El Sewedy Cables - Zawya

El Sewedy Cables - Zawya

El Sewedy Cables - Zawya

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PRIME EGYPT SALES TEAM<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

Power <strong>Cables</strong> Producer<br />

Initiation of Coverage<br />

Tamed Energy, but Growth Still Wild<br />

• <strong>Sewedy</strong> <strong>Cables</strong> operates in three segments. The power cable segment is the<br />

company’s largest segment representing over 93% of the company 2006 sales.<br />

The other two segments are turn key projects and electrical products representing<br />

5% and 2% of 2006 sales respectively.<br />

• <strong>El</strong> <strong>Sewedy</strong> cables benefits from lower cost per ton compared to its major competitors<br />

in Europe and the GCC through its accessibility to cheaper labor, energy<br />

cost and SG&A.<br />

• <strong>Sewedy</strong> <strong>Cables</strong> is Egypt’s largest power cable provider with a market share<br />

reaching 56%, while only 21% of the consolidated company sales of power<br />

cables are sold locally, while the remaining balance is either exported or produced<br />

in the companies regional affiliates.<br />

• The power cable segment produces power cables, special cables and winding<br />

wires, currently produced through five Egyptian companies and two regional<br />

plants in Syria and Sudan. The segment also produces copper along with other<br />

raw materials that is used in the cable production. However, the current cable<br />

production capacities require only 49% of the raw materials produced and the<br />

remaining balance is sold.<br />

• During 2008, three new companies in Saudi Arabia, Libya and Zambia will commence<br />

production. The Saudi company will be 60% owned by <strong>Sewedy</strong> <strong>Cables</strong><br />

with an investment cost of US$80 million and an annual capacity of 25k tons of<br />

power cables. The Libyan subsidiary’s investment cost is estimated at US$64<br />

million, 55% owned by <strong>Sewedy</strong> cables and will produce an output of 13.6k tons<br />

of power cables per annum.<br />

• Revenues and net income witnessed a robust growth during Q1 FY07, reflecting<br />

97% and 53% increase respectively over Q1 FY06, driven mainly by better<br />

selling prices and to a lesser extent by volumes, conforming with the company’s<br />

historical performance. Consequently, we expect FY07 revenues and net<br />

income to grow by 38% and 27% respectively over FY06 reported figures.<br />

• We have concluded a consolidated DCF value of LE103/share driven by the<br />

company’s ability to transfer cost increases to its customers, maintain leadership<br />

in its local market given its low cost structure and the expected expansions<br />

especially in Saudi Arabia and Libya enabling the company to take advantage of<br />

the regions’ improved economy and utilities need to expand its infrastructure<br />

layout so to come close to global peer countries levels.<br />

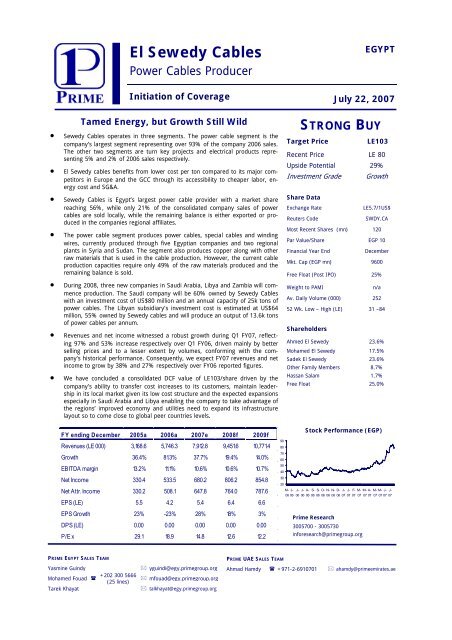

FY ending December 2005a 2006a 2007e 2008f 2009f<br />

Revenues (LE 000) 3,168.6 5,746.3 7,912.8 9,451.6 10,771.4<br />

Growth 36.4% 81.3% 37.7% 19.4% 14.0%<br />

EBITDA margin 13.2% 11.1% 10.6% 10.6% 10.7%<br />

Net Income 330.4 533.5 680.2 806.2 854.8<br />

Net Attr. Income 330.2 508.1 647.8 764.0 787.6<br />

EPS (LE) 5.5 4.2 5.4 6.4 6.6<br />

EPS Growth 23% -23% 28% 18% 3%<br />

DPS (LE) 0.00 0.00 0.00 0.00 0.00<br />

P/E x 29.1 18.9 14.8 12.6 12.2<br />

Yasmine Guindy � yguindi@egy.primegroup.org<br />

+202 300 5666<br />

Mohamed Fouad � � mfouad@egy.primegroup.org<br />

(25 lines)<br />

Tarek Khayat � talkhayat@egy.primegroup.org<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

PRIME UAE SALES TEAM<br />

EGYPT<br />

July 22, 2007<br />

STRONG BUY<br />

Target Price<br />

Recent Price LE 80<br />

Upside Potential 29%<br />

Investment Grade Growth<br />

Share Data<br />

Exchange Rate LE5.7/1US$<br />

Reuters Code SWDY.CA<br />

Most Recent Shares (mn) 120<br />

Par Value/Share EGP 10<br />

Financial Year End December<br />

Mkt. Cap (EGP mn) 9600<br />

Free Float (Post IPO) 25%<br />

Weight to PAMI n/a<br />

Av. Daily Volume (000) 252<br />

52 Wk. Low – High (LE) 31 –84<br />

Shareholders<br />

LE103<br />

Ahmed <strong>El</strong> <strong>Sewedy</strong> 23.6%<br />

Mohamed <strong>El</strong> <strong>Sewedy</strong> 17.5%<br />

Sadek <strong>El</strong> <strong>Sewedy</strong> 23.6%<br />

Other Family Members 8.7%<br />

Hassan Salam 1.7%<br />

Free Float 25.0%<br />

Stock Performance (EGP)<br />

M- J- J- J- A- S- S- O- N- N- D- J- J- F- M- M- A- M- M- J- J-<br />

06 06 06 06 06 06 06 06 06 06 06 07 07 07 07 07 07 07 07 07 07<br />

Prime Research<br />

3005700 - 3005730<br />

inforesearch@primegroup.org<br />

Ahmad Hamdy � +971-2-6910701 � ahamdy@primeemirates.ae

<strong>El</strong> <strong>Sewedy</strong> started regional<br />

expansion from<br />

2002 starting with two<br />

plans located in Sudan<br />

followed by expansions in<br />

Syria and Iraq<br />

Turnkey project segment<br />

is picking up momentum<br />

and expected to play a<br />

positive role in company’s<br />

consolidated margins<br />

<strong>El</strong> <strong>Sewedy</strong> underwent<br />

impressive growth in top<br />

line figure with CAGR of<br />

56% over last 3 years,<br />

while bottom line for Q1<br />

FY07 surged by 54.5% yo-y<br />

On May 23, 2006, <strong>El</strong><br />

<strong>Sewedy</strong> <strong>Cables</strong> Co.,<br />

executed a private placement<br />

of its shares<br />

amounting to LE1.29<br />

billion on the CASE.<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

INVESTMENT SUMMARY<br />

Egypt<br />

<strong>El</strong> <strong>Sewedy</strong> family has long operated in trading electrical construction materials since 1930s. However,<br />

they established Egypt’s first private sector cable company, Arab <strong>Cables</strong>, in 1984, capitalizing<br />

on their experience in the field. In 1996, after Arab <strong>Cables</strong> capacity had quadrupled and become<br />

feasibly profitable the company entered into a period of fast expansion in which it opened several<br />

plants specialized in power cables, special cables, winding wires.<br />

Moreover, between 1996 and 1998, the group also moved into manufacturing raw materials required<br />

for its products such as copper rods, the main component in the production of cables as<br />

well as PVC, representing another input in the production of cables.<br />

Capitalizing on their local success and their products ability to penetrate regional and global markets,<br />

the company moved regional in 2002 and built two plants in Sudan during this and the later<br />

year. Following this, the company opened two plants in Syria in order to capitalize on the growing<br />

demand for infrastructure spending in Syria and Iraq.<br />

During 2008, two major new partnerships specialized in producing power cables are expected to<br />

commence production in Saudi Arabia and Libya, which are positioned to witness strong growth in<br />

both infrastructure layout and real estate spending in the coming years. The investment cost of<br />

both projects is estimated at US$144 million and their culminated revenues are expected to contribute<br />

around 11% of FY09 revenues.<br />

In addition to its wire and cable segment, the company is currently offering other related products<br />

and services, which provide attractive gross profit margins of over 30% versus 12% in the wire<br />

and cable segment. The Turnkey projects segment is growing at a fast pace establishing a track<br />

record in prominent local and international projects, which offers its clients a one stop solutions<br />

whereby it provides supplying, planning, designing and contracting. The segment sales have<br />

grown from LE78 million in FY05 to LE266 million in FY06 and currently 2007 backlog stands at<br />

