<br />

30-Jan<br />

30-Jan<br />

30-Jan<br />

31-Jan<br />

31-Jan<br />

31-Jan<br />

1-Feb<br />

1-Feb<br />

1-Feb<br />

2-Feb<br />

2-Feb<br />

2-Feb<br />

5-Feb<br />

5-Feb<br />

5-Feb<br />

6-Feb<br />

6-Feb<br />

6-Feb<br />

7-Feb<br />

7-Feb<br />

7-Feb<br />

8-Feb<br />

8-Feb<br />

8-Feb<br />

DFM<br />

ADSM<br />

DSM<br />

Real Estate<br />

Bank<br />

Bank<br />

Energy<br />

Reality<br />

Telecome<br />

Telecom<br />

Insurance<br />

Banks<br />

Consumer<br />

Fin.Services<br />

Investment<br />

Industrial<br />

Transport<br />

Transport<br />

Services<br />

Real Estate<br />

Telcom<br />

Insurance<br />

Consumer<br />

Services<br />

Insurance<br />

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

Performance of Regional markets<br />

Country<br />

Last Index Change (%) MCap Volume Turnover P/E (x) P/E (x) P/E (x) P/B (x) Div Yld<br />

Close 1D 1M YTD US$ bn mn shr US$ mn 12M 2016 2017E Current 12M (%)<br />

Saudi Arabia 6,967 -1.0 -1.9 -3.4 435 231 1,177 17.2 14.2 12.7 1.6 3.4<br />

Qatar 10,654 0.7 0.5 2.1 134 9.5 87 15.5 13.1 11.6 1.6 3.8<br />

Dubai 3,726 0.2 2.3 5.5 86 429 161 12.4 10.7 9.4 1.3 3.6<br />

Abu Dhabi 4,574 0.6 0.6 0.6 119 107 58 11.9 12.0 10.6 1.4 5.3<br />

Kuw ait 6,656 1.1 -2.6 15.8 96 593 159 22.9 NA NA 1.2 3.6<br />

Oman 5,828 0.1 0.9 0.8 17 14 7 10.9 9.7 9.7 1.2 4.9<br />

Bahrain 1,310 0.0 0.5 7.3 20 2.7 1 9.4 NA NA 0.4 4.3<br />

Data Sources: Al Rajhi Capital, Bloomberg<br />

Dubai – Activity Trend (Last 10 Days) Dubai – Sector Performances Dubai – Top Gainers / Losers<br />

