JOINT REPORT - conwert Immobilien Invest SE

JOINT REPORT - conwert Immobilien Invest SE

JOINT REPORT - conwert Immobilien Invest SE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

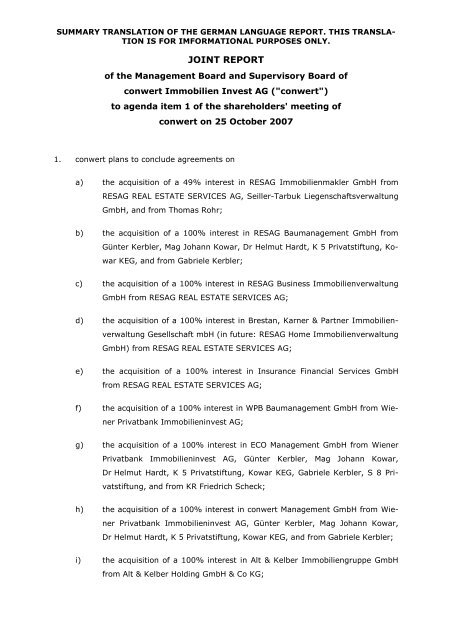

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

<strong>JOINT</strong> <strong>REPORT</strong><br />

of the Management Board and Supervisory Board of<br />

<strong>conwert</strong> <strong>Immobilien</strong> <strong>Invest</strong> AG ("<strong>conwert</strong>")<br />

to agenda item 1 of the shareholders' meeting of<br />

<strong>conwert</strong> on 25 October 2007<br />

1. <strong>conwert</strong> plans to conclude agreements on<br />

a) the acquisition of a 49% interest in RESAG <strong>Immobilien</strong>makler GmbH from<br />

RESAG REAL ESTATE <strong>SE</strong>RVICES AG, Seiller-Tarbuk Liegenschaftsverwaltung<br />

GmbH, and from Thomas Rohr;<br />

b) the acquisition of a 100% interest in RESAG Baumanagement GmbH from<br />

Günter Kerbler, Mag Johann Kowar, Dr Helmut Hardt, K 5 Privatstiftung, Ko-<br />

war KEG, and from Gabriele Kerbler;<br />

c) the acquisition of a 100% interest in RESAG Business <strong>Immobilien</strong>verwaltung<br />

GmbH from RESAG REAL ESTATE <strong>SE</strong>RVICES AG;<br />

d) the acquisition of a 100% interest in Brestan, Karner & Partner <strong>Immobilien</strong>-<br />

verwaltung Gesellschaft mbH (in future: RESAG Home <strong>Immobilien</strong>verwaltung<br />

GmbH) from RESAG REAL ESTATE <strong>SE</strong>RVICES AG;<br />

e) the acquisition of a 100% interest in Insurance Financial Services GmbH<br />

from RESAG REAL ESTATE <strong>SE</strong>RVICES AG;<br />

f) the acquisition of a 100% interest in WPB Baumanagement GmbH from Wie-<br />

ner Privatbank <strong>Immobilien</strong>invest AG;<br />

g) the acquisition of a 100% interest in ECO Management GmbH from Wiener<br />

Privatbank <strong>Immobilien</strong>invest AG, Günter Kerbler, Mag Johann Kowar,<br />

Dr Helmut Hardt, K 5 Privatstiftung, Kowar KEG, Gabriele Kerbler, S 8 Pri-<br />

vatstiftung, and from KR Friedrich Scheck;<br />

h) the acquisition of a 100% interest in <strong>conwert</strong> Management GmbH from Wie-<br />

ner Privatbank <strong>Immobilien</strong>invest AG, Günter Kerbler, Mag Johann Kowar,<br />

Dr Helmut Hardt, K 5 Privatstiftung, Kowar KEG, and from Gabriele Kerbler;<br />

i) the acquisition of a 100% interest in Alt & Kelber <strong>Immobilien</strong>gruppe GmbH<br />

from Alt & Kelber Holding GmbH & Co KG;

- 2 -<br />

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

j) the acquisition of a 22% interest in Alt & Kelber <strong>Immobilien</strong>verwaltung<br />

GmbH from Walter Leitner.<br />

To item 1.g) above it is noted, that ECO Management GmbH plans to reduce its reg-<br />

istered capital from Euro 4,500,000 by Euro 4,450,000 to Euro 50,000 before Clos-<br />

ing of the transaction with which <strong>conwert</strong> would acquire ECO Management GmbH.<br />