LE625 million. The segment’s revenue contribution of 5% in 2006 and 8% in 2007 will have a<br />

positive impact on the company’s consolidated margins.<br />

The other segment that the company is operating in is the electrical products, in which the company<br />

produces modular terminators, power cables joints, transformers, substations and fiber glass<br />

poles. The segment’s revenues represented around 2% of 2006 revenues and this ratio is expected<br />

to continue at this rate driven by the expected higher growth in the other segments.<br />

<strong>El</strong> <strong>Sewedy</strong> was able to generate an aggressive growth in the top line over the last 3 years, hiking<br />

by a CAGR of 56% to come in at LE5.75 billion in 2006, up from LE1.51 billion in 2003. EBITDA<br />

margin was at relatively high level of 21% in 2003, which severely deteriorated gradually in the<br />

coming years, because of the hike in copper prices coupled with the company’s inability to pass<br />

the whole cost increase, to record 11.1% in 2006. Interest expense was almost tripled in 2006 to<br />

record LE94.6 million because of the aggressive leverage to finance expansions. Bottom line<br />

growth was severely affected by copper prices, following the suit of EBITDA margins. It only increased<br />

by a CAGR of 8.8% over the last 3 years to record LE508 million in 2006, versus LE395<br />

million in 2003. With reference to the latest quarter released, <strong>El</strong> <strong>Sewedy</strong> realized a top-line figure<br />

of LE1.995 billion in Q107 versus LE1.014 billion in Q106, yielding a y-o-y growth of 96.8%. Our<br />

top line estimate for 2007 is around LE8 billion. The company recorded a 62.3% growth in the<br />

EBITDA figure from LE130.4 million in Q106 to LE211.7 million in Q107. However, the EBITDA<br />

margin deteriorated to record 10.6% in Q107, down from 12.9% in Q106. Our EBITDA margin<br />

estimate for 2007 is 10.64%, which is in line with the realized results of Q107. Bottom line for the<br />

Q107 came in LE155.6 million versus LE100.8 million in Q106, indicating a y-o-y growth of 54.5%.<br />

Our bottom line estimate for 2007 is LE648 million.<br />

On May 23, 2006, <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Co., executed a private placement of its shares amounting to<br />

LE1.29 billion on the CASE. The Offering was priced at LE43/ share. Total number of shares offered<br />

was 30,000,000 representing 25% of the share capital of the company. The Offering comprises<br />

a secondary offering of shares sold by Sadek <strong>El</strong> <strong>Sewedy</strong>, Ahmed <strong>El</strong> <strong>Sewedy</strong>, Mohamed <strong>El</strong><br />

<strong>Sewedy</strong>, Mohamed Hassan Kamal Abdel Salam, Azza <strong>El</strong> <strong>Sewedy</strong>, Mona <strong>El</strong> <strong>Sewedy</strong> and Zeinab <strong>El</strong><br />

<strong>Sewedy</strong> through an offering of shares to institutional buyers from Egypt and abroad. The Selling<br />

Shareholders were committed to use LE600 million of the proceeds to fund their subscription of<br />

new shares in the capital increase of the company. The capital increase consists of a rights issue<br />

by the company pursuant to Egyptian law of 60 million new shares at a par value of LE10/share<br />

exclusively to the selling shareholders on a pro rata basis. The selling shareholders subscribed for<br />

and purchased at par value, the new shares by paying 100% of the subscription price at the time<br />

the new shares were issued. Pro forma the Capital Increase, the company will have 120,000,000<br />

shares outstanding at a par value of LE 10 per share. The shares are currently listed on the CASE.<br />

It started trading on the 28th of May 2006.<br />

2

Experts estimate an<br />

additional 68k MW of<br />

electricity capacity will be<br />

added tin MENA region<br />

throughout 2006-2010<br />

Region average installed<br />

capacity of 430W is<br />

expected to increase due<br />

to electricity expansions<br />

throughout the region<br />

Several independent<br />

power providers (IPP)<br />

have been assigned to<br />

undertake significant role<br />

in the new capital investments<br />

required to establish<br />

new power stations<br />

Egypt, Algeria, and Morocco<br />

are the top nominees<br />

to attract the largest<br />

investment outlays in<br />

the region, based on the<br />

high population figures<br />

and below average MENA<br />

installed capacity per<br />

capita<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

REGIONAL ELECTRICITY INDUSTRY OVERVIEW<br />

Egypt<br />

Empowered by the Need for Power<br />

Driven by the trend for urbanization and industrialization in the MENA region necessitating the<br />

revamp and development of the region’s infrastructure, in conjunction with the ongoing construction<br />

boom, and rapid population growth; the advancement in the regional power consumption<br />

doubled the world average rate of 3%. As the economic development in the region is expected to<br />

maintain its pace, experts estimate that during 2006 to 2010 period additional 68 thousand mega<br />

watts (MW) of electricity capacity will be added to the currently installed 162 thousand MW capacity<br />

in the MENA region. This trend of above average growth rate is expected to continue at least<br />

till 2015.<br />

<strong>El</strong>ectricity Capacity<br />

As mentioned above, the total capacity of MENA in 2005 reached 162 thousand MW, representing<br />

only 4.5% of the global installed capacity. Egypt, with around 20 thousand MW, comes third in<br />

terms of total installed power capacity in the region following Iran and Saudi Arabia with installed<br />

capacities exceeding 36 and 29 thousand<br />

MW, respectively. The region average<br />

installed capacity per capita is<br />

Estimated MENA <strong>El</strong>ectricty Expansions (MW)<br />

430W, which is way below the world<br />

average of 550 W. Egypt’s range of 250<br />

50,000<br />

W per capita installed power capacity<br />

lies within the low-end of the region.<br />

40,000<br />

Qatar tops the regional list by 3,881 W,<br />

followed by UAE, Kuwait, and Bahrain.<br />

30,000<br />

The GCC average per capita installed<br />

capacity stands at 1,835 W similar to<br />

20,000<br />

ratios in many developed countries. On<br />

the other hand, Sudan with less than<br />

10,000<br />

30% population coverage (29 W per<br />

capita), as well as Palestine, and Yemen<br />

stand as the lowest installed capacity<br />

per capita in the region. Chart 1 dis-<br />

0<br />

Series1<br />

Gulf Expected<br />

47,216<br />

N. Africa Expected<br />

30,000<br />

Levant Expected<br />

4,100<br />

plays the expected electricity expansion Chart 1 Source: <strong>Zawya</strong><br />

throughout the MENA region.<br />

The power sector in the region is dominated by governmental entities or government controlled<br />

companies. Recently, however, due to the lack of professional expertise in many of the region’s<br />

countries coupled with the immense investment costs required for establishing new power stations,<br />

several independent power providers (IPP) have been assigned to undertake significant role<br />

in the new capital investments in this industry. The IPPs work by operating under Build, Own,<br />

Operate, and Transfer (BOOT), in parallel to the governmental agencies operating in the electricity<br />

field.<br />

Demand—Unlimited Growth Potential<br />

The persisting low rates of electricity consumption per capita, along with the aggressive industrialization<br />

and real estate development plans, guarantees a sustainable increase in the consumption of<br />

electricity, hence, the need for further electrical capacity. Egypt, Algeria, and Morocco are the top<br />

nominees to attract the largest investment outlays in the region, based on the high population<br />

figures and below average MENA installed capacity per capita.<br />

Iran is expected to lead the increased capacities in absolute terms by 2010 with incremental addition<br />

of 19 thousand MW, followed by Saudi Arabia with 8.5 thousand MW and Egypt with additional<br />