1.6<br />

1.2<br />

0.8<br />

0.4<br />

0.0<br />

Turnover (LHS, AED bn)<br />

DFMGI Index (RHS)<br />

3,740<br />

3,720<br />

3,700<br />

3,680<br />

3,660<br />

3,640<br />

3,620<br />

3,600<br />

3,580<br />

3,560<br />

5.0<br />

0.0<br />

-5.0<br />

1D % (LHS) MTD % (LHS) YTD % (RHS) Company Last Price Change % Vol (mn)<br />

Dubai Islamic Ins 1.09 9.0 36.82<br />

Takaful House 1.22 7.0 5.94<br />

Islamic Arab Ins 0.62 4.6 55.06<br />

Emaar Prop 7.58 1.5 11.13<br />

DXB Entertainments 1.17 0.9 49.05<br />

14.0<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

-2.0<br />

-4.0<br />

Company Last Price Change % Vol (mn)<br />

Union Properties 1.13 -1.7 24.43<br />

Drake & Scull Intl 0.53 -1.7 72.71<br />

Amanat Holdings 1.20 -1.6 23.20<br />

Damac Properties 0.45 -1.4 16.29<br />

Amlak Finance 1.31 -0.8 6.50<br />

Abu Dhabi – Activity Trend (Last 10 Days) Abu Dhabi – Sector Performances<br />

Abu Dhabi – Top Gainers / Losers<br />

0.5<br />

0.0<br />

Turnover (LHS, AED bn)<br />

ADSMI Index (RHS)<br />

5,000<br />

4,500<br />

4,000<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

1D % (LHS) MTD % (LHS) YTD % (RHS) Company Last Price Change % Vol (mn)<br />

20.0 National Takaful 0.63 14.6 0.050<br />

Union Cement 1.29 8.4 0.025<br />

15.0<br />

Intl Fish Farming 2.28 6.1 16.862<br />

10.0<br />

Al Khazna Ins 0.44 4.8 0.920<br />

Methaq Takaful 0.94 3.3 12.629<br />

5.0<br />

0.0<br />

-5.0<br />

-10.0<br />

Company Last Price Change % Vol (mn)<br />

Abu Dhabi Aviati 2.90 -3.3 0.127<br />

Arkan Building Mat 0.89 -2.2 3.531<br />

Bank Of Sharjah 1.45 -1.4 0.337<br />

Agthia Group 6.76 -1.3 0.024<br />

Eshraq Propertie 1.12 -0.9 11.516<br />

Qatar – Activity Trend (Last 10 Days) Qatar – Sector Performances Qatar – Top Gainers / Losers<br />

0.6<br />

0.3<br />

0.0<br />

Turnover (LHS, QAR bn)<br />

DSM Index (RHS)<br />

11,200<br />

10,800<br />

10,400<br />

10,000<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

1D % (LHS) MTD % (LHS) YTD % (RHS) Company Last Price Change % Vol (mn)<br />

Barw a Real Est 38.70 8.3 2.587<br />

CBQ 33.05 3.3 0.277<br />

Doha Bank 38.00 2.7 0.391<br />

Ind Qatar 112.50 1.4 0.087<br />

Mas Al Rayan 41.50 1.1 1.592<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

Company Last Price Change % Vol (mn)<br />

United Devt Co 21.88 -3.0 0.513<br />

Mazaya Qatar 14.23 -1.9 0.207<br />

Qatar Navigation 93.50 -0.5 0.035<br />

Qatary investors 54.80 -0.4 0.004<br />

Qatar Insurance 83.50 -0.4 0.159<br />

Data Sources: Al Rajhi Capital, Bloomberg<br />

Disclosures Please refer to the important disclosures at the back of this report. 3

<strong>Thousands</strong><br />

<strong>Thousands</strong><br />

26-Jan<br />

26-Jan<br />

26-Jan<br />

29-Jan<br />

29-Jan<br />

29-Jan<br />

30-Jan<br />

30-Jan<br />

30-Jan<br />

31-Jan<br />

31-Jan<br />

31-Jan<br />

1-Feb<br />

1-Feb<br />

1-Feb<br />

2-Feb<br />

2-Feb<br />

2-Feb<br />

5-Feb<br />

5-Feb<br />

5-Feb<br />

6-Feb<br />

6-Feb<br />

6-Feb<br />

7-Feb<br />

7-Feb<br />

7-Feb<br />

8-Feb<br />

8-Feb<br />

8-Feb<br />

KSE<br />

BSE<br />

Technology<br />

Investment<br />

Banks<br />

Industrial<br />

Real estate<br />

Hotel & Tourism<br />

Bank<br />

Fin. Services<br />

Parallel<br />

Insurance<br />

Services<br />

Telecom<br />

Industries<br />

Consumer<br />

Insurance<br />

Services<br />

Basic material<br />

Oil&Gas<br />

Healthcare<br />

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

Kuwait – Activity Trend (Last 10 Days) Kuwait – Sector Performances Kuwait – Top Gainers / Losers<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Turnover (LHS, KWD mn)<br />

KWSEIDX Index (RHS)<br />

7,000<br />

6,900<br />

6,800<br />

6,700<br />

6,600<br />

6,500<br />

6,400<br />

4.0<br />

2.0<br />

0.0<br />

-2.0<br />

-4.0<br />

-6.0<br />

-8.0<br />

-10.0<br />

-12.0<br />

-14.0<br />

1D % (LHS) MTD % (LHS) YTD % (RHS) Company Last Price Change % Vol (mn)<br />

35.0 National Consumer 50 17.7 0.003<br />

30.0 Real Estate Asset Mgmt 250 13.6 3.600<br />

Hets Telecom 55 10.0 1.380<br />

25.0<br />

Al Salam Group Hldg 56 9.8 8.171<br />

20.0 Yiaco Medical Co 280 9.8 0.001<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

-5.0<br />

Company Last Price Change % Vol (mn)<br />

Hayat Communications 99 -8.3 0.235<br />

Ikarus Petroleum 33 -7.0 5.367<br />

Kuw ait Foundry 320 -5.9 0.242<br />

United Real Estate 100 -5.7 0.252<br />

First Dubai Real Est 74 -5.1 2.168<br />

Oman – Activity Trend (Last 10 Days) Oman – Sector Performances Oman – Top Gainers / Losers<br />

