Business Supplement Issue-22

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DT<br />

VOL1, ISSUE <strong>22</strong> | Sunday, July 23, 2017<br />

<strong>Business</strong> Tribune<br />

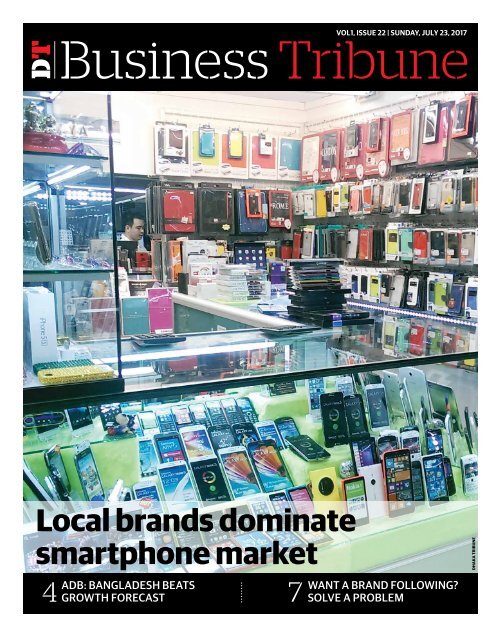

Local brands dominate<br />

smartphone market<br />

Dhaka Tribune<br />

ADB: Bangladesh beats<br />

4 growth forecast<br />

Want a brand following?<br />

7 Solve a problem

2<br />

Sunday, July 23, 2017<br />

DT<br />

Special<br />

Local brands dominate smartphone market<br />

• Ishtiaq Husain<br />

Bangladesh has seen a rapid<br />

growth in mobile handset market,<br />

specially in smartphone segment,<br />

since 2013, with local brands dominating<br />

the market, while the international<br />

ones are striving to gain<br />

momentum with their aggressive<br />

marketing strategies.<br />

At present, the country is a<br />

Tk8,500-core market of some three<br />

crore mobile handsets comprised<br />

of local and international brands<br />

vying with each other.<br />

Of the total mobile phones, only<br />

30% are smartphones and the rest<br />

are basic phones, which are priced<br />

below Tk2,000.<br />

Since 2008, local mobile handset<br />

brands had the lion’s share of<br />

the market with its lost-cost and<br />

mid-range basic products.<br />

During the period between 2008<br />

and 2012, international brands<br />

were losing their business to local<br />

brands, Symphony and Walton,<br />

which gathered momentum with<br />

their over 50% market share. The<br />

local brands served customers with<br />

low-cost smartphones priced at between<br />

Tk3,000 and Tk6,000.<br />

In recent years, particularly over<br />

the last two years, most international<br />

brands made a comeback<br />

with their quality products, strong<br />

Research and Development (R&D)<br />

strategy and after-sale services.<br />

There are hardly any districts<br />

where international brands have<br />

not opened up their showrooms to<br />

reach out their products to smartphone<br />

users.<br />

According to the Technology<br />

Market Research Firm, Counterpoint,<br />

Huawei that entered the top<br />

five smartphone brands topped the<br />

list in Q1 of 2016 and continues to<br />

perform well in the segment, moving<br />

up into top three spots in Q3<br />

of the same year. The growth was<br />

mainly driven by its affordable<br />

smartphones.<br />

Samsung has slipped to become<br />

the third largest mobile<br />

phone brand in Bangladesh, still<br />

holding the second position in the<br />

fast-growing smartphone market<br />

with a 15% market share.<br />

Indian brand LAVA that set foot<br />

in the Bangladesh market in 2013<br />

remains strong within top five<br />

smartphone brands in the country<br />

with 8% market share presently.<br />

Unlike LAVA, Micromax India<br />

which is struggling in its home<br />

market continues to lose its market<br />

share in Bangladesh as well, and is<br />

now out of the top 10 mobile phone<br />

brands listed in Q3 last year.<br />

Symphony leads by a big margin<br />

in both overall mobile phone and the<br />

fast-growing smartphone sub-segment<br />

with 14% market share.<br />

An affordable offer, effective localisation<br />

of software and services,<br />

expansive distribution and strong<br />

connection with local users drove<br />

MOBILE HANDSET IMPORT IN 2016<br />

Brand Quantity of handset (in million) Value in Tk crore<br />

Symphony 11.6 1897<br />

Samsung 2.00 1830<br />

Walton 1.80 600<br />

Huwawei 0.7 511<br />

Lava 0.7 361<br />

Oppo 0.2 301<br />

Others 21.67 515<br />

Total 38.67 6,015<br />

We have some limitations about skilled<br />

manpower and technology. It will take time<br />

to achieve that skill<br />

Source: BMPIA<br />

the Symphony’s rapid. According<br />

to the phone company, currently, it<br />

holds 38% market share.<br />

The fourth largest mobile phone<br />

player in Bangladesh, Walton, is<br />

ranked with top five in both feature<br />

as well as smartphone segments.<br />

Given the situation, Ashraful<br />

Haque, director (marketing), Symphony,<br />

said the local brand would<br />

be able to retain its market share<br />

using new strategy. Moreover, the<br />

government new tax policy on imported<br />

spare parts will be congenial<br />

to their business.<br />

In the last budget of Fiscal Year<br />

2016-17, the government has reduced<br />

tax over 15% on imported<br />

spare parts which would encourage<br />

local brands to assemble their mobile<br />

handsets in the country.<br />

At present, around 30% people<br />

use smartphones. The ratio will<br />