7.8 thousand MW. In line with these expansions, the regional capacities is expected to grow<br />

by over 68 thousand MW, increasing by 42% over a 5-year period, with over 50% of the expected<br />

growth in the region (excluding Iran) generated from growth in Saudi Arabia, Egypt, and UAE.<br />

3

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

Egypt<br />

Power Grids—All for one and one for All<br />

The Unified Arab <strong>El</strong>ectricity Grid is being established with the purpose of interconnecting national grids<br />

of Pan Arab countries. The purpose of this web is to minimize the investments required by each individual<br />

country in the power industry achieved through satisfying the seasonal demand of member<br />

countries by channeling excess electricity from other members during the same point of time, since<br />

the peak demand varies from one country to another due to time, and socio-economic differences. For<br />

instance, demand peaks in Egypt and Levant from 6-10 p.m., while in GCC between 1-5 p.m. Also,<br />

Pan Arab electricity grid<br />

Iraq demand peaks in summer versus Levant peak in winter. This shall generate additional demand on<br />

to be established with<br />

net investment of<br />

transmission cables. The grid will also allow low-cost electricity producers to export to members with<br />

US$1.78 billion higher production costs.<br />

The pan Arab Grid will be formed through linking three territorial grids, the GCC Interconnection Grid,<br />

Arab <strong>El</strong>ectricity Grid, and the North Africa Grid. The first phase of the GCC Interconnection Grid is<br />

expected to be completed by mid-2008 with a cost of around US$ 1.18 billion. In this phase Kuwait,<br />

Saudi Arabia, Qatar, and Bahrain will connect their power grids, to be followed by UAE and Oman in<br />

the second phase. At a cost of US$ 600 million, the Arab <strong>El</strong>ectricity Grid is designed to connect<br />

Egypt, Syria, Jordan, Lebanon, Iraq, and Turkey, while the North African Grid includes Libya, Tunisia,<br />

Algeria, and Morocco.<br />

Copper prices have<br />

witnessed a surge<br />

throughout FY06 up<br />

until Q1 FY07, however<br />

prices are expected to<br />

increase due to supply<br />

outstripping demand<br />

Copper Pricing<br />

For the year 2006, copper<br />

prices witnessed all time highs<br />

reaching as high as US$8,788/<br />

ton and averaging at around<br />

US$6,730/ton. As Copper is the<br />

essential raw material for<br />

power cable production, naturally<br />

it would have a predominant<br />

effect over the industry’s<br />

cost structure and ultimately<br />

over the final product’s wholesale<br />

& retail pricing. For the<br />

year 2007, copper prices are<br />

expected to average at<br />

US$7,330/ton as prices surpassed<br />

the $8,000/ton benchmark<br />

during the month of May<br />

2007. However, copper supply<br />

is expected to surpass global<br />

demand therefore yielding an<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2,801<br />

Copper Avg. Price (US$/ton)<br />

Chart 2 Source:<strong>El</strong> <strong>Sewedy</strong> & Bloomberg<br />

FY07 average price of US$7,330 and a continual decline in FY08 to average at US$7,060. Chart 2 illustrates<br />

the raw material’s price movements through out 2004 up until 2006 and provides the years<br />

2007 and 2008’s projected average price.<br />

As for aluminum which is another essential raw material used in the manufacturing of power cables,<br />

the raw material is currently priced at US$2,675 and is undergoing a robust global demand which<br />

could supersede supply, therefore causing its prices to hike within the coming period.<br />

3,684<br />

6,730<br />

7,330<br />

2004a 2005a 2006a 2007e 2008f<br />

7,060<br />

4

Egypt has several privately-owned<br />

power<br />

plants currently under<br />

construction which were<br />

financed under Build,<br />

Own, Operate, and<br />

Transfer (BOOT) financing<br />

schemes<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

OVERVIEW OF THE EGYPTIAN ELECTRICITY INDUSTRY<br />

Industry Background<br />

Egypt<br />

Egypt's installed power generating capacity stands at around 20 thousand MW, with plans to add<br />

8.38 GW by mid-2012. Around 84 percent of Egypt's electric generating capacity is powered by<br />

natural gas, with the remaining 16 percent hydroelectric, mostly from the Aswan High Dam. All oilfired<br />

plants have been converted to run on natural gas as their primary fuel, and thermal power<br />

plants now account for roughly 65 percent of Egypt 's total gas consumption.<br />

With electricity demand growing, Egypt is building several power plants and is considering limited<br />

privatization of the electric power sector. Egypt's power sector currently comprises seven regional<br />

state-owned power production and distribution companies, which were held by the Egyptian <strong>El</strong>ectricity<br />

Authority (EEA). In July 2000, the EEA was converted into a holding company, though still<br />

owned by the state. Egypt has several privately-owned power plants currently under construction<br />

which were financed under Build, Own, Operate, and Transfer (BOOT) financing schemes.<br />

Alternative Sources of <strong>El</strong>ectricity Generation<br />

Egyptian authorities established a company named New and Renewable Energy Authority (NREA),<br />

which was incorporated to develop the renewable energy. NREA’s current strategy is to satisfy 3%<br />

of energy demand from renewable resources, mainly Solar and Wind generated. In line of this,<br />

Egypt is planning to build a part-solar power plant at Kureimat as a BOOT project, which will have<br />

30 MW of solar capacity out of a total planned capacity of 150 MW. The World Bank will provide a<br />

financing package from its Global Environmental Facility which will offset the cost difference between<br />

the solar capacity and thermal capacity. A Netherlands-funded project is building 60 MW<br />

worth of wind power units in the Suez Canal area.<br />

Nuclear power has been recognized lately as another alternative source of power supply in Egypt.<br />

Egypt currently has a 22-MW nuclear research reactor at Inshas in the Nile Delta, built by INVAP<br />

S.A. of Argentina, which began operation in 1997. As per the National Democratic Party’s initiative,<br />

more weight will be provided for generating energy from this resource.<br />

Low-Cost Environment<br />

<strong>El</strong> <strong>Sewedy</strong>'s Global Advantage<br />

Egypt’s <strong>El</strong>ectrical sector Cost is a crucial element in the highly-<br />

has the advantage of competitive, capital-intensive power<br />

cheap labor , energy and<br />

cable industry. Egyptian producers en-<br />

infrastructure costs comjoy<br />

both low labor and infrastructure<br />

pared to the global market<br />

costs. Egypt is far from poor when it<br />

comes to labor force, with around 18<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

2,000<br />

4,123<br />

8,793<br />

million people qualifying as an excellent 20,000 40,455 40,455 40,455<br />

source of productive and inexpensive<br />

labor with varying skills.<br />

10,000<br />

0<br />

The labor force in Egypt grows at an<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> GCC Europe<br />

annual approximate rate of 2.7%, which<br />

sustains the availability of labor. Egypt’s<br />

average labor cost per hour is US$0.9<br />

RM Costs Manufacturing & SG&A Costs<br />

much lower than that of Europe and Chart 3 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

Mediterranean countries. Moreover,<br />

Egypt enjoys relatively low infrastructure and utility costs (building, electric power, gas, and water).<br />

<strong>El</strong> <strong>Sewedy</strong> Cable serves as a good example to Egypt’s overall cost advantage when it comes to producing<br />

cables as can be displayed in chart 3.<br />

Proximity to End User Markets<br />

The closer the distance between the buyer and the supplier, the faster and cheaper the supply<br />

chain process is. Consequently, this allows Egypt to offer competitive lead times as well as reduction<br />

in freight charges, which are added costs to the buyer. Egypt has competitive shipping times to<br />

Europe compared to the GCC and Far East.<br />

Preferential Trade Agreements<br />

As a result of a number of regional and international trade agreements, including Egypt-EU trade<br />

Preferential trade agree-<br />

partnership, Egypt has been able to exploit export-oriented opportunities. That said, <strong>El</strong> <strong>Sewedy</strong> will<br />

ments between Egypt<br />

and Europe paves way sell to Europe free of tariffs, while the European exports to Egypt are subjected to tariffs. This privi-<br />

for greater export orilege also exists in export markets in Arab Countries by virtue of the Arab Free Trade Agreement,<br />

ented opportunities.<br />

and to members of COMESA agreement in the African content. In turn this, combined with <strong>El</strong><br />

<strong>Sewedy</strong>’s lower production costs, grants a price competitive edge for its products.<br />

