SENATE

2lbouby

2lbouby

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

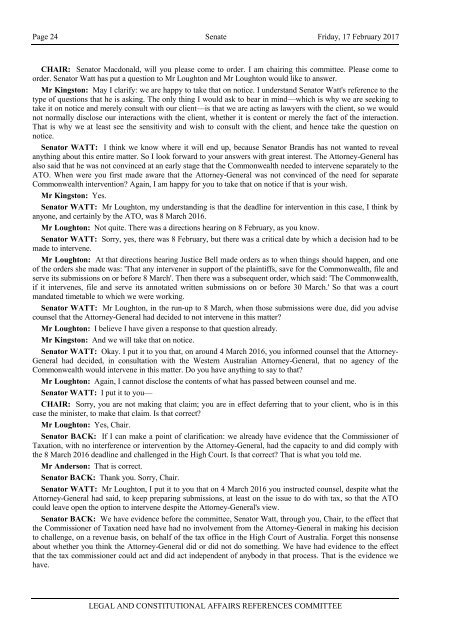

Page 24 Senate Friday, 17 February 2017<br />

CHAIR: Senator Macdonald, will you please come to order. I am chairing this committee. Please come to<br />

order. Senator Watt has put a question to Mr Loughton and Mr Loughton would like to answer.<br />

Mr Kingston: May I clarify: we are happy to take that on notice. I understand Senator Watt's reference to the<br />

type of questions that he is asking. The only thing I would ask to bear in mind—which is why we are seeking to<br />

take it on notice and merely consult with our client—is that we are acting as lawyers with the client, so we would<br />

not normally disclose our interactions with the client, whether it is content or merely the fact of the interaction.<br />

That is why we at least see the sensitivity and wish to consult with the client, and hence take the question on<br />

notice.<br />

Senator WATT: I think we know where it will end up, because Senator Brandis has not wanted to reveal<br />

anything about this entire matter. So I look forward to your answers with great interest. The Attorney-General has<br />

also said that he was not convinced at an early stage that the Commonwealth needed to intervene separately to the<br />

ATO. When were you first made aware that the Attorney-General was not convinced of the need for separate<br />

Commonwealth intervention? Again, I am happy for you to take that on notice if that is your wish.<br />

Mr Kingston: Yes.<br />

Senator WATT: Mr Loughton, my understanding is that the deadline for intervention in this case, I think by<br />

anyone, and certainly by the ATO, was 8 March 2016.<br />

Mr Loughton: Not quite. There was a directions hearing on 8 February, as you know.<br />

Senator WATT: Sorry, yes, there was 8 February, but there was a critical date by which a decision had to be<br />

made to intervene.<br />

Mr Loughton: At that directions hearing Justice Bell made orders as to when things should happen, and one<br />

of the orders she made was: 'That any intervener in support of the plaintiffs, save for the Commonwealth, file and<br />

serve its submissions on or before 8 March'. Then there was a subsequent order, which said: 'The Commonwealth,<br />

if it intervenes, file and serve its annotated written submissions on or before 30 March.' So that was a court<br />

mandated timetable to which we were working.<br />

Senator WATT: Mr Loughton, in the run-up to 8 March, when those submissions were due, did you advise<br />

counsel that the Attorney-General had decided to not intervene in this matter?<br />

Mr Loughton: I believe I have given a response to that question already.<br />

Mr Kingston: And we will take that on notice.<br />

Senator WATT: Okay. I put it to you that, on around 4 March 2016, you informed counsel that the Attorney-<br />

General had decided, in consultation with the Western Australian Attorney-General, that no agency of the<br />

Commonwealth would intervene in this matter. Do you have anything to say to that?<br />

Mr Loughton: Again, I cannot disclose the contents of what has passed between counsel and me.<br />

Senator WATT: I put it to you—<br />

CHAIR: Sorry, you are not making that claim; you are in effect deferring that to your client, who is in this<br />

case the minister, to make that claim. Is that correct?<br />

Mr Loughton: Yes, Chair.<br />

Senator BACK: If I can make a point of clarification: we already have evidence that the Commissioner of<br />

Taxation, with no interference or intervention by the Attorney-General, had the capacity to and did comply with<br />

the 8 March 2016 deadline and challenged in the High Court. Is that correct? That is what you told me.<br />

Mr Anderson: That is correct.<br />

Senator BACK: Thank you. Sorry, Chair.<br />

Senator WATT: Mr Loughton, I put it to you that on 4 March 2016 you instructed counsel, despite what the<br />

Attorney-General had said, to keep preparing submissions, at least on the issue to do with tax, so that the ATO<br />

could leave open the option to intervene despite the Attorney-General's view.<br />

Senator BACK: We have evidence before the committee, Senator Watt, through you, Chair, to the effect that<br />

the Commissioner of Taxation need have had no involvement from the Attorney-General in making his decision<br />

to challenge, on a revenue basis, on behalf of the tax office in the High Court of Australia. Forget this nonsense<br />

about whether you think the Attorney-General did or did not do something. We have had evidence to the effect<br />

that the tax commissioner could act and did act independent of anybody in that process. That is the evidence we<br />

have.<br />

LEGAL AND CONSTITUTIONAL AFFAIRS REFERENCES COMMITTEE