reach 35% by the end of this year<br />

and 60% by 2020.<br />

According to users, when it<br />

comes to quality, local brands fail<br />

to compete with the international<br />

brands, and to survive in the market<br />

situation, they got to produce<br />

quality products.<br />

Rezwanul Hoque, CEO, Transsion<br />

Bangladesh Limited, a Chinese<br />

mobile handset company, said the<br />

main weakness of local brand is they<br />

don’t have any Research and Development,<br />

one of the most important<br />

elements in manufacturing mobile<br />

handset. Transsion invests 6% of its<br />

total revenue earnings in R&D.<br />

He said Bangladesh has huge<br />

potential in mobile handset market.<br />

To meet only 30% demand,<br />

some 82 lakh smartphones were<br />

imported in the last one year. If<br />

the ratio of smartphone use rises<br />

nearly 70%, the market would be<br />

increased more than twice.<br />

Counterpoint Senior Analyst<br />

SuJeong Lim noted that “Although<br />

Bangladesh’s mobile phone market<br />

is driven by feature phones, smartphones’<br />

share is also growing every<br />

quarter.”<br />

Of the total mobile phones,<br />

smartphone’s share is estimated to<br />

rise to almost 50% from 28% by the<br />

end of 2017, he commented.<br />

The rise of smartphone users is<br />

fuelled by the launch of affordable<br />

3G devices. It is mainly driven<br />

by local brands such as Symphony<br />

and Walton. Global brands Samsung<br />

with its J series along with<br />

Huawei and Oppo are pushing up<br />

the 4G LTE-enabled smartphones,<br />

the next battleground for differentiation<br />

in Bangladesh smartphone<br />

segment in 2017.<br />

“LTE capable smartphones now<br />

contribute to nearly one on four<br />

smartphones shipped in Bangladesh,”<br />

Counterpoint Research<br />

Analyst Pavel Naiya, said, adding<br />

that Bangladesh market is mainly<br />

dominated by local players with a<br />

combined share of two-thirds of<br />

the total mobile phone market.<br />

Symphony Mobile remains the<br />

single largest mobile phone brand<br />

followed by Winmax mobile and<br />

others. Smaller Chinese brands<br />

continue to lose market share to<br />

Oppo and Xiaomi that have entered<br />

the smartphone market while local<br />

players are upping the ante with<br />

low-cost smartphones to sustain<br />

their market share, according to<br />

the research.<br />

Uday Hakim, senior operative<br />

director, Walton, said: “No doubt,<br />

international brands are the big<br />

threat for us. At this moment, we<br />

need a friendly policy that will<br />

help us compete with international<br />

brands, or else, it would be tough<br />

to survive in this market.”<br />

Industry insiders said local<br />

brands pay 15% vat on supplying<br />

level and 35% corporate tax, which<br />

they termed a huge risk factor.<br />

Uday added that Vietnamese<br />

mobile brands have a huge dominance<br />

in the world after China as its<br />

government took some supportive<br />

policies for local mobile companies.<br />

“If the government provides a<br />

20 to 30-year tax holiday for local<br />

companies as Vietnam and India<br />

do, we will be able to produce<br />

cheapest handsets in the world.”<br />

At present, there are 120 million<br />

mobile phone subscribers in the<br />

country. Of them, 63 million subscribe<br />

to mobile data plan of different<br />

sorts. The report pointed to the<br />

fact that although 10% of overall<br />

mobile phone subscribers got cut<br />

in 2016 due to biometric registration,<br />

mobile internet saw a 24% rise<br />

in subscriber’s number.<br />

Handset importers of the country<br />

are eyeing a 25% growth in total<br />

sales of all kinds in 2017, said Bangladesh<br />

Mobile Phone Importers Association<br />

(BMPIA) president Ruhul<br />

Alam Al Mahbub.<br />

He said in Bangladesh customers<br />

become interested in buying<br />

brand handsets as their buying capacity<br />

has increased.<br />

“We have some limitations<br />

about skilled manpower and technology.<br />

It will take time to achieve<br />

that skill,” said Symphony Director<br />

(Marketing) Ashraful Haque.<br />

In the country, over 40% population<br />

are connected to internet<br />

and there is a huge opportunity for<br />

the handset players to tap the first<br />

time users by offering affordable,<br />

yet quality smartphones. •<br />

MD MANIK

Interview<br />

3<br />

Sunday, July 23, 2017<br />

DT<br />

Bangladesh to turn mobile manufacturer soon<br />

Bangladesh government should come up with attractive package including tax holiday and<br />