Cost Per Ton (LE)<br />

5

A dominant Egyptian<br />

cable company, and<br />

leading regional player<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

COMPANY OVERVIEW<br />

<strong>El</strong> <strong>Sewedy</strong> Group’s Brief History<br />

1938 <strong>El</strong> <strong>Sewedy</strong> family started its operations through trading in <strong>El</strong>ectrical equipments.<br />

1960<br />

1986<br />

1996<br />

1997<br />

Egypt<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> is an Egyptian joint stock company incorporated for the purpose of establishing<br />

and operating production facilities for power cables, transformers, terminators, joint accessories,<br />

copper and aluminum terminators, lightning fiber poles, in addition to the production of polyvinyl<br />

chloride “PVC”. The Company is also engaged in designing, building, managing, operating and<br />

maintaining power generation units and power grids.<br />

The company has over four thousand employees and holds majority stake in over a dozen companies<br />

all of which are operating in the <strong>El</strong>ectric cables and appliances production. Its subsidiaries<br />

include Arab <strong>Cables</strong> Co., United Metals Co., Sedplast Co., Egytec <strong>Cables</strong> Co., United Industries<br />

Co., <strong>El</strong>astimold, <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Co., United Metals Co., Egyplast Co., <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>-Syria,<br />

Sudanese Egyptian <strong>El</strong>ectric, Giyad-<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Co., <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Ghana, <strong>El</strong> <strong>Sewedy</strong><br />

<strong>El</strong>ectric-Qatar, <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>-Algeria and <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric-Syria.<br />

The operations extended into the distribution of cables manufactured by the sole local producer at that<br />

time.<br />

The business undertook a major leap through the establishment of Arab <strong>Cables</strong> Co., the first Egyptian<br />

private sector cable factory with a capacity of 6 K tons of copper cables per annum .<br />

Arab <strong>Cables</strong> capacity quadrupled to 23 K ton of copper cables per annum<br />

The group also established its second factory, Egytech <strong>Cables</strong>, a state of the art facility with annual production<br />

capacity of 14.4 K tons of copper and 8.4 K tons of aluminum.<br />

Later, it incorporated Sedplast, <strong>El</strong> <strong>Sewedy</strong>’s first PVC production plant used to supply PVC compounds<br />

and master batch for cables isolation which constitutes a major portion of the production inputs .<br />

<strong>El</strong> <strong>Sewedy</strong> family established United Industries, constituting of three factories, the first designed for the<br />

production of special cables, the second for Magnet wires, and the third for fiber glass poles.<br />

Also, in the same period, it established of <strong>El</strong>astimold Egypt as a joint venture with <strong>El</strong>astimold, a unit of<br />

Thomas & Betts, one of the leading companies in the field of cable accessories worldwide. The company’s<br />

key product is power cable joints.<br />

1998 <strong>El</strong> <strong>Sewedy</strong> family established <strong>El</strong> <strong>Sewedy</strong> Sedco specialized in producing cables accessories.<br />

2000<br />

2002<br />

2003<br />

2005<br />

2007<br />

2008<br />

United Metals Co, Egypt’s first high grade copper rod producer and the largest in the Middle East, commences<br />

operations. The produced copper rods represents the main components in cable production.<br />

Establishment of first regional cable factory, Giad <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>, in partnership with Sudanese Company<br />

– Giad, for the production of power and telephone cables.<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> expanded its regional facilities by establishing Sudanese Egyptian <strong>El</strong>ectrical Industries<br />

Co. in partnership with the Sudanese <strong>El</strong>ectricity Authority. The new entity in turn inaugurated two subsidiaries:<br />

Sudatraf, specialized in manufacturing transformers and electrical panels; and Sudaconcrete,<br />

specialized in producing concrete panels<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>-Syria, specialized in manufacturing of power cables up to 400 Kv, planned to capitalize<br />

on the growth potential in Levant and Iraq.<br />

<strong>El</strong> <strong>Sewedy</strong> further penetrates Africa, through opening <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric-Ghana, designed to produce<br />

fiber glass road lighting poles.<br />

<strong>El</strong> <strong>Sewedy</strong> is in the process of establishing three new factories: <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Syria, United Wires,<br />

and Egyplast.<br />

The company plans to further open three additional factories in 2008, namely: <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Zambia,<br />

Libya <strong>Cables</strong>, and <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Saudi Arabia.<br />

Table 1 Source: <strong>El</strong> <strong>Sewedy</strong><br />

6

A leading Egyptian cable<br />

company, following a vertically<br />

integrated model<br />

Unique duality:<br />

Profound history and<br />

ongoing rapid expansion<br />

brought together<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

COMPANY OVERVIEW<br />

Corporate Strategy<br />

Egypt<br />

The company aims to maintain its current position as the leading power cables manufacturer in the<br />

Middle East and Africa. In its pursuit to achieve this goal, <strong>El</strong> <strong>Sewedy</strong> primarily focuses on organic<br />

growth in local and regional markets through the erection of Greenfield projects, while acquisitions<br />

settles as a secondary option.<br />

<strong>El</strong> <strong>Sewedy</strong> is structured as a vertically integrated pure play electric products manufacturer. This<br />

comes inline with its adopted strategy to maintain low-cost production as a cornerstone for market<br />

penetration. The substantial portion of raw materials developed in-house thus enables it to achieve<br />

price differential while offering quality similar to that of the competing international players. To<br />

that end, the group identifies markets with competitive cost environments on both investment and<br />

production frontiers as well as proximity to major importing markets as its optimal investment<br />

habitat. Meanwhile, it addresses environments with vast demand for infrastructure and real estate<br />

development and renovation as their prime sales markets.<br />

More recently, <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> increased it emphases on integrated solutions through offering<br />

customers turn key packages including: engineering, transmission and distribution services.<br />

Chart 4 Source: <strong>El</strong> <strong>Sewedy</strong><br />

Historical Overview<br />

The group has commenced its operations in electric supplies industry since the late 1930s. Up till<br />

the mid 1980s, <strong>El</strong> <strong>Sewedy</strong>’s operations were limited to trading in electrical equipments and cables,<br />

thereby evolving in 1986 as the first private power cable producer in Egypt. Since then, the business<br />

has rapidly emerged capitalizing on the extensive infrastructure revamp, while at the same<br />

time Egypt was undergoing developments as a backbone to attract FDI targeted by the consecutive<br />

Egyptian governments. The group now employs over 4,000 workers in its various companies.<br />

In 1996, the group initiated its vertical integration through expanding into the production of PVC,<br />

an essential raw material in cable production, meanwhile horizontal integration continued to gain<br />

momentum as annual production capacity reached over 45 k tons of power cables.<br />

Capitalizing on their operational experience, established brand-name and solid position in the local<br />

market, the group spotted the opportunity to invade regional markets. As realized by the group’s<br />

executives, the potential opportunities in the Middle East and African markets offered exponential<br />

growth for the company. The driver behind the ongoing expansion remains the favorable cost<br />

differential providing <strong>El</strong> <strong>Sewedy</strong> group a competitive edge over European and GCC competitors.<br />

As much as the unique duality used in the company’s new advertising campaign brings flavor to its<br />

client base: Power & Safety coming along, the group has clearly succeeded in achieving another<br />

distinct duality appealing to its shareholders: profound history and ongoing rapid expansion.<br />

7

Power <strong>Cables</strong> segment<br />

accounts for 93% of <strong>El</strong><br />

<strong>Sewedy</strong> Cable’s total<br />

turnover<br />

Turn Key projects will<br />

expand due to opportunities<br />

in foreign markets<br />

<strong>El</strong> <strong>Sewedy</strong> benefits from<br />

being the sole producer<br />

of fiber glass poles in<br />

Africa<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

OPERATIONS ANALYSIS<br />

Egypt<br />

The group operates in three main segments of the electric equipments industry: Wire & Power<br />

<strong>Cables</strong>, Turn Key Projects, and <strong>El</strong>ectric Appliances.<br />

