semi-annual report 30 Sep 2010 - SEB Asset Management

semi-annual report 30 Sep 2010 - SEB Asset Management

semi-annual report 30 Sep 2010 - SEB Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 | <strong>SEB</strong> ImmoInvest<br />

A broad distribution of tenants across many different industries<br />

also reduces dependency on specific economic segments.<br />

Long-term leases safeguard the stability and earnings<br />

power of open-ended real estate funds. At the <strong>report</strong>ing<br />

date, 43.7% of the leases in <strong>SEB</strong> ImmoInvest had a duration<br />

of more than five years.<br />

From 1 April <strong>2010</strong> to <strong>30</strong> <strong>Sep</strong>tember <strong>2010</strong>, the Fund’s management<br />

signed 394 new leases for 110,000 m 2 . In addition,<br />

363 existing leases for 61,000 m 2 were extended, which<br />

represents a total of 5.7% of the Fund’s estimated net rental<br />

for the year as of <strong>30</strong> <strong>Sep</strong>tember <strong>2010</strong>.<br />

A total of 5.6% of the leases in the portfolio of directly held<br />

properties in Germany may expire in <strong>2010</strong> and 2011. In<br />

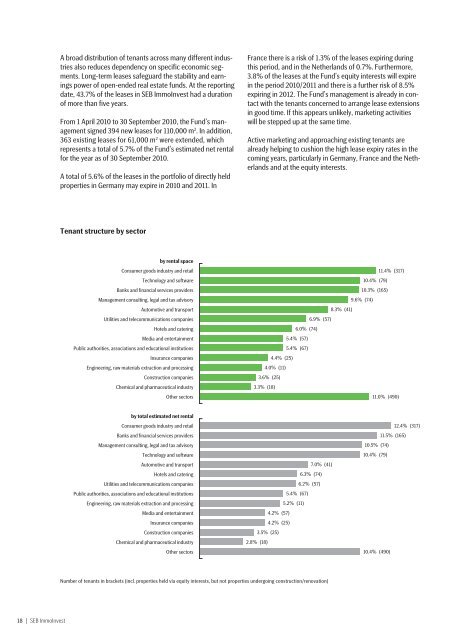

Tenant structure by sector<br />

by rental space<br />

Consumer goods industry and retail<br />

Technology and software<br />

Banks and financial services providers<br />

<strong>Management</strong> consulting, legal and tax advisory<br />

Automotive and transport<br />

Utilities and telecommunications companies<br />

Hotels and catering<br />

Media and entertainment<br />

Public authorities, associations and educational institutions<br />

Insurance companies<br />

Engineering, raw materials extraction and processing<br />

Construction companies<br />

Chemical and pharmaceutical industry<br />

Other sectors<br />

by total estimated net rental<br />

Consumer goods industry and retail<br />

Banks and financial services providers<br />

<strong>Management</strong> consulting, legal and tax advisory<br />

Technology and software<br />

Automotive and transport<br />

Hotels and catering<br />

Utilities and telecommunications companies<br />

Public authorities, associations and educational institutions<br />

Engineering, raw materials extraction and processing<br />

Media and entertainment<br />

Insurance companies<br />

Construction companies<br />

Chemical and pharmaceutical industry<br />

Other sectors<br />

3.3% (18)<br />

2.8% (18)<br />

4.4% (25)<br />

4.0% (11)<br />

3.6% (25)<br />

4.2% (57)<br />

4.2% (25)<br />

3.5% (25)<br />

6.0% (74)<br />

5.4% (57)<br />

5.4% (67)<br />

5.4% (67)<br />

5.2% (11)<br />

6.9% (57)<br />

7.0% (41)<br />

6.3% (74)<br />

6.2% (57)<br />

Number of tenants in brackets (incl. properties held via equity interests, but not properties undergoing construction/renovation)<br />

France there is a risk of 1.3% of the leases expiring during<br />

this period, and in the Netherlands of 0.7%. Furthermore,<br />

3.8% of the leases at the Fund’s equity interests will expire<br />

in the period <strong>2010</strong>/2011 and there is a further risk of 8.5%<br />

expiring in 2012. The Fund’s management is already in contact<br />

with the tenants concerned to arrange lease extensions<br />

in good time. If this appears unlikely, marketing activities<br />

will be stepped up at the same time.<br />

Active marketing and approaching existing tenants are<br />

already helping to cushion the high lease expiry rates in the<br />

coming years, particularly in Germany, France and the Netherlands<br />

and at the equity interests.<br />

8.3% (41)<br />

10.4% (79)<br />

10.3% (165)<br />

9.6% (74)<br />

10.5% (74)<br />

10.4% (79)<br />

11.4% (317)<br />

11.0% (490)<br />

10.4% (490)<br />

11.5% (165)<br />

12.4% (317)