SENATE

2lbouby

2lbouby

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

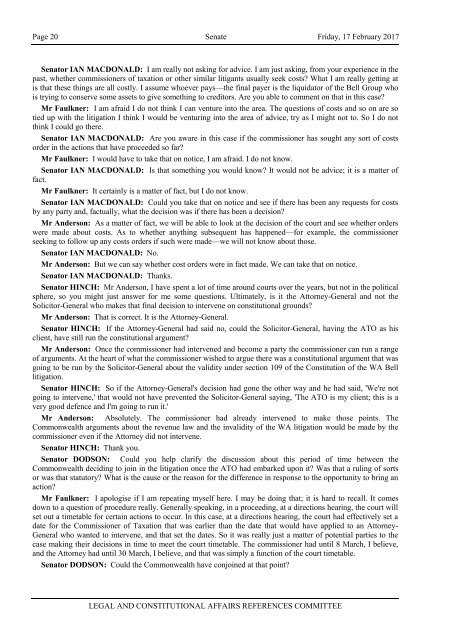

Page 20 Senate Friday, 17 February 2017<br />

Senator IAN MACDONALD: I am really not asking for advice. I am just asking, from your experience in the<br />

past, whether commissioners of taxation or other similar litigants usually seek costs? What I am really getting at<br />

is that these things are all costly. I assume whoever pays—the final payer is the liquidator of the Bell Group who<br />

is trying to conserve some assets to give something to creditors. Are you able to comment on that in this case?<br />

Mr Faulkner: I am afraid I do not think I can venture into the area. The questions of costs and so on are so<br />

tied up with the litigation I think I would be venturing into the area of advice, try as I might not to. So I do not<br />

think I could go there.<br />

Senator IAN MACDONALD: Are you aware in this case if the commissioner has sought any sort of costs<br />

order in the actions that have proceeded so far?<br />

Mr Faulkner: I would have to take that on notice, I am afraid. I do not know.<br />

Senator IAN MACDONALD: Is that something you would know? It would not be advice; it is a matter of<br />

fact.<br />

Mr Faulkner: It certainly is a matter of fact, but I do not know.<br />

Senator IAN MACDONALD: Could you take that on notice and see if there has been any requests for costs<br />

by any party and, factually, what the decision was if there has been a decision?<br />

Mr Anderson: As a matter of fact, we will be able to look at the decision of the court and see whether orders<br />

were made about costs. As to whether anything subsequent has happened—for example, the commissioner<br />

seeking to follow up any costs orders if such were made—we will not know about those.<br />

Senator IAN MACDONALD: No.<br />

Mr Anderson: But we can say whether cost orders were in fact made. We can take that on notice.<br />

Senator IAN MACDONALD: Thanks.<br />

Senator HINCH: Mr Anderson, I have spent a lot of time around courts over the years, but not in the political<br />

sphere, so you might just answer for me some questions. Ultimately, is it the Attorney-General and not the<br />

Solicitor-General who makes that final decision to intervene on constitutional grounds?<br />

Mr Anderson: That is correct. It is the Attorney-General.<br />

Senator HINCH: If the Attorney-General had said no, could the Solicitor-General, having the ATO as his<br />

client, have still run the constitutional argument?<br />

Mr Anderson: Once the commissioner had intervened and become a party the commissioner can run a range<br />

of arguments. At the heart of what the commissioner wished to argue there was a constitutional argument that was<br />

going to be run by the Solicitor-General about the validity under section 109 of the Constitution of the WA Bell<br />

litigation.<br />

Senator HINCH: So if the Attorney-General's decision had gone the other way and he had said, 'We're not<br />

going to intervene,' that would not have prevented the Solicitor-General saying, 'The ATO is my client; this is a<br />

very good defence and I'm going to run it.'<br />

Mr Anderson: Absolutely. The commissioner had already intervened to make those points. The<br />

Commonwealth arguments about the revenue law and the invalidity of the WA litigation would be made by the<br />

commissioner even if the Attorney did not intervene.<br />

Senator HINCH: Thank you.<br />

Senator DODSON: Could you help clarify the discussion about this period of time between the<br />

Commonwealth deciding to join in the litigation once the ATO had embarked upon it? Was that a ruling of sorts<br />

or was that statutory? What is the cause or the reason for the difference in response to the opportunity to bring an<br />

action?<br />

Mr Faulkner: I apologise if I am repeating myself here. I may be doing that; it is hard to recall. It comes<br />

down to a question of procedure really. Generally speaking, in a proceeding, at a directions hearing, the court will<br />

set out a timetable for certain actions to occur. In this case, at a directions hearing, the court had effectively set a<br />

date for the Commissioner of Taxation that was earlier than the date that would have applied to an Attorney-<br />

General who wanted to intervene, and that set the dates. So it was really just a matter of potential parties to the<br />

case making their decisions in time to meet the court timetable. The commissioner had until 8 March, I believe,<br />

and the Attorney had until 30 March, I believe, and that was simply a function of the court timetable.<br />

Senator DODSON: Could the Commonwealth have conjoined at that point?<br />

LEGAL AND CONSTITUTIONAL AFFAIRS REFERENCES COMMITTEE