Business Supplement Issue-16

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DT<br />

VOL1, ISSUE <strong>16</strong> | Sunday, June 4, 2017<br />

<strong>Business</strong> Tribune<br />

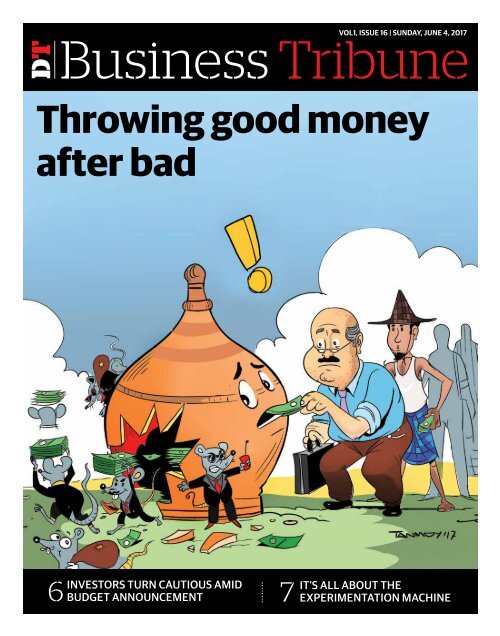

Throwing good money<br />

after bad<br />

Investors turn cautious amid<br />

6 budget announcement<br />

7<br />

It’s all about the<br />

experimentation machine

2<br />

Sunday, June 4, 2017<br />

DT<br />

Special<br />

SoB Recapitalisation<br />

Throwing good money after bad<br />

• Asif Showkat Kallol and<br />

Shariful Islam<br />

RECAPITALISATION FUND FOR STATE-OWNED BANKS<br />

The practice of recapitalisation<br />

continues to meet the capital<br />

shortage of state-owned banks<br />

(SoBs), but no significant steps are<br />

in sight to stop the ‘bad move’.<br />

Though the government is trying<br />

to ease the SoBs’ fund crunch<br />

with the help of tax payer money,<br />

the default loan situation of the<br />

banks still remains a far cry.<br />

Finance Minister AMA Muhith<br />

on Thursday has proposed to allocate<br />

Tk2,000 crore for recapitalisation<br />

during the Fiscal Year 2017-18.<br />

Recapitalisation is a type of corporate<br />

reorganisation involving<br />

substantial change to a company’s<br />

capital structure, motivated by a<br />

number of reasons. Usually the<br />

large part of equity is replaced with<br />

debt or vice versa.<br />

But in Bangladesh, recapitalisation<br />

fund is being termed a ‘black<br />

hole’ in the financial sector after<br />

the largest loan scams at the two<br />

SoBs – Sonali Bank and BASIC Bank.<br />

The financial conditions of the<br />

two deteriorated due to massive<br />

loan anomalies and malpractices.<br />

The government has been providing<br />

liberal support for the state<br />

banks as recapitalisation fund so<br />

they can meet the capital shortage<br />

created by loan defaults. It has<br />

been said the recapitalisation funds<br />

could only improve the banks’ balance<br />

sheet.<br />

The government injected a total<br />

of Tk11,705 crore as recapitalisation<br />

fund into the SoBs from FY2009-10<br />

to 2015-<strong>16</strong>.<br />

Among the receiving banks,<br />

Sonali Bank got the highest amount<br />

of Tk2,794.8 crore followed by BA-<br />

SIC Bank Tk2,390 crore.<br />

While the other fund-receiving<br />

banks, Agrani Bank received<br />

Tk1,081 crore, Janata Bank Tk814<br />

crore, Rupali Bank Tk272.5 crore,<br />

Bangladesh Krishi Bank Tk789.7<br />

crore and Rajshahi Krishi Unnayan<br />

Bank Tk318 crore.<br />

In the outgoing Fiscal Year 20<strong>16</strong>-<br />

17, the government also disbursed<br />

Tk2,000 crore for state-owned<br />

banks, with BASIC Bank getting<br />

Tk1,000 crore from the allocation<br />

in the revised budget.<br />

Probashi Kallyan Bank will get<br />

Tk250 crore while Bangladesh<br />

House Building Finance Corporation<br />

will be given Tk200 crore.<br />

The Finance Ministry will provide<br />

Tk184.65 crore to the IFIC as<br />

the private commercial bank earlier<br />

decided to increase paid-up capital<br />

through issuance of rights share<br />

after considering bonus shares for<br />

stock dividend<br />

In the upcoming fiscal year,<br />

1,000<br />

FY10<br />

1,050<br />

FY11<br />

Tk2,000 crore has once again been<br />

set aside for the state banks’ recapitalisation.<br />

Though the government recapitalisation<br />

from the citizen’s tax<br />

money to the SoBs, the default<br />

loan situation of the banks is not<br />

improved.<br />

The Non-Performing Loans<br />

(NPLs) soared to 82% of total bad<br />

loans in the banking sector till<br />

March 2017 while the SoBs alone<br />

have 84% of them, according to the<br />

latest Bangladesh Bank data.<br />

The central bank data also<br />

shows that the default loans<br />

reached Tk35,715 crore in the six<br />

state banks while Tk29,920 crore is<br />

classified as bad loans.<br />

As the growing non-performing<br />

loans in the state-owned banks<br />

are increasing, the government has<br />

failed to realise the money, rather it<br />

is interested in recapitalisation from<br />

public exchequer in every budget.<br />

It has been alleged that the ongoing<br />

mechanism is mainly helping<br />

some vested quarters, mainly the<br />

ruling party’s blessed businesspeople,<br />

take loans from banks without<br />

proper mortgages and documents.<br />

Even the loanees do not pay<br />

monthly instalments.<br />

“The wilful defaulters and plunderers<br />

feel encouraged as more<br />

and more public money is injected<br />

into troubled banks without holding<br />

anyone accountable,” Director<br />

341<br />

FY12<br />

420<br />

FY13<br />