Power <strong>Cables</strong><br />

The wire & cable segment is the most significant one within the group as it represents the main<br />

stream of the group’s operations accounting for over 93% of its turnover. The segment specializes<br />

in the production of power, special cables & winding wires. Copper, aluminum, and plastic products<br />

represents the main components of the wire and cable industry. In accordance with its vertical<br />

integration strategy, the group manufactures copper rods and plastic material required for<br />

coating (mainly PVC) in-house out of which around 54% is consumed in the production of cables<br />

within the group. This figure is expected to increase to 60-70% during FY07. The group currently<br />

has cable production facilities in Egypt, Syria, and Sudan. <strong>El</strong> <strong>Sewedy</strong> enjoys the benefit of owning<br />

one of the largest copper plants throughout the MENA region as it holds a production capacity of<br />

120k tons of copper per year which can be converted into a 8 mm diameter rod. Additionally, to its<br />

advantage, the company’s production cost is 50% lower than that of its competitors in the GCC<br />

countries.<br />

Turn Key Projects<br />

The second line of business performed by the group lies in comprehensive turn key projects where<br />

<strong>El</strong> <strong>Sewedy</strong> engages in huge contracting projects including infrastructure projects, distribution and<br />

transmission projects and rural electrification projects. This segment offers clients a one-stop solutions<br />

to undertake large projects including planning, designing, supplying, and contracting largescale<br />

projects both in Egypt and internationally. Although this line merely represents 5% of the<br />

group’s aggregate revenues, <strong>El</strong> <strong>Sewedy</strong> plans to augment the percentage of contribution of this<br />

segment in order to tap the higher profit margins characterizing this field.<br />

<strong>El</strong>ectrical Appliances<br />

<strong>El</strong>ectrical appliances stands as the final operational segment of the group representing 2% of its<br />

sales. The electrical products includes cables accessories such as modular terminators, power<br />

cable joints, transformers and substations. Additionally, <strong>El</strong> <strong>Sewedy</strong> owns a fiber glass poles production<br />

facility in Egypt with a capacity of 10,800 poles/year. The company’s fiber glass poles<br />

plant was the only plant in Africa producing poles, however due to strong demand, <strong>El</strong> <strong>Sewedy</strong> has<br />

established a second plant in Ghana for fiber glass poles production. <strong>El</strong> <strong>Sewedy</strong> also has manufacturing<br />

facilities in Sudan which produces electrical appliances.<br />

Cable Production Process in a Nutshell<br />

<strong>El</strong> <strong>Sewedy</strong> imports refined copper cathodes from various London Metal Exchange “LME” registered<br />

sources, primarily from Zambia, Spain, Cyprus, Chile, & USA. The cathodes with purity of approximately<br />

99.9% are bought based on LME declared prices plus fixed premium covering freight, insurance,<br />

and freight. Cathodes are charged into furnace where they are placed into a bucket<br />

which hoisted to the charge level & tilt the cathode in the furnace.<br />

The metal is then melted and then cast. The flow of molten metal in a continuously rotated casting<br />

ring at fixed speed and is cooled from outside by specially designed water spray transforming<br />

the molted metal into cast bar. The cast bar formed is milled through hot rolling mills into copper<br />

rod. The rod is then cooled and passed through magnetic coil which detects imperfection/damage<br />

on the surface of the rod. Afterwards, a plastic coat of sufficient strength over the coil to prevent<br />

atmospheric oxidation.<br />

The pricing of the copper rod manufactured by the group is based on copper cathode purchase<br />

cost plus the rod transformations cost incurred within their facilities, while the power cables produced<br />

is charged by the additional cable transformation costs. Both rods and cables’ prices are<br />

marked-up by both a fixed premium per ton and a variable premium.<br />

8

<strong>El</strong> <strong>Sewedy</strong> is currently<br />

the second largest regional<br />

market player and<br />

is on its way to being the<br />

largest market player due<br />

to expansion plans<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

<strong>El</strong> <strong>Sewedy</strong> — The Right Place, the Right Time<br />

<strong>El</strong> <strong>Sewedy</strong> is by far the dominant<br />

market player for power cables in<br />

Egypt. It is one of two highvoltage<br />

cables producers in<br />

Egypt, the other being Giza <strong>Cables</strong>.<br />

The company succeeded in<br />

raising its stake in the power<br />

cables’ local market (high, medium,<br />

and low-voltage) up to<br />

56%, while its first competitor’s<br />

share—Giza <strong>Cables</strong>—is as low as<br />

11%. The remaining 33% are<br />

fragmented among 7 local producers.<br />

Egypt<br />

Despite the fact that power ca-<br />

Chart 5 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

bles is a capital intensive industry<br />

placing hindering barriers to entry, the regional markets remain highly competitive. The major<br />

rivals are GCC manufacturers who have gained respectable market presence in their home markets.<br />

Indian manufacturer represent serious competition in the GCC markets, while Tunisia, and<br />

Morocco are the main rivals in European export markets.<br />

Currently, <strong>El</strong> <strong>Sewedy</strong> is the second<br />

largest regional market player by<br />

capacity, yet it is expected to recapture<br />

the leadership in terms of<br />

capacity upon the completion of its<br />

undergoing expansions. <strong>El</strong> <strong>Sewedy</strong>,<br />

succeeded in capitalizing on its<br />

cost advantage, its size, its brand<br />

name and, most importantly, its<br />

integrated solutions to gain distinguished<br />

market position in the GCC<br />

markets. Other producers in the<br />

region, namely in Syria, Lebanon<br />

and Jordan are comparatively<br />

small in size.<br />

Others,<br />

33%<br />

Giza<br />

<strong>Cables</strong>,<br />

11%<br />

Power <strong>Cables</strong> Local M arket<br />

<strong>El</strong> <strong>Sewedy</strong>,<br />

56%<br />

Chart 6 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

However, it should be noted that <strong>El</strong> <strong>Sewedy</strong> has an ambitious regional expansion plan whereby<br />

we expect to see <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> production capacity to increase by a CAGR of 91% over FY07<br />

and FY08 as can be seen in chart 7<br />

FY08<br />

FY07<br />

FY06<br />

FY05<br />

FY04<br />

180,000<br />

160,000<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

Regional <strong>Cables</strong> Capacity ( tons)<br />

Riyad <strong>Cables</strong><br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

<strong>El</strong> <strong>Sewedy</strong> Capacity Expansion<br />

0 50000 100000 150000 200000 250000<br />

<strong>Cables</strong> (Tons)<br />

Capacity Production<br />

DUCAB<br />

Saudi <strong>Cables</strong><br />

Jeddah <strong>Cables</strong><br />

Oman <strong>Cables</strong><br />

Chart 7 Source: <strong>El</strong> <strong>Sewedy</strong> & Prime Estimates<br />

Gulf <strong>Cables</strong><br />

MESC<br />

9

Company enjoyed<br />

high growth rate in its<br />

Cable venture in Syria<br />

and will become the<br />

sole manufacturer of<br />

transformers within<br />

the country<br />

Sudan has an untapped<br />

market as only<br />

30% of population<br />

have access to electricity<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

AMBITIOUS INVESTMENT STRATEGY<br />

Egypt<br />

Abiding by its corporate strategy to maintain the well deserved leadership position as one of the<br />

largest power cables manufacturers in the Middle East, the group is undergoing daring expansion<br />

plan that is expected to double its capacity during the foreseeable future.<br />

Strong Presence in Regional Markets coupled with Expansion<br />

Syria<br />

<strong>El</strong> <strong>Sewedy</strong> seized the opportunity to establish green field projects in Syria, namely <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

Syria which started operations in 2005 and the establishment of <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Syria which is<br />

expected to commence operations by July 2008. <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> was capable of filling in a market<br />

gap through becoming the sole producer of high & extra high voltage cables, whereas prior to its<br />

inception the demand for high and extra high voltage cables in Syria was previously catered by<br />

exports. It should be noted that <strong>El</strong> <strong>Sewedy</strong> Cable is one out of four producers of cables in the Syrian<br />

market and not only intends to capitalize on its growing need for power cables, but has the benefit<br />

of being in good proximity to Iraq and other markets such as Jordan, Lebanon and Iran. Accordingly,<br />

<strong>El</strong> <strong>Sewedy</strong> Syria realized revenues of LE334 million of which 73% were exports (65% of exports<br />

directed to Iraq). As for <strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Syria, it intends to commence its production activities<br />

by July 2007 with a production capacity of 2k transformers per year which is expected to increase<br />

to 4k transformers per year. The plant will be the sole manufacturer of transformers in Syria<br />

and is expected to sell both locally and to the neighboring countries.<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Syria<br />