measures to create skilled workforce to tap huge opportunity of mobile phone industry to meet<br />

the demands locally, Asifur Rahman Khan, head of marketing, Walton cellular phone, told the<br />

Dhaka Tribune’s Ibrahim Hossain Ovi in an exclusive interview<br />

What are the challenges to local<br />

brands?<br />

Now, there are a number of challenges<br />

to local brands. These are<br />

scarcity of skilled labour force;<br />

relatively higher production cost<br />

compared to that of foreign brands;<br />

price competitiveness; risk of technology<br />

transfer, etc.<br />

Do you think Bangladesh can<br />

export mobile phone after<br />

meeting local demands?<br />

Of course, the country has an opportunity<br />

to export locally made<br />

mobile phone sets after meeting local<br />

demands. A significant number<br />

of expatriate Bangladeshis are now<br />

in different countries. If we target<br />

those Non-Resident Bangladeshis<br />

(NRBs), we will find a potential<br />

market abroad.<br />

Do you think Bangladesh can<br />

manufacture mobile phone<br />

instead of assembling?<br />

Yes, I think so. The country will<br />

turn into a mobile phone manufacturing<br />

hub rather than an assembling<br />

industry. Once, we used<br />

to manufacture some spare parts<br />

of refrigerators, televisions and air<br />

conditioners locally, but now we<br />

have turned ourselves as a 100%<br />

local manufacturer of those home<br />

appliances.<br />

Does Walton assemble its own<br />

handsets locally? If no, do you<br />

have any plan to do so in the near<br />

future and when?<br />

Right now, Walton is not assembling<br />

its own brand handsets locally,<br />

but it has a plan to manufacture<br />

world-class handsets in its own<br />

factory at Chandra in Gazipur.<br />

DG Tech Industries Ltd, a sister<br />

concern of Walton Group, is establishing<br />

manufacturing project.<br />

If everything goes fine, we would<br />

be able to start production by this<br />

month.<br />

Asifur Rahman Khan, head of marketing, Walton cellular phone<br />

How can local brand turn out to be<br />

a global brand?<br />

It is a 100 million question, but it is<br />

now a reality, as Walton has started<br />

making it happen for its other<br />

products. If we look into the present<br />

market scenario, you will find<br />

some recognise Walton as a brand.<br />

We are producing different electronics<br />

products and home appliances,<br />

which have already started<br />

to be exported in small scale.<br />

Now, it is time for the government<br />

to take measures to make our<br />

products familiar with the world<br />

through its commerce wings in different<br />

countries.<br />

On the other hand, the Export<br />

Promotion Bureau (EPB), Bangladesh,<br />

should include the sector<br />

into its expo list to create an opportunity<br />

for the products to display in<br />

the global markets.<br />

How will Walton ensure better<br />

designs and quality products?<br />

Walton has already set up Research<br />

and Development Centre with<br />

highly qualified, skilled and experienced<br />

engineers from home and<br />

abroad. The team of professional<br />

engineers are engaged in product<br />

development as well as ensuring<br />

quality of products.<br />

In addition, the company has<br />

capacity to manufacture multi-layer<br />

motherboard or Printed Circuit<br />

Board (PCB) by most-advanced<br />

SMT Machine at its own factory.<br />

With the help of its research<br />

team, the company always focuses<br />

on innovation to upgrade its product<br />

models and designs to satisfy<br />

customers in comparison with other<br />

brands.<br />

How will you meet the demand for<br />

skilled manpower?<br />

There is scarcity of skilled workforce.<br />

Thus, productivity rate of local<br />

industry’s workforce gets lower<br />

than that of overseas brands. Besides,<br />

mobile phone technology is<br />

entirely a new technology for local<br />

industry, and therefore, risk factor<br />

is very high in terms of technology<br />

transfer.<br />

In order to meet the demand for<br />

skilled workforce, the government<br />

should focus on vocational training.<br />

While the universities need<br />

to prepare their fresh graduates in<br />

such a manner that they can fulfill<br />

the industry needs.<br />

On the hand, through proper<br />

negotiation with developed<br />

countries, the government should<br />

arrange training that will help acquire<br />

knowledge on the latest development<br />

in technologies.<br />

Will the current budget help the<br />

local industry?<br />

For the current fiscal year, the government<br />

has cut duties and taxes<br />

on the import of raw materials and<br />

spare parts to facilitate manufacture<br />