General of Bangladesh Institute of<br />

Bank Management (BIBM) Dr Toufic<br />

Ahmad Choudhury told the Dhaka<br />

Tribune.<br />

He said the government provides<br />

recapitalisation for financially<br />

weak banks instead of taking exemplary<br />

legal action against those<br />

making the banks vulnerable.<br />

“Good governance will not be<br />

fully established in banking unless<br />

people like the former chairman<br />

of BASIC Bank, Sheikh Abdul Hye<br />

Bacchu, are punished for their corruption.”<br />

The quality of good governance<br />

in the banking sector also comes<br />

into a question again after the government’s<br />

latest move to change to<br />

the Bank Company Act.<br />

The government has approved<br />

amendments to three provisions of<br />

the Bank Company Act including<br />

increasing the tenure of board of<br />

directors of a private bank from six<br />

years to nine years.<br />

The change to a third provision<br />

states that up to four members of a<br />

family may be appointed as board<br />

of directors for a bank while the<br />

law currently permits only two<br />

members from one family.<br />

The Centre for Policy Dialogue,<br />

an independent think tank in the<br />

country, stated that, “The most<br />

recent amendment is regressive in<br />

nature since it will be taking a step<br />

back from the previous changes<br />

4,477<br />

FY14<br />

2,617<br />

FY15<br />

1,800<br />

FY<strong>16</strong><br />

made to the act.”<br />

“This law means that family<br />

ownership will have a greater control<br />

on the banks with the possibility<br />

of erosion of corporate governance.”<br />

As the good governance in the<br />

banking sector is decreasing and<br />

the number of default loans is on<br />

the rise, economists and experts<br />

strongly criticised the government’s<br />

repeated draining of public<br />

money on the SoBs in the name of<br />

recapitalisation.<br />

AB Mirza Azizul Islam, a former<br />

adviser to the caretaker government,<br />

told the Dhaka Tribune,<br />

“The government could recapitalise<br />

the SoBs in the short term, but the<br />

banks had to be financially solvent<br />

as they have not to take money from<br />

the government, rather they would<br />

pay their profit to the government.”<br />

“In this regard, increased loan<br />

recovery capacity and end to political<br />

influence on loan disbursement<br />

are needed to make the banks commercially<br />

viable and stable.”<br />

BB Governor Fazle Kabir, however,<br />

said the government is trying<br />

to improve asset quality of the<br />

state banks to reduce their dependency<br />

on public fund.<br />

“We are trying to improve their<br />

asset quality. No further recapitalisation<br />

will be needed then,” Fazle<br />

Kabir said at a post-budget press<br />

conference at Osmani Auditorium<br />

in the capital Friday.<br />

Amount in Tk, crore<br />

* Proposed<br />

2,000<br />

FY17<br />

2,000<br />

FY18*<br />

Source: MoF, CPD<br />

He said sometimes the SoBs<br />

need recapitalisation as they do<br />

many important works for the government,<br />

including financing priority<br />

projects, making payment of<br />

all types of government wages, social<br />

security-related payments and<br />

receiving utility payments without<br />

any commission.<br />

Reforms: Time has gone<br />

It has been a much-talked-about<br />

demand of the stakeholders of the<br />

banking sector to reform financial<br />

sector to bring accuracy, accountability<br />

and good governance, but the<br />

time is flying by while no reforms<br />

have been made over the years.<br />

Experts said since the election<br />

is nearing, the government will not<br />

be able to meet the stakeholders’<br />

demand like establishing an Independent<br />

Financial Sector Reform<br />

Commission (IFSRC) for the banking<br />

sector.<br />

“There is very little scope to<br />

reform the banking sector as big<br />

businesses are involved in anomalies.<br />

One has to understand political<br />

economy in this regard,” said<br />

Debapriya Bhattacharya, distinguished<br />

fellow of CPD.<br />

Meanwhile on February 6, Finance<br />

Minister AMA Muhith declared<br />

formation of a Bank Commission<br />

during the tenure of<br />

current government to monitor the<br />

banking sector. •

Interview<br />

3<br />

Sunday, June 4, 2017<br />

DT<br />

'Culture of impunity must end'<br />

The willful defaulters and plunderers feel encouraged as more and more public money is injected<br />

into troubled banks without holding anyone accountable, Director General of Bangladesh Institute<br />

of Bank Management Dr Toufic Ahmad Choudhury tells Dhaka Tribune’s Asif Showkat Kallol<br />