8<br />

4<br />

0<br />

Turnover (LHS, OMR mn)<br />

MSM30 Index (RHS)<br />

5,840<br />

5,820<br />

5,800<br />

5,780<br />

5,760<br />

5,740<br />

5,720<br />

5,700<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

1D % (LHS) MTD % (LHS) YTD % (RHS) Company Last Price Change % Vol (mn)<br />

6.0<br />

Al-Anw ar Ceramic 0.169 2.4 4.932<br />

5.0 Bank Nizw a 0.089 1.1 3.948<br />

4.0 Al Batinah Pow er 0.189 1.1 0.007<br />

3.0 Oman Telecom 1.435 0.4 0.115<br />

2.0<br />

NA NA NA NA<br />

MSM 30 Bank Industry Services<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

Company Last Price Change % Vol (mn)<br />

Al Anw ar Holding 0.186 -1.6 0.170<br />

Phoenix Pow er 0.144 -1.4 0.015<br />

Renaissance Serv 0.241 -1.2 0.150<br />

Al Sharqiya Inv 0.139 -0.7 0.053<br />

Oman Invest &Fin 0.216 -0.5 0.692<br />

Bahrain – Activity Trend (Last 10 Days) Bahrain – Sector Performances Bahrain – Top Gainers / Losers<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

-<br />

Turnover (LHS, BHD mn)<br />

BHSEASI Index (RHS)<br />

1,315<br />

1,310<br />

1,305<br />

1,300<br />

1,295<br />

1,290<br />

1,285<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

1D % (LHS) MTD % (LHS) YTD % (RHS)<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

-5.0<br />

-10.0<br />

-15.0<br />

Company Last Price Change % Vol (mn)<br />

Ithmaar Bank 0.190 5.6 0.750<br />

Bahrain Islamic Bk 0.135 3.9 0.174<br />

Nass Corp 0.147 2.8 0.189<br />

BMMI 0.835 1.8 0.070<br />

Bahrain Comm Fac 0.665 1.5 0.020<br />

Company Last Price Change % Vol (mn)<br />

Khaleeji Com Bk 0.103 -2.8 0.420<br />

Al-Salam Bank 0.121 -2.4 0.065<br />

Ahli United Bk 0.710 -0.7 0.707<br />

NA NA NA NA<br />

NA NA NA NA<br />

Data Sources: Al Rajhi Capital, Bloomberg<br />

Disclosures Please refer to the important disclosures at the back of this report. 4

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

IMPORTANT DISCLOSURES FOR U.S. PERSONS<br />

This research report was prepared by Al Rajhi Capital (Al Rajhi), a company authorized to engage in securities activities in Saudi Arabia. Al<br />

Rajhi is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of research<br />

reports and the independence of research analysts. This research report is provided for distribution to “major U.S. institutional investors” in<br />

reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the<br />

“Exchange Act”).<br />

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on<br />

the information provided in this research report should do so only through Rosenblatt Securities Inc, 40 Wall Street 59th Floor, New York,<br />

NY 10005, a registered broker dealer in the United States. Under no circumstances should any recipient of this research report effect any<br />

transaction to buy or sell securities or related financial instruments through Al Rajhi. Rosenblatt Securities Inc. accepts responsibility for the<br />

contents of this research report, subject to the terms set out below, to the extent that it is delivered to a U.S. person other than a major U.S.<br />

institutional investor.<br />

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry<br />

Regulatory Authority (“FINRA”) and may not be an associated person of Rosenblatt Securities Inc. and, therefore, may not be subject to<br />

applicable restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a<br />

research analyst account.<br />

Ownership and Material Conflicts of Interest<br />

Rosenblatt Securities Inc. or its affiliates does not ‘beneficially own,’ as determined in accordance with Section 13(d) of the Exchange Act,<br />

1% or more of any of the equity securities mentioned in the report. Rosenblatt Securities Inc, its affiliates and/or their respective officers,<br />

directors or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent<br />

of the securities referred to herein. Rosenblatt Securities Inc. is not aware of any material conflict of interest as of the date of this<br />

publication.<br />

Compensation and Investment Banking Activities<br />

Rosenblatt Securities Inc. or any affiliate has not managed or co-managed a public offering of securities for the subject company in the past<br />