of mobile phones locally.<br />

Undoubtedly, such tax benefit<br />

will encourage local entrepreneurs<br />

to produce mobile phones in Bangladesh,<br />

but I think the government<br />

should provide some extra benefits<br />

to ensure sustainable boom in<br />

handset manufacturing industry in<br />

Bangladesh.<br />

Is the taxation in favour of local<br />

industry?<br />

Though there is a relief on the import<br />

of raw materials, overall taxation<br />

system is not in favour of the<br />

industry.<br />

Currently, the sector has to<br />

pay 35% corporate tax. To attract<br />

more investment, the government<br />

should provide incentives and policy<br />

support for the sector as it is an<br />

emerging industry.<br />

For the sake of local entrepreneurs,<br />

the government should<br />

declare tax holiday at least for<br />

20 years for ensuring sustainable<br />

boom of mobile set industry in the<br />

Courtesy<br />

country.<br />

If mobile phone industry is expanded,<br />

it can meet a larger portion<br />

of demand locally. Thus, Bangladesh<br />

can save a huge amount of<br />

foreign currency, alongside creating<br />

a good number of jobs for the<br />

young generation.<br />

The latest budget has increased<br />

the import duty on handsets from<br />

5% to 10%. What would be the<br />

possible impact of this measure?<br />

Of course, the increase of customs<br />

duty on imported handsets would<br />

raise the prices of the imported<br />

mobile phones, but there is a concern<br />

that some unscrupulous businessmen<br />

might bring mobile sets<br />

through illegal channels.<br />

As a result, the government<br />

would be deprived of huge amount<br />

of revenue while local handsets<br />

lose price competitiveness. Respective<br />

agencies have to be more<br />

careful so that no one can bring a<br />

single piece of handset without<br />

paying the government due taxes<br />

and duties. •

4<br />

Sunday, July 23, 2017<br />

DT<br />

Week in Review<br />

ADB: Bangladesh beats growth forecast<br />

Preliminary government economic<br />

growth estimates in Bangladesh for the<br />

last fiscal beat the forecasts of Asian<br />

Development Outlook (ADO) 2017,<br />

according to an Asian Development<br />

Bank (ADB) report.<br />

In the ADO 2017, published in April<br />

this year, ADB said Bangladesh economy<br />

will grow to 6.9% in the fiscal 2016-<br />

17 but Bangladesh’s gross domestic<br />

product (GDP) growth reached 7.24% in<br />

FY2017, beating all the previous records.<br />

In a supplement to its ADO 2017<br />

report released on July 20, ADB<br />

upgraded its growth outlook in the<br />

region from 5.7% to 5.9% in 2017<br />

and from 5.7% to 5.8% for 2018. The<br />

smaller uptick in the 2018 rate reflects<br />

a cautious view on the sustainability of<br />

this export push.<br />

According to the report, agriculture<br />

growth in Bangladesh in FY2017<br />

was higher than anticipated. Services<br />

growth also outperformed expectations,<br />

supported by agriculture growth<br />

and solid performances in wholesale<br />

and retail trade, real estate, hotels and<br />

restaurants, and transport.<br />

Inflation forecasts for South Asia are<br />

cut to 4.2% from 5.2% in 2017 and to<br />

4.7% from 5.4% in 2018, prompted by<br />

lower increases in Bangladesh, Bhutan,<br />

India, and Nepal.<br />

Bangladesh is experiencing a steady<br />

decline in nonfood inflation, reflecting<br />

favorable international prices, it said.<br />

In Pakistan, growth was similarly<br />

supported by a revival in agriculture,<br />

as well as by continued expansion in<br />

construction and steady growth in<br />

services.<br />

Strong private consumption<br />

remained the largest contributor to<br />

growth. Robust growth in industry and<br />

services lifted growth prospects for<br />

Nepal in FY2017 (ended July 15, 2017),<br />

as did accelerated earthquake reconstruction,<br />

while an improved prognosis<br />

for the important tourism sector is<br />

providing a boost to the Maldives.<br />

These improved prospects for Bangladesh,<br />

Maldives, Nepal, and Pakistan<br />

are balanced by slower growth projected<br />

for Bhutan and Sri Lanka.<br />

The construction of hydropower<br />

projects has been delayed in Bhutan,<br />

undermining economic growth there.<br />

In Sri Lanka, heavy rain caused severe<br />

floods in 15 of 25 districts and triggered<br />

landslides in some areas in May<br />

2017. Disrupted economic activity and<br />

Dhaka Tribune<br />

damage to agriculture will slow growth<br />

in 2017, but subsequent recovery may<br />

boost GDP growth somewhat in 2018.<br />

In India, economic growth slowed<br />

to 7.1% in FY2016 (ended March<br />

31, 2017) from 8% in FY2015. The<br />