•Total investment cost of US$80 million<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> (92%)<br />

Syrian shareholders (8%).<br />

•Capacity of 17 thousand tons/annum of low &<br />

medium, high & extra high voltage cables.<br />

(13.5k copper & 3.6k aluminum)<br />

•In 2006, realized revenues of LE 334 million.<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Syria<br />

•Total investment cost of US$ 12 million.<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> (94%) -<br />

Syrian shareholders (6%).<br />

•Capacity of 2 thousand transformers per year<br />

with expectations to increase capacity to 4<br />

thousand transformers per year.<br />

•Commencement of production is expected by<br />

July 2008.<br />

Sudan<br />

Additionally, <strong>El</strong> <strong>Sewedy</strong> has established a strong presence in Sudan through the establishment of<br />

Giad <strong>Cables</strong> and Sudatraf which specializes in the production of transformers. First off, Giad <strong>Cables</strong><br />

was established in 2003 for the purpose of producing the full range of power cables. Accordingly,<br />

Giad has a total capacity of 9k tons (3.6k copper and 5.4k aluminum) which is fully consumed by<br />

the local market due to high demand as <strong>El</strong> <strong>Sewedy</strong> has the opportunity to capitalize on being the<br />

sole local producer of cables. For FY06 Giad <strong>Cables</strong> realized revenues of LE174 million versus<br />

LE102million in FY05, displaying a significant leap of 70.5%. As for Sudatraf which has a annual<br />

capacity of 1.5k transformers and is currently the sole producer of transformers in Sudan, it realized<br />

revenues of LE64 million in 2006 versus LE16 million in FY05. a 300% growth. It should be noted<br />

that provided that Sudan’s electricity coverage only supplies 30% of the population gives greater<br />

value to <strong>El</strong> <strong>Sewedy</strong>’s investment as an additional power capacity of 700MW is expected to complete<br />

by 2008.<br />

Giad <strong>Cables</strong><br />

•Total investment cost of US$25 million<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> (45%) - Suda<br />

nese government (55%)<br />

•Capacity of 9 thousand tons/annum of low &<br />

medium, high & extra high voltage cables.<br />

(3.6k copper & 5.4k aluminum)<br />

•In 2006, realized revenues of LE 174 million.<br />

Sudatraf<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> (70%)<br />

- National <strong>El</strong>ectricity Corporation (30%).<br />

•Capacity of 1.5 thousand transformers per year<br />

•In 2006, realized revenues of LE 64 million.<br />

10

New ventures in the<br />

MENA region and Africa<br />

which will cause <strong>El</strong><br />

<strong>Sewedy</strong> to become a<br />

regional leader<br />

Company has a backlog<br />

of LE3.1 billion for the<br />

year 2007.<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Saudi Arabia<br />

•Total investment cost of US$ 80 million<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> (60%) -<br />

<strong>El</strong> Raghy Group (40%).<br />

•Capacity of 25 thousand tons/annum of power<br />

cables up to 400 KV.<br />

•Commencement of production is expected in<br />

H2 2008.<br />

Libya <strong>Cables</strong><br />

•Total investment cost of US$ 64 million.<br />

Egypt<br />

Green field expansions within the Middle Eastern and African region are taking place with the intention<br />

to penetrate underdeveloped markets where benefits can be reaped through tapping markets<br />

equipped with cheaper variable costs (including labor) and energy costs in order to maintain it’s<br />

global cost advantage and attain a greater return on investments.<br />

New Ventures and Production Facilities<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>El</strong>ectric Zambia<br />

•Total investment cost of US$ 8.4 million.<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> (60%) -<br />

Zambian Authorities (40%).<br />

•Capacity of 1.2 thousand transformers per year.<br />

•Commencement of production is expected by<br />

H2 2008.<br />

•Ownership structure: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> (55%) -<br />

Libyan Authorities (45%).<br />

•Capacity of 13.6 thousand tons/annum of high<br />

voltage power cables.<br />

•Commencement of production is expected by<br />

H2 2008.<br />

Tenth of Ramadan Factory<br />

Tenth of Ramadan Factory<br />

•Total investment cost of US$ 50 million.<br />

•Production facility of <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>.<br />

• Capacity of 600 dry-type transformers and 105<br />

power transformers.<br />

• Commencement of operations is expected by<br />

March 2008 and beginning of 2009 for, drytype<br />

and power transformers respectively.<br />

For the year 2006, <strong>El</strong> <strong>Sewedy</strong> attained consolidated revenues of LE5.7 billion and as of now, the company<br />

has a backlog of LE3.1 billion for the year 2007. However, it should be noted that large part of<br />

<strong>El</strong> <strong>Sewedy</strong>’s segments does not sell upon contracts, such as the plastics and the electrical products<br />

and almost 50% of the copper sales are not based on contracted revenues either. Chart 8 breaks<br />

down the cable producer’s backlog for 2007 into the segments it belongs to.<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

741<br />

Export <strong>Cables</strong><br />

Orders<br />

Backlog Revenues in 2007 (LE mn)<br />

242<br />

Chart 8 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

625<br />

1500<br />

Local <strong>Cables</strong> Orders Turnkey Projects Copper Export<br />

Contracts<br />

11

Revenues escalated from<br />

EGP 1.5 billion in FY03 by<br />

a CAGR of 55.95% to<br />

EGP 5.7 billion in FY 06<br />

Q1 FY 07 witnessed QOQ<br />

growth in excess of 96%<br />

Shrinking trend of<br />

EBITDA margins by over<br />

2 percentage points in<br />

FY05 and FY 06<br />

EBITDA Margin decrease<br />

attributable to increase in<br />

COGS/Sales ratios in<br />

power cables and electrical<br />

appliances segements<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

FINANCIAL ASSESSMENT<br />

Consolidated Revenues & Margins<br />

<strong>El</strong> <strong>Sewedy</strong> succeeded in generating exponential<br />

growth in its consolidated revenues over<br />

the last four years under review. It advanced<br />

from LE1.5 billion in FY03 to reach EGP 5.7<br />

billion and recognized a CAGR of 55.95%<br />

over the last four years. In 2006 alone the<br />

company surged it top-line figure by over<br />

81.3% due to <strong>El</strong> <strong>Sewedy</strong>’s realized positive<br />

returns from investments made in Syria,<br />

Sudan and Ghana as well as an impressive<br />

hike made in export sales as it witnessed a<br />

CAGR of 87% from years FY03 to FY06<br />

reaching LE3.1 billion for FY06 versus 1.7<br />

billion in the prior year.<br />

Furthermore, Q1 FY07 demonstrated LE2<br />

billion top-line figure which is a 96.8% q-o-q<br />

hike over Q1 FY06 of which LE1.2 billion<br />

constitutes of exports making up 60% of<br />

total sales. Chart 9 displays the company’s<br />

export growth from FY03 up until Q1 FY07.<br />

Positive yet declining EBITDA margin<br />

<strong>El</strong> <strong>Sewedy</strong> maintained positive EBITDA over<br />

the past 4 years, advancing in absolute<br />

terms from LE323 million in FY03 to LE637<br />

million in FY06 with CAGR of 25.38%. However,<br />

the margins tend to follow a declining<br />

rate of around 2 percentage points per annum<br />

during this period. The EBITDA margins<br />

was brought down due to the steady inflation<br />

of COGS/Sales ratio from 74.5% in FY03<br />

to 86% in FY06 attributable to an increase in<br />

energy prices that took place during July<br />

2006 as a means for the government to<br />

decrease the amount subsidized to energy<br />

resources. Furthermore, the cable producer’s<br />

Q1 FY07 EBITDA Margin stands at 10.6%<br />

versus 12.9% during the same period of last<br />

year as the COGS/Sales ratio witnessed a<br />

230 bps increase to reach 87.3% compared<br />

to 85.0% during Q1 FYO6.<br />

INCOME STATEMENT SUMMARY<br />

Egypt<br />

LE 000‘s Q1 FY06 Q1 FY07<br />

Revenues 1,013,841 1,995,225<br />

Growth 96.8%<br />

COST OF GOODS SOLD 862,233 1,742,497<br />

COGS/Revenues Ratio 85% 87.3%<br />

SG&A Expenses 21,187 41,040<br />

EBITDA 130,421 211,688<br />

EBITDA Margin 12.9% 10.6%<br />

Depreciation 8,651 19,824<br />

Sundry Revenues 432 7,209<br />

Interest Expense 17,835 53,212<br />

Net Income 100,808 155,756<br />

Growth 54.5%<br />

NPAT Margin 9.9% 7.8%<br />

Table 2 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

LE mn<br />

<strong>El</strong> <strong>Sewedy</strong>'s Export Growth<br />

Chart 9 Source: <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

The lowest GPM margin figure accounts for the power cables and raw materials segment which<br />

amounted to 10% for Q1 FY07. From the year 2005 to date, the above mentioned segment has<br />

witnessed a 200 bps annual decrease in its GPM as it stood at 14% in 2005 only to decrease to<br />

