Hypercom Corporation Annual Report - CiteSeer

Hypercom Corporation Annual Report - CiteSeer

Hypercom Corporation Annual Report - CiteSeer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Lisa Shipley v. <strong>Hypercom</strong> <strong>Corporation</strong>. (United States District Court for the Northern District of Georgia, Civil Action No.<br />

1:09-CV-0265, filed on January 30, 2009)<br />

Lisa Shipley (“Shipley”), a former employee, filed this action against us in January 2009, alleging that we violated Title VII of<br />

the Civil Rights Act by discriminating against her on the basis of her gender, violated the Georgia Wage Payment laws, the Equal Pay<br />

Act and Georgia law by paying her lower compensation based on her gender. Ms. Shipley is seeking compensatory damages for<br />

emotional distress, damage to reputation, embarrassment, lost wages, back pay, accrued interest, punitive damages, attorney’s fees and<br />

expenses, and interest. In February 2009, we filed a motion to dismiss based on improper venue or, in the alternative, to transfer venue<br />

to the United States District Court for the District of Arizona. In June 2009, the Court denied the motion. In June 2009, we filed our<br />

answer, generally denying the material allegations of Ms. Shipley’s complaint. In October 2009, Ms. Shipley filed an amended<br />

complaint adding an allegation that we unlawfully retaliated against her. In November 2009, we filed our answer, denying the material<br />

allegations of the amended complaint. In February 2010, we filed a Motion for Judgment on the Pleadings as to Ms. Shipley's<br />

retaliation claim. This action is currently in the discovery stage.<br />

Item 4. (Removed and Reserved)<br />

PART II<br />

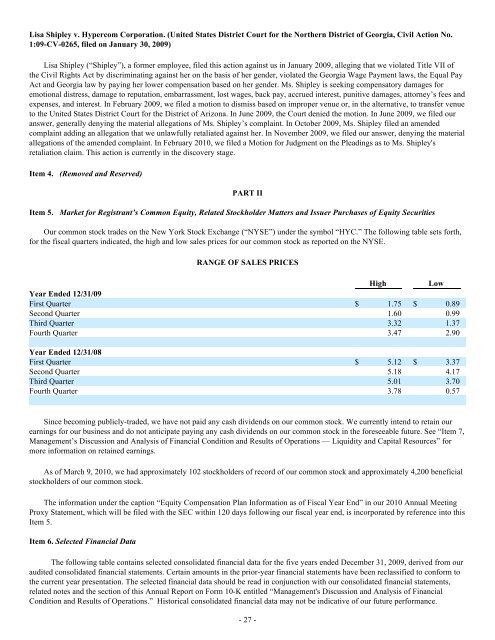

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities<br />

Our common stock trades on the New York Stock Exchange (“NYSE”) under the symbol “HYC.” The following table sets forth,<br />

for the fiscal quarters indicated, the high and low sales prices for our common stock as reported on the NYSE.<br />

RANGE OF SALES PRICES<br />

High Low<br />

Year Ended 12/31/09<br />

First Quarter $ 1.75 $ 0.89<br />

Second Quarter 1.60 0.99<br />

Third Quarter 3.32 1.37<br />

Fourth Quarter 3.47 2.90<br />

Year Ended 12/31/08<br />

First Quarter $ 5.12 $ 3.37<br />

Second Quarter 5.18 4.17<br />

Third Quarter 5.01 3.70<br />

Fourth Quarter 3.78 0.57<br />

Since becoming publicly-traded, we have not paid any cash dividends on our common stock. We currently intend to retain our<br />

earnings for our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future. See “Item 7,<br />

Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” for<br />

more information on retained earnings.<br />

As of March 9, 2010, we had approximately 102 stockholders of record of our common stock and approximately 4,200 beneficial<br />

stockholders of our common stock.<br />

The information under the caption “Equity Compensation Plan Information as of Fiscal Year End” in our 2010 <strong>Annual</strong> Meeting<br />

Proxy Statement, which will be filed with the SEC within 120 days following our fiscal year end, is incorporated by reference into this<br />

Item 5.<br />

Item 6. Selected Financial Data<br />

The following table contains selected consolidated financial data for the five years ended December 31, 2009, derived from our<br />

audited consolidated financial statements. Certain amounts in the prior-year financial statements have been reclassified to conform to<br />

the current year presentation. The selected financial data should be read in conjunction with our consolidated financial statements,<br />

related notes and the section of this <strong>Annual</strong> <strong>Report</strong> on Form 10-K entitled “Management's Discussion and Analysis of Financial<br />

Condition and Results of Operations.” Historical consolidated financial data may not be indicative of our future performance.<br />

- 27 -