slowdown can be partly attributed to<br />

the demonetisation and replacement<br />

of high-denomination banknotes<br />

in November 2016, which affected<br />

economic activity in several cash-dependent<br />

sectors. •<br />

MPS for H2 in<br />

FY’17 fails to<br />

achieve target<br />

The Monetary Policy Statement has<br />

failed to achieve its target in almost all<br />

categories during the second half of<br />

the just-concluded fiscal year 2016-17.<br />

In the performance analysis of<br />

January-June period, it has been noticed<br />

that the credit growth in the<br />

private sector rose only 11% till May<br />

while it was estimated at 16.5%. The<br />

trend shows that the growth won’t<br />

be optimum even in June.<br />

The inflation was stated at between<br />

5.3% and 5.6%, but stood at<br />

5.72% mark during the six months<br />

of FY’17. In terms of Net Domestic<br />

Asset (NDA) growth, it went on the<br />

downswing than estimated. The<br />

NDA only stood at 12.24% while the<br />

target was 17.3%.<br />

Broad money has also failed to<br />

achieve its target of 15%. Till May,<br />

it only achieved 11.69% growth.<br />

Likewise, other categories in the<br />

MPS also followed the suit.<br />

The central bank is likely to<br />

announce its Monetary Policy<br />

Statement (MPS) for the first half<br />

(July-December) of the new Fiscal<br />

Year 2017-18 on July 25. Bangladesh<br />

Bank Governor Fazle Kabir will<br />

announce the MPS.<br />

BB is currently holding talks<br />

with stakeholders and economists<br />

to make the policy more effective<br />

for the country’s future economic<br />

development. •<br />

Bangladesh Bank eyes reducing<br />

remittance fees<br />

Bangladesh Bank (BB) is likely to determine<br />

a low transfer fee for remittance<br />

on July 24 with a view to encouraging<br />

non-resident Bangladeshis (NRBs) to<br />

send more remittances through banking<br />

channel.<br />

The central bank high-ups organised<br />

a meeting with senior officials of top 20<br />

remittance recipient banks to talk over<br />

the issue at its head office on July 19.<br />

BB Executive Director Ahmed<br />

Jamal presided over the meeting while<br />

senior officials from Agrani Bank, Bank<br />

Asia, Brac Bank, Janata Bank, National<br />

Bank, Mercantile Bank and Islami Bank,<br />

among others, attended the event.<br />

Talking to the Dhaka Tribune, one<br />

of the government bank representatives<br />

said: “We met the central bank<br />

authorities to fix a reduced remittance<br />

transfer fee. But today’s meeting was a<br />

preliminary meeting, the final decision<br />

would be taken in the next meeting on<br />

July 24.”<br />

When contacted, Ahmed Jamal declined<br />

to make any comment over the<br />

matter. However, he said they sat with<br />

top 20 remittance receiver banks after<br />

remittance inflows into the country<br />

went down.<br />

Commissions taken by the exchange<br />

Dhaka Tribune<br />

houses abroad increase the cost of<br />

remittance transfer, Ahmed Jamal said<br />

in a meeting with journalists on July 18.<br />

“Bangladesh Bank is concerned<br />

about the declining trend of remittance<br />

flow. The central bank will advise the<br />

banks to cut the remittance transfer<br />

fee so that its flow goes up in coming<br />

months,” he told the meeting.<br />

BB Executive Director Shubhankar<br />

Saha, also the spokesperson of the<br />

central bank, said: “The government<br />

has planned to subsidise the remittance<br />

transfer cost. Moreover, we are<br />

discussing the issue with the remittance<br />

receiving banks to reduce the<br />

remittance fee.”<br />

While talking to journalists after<br />

inauguration of the newly constructed<br />

fountain in Naiyorpul area of Sylhet on<br />

July 8, Finance Minister AMA Muhith<br />

said they would bring down the cost of<br />

remittance transfer soon to increase its<br />

flow into the country.<br />

The tendency of settling abroad is<br />

rising, which is the key reason behind<br />

the less remittance inflow into Bangladesh.<br />

The government will reduce fees<br />

for remittance transfer from next month<br />

to develop the scenario, he said. •<br />

Home loans get siphoned off<br />

for second homes abroad<br />

An unholy nexus of real estate business<br />

tycoons is moving capital out of<br />

the country to find second homes,<br />

deceiving banks and their clients<br />

looking for apartments.<br />

Md Yasin Ali, former Bangladesh<br />

Bank executive director, said that<br />

without using the bank loans drawn<br />

for real estate development, the realtors<br />

siphon off their capital abroad to<br />

build second homes, thus putting the<br />

banks in danger of default and contributing<br />