The sellers shall be entitled to the reduction amount of Euro 4,450,000 in the ratio<br />

of their interests in ECO Management GmbH.<br />

2. To facilitate the execution of the acquisitions mentioned under item 1, each of the<br />

sellers has submitted to <strong>conwert</strong> an offer for the sale and transfer of the interests<br />

held by such seller. The offers can be accepted by <strong>conwert</strong> by way of a acceptance<br />

declaration in accordance with the applicable acceptance periods set forth in the of-<br />

fers.<br />

3. By acquiring the interests in <strong>conwert</strong> Management GmbH, Insurance Financial Ser-<br />

vice GmbH and Alt & Kelber <strong>Immobilien</strong>gruppe GmbH, <strong>conwert</strong> would also indirectly<br />

acquire the interests held by <strong>conwert</strong> Management GmbH, Insurance Financial Ser-<br />

vice GmbH and Alt & Kelber <strong>Immobilien</strong>gruppe GmbH in the following subsidiaries:<br />

a) <strong>conwert</strong> Management GmbH holds a 70% interest in BOKRÉTA Management<br />

Kft., Budapest, a 60% interest in Pdcz brno s.r.o, Brno, a 60% interest in<br />

Pdsk Bratislava s.r.o., Bratislava, a 60% interest in <strong>conwert</strong> Thüringen Port-<br />

folio GmbH, Berlin, a 100% interest in <strong>conwert</strong> Deutschland <strong>Immobilien</strong><br />

GmbH, Berlin, a 40% interest in Bau-Verein zu Hamburg Hausverwaltungs-<br />

gesellschaft mbH, Hamburg, and a 60% interest in CC Portfolio GmbH, Ber-<br />

lin.<br />

b) Insurance Financial Services GmbH holds a 100% interest in RESAG Insur-<br />

ance Broker GmbH, Vienna.<br />

c) Alt & Kelber <strong>Immobilien</strong>gruppe GmbH holds a 100% in ALT & KELBER Woh-<br />

nungsprivatisierung GmbH, Heilbronn, Germany, a 78% interest in Alt &<br />

Kelber <strong>Immobilien</strong>verwaltung GmbH, Heilbronn, Germany, a 100% interest<br />

in ALT & KELBER Verwaltungs GmbH, Heilbronn, Germany, a 100% interest<br />

in ALT & KELBER <strong>Immobilien</strong>management GmbH, Heilbronn, Germany, a<br />

100% interest in ALT & KELBER Eigenheim GmbH, Heilbronn, Germany, a<br />

100% interest in ALT & KELBER Wohninvest GmbH, Heilbronn, Germany,<br />

and is also the sole limited partner of ALT & KELBER <strong>Immobilien</strong>kontor

- 3 -<br />

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

GmbH & Co. KG, Gera, Germany, and Alt & Kelber Verwaltungs GmbH is a<br />

limited partner of ALT & KELBER <strong>Immobilien</strong>consulting GmbH & Co. KG, Heil-<br />

bronn, Germany.<br />

4. The purchase prices 1 for the interests to be acquired by <strong>conwert</strong> are:<br />

a) Euro 95,385,000 for the interest in <strong>conwert</strong> Management GmbH as well as<br />

the interests held by <strong>conwert</strong> Management GmbH in subsidiaries;<br />

b) Euro 48,800,000 for the interest in ECO Management GmbH;<br />

c) Euro 35,487,000 for the interests in RESAG <strong>Immobilien</strong>makler GmbH,<br />

RESAG Baumanagement GmbH, RESAG Business <strong>Immobilien</strong>verwaltung<br />

GmbH, Brestan, Karner & Partner <strong>Immobilien</strong>verwaltung Gesellschaft mbH<br />