in an exclusive interview<br />

Good governance will not be fully<br />

established in banking unless people<br />

like the former chairman of BA-<br />

SIC Bank Sheikh Abdul Hye Bacchu<br />

are punished for their corruption.<br />

The government provides recapitalisation<br />

to financially weak<br />

banks instead of taking exemplary<br />

legal action against those who<br />

make the banks vulnerable, he<br />

says.<br />

Recapitalisation of state owned<br />

banks should be done by the government<br />

because those banks<br />

are owned by the government.<br />

We have learned that in the next<br />

budget, Tk2000 cr has been set<br />

aside for the recapitalisation of<br />

state-owned banks.<br />

The culture of impunity must<br />

end in the banking sector if good<br />

governance is to be enforced.<br />

Are you sure the government can<br />

get back the central bank’s stolen<br />

money?<br />

Bangladesh Bank should have disclosed<br />

matters of the stolen foreign<br />

exchange reserve after recovery of<br />

the stolen money. Foreign hackers<br />

have taken opportunities as we<br />

have disclosed the matter to the<br />

media. Now Philippine authorities<br />

say Bangladesh Bank itself is responsible<br />

for that incident.<br />

Filipino casinos now say it is<br />

not possible to return that money,<br />

though one Filipino minister said,<br />

a new law will be enacted to get the<br />

money back.<br />

Since both Bangladesh and Philippine<br />

are members of Egmont<br />

group, now this is the responsibility<br />

of Philippine to return the stolen<br />

money, as the provisions of the<br />

group held the country responsible<br />

where the money is laundered.<br />

The Federal Bank of India recovered<br />

$112 million stolen money<br />

from its reserves and then disclosed<br />

the matter to the media. The<br />

stolen funds from BB will return in<br />

time but it may take time.<br />

How can we ensure good<br />

governance in the banking sector?<br />

Bangladesh Bank has deployed observers<br />

in 27 out of the 54 banks.<br />

That means half of the banks are<br />

now problem banks. There is no<br />

effective internal control within<br />

most of the banks. The central bank<br />

cannot set up vigilance teams in all<br />

9,500 commercial bank branches.<br />

The reason why the banking<br />

sector is in a bad shape is because<br />

of a lack of good governance. Many<br />

Dr Toufic Ahmad Choudhury<br />

Good governance will not be fully established in banking unless<br />

people like the former chairman of BASIC Bank Sheikh Abdul Hye<br />

Bacchu are punished for their corruption<br />

say banking sector’s main problem<br />

is Non Performing Loans or default<br />

loans but the real issue is good governance.<br />

We have to know the structure<br />

of banking sector governance. External<br />

governance is maintained by<br />

the central bank but internal governance<br />

will be maintained by the<br />

banks themselves through their effective<br />

internal control.<br />

If a bank does not maintain internal<br />

governance, the central bank<br />

can do nothing with outside monitoring.<br />

The central bank cannot improve<br />

the banking system without<br />

successful internal governance in<br />

the banks.<br />

Without improvement of good<br />

governance, the banking culture<br />

will never make any progress. Big<br />

loan scams like Hallmark and Bismilllah<br />

happened due to lack of internal<br />

control.<br />

Is latest amendment of Bank<br />

Company Act good for banking<br />

sector?<br />

Ignoring the deplorable<br />

governance situation, the cabinet<br />

gave its consent to the amendment<br />

of bank company act allowing the<br />

appointment of four directors from<br />

a family instead of two for private<br />

banks.<br />

Four directors will create more<br />

problems of governance and the<br />

situation is likely to deteriorate<br />

than improve.<br />

We will be very happy if the government<br />

can increase the number<br />

of independent directors and put<br />

Rajib Dhar<br />

emphasis on transparency in their<br />

selection.<br />

Main owners of the bank are depositors<br />

and in percentage terms<br />

they own 95% of a bank. Board directors<br />

contribute only about 5% to<br />

the bank.<br />

The government has not taken<br />

any decision to protect the interests<br />

of the depositors. This decision<br />

favours the 5% contributors.<br />

Now the government is moving to<br />

make directors’ positions permanent,<br />

which will not bring anything<br />

good for the banking sector. It is<br />

not the right decision for the sector<br />

and the government should think<br />

about the matter.<br />

More surprisingly, government<br />

is planning to impose excise duty,<br />

on the depositors’ money, in addition<br />

to source tax on interest income,<br />

and high maintenance fee<br />

of PCBs. Already the depositors<br />

return is negative, because prevailing<br />

interest rate on deposit is lower<br />

than inflation rate. In such a situation,<br />

imposing excise duty on deposit<br />

is absolutely unacceptable. •

4<br />

Sunday, June 4, 2017<br />

DT<br />

Week in Review<br />

Muhith: Excise on bank savings will stay<br />

Finance Minister AMA Muhith has said<br />

that he will not withdraw the added<br />

excise duty on bank account transactions<br />

above Tk1 lakh because people<br />

who have such amount in the bank are<br />

affluent.<br />

Muhith proposed Tk800 excise<br />

duty on bank account debits and<br />

credits between Tk1 lakh and Tk10 lakh<br />

in the budget for fiscal year 2017-18<br />