to the rise of default loans.<br />

“They purchase their new homes<br />

in Western countries like Canada,<br />

USA, Switzerland, also in Malaysia<br />

and Singapore, without paying off the<br />

bank debts,” he said at a round-table<br />

meeting on ‘Home Loan of Banks:<br />

Trend and Impact’ organised by the<br />

Bangladesh Institute of Bank Management<br />

in its auditorium on July 20.<br />

“The developers also deprive their<br />

clients of timely registration of their<br />

long-cherished flats. In most cases,<br />

it so happens that customers keep<br />

chasing after their apartments years<br />

after years while manufacturers lead a<br />

flamboyant life in their second homes,<br />

ignoring the banks’ debts as well as<br />

their clients,” he said.<br />

Yasin said developers sell off their<br />

flats, but do not have them registered<br />

for their owners, because they fail to<br />

pay off their bank loans. He urged the<br />

government to look into this “unholy<br />

practice that throws apartment buyers<br />

into disarray”.<br />

The central bank Deputy Governor<br />

SK Sur was present at the discussion<br />

as the chief guest.<br />

He urged the bank to facilitate<br />

home loans on “easy terms so<br />

middle-income people can dream to<br />

arrange a shelter in the capital”.<br />

He said Bangladesh Bank is<br />

working on a home loans policy which<br />

will help loan seekers get loan on easy<br />

terms.<br />

Home loans in Bangladesh are<br />

mainly regulated by the government<br />

policy and Bangladesh Bank<br />

guidelines. In order to arrest the flow<br />

of credit from banks to unproductive<br />

sectors, banks are also instructed not<br />

to provide any loan/credit facility for<br />

purchasing land.<br />

All scheduled banks are instructed<br />

to refrain from disbursing any loan to<br />

private housing projects which are not<br />

approved by statutory government<br />

organisations. •

Corporate News<br />

5<br />

Sunday, July 23, 2017<br />

DT<br />

AB Bank Limited has recently disbursed a loan (SME) of Tk20 lac to a client of its Bhairab Bazar branch,<br />

said a press release. Governor of Bangladesh Bank, Fazle Kabir has handed over a cheque to the client<br />

in this regard<br />

Dhaka Bank Limited has recently launched an automated and secured LC management solution service<br />

named Dhaka Bank TradeCloud for its corporate clients, said a press release. The bank’s MD, Syed<br />

Mahbubur Rahman and CEO of Hashkloud Pty Ltd, Tarique A Bhuiyan have launched the service<br />

Compliance division and Dhaka central regional office of Pubali Bank Limited have jointly organised<br />

a workshop on AML, ICC, Foreign Remittance, Sanction Screening, Ethical Banking and FATCA, said a<br />

press release. The bank’s additional managing director, Safiul Alam Khan Chowdhury was present on the<br />

occasion as chief guest<br />

Prime Bank Limited has recently disbursed a loan (SME) of Tk15 lac to its client in Kishoregonj, said a press<br />

release. Governor of Bangladesh Bank, Fazle Kabir has handed over a cheque to the client in this regard<br />

National Bank Limited has recently held a workshop on prevention of money laundering and combating<br />

financing of terrorism, said a press release. The bank’s deputy managing director, Shah Syed Abdul Bari<br />

inaugurated the workshop as chief guest<br />

Crown Cement yesterday renowned its agreement with national cricketer Tamim Iqbal Khan as its brand<br />

ambassador for next two years<br />

A seminar was recently held on legal regime at sea and governance of maritime resources for sustainable<br />

blue economy was recently held, said a press release. The seminar was jointly held by Faculty of<br />

Maritime Governance and Policy (FMGP) at Bangabandhu Sheikh Mujibur Rahman Maritime University,<br />

Bangladesh (BSMRMU) and Blue Economy Cell, Energy and Mineral Resources Division, Government of<br />

the People’s Republic of Bangladesh<br />

29th AGM of Federal Insurance held on July 17, 2017<br />

Symphony Mobile has recently handed over prizes to the winners<br />

of its campaign titled Symphony Eid E Offer, said a press release.<br />

The company’s director of marketing, Ashraful Haque was present<br />

on the occasion<br />

Chairperson at University Grants<br />

Commission of Bangladesh,<br />

Professor Abdul Mannan has<br />

recently been honored with<br />

Australian Academy of <strong>Business</strong><br />

Leadership (AABL) Award for his<br />

contribution towards promoting<br />

higher education in Bangladesh,<br />

said a press release

6<br />

Sunday, July 23, 2017<br />

DT<br />

Stocks<br />

W E E K L Y M a r k e t O v e r v i e w<br />

SUMMARY Points Change (%) Turnover (BDTmn) Volume (mn) Advanced issues Declined issues Unchanged <strong>Issue</strong>s<br />