(in future: RESAG Home <strong>Immobilien</strong>verwaltung GmbH) and in Insurance Fi-<br />

nancial Services GmbH (including the interest held by Insurance Financial<br />

Services GmbH in RESAG Insurance Broker GmbH);<br />

d) Euro 2,256,500 for the interest in WPB Baumanagement GmbH; and<br />

e) Euro 34,171,000 for the interest in Alt & Kelber <strong>Immobilien</strong>gruppe GmbH as<br />

well as for the interests held by Alt & Kelber <strong>Immobilien</strong>gruppe GmbH in<br />

subsidiaries.<br />

5. The target companies (together with each of their subsidiaries) are active in the fol-<br />

lowing business areas:<br />

a) <strong>conwert</strong> Management GmbH is the management company of <strong>conwert</strong>. con-<br />

wert Management GmbH and its subsidiaries are active in Austria, Germany<br />

and the CEE region. <strong>conwert</strong> Management GmbH employs 105 employees.<br />

b) ECO Management GmbH is the management company of the stock exchange<br />

listed ECO Business-<strong>Immobilien</strong> AG and is responsible for its commercial real<br />

estate assets. The company employs 24 employees and is active in Austria,<br />

Germany and the CEE region.<br />

c) RESAG <strong>Immobilien</strong>makler GmbH, RESAG Baumanagement GmbH, RESAG<br />

Business <strong>Immobilien</strong>verwaltung GmbH, Brestan, Karner & Partner Immo-<br />

1 These purchase prices are preliminary purchase prices. The final purchase prices will be determined<br />

on the basis of audited financial statements of the target companies as of 31 December<br />

2007. Compare also item 6 of this report.

- 4 -<br />

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

bilienverwaltung Gesellschaft mbH (in future: RESAG Home <strong>Immobilien</strong>ver-<br />

waltung GmbH) and Insurance Financial Services GmbH as well as its sub-<br />

sidiary RESAG Insurance Broker GmbH are Austrian real estate service pro-<br />

viders. They offer different real estate services such as property manage-<br />

ment, real estate brokerage services, insurance brokerage services and con-<br />

struction management services. Currently the companies employ 74 em-<br />

ployees.<br />

d) The Alt & Kelber-Group (Alt & Kelber <strong>Immobilien</strong>gruppe GmbH and its sub-<br />

sidiaries) is a German real estate service provider group that is active in the<br />

area of third party housing privatisation, but also offers property manage-<br />

ment services, real estate brokering services and real estate development<br />

services. The Alt & Kelber-Group employs approximately 220 employees and<br />

has over 100 offices in the whole of Germany at its disposal.<br />

6. The other material terms of the agreements between <strong>conwert</strong> and the sellers na-<br />

med in agenda item 1 of the invitation to <strong>conwert</strong>'s shareholders' meeting on 25<br />

October 2007 are largely identical or very similar and can be summarized as fol-<br />

lows:<br />

• The sellers were provided with a standard for their offers by <strong>conwert</strong>. Based<br />

on this standard <strong>conwert</strong> negotiated with each of the sellers and adapted the<br />

standard according to the results of the negotiations.<br />

• The agreements, also the agreements regarding the acquisition of the Alt &<br />

Kelber interests, will be subject to Austrian law. The legal venue is in each<br />

case the commercial court of Vienna.<br />

• The sellers' offers for the conclusion of share purchase agreements are, with<br />

exception of the offers by Wiener Privatbank <strong>Immobilien</strong>invest AG that are<br />

subject to the approval of the shareholders' meeting of Wiener Privatbank<br />

<strong>Immobilien</strong>invest AG, unconditional. The Closing of the transfer of the inter-<br />

ests is subject to customary conditions precedent, such as approval by the<br />

cartel authorities and that no material adverse changes shall have occurred.<br />

• <strong>conwert</strong> does not have the obligation to accept the offers before the share-<br />

holders' meeting, but has sufficient time to conclude its extensive due dili-<br />

gence of the target companies.<br />

• The purchase prices are subject to a customary purchase price adjustment.<br />

The final purchase prices will be determined on the basis of audited financial

- 5 -<br />

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

statements as of 31 December 2007. The financial statements will be audited<br />

by <strong>conwert</strong>'s independent auditor.<br />

• The sellers are entitled to receive the profits earned by the target companies<br />

in the financial year 2007. <strong>conwert</strong> is, however, economically entitled to the<br />

profits for subsequent financial years.<br />

• In their offers the sellers have given an extensive catalogue of customary rep-<br />

resentations and warranties, in particular concerning company law matters, fi-<br />

nancial statements, accountancy and financial matters, taxes and fees, intel-<br />

lectual property rights, material contracts, insurance matters, employment law<br />

matters, litigation, real estate and environmental law matters, administrative<br />

law matters, the conduct of the business since the end of the last financial<br />

year and regarding the truthfulness, completeness and correctness of the in-<br />

formation disclosed in the due diligence and the non-misleading nature of such<br />