on Thursday. The duty increases after<br />

Tk10 lakh.<br />

“Those who put Tk1 lakh in bank,<br />

they are rich people in the context<br />

of our country. They can afford this<br />

additional burden, there will be no<br />

problem,” said Muhith.<br />

The finance minister was addressing<br />

a post-budget briefing at Osmani<br />

Auditorium in the capital on June 2.<br />

Muhith said imposition of excise<br />

duty limit has been increased from<br />

Tk20,000 to Tk1,00000. Earlier,<br />

account holders had to pay Tk150 for a<br />

transaction of Tk20,000. •<br />

Dhaka Tribune<br />

Gold import policy<br />

by this year<br />

“The government will prepare a<br />

policy for importing gold which will<br />

help this sector flourish and create<br />

an overseas market for exports.”<br />

Finance Minister AMA Muhith<br />

made the remark as part of his<br />

budget statement for the FY18.<br />

“Gold has always been a traditional<br />

business in Bangladesh. But since there<br />

is no hard and fast rule for the import<br />

of gold, the sector has not been able<br />

to flourish in a befitting manner,” said<br />

the finance minister. In his statement,<br />

he mentioned various proposals by<br />

the bodies associated with the sector<br />

to formulate a realistic guideline to<br />

facilitate importing gold. •<br />

Green RMG<br />

manufacturers<br />

to enjoy 1%<br />

corporate tax cut<br />

Green RMG factory owners are going<br />

to enjoy 1% cut in corporate tax<br />

from the next fiscal year 2017-18.<br />

For the next fiscal year, the<br />

government has proposed to<br />

reduce the corporate tax to 15%<br />

from 20% for the apparel sector. It<br />

also proposed 14% corporate tax for<br />

green RMG factories.<br />

Finance Minister AMA Muhith<br />

made the proposal while presenting<br />

the budget for FY2017-18 in the<br />

parliament on June 1.<br />

Muhith said: “In order to keep<br />

the earth habitable for our next<br />

generation, we need to ensure both<br />

sustainable development and the<br />

conservation of our environment.”<br />

“We plan to integrate the environmental<br />

issues in our tax policy. In<br />

line with that, I propose to reduce<br />

the tax rate of RMG companies to<br />

14% – if their factories are internationally<br />

recognised with green building<br />

certification,” the minister said.<br />

He added: “Withholding tax rate<br />

on ready-made garments export is<br />

currently 0.70%, and companies<br />

are enjoying reduced corporate tax<br />

rate of 20%. I propose to reduce<br />

the corporate tax rate to 15% for<br />

this sector.” •<br />

International air ticket<br />

prices to soar as double<br />

excise duty proposed<br />

International airline ticket prices are<br />

set to go up as Finance Minister AMA<br />

Muhith proposed that the excise duty<br />

on tickets to countries outside Saarc<br />

be doubled.<br />

“I am proposing to revise the existing<br />

excise duty on air tickets, except<br />

for domestic flights and those travelling<br />

to Saarc member countries,” said<br />

Muhith while unveiling the proposed<br />

national budget for the fiscal year<br />

2017-18 at Jatiya Sangsad on June 1.<br />

According to the proposal, excise<br />

Prices of essentials invariably increase during Ramadan<br />

Even with strict guidelines from both<br />

city corporations, the prices of essential<br />

goods have gone up exponentially<br />

in the month of Ramadan with some<br />

places charging double the regular<br />

price of cooking oil.<br />

Having visited some kitchen markets<br />

on June 2 including Dhaka North City<br />

Corporation (DNCC) Kitchen Market,<br />

Karwan Bazar and New Market, the<br />

Dhaka Tribune has found the prices of<br />

eggplants, cucumber, green chilli, lentils,<br />

garlic, onions, gram flour, sugar, puffed<br />

rice and cooking oil had risen by 10% to<br />

100% in just one week of Ramadan.<br />

“While the prices of some goods<br />

have been the same, the prices of<br />

certain goods have gone up beyond<br />

comprehension. The government<br />

should really monitor the activities of<br />

kitchen market traders to make sure<br />

duty on air tickets to Asian countries<br />

outside of Saarc would rise<br />

to Tk2,000 instead of the existing<br />

Tk1,000.<br />

In addition, the excise duty on<br />

airline tickets for travel to Europe,<br />

USA and other countries of the world<br />

would be Tk3,000 as opposed to the<br />

current Tk1,500.<br />

In order to avoid any inconvenience<br />

for travellers, the excise duty<br />

would be collected at the time of<br />

purchasing air tickets. •<br />

they are not increasing the prices to<br />

make a profit during Ramadan,” said<br />

Mushfiqa Aktar, a regular shopper at<br />

Gulshan DNCC market.<br />

Consumers are frustrated that<br />

Govt to borrow Tk30,150cr<br />

from savings certificates in<br />

next fiscal year<br />

The government will take loans of<br />

Tk30,150 crore from savings certificates<br />

in the next fiscal year, though there will<br />

be a heavy burden of interest payments.<br />

Finance Minister AMA Muhith made<br />

the statement in his speech on the<br />

budget at Jatiya Sangsad on June 1.<br />

In the speech, he said: “The budget<br />

deficit in the next fiscal year will be<br />

Tk1,12,275 crore, which is 5% of our<br />

GDP. While the deficit will increase<br />

slightly compared to the previous year<br />

due to increased allocations for development<br />

activities and in the social<br />

they have to pay arbitrarily hiked<br />

prices during Ramadan. Md Shohel Mia<br />

expressed similar sentiments: “I bought<br />

eggplants for Tk30, sugar for Tk60 and<br />