12 months, nor received compensation for investment banking services from the subject company in the past 12 months, neither does it or<br />

any affiliate expect to receive, or intends to seek compensation for investment banking services from the subject company in the next 3<br />

months.<br />

Additional Disclosures<br />

This research report is for distribution only under such circumstances as may be permitted by applicable law. This research report has no<br />

regard to the specific investment objectives, financial situation or particular needs of any specific recipient, even if sent only to a single<br />

recipient. This research report is not guaranteed to be a complete statement or summary of any securities, markets, reports or<br />

developments referred to in this research report. Neither Al Rajhi nor any of its directors, officers, employees or agents shall have any<br />

liability, however arising, for any error, inaccuracy or incompleteness of fact or opinion in this research report or lack of care in this research<br />

report’s preparation or publication, or any losses or damages which may arise from the use of this research report.<br />

Al Rajhi may rely on information barriers, such as “Chinese Walls” to control the flow of information within the areas, units, divisions, groups,<br />

or affiliates of Al Rajhi.<br />

Investing in any non-U.S. securities or related financial instruments (including ADRs) discussed in this research report may present certain<br />

risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the U.S. Securities and Exchange<br />

Commission. Information on such non-U.S. securities or related financial instruments may be limited. Foreign companies may not be<br />

subject to audit and reporting standards and regulatory requirements comparable to those in effect within the United States.<br />

The value of any investment or income from any securities or related financial instruments discussed in this research report denominated in<br />

a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or<br />

income from such securities or related financial instruments.<br />

Past performance is not necessarily a guide to future performance and no representation or warranty, express or implied, is made by Al<br />

Rajhi with respect to future performance. Income from investments may fluctuate. The price or value of the investments to which this<br />

research report relates, either directly or indirectly, may fall or rise against the interest of investors. Any recommendation or opinion<br />

contained in this research report may become outdated as a consequence of changes in the environment in which the issuer of the<br />

securities under analysis operates, in addition to changes in the estimates and forecasts, assumptions and valuation methodology used<br />

herein.<br />

No part of the content of this research report may be copied, forwarded or duplicated in any form or by any means without the prior consent<br />

of Al Rajhi and Al Rajhi accepts no liability whatsoever for the actions of third parties in this respectThis research document has been<br />

prepared by Al Rajhi Capital Company (“Al Rajhi Capital”) of Riyadh, Saudi Arabia. It has been prepared for the general use of Al Rajhi<br />

Capital’s clients and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express<br />

written consent of Al Rajhi Capital. Receipt and review of this research document constitute your agreement not to redistribute, retransmit,<br />

or disclose to others the contents, opinions, conclusion, or information contained in this document prior to public disclosure of such<br />

information by Al Rajhi Capital. The information contained was obtained from various public sources believed to be reliable but we do not<br />

guarantee its accuracy. Al Rajhi Capital makes no representations or warranties (express or implied) regarding the data and information<br />

provided and Al Rajhi Capital does not represent that the information content of this document is complete, or free from any error, not<br />

misleading, or fit for any particular purpose. This research document provides general information only. Neither the information nor any<br />

opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment products related to<br />

such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific<br />

investment objectives, financial situation and the particular needs of any specific person who may receive this document.<br />

Investors should seek financial, legal or tax advice regarding the appropriateness of investing in any securities, other investment or<br />

investment strategies discussed or recommended in this document and should understand that statements regarding future prospects may<br />

not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that the price or value<br />

of such securities and investments may rise or fall. Fluctuations in exchange rates could have adverse effects on the value of or price of, or<br />

income derived from, certain investments. Accordingly, investors may receive back less than originally invested. Al Rajhi Capital or its<br />

officers or one or more of its affiliates (including research analysts) may have a financial interest in securities of the issuer(s) or related<br />

investments, including long or short positions in securities, warrants, futures, options, derivatives, or other financial instruments. Al Rajhi<br />

