semi-annual report 30 Sep 2010 - SEB Asset Management

semi-annual report 30 Sep 2010 - SEB Asset Management

semi-annual report 30 Sep 2010 - SEB Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

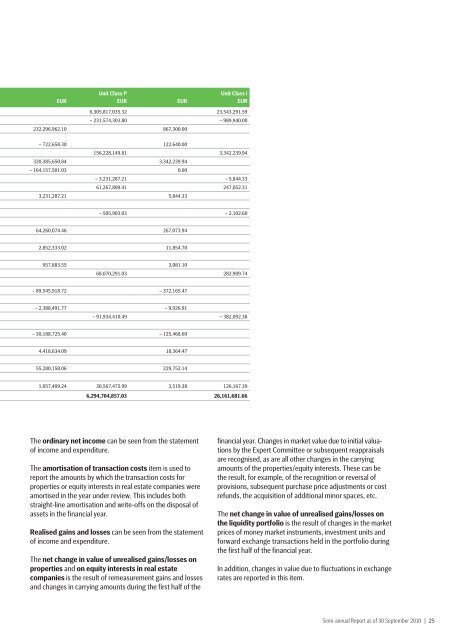

Unit Class P Unit Class I<br />

EUR EUR EUR EUR<br />

6,<strong>30</strong>5,817,035.32 23,543,291.59<br />

– 231,574,<strong>30</strong>3.80 – 989,940.00<br />

232,296,962.10 867,<strong>30</strong>0.00<br />

– 722,658.<strong>30</strong> 122,640.00<br />

156,228,149.81 3,342,239.94<br />

320,385,650.84 3,342,239.94<br />

– 164,157,501.03 0.00<br />

– 3,231,287.21 – 5,844.33<br />

61,267,809.41 247,052.31<br />

3,231,287.21 5,844.33<br />

– 505,903.03 – 2,102.60<br />

64,260,074.46 267,073.94<br />

2,852,333.02 11,854.70<br />

957,883.55 3,981.10<br />

68,070,291.03 282,909.74<br />

– 89,545,918.72 – 372,165.47<br />

– 2,388,491.77 – 9,926.91<br />

– 91,934,410.49 – 382,092.38<br />

– <strong>30</strong>,188,725.40 – 125,468.60<br />

4,418,634.09 18,364.47<br />

55,280,158.06 229,752.14<br />

1,057,409.24 <strong>30</strong>,567,475.99 3,519.38 126,167.39<br />

6,294,704,857.03 26,161,681.66<br />

The ordinary net income can be seen from the statement<br />

of income and expenditure.<br />

The amortisation of transaction costs item is used to<br />

<strong>report</strong> the amounts by which the transaction costs for<br />

properties or equity interests in real estate companies were<br />

amortised in the year under review. This includes both<br />

straight-line amortisation and write-offs on the disposal of<br />

assets in the financial year.<br />

Realised gains and losses can be seen from the statement<br />

of income and expenditure.<br />

The net change in value of unrealised gains/losses on<br />

properties and on equity interests in real estate<br />

companies is the result of remeasurement gains and losses<br />

and changes in carrying amounts during the first half of the<br />

financial year. Changes in market value due to initial valuations<br />

by the Expert Committee or subsequent reappraisals<br />

are recognised, as are all other changes in the carrying<br />

amounts of the properties/equity interests. These can be<br />

the result, for example, of the recognition or reversal of<br />

provisions, subsequent purchase price adjustments or cost<br />

refunds, the acquisition of additional minor spaces, etc.<br />

The net change in value of unrealised gains/losses on<br />

the liquidity portfolio is the result of changes in the market<br />

prices of money market instruments, investment units and<br />

forward exchange transactions held in the portfolio during<br />

the first half of the financial year.<br />

In addition, changes in value due to fluctuations in exchange<br />

rates are <strong>report</strong>ed in this item.<br />

Semi-<strong>annual</strong> Report as of <strong>30</strong> <strong>Sep</strong>tember <strong>2010</strong> | 25