garlic for Tk220 per kg at Karwan Bazar<br />

Dhaka Tribune<br />

security sector, it is unlikely to have<br />

any negative macroeconomic impact<br />

due to robust GDP growth.”<br />

Muhith added that Tk51,924 crore<br />

(46% of the budget deficit) would be<br />

financed from external sources while<br />

Tk60,352 crore (54% of the deficit)<br />

would be sourced domestically.<br />

Of the domestic sources, Tk28,203<br />

crore (48% of the deficit) is expected<br />

to come from the banking system and<br />

Tk32,149 crore (52% of the deficit) from<br />

savings certificates and other non-banking<br />

sources, said the finance minister. •<br />

just last week. They are now charging<br />

Tk70 just for eggplants!”<br />

Traders argue that the price hike<br />

is because of a shortage in supply. “It<br />

is due to the shortage in supply but<br />

let’s face it, prices always go up during<br />

Ramadan,” said commodities trader<br />

Sobhan Talukdar from Karwan Bazar.<br />

On May 23, DNCC Mayor Annisul<br />

Huq said all kitchen markets under<br />

his jurisdiction will be monitored and<br />

handed out a price list for the traders<br />

to maintain.<br />

The Dhaka South City Corporation<br />

(DSCC) Mayor Mohammad Sayeed<br />

Khokon had also set a price list for beef<br />

at Tk475 and mutton at Tk725.<br />

Both the city corporations said they<br />

would take legal actions against any<br />

trader found intentionally increasing the<br />

prices and also for food adulteration. •

Corporate News<br />

5<br />

Sunday, June 4, 2017<br />

DT<br />

BRAC Bank Limited has recently awarded top scorers at its banking foundation course, said a press<br />

release. The bank’s managing director, Selim RF Hussain was present on the occasion<br />

A referendum was recently held in three factories (Adnan PSF Industries, Fujian Export Industry and<br />

Gold Shine Industries) of Ishwardi EPZ in order to form Workers Welfare Association (WWA), said a press<br />

release. Workers voted against formation of WWA in all three factories<br />

Pan Pacific Sonargaon Hotel has recently organised an Iftar and dinner party for children at its grand<br />

ballroom, said a press release. Minister at Ministry of Civil Aviation and Tourism, Rashed Khan Menon<br />

was present at the event as chief guest<br />

Bangladesh National Cadet Corps (BNCC) female platoon was recently inaugurated at Milestone College,<br />

said a press release. Regiment commander of BNCC at Ramna Regiment Dhaka, Lt Col SM Salahuddin<br />

was present on the occasion as chief guest<br />

Bangladesh National Cadet Corps (BNCC) female platoon was recently inaugurated at Milestone College,<br />

said a press release. Regiment commander of BNCC at Ramna Regiment Dhaka, Lt Col SM Salahuddin<br />

was present on the occasion as chief guest<br />

NCC Bank Limited has recently launched TransFast payment services through all branches of<br />

Karmasangsthan Bank, said a press release. Chairperson of Karmasangsthan Bank, Parikshit Datta<br />

Choudhury, DMD of NCC Bank, AZM Saleh and country director of TransFast Remittance LLC, Mohammad<br />

Khairuzzaman was present on the occasion<br />

UGC and University of Wollongong in Australia have recently signed an agreement on collaborating<br />

research, innovation and training, said a press release. UGC secretary, Dr Md Khaled and Professor Alex<br />

Frino, deputy vice-chancellor (global strategy) at University of Wollongong have signed the agreement<br />

Walton has recently opened its exclusive distributor showroom named Imran Electronics at Nazira Bazar<br />

in Bangshal, said a press release. The company’s brand ambassador, film actor Ilias Kanchan inaugurated<br />

the showroom

6<br />

Sunday, June 4, 2017<br />

DT<br />

Stocks<br />

W E E K L Y M a r k e t O v e r v i e w<br />

SUMMARY Points Change (%) Turnover (BDTmn) Volume (mn) Advanced issues Declined issues Unchanged <strong>Issue</strong>s<br />

DSEX<br />

5438.71 DSEX 5,438.7 0.46% 20,556 632 128 173 31<br />

(+) 0.46%<br />

CSE ASI <strong>16</strong>,838.1 0.49% 3,104 59 104 148 25<br />

Investors turn cautious amid budget<br />

announcement<br />

• Tribune <strong>Business</strong> Desk<br />

Stocks advanced marginally last<br />

week as investors turn cautious<br />

amid national budget announcement<br />

held on Thursday evening.<br />

Dhaka Stock Exchange witnessed<br />

a sharp decline in its turnover<br />

over the week with daily average<br />

turnover falling by 23.9% to<br />

Tk411cr.<br />

Several traders suggested that<br />

the investor participation has declined<br />

because many investors<br />

took a wait-and-see approach before<br />

the budget announcement.<br />

The benchmark index, DSEX<br />

closed at 5,438.7 points on last<br />

Thursday after gaining 0.46%<br />

over the week while CSE ASI<br />

Most Traded<br />

IFAD Autos 135.6 1.95%<br />

Equities advance despite weak US jobs report<br />

• AFP, New York<br />

Price Weekly change<br />

UPGD 182.8 2.87%<br />

LankaBangla 51.6 8.63%<br />

BRAC Bank 79.2 5.32%<br />

ETL 22.5 0.90%<br />

BSC 58.2 -4.45%<br />

PTL 31.9 -8.33%<br />

MJLBD 120.7 1.17%<br />

Doreen Power 144.0 4.27%<br />

Agni Systems 27.9 0.36%<br />

Dhaka Tribune has accumulated the stock market related data primarily from Dhaka Stock Exchange website. The basis of information collected was primarily from daily stock quotations and audited/unaudited<br />

reports of publicly listed companies. High level of caution has been taken to collect and present the above information and data. The publisher will not take any responsibility if any body uses this information and<br />

data for his/her investment decision. For any query please email to news@dhakatribune.com.<br />