DSEX<br />

5,782.5 DSEX 5,782.5 -0.90% 50,795 1,455 116 200 17<br />

(-) 0.90%<br />

CSE ASI 17,936.3 -0.86% 3,038 106 108 166 21<br />

Stocks break four-week winning streak<br />

DSE NEWS<br />

• Tribune <strong>Business</strong> Desk<br />

Stocks took a nosedive last week<br />

as many investors seen booking<br />

profits from the rally earlier this<br />

month.<br />

The market has stayed vibrant<br />

since Eid holidays and therefore<br />

such minor corrections are inevitable<br />

in stock markets, echoed traders<br />

at several stock brokerage firms.<br />

Participation in the Dhaka<br />

Stock Exchange decreased moderately<br />

by 10.4% to amount an average<br />

daily turnover of Tk1,016cr,<br />

crossing the Tk1,000cr mark for<br />

the third week in a row.<br />

The benchmark index, DSEX<br />

closed at 5,782.5 points on last<br />

Thursday after losing 52.4 points<br />

or -0.90% over the week while<br />

Most Traded Price Weekly change<br />

LankaBangla 55.8 -1.59%<br />

Regent Textile 27.2 -9.63%<br />

Baraka Power 45.1 -1.53%<br />

Fu Wang Food 21.9 -11.69%<br />

Keya Cosmetics 16.6 -8.79%<br />

Doreen Power 146.2 -1.28%<br />

BEXIMCO 33.5 -4.01%<br />

Prime Bank 23.6 -3.67%<br />

SAIF Powertec 45.6 -2.56%<br />

ICB 190.6 0.69%<br />

Dhaka Tribune has accumulated the stock market related data primarily from Dhaka Stock Exchange website. The basis of information collected was primarily from daily stock quotations and audited/unaudited<br />

reports of publicly listed companies. High level of caution has been taken to collect and present the above information and data. The publisher will not take any responsibility if any body uses this information and<br />

data for his/her investment decision. For any query please email to news@dhakatribune.com.<br />

