Hypercom Corporation Annual Report - CiteSeer

Hypercom Corporation Annual Report - CiteSeer

Hypercom Corporation Annual Report - CiteSeer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

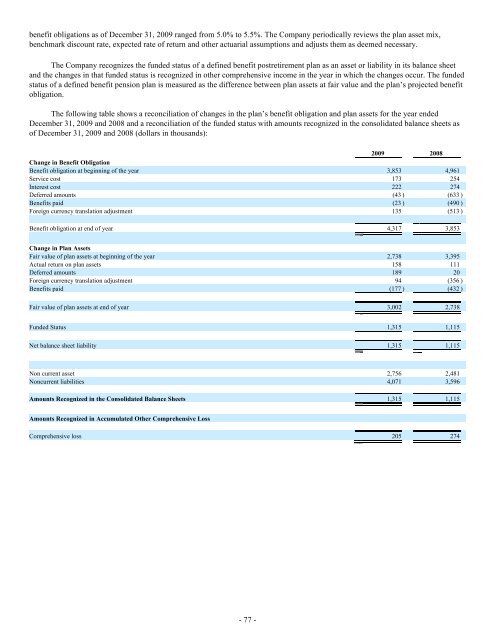

enefit obligations as of December 31, 2009 ranged from 5.0% to 5.5%. The Company periodically reviews the plan asset mix,<br />

benchmark discount rate, expected rate of return and other actuarial assumptions and adjusts them as deemed necessary.<br />

The Company recognizes the funded status of a defined benefit postretirement plan as an asset or liability in its balance sheet<br />

and the changes in that funded status is recognized in other comprehensive income in the year in which the changes occur. The funded<br />

status of a defined benefit pension plan is measured as the difference between plan assets at fair value and the plan’s projected benefit<br />

obligation.<br />

The following table shows a reconciliation of changes in the plan’s benefit obligation and plan assets for the year ended<br />

December 31, 2009 and 2008 and a reconciliation of the funded status with amounts recognized in the consolidated balance sheets as<br />

of December 31, 2009 and 2008 (dollars in thousands):<br />

2009 2008<br />

Change in Benefit Obligation<br />

Benefit obligation at beginning of the year $ 3,853 $ 4,961<br />

Service cost 173 254<br />

Interest cost 222 274<br />

Deferred amounts<br />

(43 )<br />

(633 )<br />

Benefits paid<br />

(23 )<br />

(490 )<br />

Foreign currency translation adjustment 135<br />

(513 )<br />

Benefit obligation at end of year $ 4,317 $ 3,853<br />

Change in Plan Assets<br />

Fair value of plan assets at beginning of the year $ 2,738 $ 3,395<br />

Actual return on plan assets 158 111<br />

Deferred amounts 189 20<br />

Foreign currency translation adjustment 94<br />

(356 )<br />

Benefits paid<br />

(177 )<br />

(432 )<br />

Fair value of plan assets at end of year $ 3,002 $ 2,738<br />

Funded Status $ 1,315 $ 1,115<br />

Net balance sheet liability $ 1,315 $ 1,115<br />

Non current asset 2,756 2,481<br />

Noncurrent liabilities 4,071 3,596<br />

Amounts Recognized in the Consolidated Balance Sheets $ 1,315 $ 1,115<br />

Amounts Recognized in Accumulated Other Comprehensive Loss<br />

Comprehensive loss 205 274<br />

- 77 -