Global stocks rallied Friday, with<br />

US and German markets hitting<br />

records after a lackluster US jobs<br />

report raised expectations the<br />

Federal Reserve could take a more<br />

gradual approach to increasing<br />

interest rates.<br />

The Nikkei in Japan also<br />

surged, ending at a 22-month<br />

high, while Britain’s FTSE finished<br />

near flat as election uncertainty<br />

continued to weigh on sentiment.<br />

The US jobs report showed unemployment<br />

in May fell to 4.3%, a<br />

<strong>16</strong>-year low. But the economy added<br />

just 138,000 jobs last month,<br />

far below expectations, while<br />

wage growth remained anemic,<br />

advanced by 0.49% to end at<br />

<strong>16</strong>,838.1 points.<br />

Textile equities contributed<br />

18.2% of the week’s total turnover,<br />

said the weekly market report<br />

of UCB Capital Management Ltd.<br />

5,460<br />

5,440<br />

5,420<br />

5,400<br />

5,380<br />

5,360<br />

5,340<br />

5,320<br />

5,300<br />

rising just 0.2% for the month.<br />

The Fed still is expected to hike<br />

interest rates later this month,<br />

but analysts said the employment<br />

report weakened the chances the<br />

central bank will accelerate tightening<br />

efforts later this year.<br />

“The market is beginning to rethink<br />

the Fed’s course and whether<br />

there will still be two interest<br />

rate increases by the end of the<br />

year, plus a reduction of the balance<br />

sheet,” said Gregori Volokhine,<br />

president of Meeschaert Capital<br />

Markets.<br />

“The report was not bad, but<br />

was also not too good,” he added.<br />

All three US indices notched<br />

records for the second day in a<br />

row, with the Nasdaq leading the<br />

way with a 0.9% gain.<br />

Dhaka Tribune<br />

MOVEMENT OF DSEX INDEX LAST WEEK<br />

‘Irrational exuberance’?<br />

Some market watchers have begun<br />

to express discomfort at the<br />

latest stock surge. Continued worries<br />

about politics and terrorism<br />

raise the question of whether the<br />

records are justified by economic<br />

fundamentals or are another case<br />

of “irrational exuberance,” said<br />

Howard Silverblatt, senior index<br />

analyst at S&P Dow Jones Indices.<br />

“The bottom line still appears<br />

to be slightly unrealistic expectations<br />

instead of irrational,” he<br />

said, while noting that more investors<br />

are on guard for signs of<br />

market skittishness.<br />

The worries include unknowns<br />

over investigations into President<br />

Donald Trump over connections<br />

to Russia, and the effect of the<br />

Debut of a new scrip, Nurani<br />

Dyeing and Sweater Limited on<br />

Thursday has helped textile sector<br />

to be the most traded sector<br />

last week.<br />

Standard Insurance Ltd secured<br />

the highest weekly gain of<br />

17.5% while the worst loser, Mutual<br />

Trust Bank share price declined<br />

by 13.4%.<br />

IFAD Autos held its leadership<br />

position on the top turnover table<br />

for a consecutive third week<br />

with a turnover of Tk75cr over the<br />

week with its share price appreciating<br />

by 1.95% during the week.<br />

DS30, the blue-chip index advanced<br />

by 11.4 points or 0.57% to<br />

end at 2,022.7 points, while DSE<br />

Shariah based index declined<br />

by 1.6 points or 0.13% to close at<br />

1,258.9 points.<br />

Among the traded issues 128<br />

gained, 173 declined and 31 remained<br />

unchanged during the<br />

week. •<br />

DAY 0 DAY 1 DAY 2 DAY 3 DAY 4 DAY 5<br />

probes on the broader Washington<br />

agenda. Elsewhere, Frankfurt’s<br />

DAX 30 jumped 1.3% to a<br />

record close at 12,822.94 points.<br />

London’s FTSE 100 hit another<br />

intraday record, before trimming<br />

gains ahead of next week’s British<br />

election. It closed 0.1% higher.<br />

The Nikkei gained 1.6% to finish<br />

at 20,177.28, the first time it<br />

has crossed 20,000 since December<br />

2015 and the highest since August<br />

that year.<br />

Oil prices tumbled on concerns<br />

of a ramp-up in fossil-fuel production<br />

following Trump’s controversial<br />

decision to withdraw the United<br />

States from the Paris climate agreement.<br />

The dollar retreated against<br />

the euro and other major currencies<br />

after the US jobs report. •<br />

DSE NEWS<br />

REGENTTEX: EPS was Tk. 0.30 for January-March,<br />

2017 as against Tk. 0.27 for<br />

January-March, 20<strong>16</strong>; EPS was Tk. 0.83<br />

for July, 20<strong>16</strong>-March, 2017 as against Tk.<br />

0.68 for July, 2015-March, 20<strong>16</strong>. NOCFPS<br />

was Tk. 0.04 for July, 20<strong>16</strong>-March, 2017<br />

as against Tk. (0.08) for July, 2015-March,<br />

20<strong>16</strong>. NAV per share was Tk. 29.86 as on<br />

March 31, 2017 and Tk. 31.37 as on June<br />

30, 20<strong>16</strong>.<br />

PTL: The Company has informed that the<br />

Board of Directors has decided to form<br />

a Consortium whose name would be<br />

Paramount-Aggretech Energy Consortium<br />

with 1) Paramount Spinning Limited,<br />