information. The representations and warranties are valid for certain periods,<br />

in which <strong>conwert</strong>'s auditors will, in particular, audit the financial statements of<br />

the target companies, and are secured by profits to which the sellers are eco-<br />

nomically entitled. In case of a breach of a representation or warranty <strong>conwert</strong><br />

can use this security to satisfy its claims.<br />

<strong>conwert</strong>'s representation and warranty claims are subject to customary liability<br />

limitations. Liabilities resulting from the breach of representations or warran-<br />

ties are generally limited to half of the purchase price. The liability for repre-<br />

sentations and warranties regarding company law matters and taxes is, how-<br />

ever, limited with the purchase price, in one case this liability is even unlim-<br />

ited.<br />

• For the period from the date of the offers (30 September 2007) until Closing<br />

<strong>conwert</strong> has customary co-determination rights and the sellers are obligated<br />

not to carry out any disadvantageous transactions.<br />

• In addition, the sellers are subject to non-compete and non-solicitation clauses<br />

for a period of between one year (for the stock exchange listed Wiener Privat-<br />

bank <strong>Immobilien</strong>invest AG) and up to 5 years. A breach of these clauses trig-<br />

gers a contractual penalty.<br />

7. The aim of the acquisition of the above mentioned interests is the expansion of<br />

<strong>conwert</strong>'s operative business so that it includes real estate management and real<br />

estate services. After having acquired RESAG <strong>Immobilien</strong>makler GmbH, RESAG<br />

Baumanagement GmbH, RESAG Business <strong>Immobilien</strong>verwaltung GmbH, Brestan,

- 6 -<br />

SUMMARY TRANSLATION OF THE GERMAN LANGUAGE <strong>REPORT</strong>. THIS TRANSLA-<br />

TION IS FOR IMFORMATIONAL PURPO<strong>SE</strong>S ONLY.<br />

Karner & Partner <strong>Immobilien</strong>verwaltung Gesellschaft mbH (in future: RESAG Home<br />

<strong>Immobilien</strong>verwaltung GmbH) and Insurance Financial Services GmbH (including its<br />

subsidiary RESAG Insurance Broker GmbH) <strong>conwert</strong> will have all material real es-<br />

tate services at its disposal internally and will, therefore, become a fully integrated<br />

provider of all real estate services that covers the whole real estate value chain. By<br />

covering the whole real estate value chain <strong>conwert</strong> should be able to generate addi-<br />

tional cash-flows. The strategic focus of <strong>conwert</strong> after the acquisition of the inter-<br />

ests will remain in high-quality residential properties and will be extended by the<br />

management expertise of ECO Management GmbH in business properties.<br />

In addition, the acquisition of the Alt & Kelber-Group is an important step for con-<br />

wert's expansion in Germany. Through this acquisition <strong>conwert</strong> would have exten-<br />

sive and established property management and Alt & Kelber-Group's 20 year<br />

knowledge of the German real estate market at its internal disposal.<br />

8. JP Morgan acted as <strong>conwert</strong>'s financial advisor in this transaction and submitted a<br />

fairness opinion to the management board.<br />

Due to the importance of the acquisitions stated in agenda item 1 of the invitation to<br />

<strong>conwert</strong>'s shareholders' meeting on 25 October 2007 for <strong>conwert</strong>'s group-structure and<br />

the future strategy of <strong>conwert</strong> as well as due to certain relationships between <strong>conwert</strong>'s<br />

boards and individual sellers respectively the boards of individual sellers the manage-<br />

ment board and the supervisory board of <strong>conwert</strong> have – after the management board<br />

had submitted a request for approval by the supervisory board and after the supervisory<br />

board had discussed such request benevolently – agreed to inform the shareholders'<br />

meeting extensively on the planned transaction and to request the approval of the<br />

shareholders' meeting to the conclusion of the agreements by <strong>conwert</strong>'s boards.<br />

The management board and the supervisory board of <strong>conwert</strong> recommend that <strong>conwert</strong>'s<br />

shareholders approve the conclusion of the agreements regarding the planned acquisition<br />

of interests by <strong>conwert</strong>'s boards in the shareholders' meeting on 25 October 2007.<br />

Vienna, 3 October 2007<br />

_____________________________ __________________________<br />

Mag Franz Zwickl Mag Johann Kowar<br />

(Chairman of the Supervisory Board) (Chairman of the Management Board)