12% by the end of FY06. This positively correlates with the noticeably increased COGS/Sales ratio<br />

pertaining to that segment, which occurred due to the increased global prices in its essential components<br />

which are copper and aluminum. Accordingly, the company’s power cables and raw materials<br />

segment witnessed a 400 bps surge of 85.6% in its COGS/Sales from FY05 to Q1 FY07 and<br />

increased to 89.6%.<br />

Meanwhile, the electrical appliance segment underwent a similar trend as it’s GPM margin witnessed<br />

a significant drop of 2000 bps to land at 35% for Q1 FY07 versus 55% in FY05. Accordingly, the<br />

company witnessed a change in its COGS/Sales ratio from 44.6% as of FY05 to 65.3% for Q1 FY07.<br />

The upward trend experienced by the electrical appliances and power cables segment in the COGS/<br />

Sales figure are main contributors to the company’s declining EBITDA margin. However, as global<br />

copper prices are expected to become less volatile through out the coming period, in addition to the<br />

expected commencement of the company’s green field projects in countries that benefit from cheap<br />

energy resources and labor, we could witness improved outcomes pertaining to the company’s<br />

overall COGS/Sales ratio and ultimately its EBITDA Margin.<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

471<br />

1,180<br />

1,762<br />

3,101<br />

1,816<br />

FY03 FY04 FY05 FY06 Q1FY07<br />

12

Power cable segment<br />

represents the bulk of <strong>El</strong><br />

<strong>Sewedy</strong>’s operations.<br />

However, Turn Key projects<br />

are on the rise.<br />

The increase in the interest<br />

expense was brought<br />

by the increase in the<br />

interest-bearing debt to<br />

fuel the undergoing<br />

expansions<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

FINANCIAL ASSESSMENT (Cont’d.)<br />

Sector Segmental Analysis<br />

The company operates in 3 power segments:<br />

power cables (including both copper and aluminum),<br />

electrical appliances, and comprehensive<br />

turn key projects.<br />

126,369<br />

Power <strong>Cables</strong><br />

Revenues of power cables segment represents<br />

about 93% of the total turnover of <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong>.<br />

This contribution is almost split equally between<br />

cables sales and raw materials. The power<br />

cables sales (including raw materials) are generated<br />

from three different avenues: exports with<br />

49.3% contribution, local sales with 43.5%, and<br />

regional operations with only 7.2% share.<br />

Turn Key Projects<br />

Egypt<br />

<strong>El</strong> <strong>Sewedy</strong> business strategy focuses on comprehensive<br />

turn key projects as a premier field for Chart 10 Source: <strong>El</strong> <strong>Sewedy</strong> Financials<br />

growth relying on two key factors; significance of<br />

brand recognition empowering <strong>El</strong> <strong>Sewedy</strong> to undertake landmark projects and the associated higher<br />

profit margins.<br />

As such, turn key projects expanded its input share to the groups sales from 4.65% in Q1 FY06 up to<br />

5% in FY06 and 7.3% in Q1 FY07.<br />

<strong>El</strong>ectric Appliances<br />

The share of <strong>El</strong>ectric appliances to the total sales of the group amounts to a humble 2%. Q1 in FY 07<br />

did not witness material deviation from this level.<br />

ROIC Hikes Up and Increased Operational Efficiency<br />

Despite having witnessed a declining EBITDA Margin in FY06, the company’s ROIC has witnessed a<br />

544 bps increase to reach 29.39% versus 23.95% in FY05. Furthermore, the company executed a<br />

stronger level of efficiency as its cash conversion cycle witnessed an overall decrease of 36 days to<br />

reach 162 days in FY06 versus 198 days in FY05 which can be credited to the company’s ability to<br />

improve its collection capabilities as the average collection period decreased from 88.48 days for the<br />

year 2005 to 57.37days in FY06. It should also be noted that as the group moves away from stock<br />

pilling towards forward contracts as a hedging tool, raw materials average days on hand followed suit<br />

declining from 72 to 55 days from FY03 to FY 07.<br />

Interest Expense<br />

In FY06, interest expense incurred by the group amounted to EGP 94.6 million, representing 16.75%<br />

of the EBIT. This leap in interest expense by over 158% from FY05 level of EGP 36.6 million amid the<br />

increase in interest-bearing debt from EGP 789 million in FY05 to EGP 1,975 million in FY06 stems<br />

from the hyper increase in funding requirements to accommodate for the capital expansions in addition<br />

to expansion of working capital to factor for the increase in raw material prices, in particular<br />

copper and aluminum. However, the net interest expense amounts to only EGP 48.87 million as funds<br />

acquired to finance capital expenditures were locked in marketable securities; namely treasury bills<br />

and CBE certificates up till due disbursement dates.<br />

Effective Tax Rate<br />

Revenue Generators (LE '000s)<br />

266,350<br />

5,353,552<br />

2<br />

<strong>Cables</strong> Turn Key Projects <strong>El</strong>ect rical Appliances<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> is itself enjoys a 10-fiscal-years tax holiday following its first year of operations,<br />

subject that actual operation starts before June 2008. The company’s local and regional subsidiaries<br />

include various entities that are tax exempted or that enjoy tax holiday’s expiring at varying duration.<br />

Up till FY06 the only subsidiary subjected to taxation is Arab <strong>Cables</strong> Co, <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Qatar, and<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> Algeria. Accordingly, the effective tax rate during the last two years was a minimal<br />

rate of 2.78% in FY05, and 2.11% in FY06.<br />

13

Surge in bottom line<br />

figure of 53.8% for FY06<br />

and a greater bottom line<br />

growth of 54.5% for Q1<br />

FY07.<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

FINANCIAL ASSESSMENT (Cont’d.)<br />

Dividends Payout<br />

Egypt<br />

Being in supernatural growth phase, <strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> did not distribute dividends to its shareholders<br />

over FY06. It is expected that the company will follow suit in the foreseeable future.<br />

Bottom-Line Surged over the<br />

Last Two Years<br />

<strong>El</strong> <strong>Sewedy</strong> Cable's Bottom Line Growth (LE '000)<br />

Rapid expansion in the group’s<br />

operations was able to realize a<br />

strong growth in its bottom-line, as 600,000<br />

shown from the performance of the<br />

net attributable income (NAI) over<br />

the last two years. Net profit real-<br />

500,000<br />

400,000<br />

ized 23% y-o-y from FY04 to FY05<br />

reaching EGP 330 million and further<br />

surged by 53.8% to material-<br />

300,000<br />

200,000<br />

ize EGP 508 million in profits for<br />

FY06. As for Q1 FY07, the company<br />

realized a bottom line figure<br />

100,000<br />

0<br />

of LE155.7 million compared to Q1<br />

FY04 FY05 Q1FY06 FY06 Q1FY07<br />

FY06’s bottom line figure of<br />

LE100.8 million displaying a y-o-y<br />

Chart 11<br />

growth of 54.5%. Chart 9 provides<br />

Source: <strong>El</strong> <strong>Sewedy</strong> Financials<br />

a yearly historical outlook at the company’s bottom line performance in addition to a comparison<br />

outlook of Q1 FY06 and Q1 FY07’s realized net profits.<br />

Capital Structure & Leverage Level<br />

Leverage increasing as<br />

<strong>El</strong> <strong>Sewedy</strong>’s current ratio fell down from 1.86x in FY05 to 1.68x during FY06. However, given the<br />

expansions are on the<br />

rise and company holds<br />

quality of the group’s trading assets indicates the acceptable liquidity levels and effective perform-<br />

adequate current ratio. ance in terms of a more efficient capital base. The group is moderately leveraged were the debt<br />