2) Paramount Holdings Limited & 3)<br />

Aggretech AG, Germany for establishing<br />

a 100 MW HFO Fired Engine Based<br />

Power Plant on Build, Own and Operate<br />

(BOO) Basis upon getting permission<br />

from the concern authority at Baghabari,<br />

Shirajgonj, Bangladesh under Bangladesh<br />

Power Development Board (BPDB). The<br />

Board of Directors has also decided to act<br />

as the Lead Member and contribute 55%<br />

Share Capital of the total share capital of<br />

the Consortium amongst the members of<br />

the consortium.<br />

ISLAMIBANK: Excel Dyeing & Printing<br />

Limited, one of the Corporate Directors of<br />

the Company, has expressed its intention<br />

to buy 32,038,814 shares of the Company<br />

at prevailing market price (In the Public/<br />

Block Market) through Stock Exchange<br />

within next 30 working days.<br />

NURANI: The Company has reported<br />

its profit after tax of Tk. <strong>16</strong>.13 million and<br />

basic EPS of Tk. 0.40 for the 3 (three)<br />

months period ended on 31 March 2017<br />

(January- March, 2017) as against profit<br />

after tax of Tk. 11.91 million and basic<br />

EPS of Tk. 0.30 for the same period of<br />

the previous year. It is to be noted that<br />

basic EPS has been calculated based on<br />

weighted average Pre-IPO paid-up number<br />

of shares 40,000,000 in both the<br />

periods. However, considering Post-IPO<br />

83,000,000 number of shares the Company’s<br />

basic EPS for the 3 (three) months<br />

period ended on 31 March, 2017 would<br />

be Tk. 0.19. For the period of 9 (nine)<br />

months (July, 20<strong>16</strong>- March, 2017) ended<br />

on 31 March, 2017 profit after tax was Tk.<br />

47.63 million and basic EPS was Tk. 1.19<br />

as against profit after tax of Tk. 42.24<br />

million and basic EPS of Tk. 1.06 for the<br />

same period of the previous year. It is to<br />

be noted that the said EPS has been calculated<br />

based on weighted average Pre-IPO<br />

paid-up number of shares 40,000,000<br />

in both the periods. However, considering<br />

Post-IPO 83,000,000 number of shares,<br />

Company’s basic EPS would be Tk. 0.57<br />

for 9 (nine) months period ended on 31<br />

March, 2017 (July, 20<strong>16</strong>- March, 2017) and<br />

NAV per share would be Tk. 12.68 as on 31<br />

March, 2017. •

THE lAST<br />

WORD<br />

• Tim Worstall<br />

Good grief, is Bangladesh really as<br />

bad as this? How does anyone get<br />

anything done, how is it possible<br />

to have an economy at all? That’s<br />

the only rational reaction to<br />

one part of FM Muhith’s budget<br />

speech, where he outlines plans to<br />

improve the ranking of the country<br />

in the World Bank’s “Ease of Doing<br />

<strong>Business</strong>” rankings. Bangladesh<br />

currently ranks 176th and the aim<br />

is to get it up to 100th over the<br />

years.<br />

That is, the ambition is to get<br />

from ever so slightly better than<br />

DR Congo, a place which doesn’t<br />

really have a formal economy at<br />

all, or Equitorial Guinea, a strict<br />

dictatorship floating on a sea of<br />

oil, Yemen, suffering a full own<br />

shooting war, all the way up to<br />

the position of say Lesotho or the<br />

efficient places like Zambia. This is<br />

a notably modest ambition -- note<br />

that there are only 190 countries<br />

ranked (Somalia is at the bottom,<br />

not really even a country at present)<br />

and a higher number is worse.<br />

I think we can and probably<br />

should be able to demand a rather<br />

better performance than this. And<br />

that takes us into a particularly<br />

thorny economic point.<br />

It is actually necessary for us to<br />

have a government. Anarchism, the<br />

Ayn Rand style Objectivist fantasies<br />

are exactly that, fantasies. Someone,<br />

somewhere, needs to secure<br />

the country, organise those things<br />

which only the imposition of state<br />

power can organise, along with that<br />

monopoly upon legal violence and<br />

so on. That means a government<br />

and taxation to fund it.<br />

The thorny part of the point<br />

being that all too many think that<br />

the necessity of having some<br />

government means that all things<br />

must be governed, that being a<br />

large error.<br />

To take one little example,<br />

there is now talk about legalising<br />

gold imports, this talk being part<br />

of the same budget speech. The<br />

concern being that there is no policy<br />

laid out and thus Bangladesh is<br />

missing out on an opportunity.<br />

It seems likely that there is an<br />

opportunity being missed. There’s<br />

very definitely a market for hand<br />

made jewellery out there across<br />

the globe. Bangladesh is not short<br />

of craftsmen, the Bengali history<br />

of fine arts and crafts is renowned.<br />

The conversion of gold ingot<br />

into fine pieces by the application<br />

of that skilled labour and historical,<br />

cultural background, yes, why<br />

Distance to frontler score<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Starting a <strong>Business</strong><br />