Capital or its affiliates may from time to time perform investment banking or other services for, solicit investment banking or other business<br />

from, any company mentioned in this research document. Al Rajhi Capital, together with its affiliates and employees, shall not be liable for<br />

any direct, indirect or consequential loss or damages that may arise, directly or indirectly, from any use of the information contained in this<br />

research document.<br />

This research document and any recommendations contained are subject to change without prior notice. Al Rajhi Capital assumes no<br />

responsibility to update the information in this research document. Neither the whole nor any part of this research document may be altered,<br />

duplicated, transmitted or distributed in any form or by any means. This research document is not directed to, or intended for distribution to<br />

or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such<br />

distribution, publication, availability or use would be contrary to law or which would subject Al Rajhi Capital or any of its affiliates to any<br />

registration or licensing requirement within such jurisdiction.<br />

5

Daily Market Report<br />

Saudi Arabia Stock Exchange<br />

Disclaimer and additional disclosures for Equity Research<br />

Disclaimer<br />

This research document has been prepared by Al Rajhi Capital Company (“Al Rajhi Capital”) of Riyadh, Saudi Arabia. It has been prepared<br />

for the general use of Al Rajhi Capital’s clients and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or<br />

manner, without the express written consent of Al Rajhi Capital. Receipt and review of this research document constitute your agreement<br />

not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained in this document prior to<br />

public disclosure of such information by Al Rajhi Capital. The information contained was obtained from various public sources believed to be<br />

reliable but we do not guarantee its accuracy. Al Rajhi Capital makes no representations or warranties (express or implied) regarding the<br />

data and information provided and Al Rajhi Capital does not represent that the information content of this document is complete, or free<br />

from any error, not misleading, or fit for any particular purpose. This research document provides general information only. Neither the<br />

information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment<br />

products related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account<br />

the specific investment objectives, financial situation and the particular needs of any specific person who may receive this document.<br />

Investors should seek financial, legal or tax advice regarding the appropriateness of investing in any securities, other investment or<br />

investment strategies discussed or recommended in this document and should understand that statements regarding future prospects may<br />

not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that the price or value<br />

of such securities and investments may rise or fall. Fluctuations in exchange rates could have adverse effects on the value of or price of, or<br />

income derived from, certain investments. Accordingly, investors may receive back less than originally invested. Al Rajhi Capital or its<br />

officers or one or more of its affiliates (including research analysts) may have a financial interest in securities of the issuer(s) or related<br />

investments, including long or short positions in securities, warrants, futures, options, derivatives, or other financial instruments. Al Rajhi<br />

Capital or its affiliates may from time to time perform investment banking or other services for, solicit investment banking or other business<br />

from, any company mentioned in this research document. Al Rajhi Capital, together with its affiliates and employees, shall not be liable for<br />

any direct, indirect or consequential loss or damages that may arise, directly or indirectly, from any use of the information contained in this<br />

research document.<br />

This research document and any recommendations contained are subject to change without prior notice. Al Rajhi Capital assumes no<br />

responsibility to update the information in this research document. Neither the whole nor any part of this research document may be altered,<br />

duplicated, transmitted or distributed in any form or by any means. This research document is not directed to, or intended for distribution to<br />

or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such<br />

distribution, publication, availability or use would be contrary to law or which would subject Al Rajhi Capital or any of its affiliates to any<br />

registration or licensing requirement within such jurisdiction.<br />

Explanation of Al Rajhi Capital’s rating system<br />

Al Rajhi Capital uses a three-tier rating system based on absolute upside or downside potential for all stocks under its coverage except<br />

financial stocks and those few other companies not compliant with Islamic Shariah law:<br />

"Overweight": Our target price is more than 10% above the current share price, and we expect the share price to reach the target on a 12<br />

month time horizon.<br />

"Neutral": We expect the share price to settle at a level between 10% below the current share price and 10% above the current share price<br />

on a 12 month time horizon.<br />

"Underweight": Our target price is more than 10% below the current share price, and we expect the share price to reach the target on a 12<br />

month time horizon.<br />

"Target price": We estimate target value per share for every stock we cover. This is normally based on widely accepted methods<br />

appropriate to the stock or sector under consideration, e.g. DCF (discounted cash flow) or SoTP (sum of the parts) analysis.<br />

Please note that the achievement of any price target may be impeded by general market and economic trends and other external factors, or<br />

if a company’s profits or operating performance exceed or fall short of our expectations.<br />

Contact us<br />

Al Rajhi Capital<br />

Research Department<br />

Head Office, King Fahad Road<br />

P.O. Box 5561, Riyadh 11432<br />

Kingdom of Saudi Arabia<br />

Email: research@alrajhi-capital.com<br />

Al Rajhi Capital is licensed by the Saudi Arabian Capital Market Authority, License No. 07068/37.<br />

6