ratio is constantly increasing from 23.8% in FY04 to 53.8% in FY06 which is properly perceived in<br />

the context of the rapid expansion plans undergone by the group.<br />

14

Consolidated revenues<br />

expected to grow 46% in<br />

FY07<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

GROWTH DRIVERS<br />

REVENUES<br />

<strong>El</strong> <strong>Sewedy</strong> group’s revenues come from various<br />

sources, out of which cables (copper & Aluminum)<br />

contributes with the lion’s share in the top line figure.<br />

We will provide full analysis of copper & aluminum<br />

cables revenues broken down into capacity, production,<br />

and prices.<br />

PRODUCTION CAPACITY<br />

Table x shows the current & projected production<br />

capacity in Egypt and other ventures in the region.<br />

Egypt production facilities will witness huge expansions<br />

in both copper & aluminum. In 2008, copper is<br />

expected to reach 76.5k tons, up from 45.35k tons in<br />

2006. In addition, aluminum is expected to reach<br />

41.4k tons, up from 20.4k tons in 2006. Total capacity<br />

shall grow over the two years by 18.6% in 2007 and a<br />

2.7x growth of 51.15% in 2008. Sudan facility expected<br />

to remain stagnant over the coming 2 years at<br />

3.6k tons for copper and 5.4k tons for aluminum.<br />

Syria venture will enter an aggressive expansion<br />

phase of the copper faculties only. In 2008, copper is<br />

expected to reach 20.4k tons, up from 12k tons in<br />

2006. Meanwhile, aluminum is expected to remain<br />

unchanged at 3.6k tons level. The Libyan subsidiary is<br />

planning to commence operations in 2008 and it will<br />

possess 11.2k tons in copper capacity and 2.4k tons in<br />

aluminum capacity. Following in suit, the Saudi affiliate<br />

with Al-Raghy is expected to become on line in<br />

2008, but with much higher capacity in copper that is<br />

expected to be 22.3k tons, while aluminum capacity<br />

will come in at 2.7k tons. The UIC facilities are expected<br />

to witness mild growth. The special cables<br />

facility is expected to remain at the same level of 12k<br />

tons, while the winding wires facility will increase only<br />

in 2008 to stand at 10.5k tons compared to 8.54k tons<br />

in 2006 & 2007.<br />

UTILIZATION<br />

Due to aggressive demand on the company’s products<br />

and aims to expand the export market, utilization rates<br />

are expected to remain high as historical trends indicate.<br />

Only when there is a capacity addition, the utilization<br />

will dip accordingly and rebound in the next<br />

year after start-up operations succeed.<br />

PRICES<br />

Copper cables prices witnessed a 51.7% hike in 2006<br />

backed by substantial increase in the copper materials.<br />

However, we anticipate a slower hike in selling<br />

prices to reach LE58.1k/ton in 2007, before it slightly<br />

grows at 4%/annum thereafter. We anticipated a<br />

20% hike in the aluminum cables prices to reach<br />

LE37.5k/ton in 2007. thereafter, we foresee it also to<br />

rise by 4%/annum. Special & Winding wires’ prices<br />

witnessed an aggressive hike in 2006 to reach<br />

LE54.2k/ton and LE40.5k/ton, respectively. However,<br />

expectations foresee a slow down in 2007 and prices<br />

to march forward slightly with 4%/annum to reach<br />

LE60k/ton and LE47.9k/ton in 2008.<br />

Egypt<br />

Production Capacities<br />

In Tons<br />

Egypt<br />

2006 2007 2008<br />

Copper 45,350 51,600 76,500<br />

Aluminum 20,400 26,400 41,400<br />

Total 65,750 78,000 117,900<br />

y-o-y %<br />

Sudan<br />

18.63% 51.15%<br />

Copper 3,600 3,600 3,600<br />

Aluminum 5,400 5,400 5,400<br />

Total 9,000 9,000 9,000<br />

y-o-y %<br />

Syria<br />

0.00% 0.00%<br />

Copper 12,000 13,500 20,400<br />

Aluminum 3,600 3,600 3,600<br />

Total 15,600 17,100 24,000<br />

y-o-y %<br />

Libya<br />

9.62% 40.35%<br />

Copper 0 0 11,200<br />

Aluminum 0 0 2,400<br />

Total<br />

y-o-y %<br />

Saudi<br />

13,600<br />

Copper 0 0 22,300<br />

Aluminum 0 0 2,700<br />

Total<br />

y-o-y %<br />

UIC<br />

25,000<br />

Special <strong>Cables</strong> 12,000 12,000 12,000<br />

Winding Wires 8,540 8,540 10,512<br />

Total 20,540 20,540 22,512<br />

y-o-y % 0.00% 9.60%<br />

Table 3 Source: <strong>Sewedy</strong> & Prime<br />

Average Prices per Ton<br />

LE/Ton 2006a 2007e 2008f<br />

Copper 46,681 58,157 60,483<br />

% Change 51.7% 24.6% 4.0%<br />

Aluminum 31,212 37,464 38,963<br />

% Change 0.4% 20.0% 4.0%<br />

Special Wire 54,225 57,668 59,975<br />

% Change 50.7% 6.4% 4.0%<br />

Winding Wire 40,541 46,040 47,882<br />

% Change 47.0% 13.6% 4.0%<br />

Table 4 Source: <strong>Sewedy</strong> & Prime<br />

15

Consolidated revenues<br />

expected to grow 46% in<br />

FY07<br />

Prime Research<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong><br />

GROWTH DRIVERS (Cont’d.)<br />

Egypt<br />

Second, the turnkey projects constitutes the secondary growth driver in turnover. This comes in<br />

line with the groups plans and supported by the existence of LE 625 million backlog for FY 07 (as<br />

per the company’s records) up from LE 266 million of revenues generated in FY 06. Thereafter,<br />

turnkey projects’ revenues will increase at a moderate rate of 5%, while its contribution to the top<br />

line will diminish after huge expansions expected in the cables segment.<br />

Finally, <strong>El</strong> <strong>Sewedy</strong> group is expected to generate a growing top line backed by cables sales that are<br />

expected to record LE7.69 billion in 2007 and march forward at a CAGR of 23.39% over the next 4<br />

years to come in at LE17.82 billion in 2011.<br />

EBITDA<br />

Operating profit margins are expected to sustain, to a great extent, its level in FY06. EBITDA margin<br />

of 11% realized in FY 06 will be exposed to two new counter eliminating elements. The first<br />

being the increased weight of exports and international operations (specially in GCC and Europe)<br />

characterized by high competition accompanies by relatively tight profit margins. The second element<br />

represents a reliving factor as the increased weight of turnkey projects to total revenues<br />

positively contributes to the group’s profitability.<br />

CAPEX<br />

The group is adopting extensive expansion plan requiring substantial capital expenditures, bearing<br />

in mind the nature of cables production as a capital intensive industry. The group is currently establishing<br />

four major projects in Egypt, Saudi Arabia, Libya, and Zambia (see page 8). The aggregate<br />

investment cost of these projects is expected to amount for US$ 132 million. <strong>El</strong> <strong>Sewedy</strong>’s<br />

Capex stream is deemed to be very aggressive in order to cope with the group’s expansionary<br />

plans. The formula for estimating the capex is directly related to the incremental cost of ton, which<br />

is estimated at US$1500/ton of cables. Table xx shows expected incremental capacity and related<br />

capex during the next 5 years. Note that 2009 will incur no capex related to the capacity upgrade,<br />

but it will include another capex related to the maintenance.<br />

2007 2008 2009 2010 2011<br />

Incremental<br />

Capacity Increase 13,750 87,372 0 34,475 36,949<br />

CAPEX 117,563 747,031 68,400 294,761 315,916<br />

Table 5 Source: Prime estimates<br />

Taxes<br />

<strong>El</strong> <strong>Sewedy</strong> <strong>Cables</strong> enjoys a 10-years tax holiday starting from its first year of operations. While<br />

several of its subsidiaries are also tax exempted, a number of which will expire during the projected<br />

period. Accordingly, the effective tax rate in the projected years is expected to escalate<br />

from 2.11% in FY06 to 3% in 2007 and 2008 and inclining by 2 pct points onwards until reaching<br />

20% by 2018 (not included in our projections).<br />

Net Attributable Income<br />