Dealing with Construction Permits<br />

OPINION 7<br />

Vast numbers, nearly all in fact, of these experiments fail. Four out<br />

of five new businesses cease to exist within five years. For reasons<br />

like: The originators of the scheme were simply deluded all the way<br />

through to other people just doing it better, perhaps with side routes<br />

through the technology just don’t work for anyone wanting the<br />

finished production<br />

not? But to think that there must<br />

be a policy about this is to be in<br />

error.<br />

What we need instead is a<br />

policy which does not forbid nor<br />

interfere with it. All that needs to<br />

be done is to amend the import<br />

regulations so that gold is a legal<br />

import. Then we’re done.<br />

We also don’t need to try to<br />

distinguish between imports for<br />

domestic consumption and for<br />

re-manufacturing for export. We<br />

just need to let the market, the<br />

participants in it, make their own<br />

decisions.<br />

That is just an example but<br />

it is the exemplar for the entire<br />

economy.<br />

Sure, there are things that<br />

government and governance must<br />

do. A decent bankruptcy law is<br />

vital for any functioning economy.<br />

We need to know who owns what<br />

-- not so that we can keep an eye<br />

upon it but so that transfer is possible<br />

-- we know the seller owns<br />

2013<br />

Getting Electricity<br />

Registering Property<br />

2014<br />

what they’re selling. Thus, land<br />

registry is a vital task.<br />

Laws stating that employers<br />

may not poison or otherwise kill<br />

off their workers seem like a pretty<br />

good idea, even Adam Smith<br />

insisted that government financing<br />

of at least basic education was a<br />

good idea.<br />

There are these many things<br />

which government can and should<br />

do to create the structure within<br />

which an economy can flourish.<br />

But going beyond that to try to<br />

insist that government should<br />

be planning what economy will<br />

then flourish is where the mistake<br />

comes in. Because the truth about<br />

the economy in detail is that we<br />

just don’t know.<br />

Technology is an ever moving<br />

feast, what is possible for us to do<br />

changes over time. The tastes of<br />

the people change too. Thus, we<br />

have an ever expanding universe<br />

of combinations of resources and<br />

technologies to match up with that<br />

Getting Credit<br />

Protecting Minority Investors<br />

2015 20<strong>16</strong><br />

Paying Taxes<br />

Trading across Borders<br />

Enforcing Contracts<br />

Resolving Insolvency<br />

DT<br />

Sunday, June 4, 2017<br />

It’s all about the experimentation machine<br />

PROGRESS OF BANGLADESH IN THE AREAS MEASURED BY DOING BUSINESS<br />

ever changing consumer taste. As<br />

Friedrich Hayek got the Nobel prize<br />

for pointing out (and it was the basis<br />

of his Nobel lecture) there is just<br />

no manner in which the centre, the<br />

government, can gain access to the<br />

information needed to plan this.<br />

Even Kantorovich, the only Soviet<br />

economics Nobel winner agreed<br />

with this point.<br />

We really just don’t know. Thus,<br />

we’ve got to leave it up to the<br />

fertile imaginations of the people<br />

to work through the possibilities.<br />

And that’s really what the free<br />

market is, the experimentation<br />

machine.<br />

Vast numbers, nearly all in fact,<br />

of these experiments fail. Four out<br />

of five new businesses cease to<br />

exist within five years. For reasons<br />

like: The originators of the scheme<br />

were simply deluded all the way<br />

through to other people just doing<br />

it better, perhaps with side routes<br />

through the technology just don’t<br />

work for anyone wanting the finished<br />

production.<br />

The task of government in<br />

economic management is thus to<br />

create that structure within which<br />

economic activity can occur. The<br />

rule of law, a bit of education, providing<br />

public goods, and so on.<br />

But then to stop and just leave<br />

the room for that economic activity<br />

to happen within. Or, as Adam<br />

Smith again put it, little else is<br />

requisite to carry a state to the<br />

highest degree of opulence from<br />

the lowest barbarism -- but peace,<br />

easy taxes, and a tolerable administration<br />

of justice; all the rest being<br />

brought about by the natural course<br />

of things.<br />

We might expand the list of<br />

things which government can<br />

usefully do a little these days. But<br />

the basic concept still holds. Those<br />

things which must be done and<br />

which can only be done by the<br />

government are the things which<br />

the government must do. But once<br />

they are done, government needs<br />

to get out of our way as we make<br />

headway to build that opulence.<br />

So why shouldn’t Bangladesh<br />

be at the top of the ease of doing<br />

business list alongside New Zealand<br />

-- that being the one single<br />

thing which would propel it to<br />

being as rich as New Zealand?<br />

Why is the ambition limited as<br />

to desire to be only in top 100 on<br />

the list? •<br />

Tim Worstall is a Senior Fellow at the<br />

Adam Smith Institute in London.