Euro surge to two-year high prompts stocks pause<br />

• Reuters, London<br />

CSE ASI declined 154.6 points or<br />

-0.86% to end at 17,936.3 points.<br />

Textile equities contributed<br />

14.9% of the week’s total turnover,<br />

said the weekly market report<br />

5,860<br />

5,840<br />

5,820<br />

5,800<br />

5,780<br />

5,760<br />

5,740<br />

The euro’s surge to an almost<br />

two-year high dominated financial<br />

markets on Friday, with most<br />

major stock exchanges consolidating<br />

after a second strong week<br />

of gains while those in mainland<br />

Europe dipped.<br />

Investors seem largely to have<br />

got over a period of jitters spurred<br />

by concerns over the pace of US<br />

economic growth and signs that<br />

several of the world’s major central<br />

banks were determined to<br />

tighten monetary policy soon.<br />

Thursday’s meeting of the<br />

European Central Bank did just<br />

enough to show euro zone policymakers<br />

were on course to rein<br />

in their two-year old emergency<br />

programme of bond-buying without<br />

quite scaring the horses.<br />

The euro surged to its highest<br />

against the dollar since August<br />

2015, but government bond yields<br />

for Europe’s southern governments<br />

fell sharply - a reflection of<br />

relative confidence in the economic<br />

outlook and the cautious line<br />

taken by ECB chief Mario Draghi.<br />

Euro zone stock markets, however,<br />

were lower on the day, with<br />

some analysts worrying a stronger<br />

euro may do more to undermine<br />

growth going forward.<br />

“We can be pretty sure that<br />

when Draghi sat down for his<br />

press conference yesterday the<br />

last thing he expected to see was<br />

the euro hit its highest level in<br />

over two years and for equity<br />

markets to slide back,” said CMC<br />

Markets analyst Michael Hewson.<br />

Dhaka Tribune<br />

of UCB Capital Management Ltd.<br />

Jute Spinning secured the<br />

highest weekly gain of 28.4%<br />

while Bangladesh Welding turned<br />

out the worst loser with its price<br />

MOVEMENT OF DSEX INDEX LAST WEEK<br />

“The strength of the euro does<br />

appear to be acting as a bit of a headwind<br />

for European stocks as they<br />

look to close the week sharply lower,<br />

in contrast to the performance of<br />

UK and US stocks this week.”<br />

The euro gained around 0.2%<br />

on the day in morning trade in<br />

Europe, hitting an almost twoyear<br />

high of $1.1676.<br />

Signs of steady global growth,<br />

which have prompted the ECB<br />

and a couple of other major central<br />

banks to signal future tightening<br />

since last month, have kept<br />

the world’s shares on firm footing.<br />

In Asia, MSCI’s broadest index<br />

of Asia-Pacific shares outside<br />

Japan, which has gained about<br />

5% in the past two weeks, eased<br />

0.2%, dragged down by a fall in<br />

material and financial shares.<br />

declining by -17.6%.<br />

Ifad Autos secured leadership<br />

position on the weekly top turnover<br />

chart with a turnover of Tk-<br />

249cr over the week with its share<br />

price advancing 7.7% by the end<br />

of week.<br />

DS30, the blue-chip index declined<br />

9.4 points or -0.44% to end<br />

at 2,121.8 points, while DSE Shariah<br />

based index lost 13.3 points or<br />

-1.0% to close at 1,313.7 points.<br />

Among the traded issues 116<br />

gained, 200 declined and 17 remained<br />

unchanged during the<br />

week.<br />

The Dhaka Stock Exchange currently<br />

has a market capitalisation<br />

of BDT 390,112cr with the benchmark<br />

index, DSEX up by 14.8%<br />

since beginning of this year. •<br />

DAY 0 DAY 1 DAY 2 DAY 3 DAY 4 DAY 5<br />

Japan’s Nikkei dropped 0.2%.<br />

MSCI’s gauge of stocks across<br />

the globe was steady after rising for<br />

a 10th straight session on Thursday,<br />

its longest such streak since<br />

February 2015. It has advanced<br />

around 3% in the latest rally.<br />

“Strong global growth and (a)<br />

decent earnings outlook are supporting<br />

shares globally,” said Tatsushi<br />

Maeno, senior strategist at<br />

Okasan Asset Management.<br />

US quarterly earnings are expected<br />

to have climbed 8.6%,<br />

above the 8% rise projected at the<br />

start of the month, according to<br />

Thomson Reuters I/B/E/S. About<br />

15% of S&P 500 companies having<br />

posted results so far.<br />

Brent crude futures traded at<br />

$49.31 per barrel, unchanged on<br />

day. •<br />

DBH: Q2 Un-audited – EPS was Tk.<br />

1.73 for April-June, 2017 as against Tk.<br />

1.47 for April-June, 2016; EPS was Tk.<br />

4.76 for January-June, 2017 as against<br />

Tk. 4.09 January-June, 2016. NOCFPS<br />

was Tk. 0.80 for January-June, 2017<br />

as against Tk. (7.36) for January-June,<br />

2016. NAV per share was Tk. 32.73 as of<br />

June 30, 2017 and Tk. 29.62 as of June<br />

30, 2016.<br />

BERGERPBL: Q1 Un-audited – Consolidated<br />

EPS was Tk. 18.40 for April-June,<br />

2017 as against Tk. <strong>22</strong>.52 for April-June,<br />

2016; Consolidated NOCFPS was Tk.<br />

10.10 for April-June, 2017 as against Tk.<br />

35.40 for April-June, 2016. Consolidated<br />

NAV per share was Tk. 267.91 as of June<br />

30, 2017 and Tk. 249.51 as of March 31,<br />

2017.<br />

MARICO: Q1 Audited – EPS was Tk. 15.71<br />

for April-June, 2017 as against Tk. 14.17<br />

for April-June, 2016; NOCFPS was Tk.<br />

23.05 for April-June, 2017 as against Tk.<br />

7.32 for April-June, 2016. NAV per share<br />

was Tk. 65.88 as of June 30, 2017 and<br />

Tk. 50.16 as of March 31, 2017.<br />

NATLIFEINS: The Board of Directors<br />

has recommended 20% cash dividend<br />

and 15% stock dividend for the year<br />

ended on December 31, 2016. Date<br />

of AGM: 26.09.2017, Time: 11:00 AM,<br />

Venue: Auditorium, NLI Tower, 54, Kazi<br />

Nazrul Islam Avenue, Karwan Bazar,<br />

Dhaka-1215. Record Date: 08.08.2017.<br />

Q1 Un-audited – Decrease in consolidated<br />

life revenue account for Jan-Mar,<br />

2017 was Tk. 266.08 million with<br />

consolidated total life insurance fund of<br />

Tk. 32,125.55 million as against decrease<br />

of consolidated life revenue account<br />

was Tk. 142.17 million and Tk. 31,211.85<br />

million respectively for the same period<br />

of the previous year.<br />

SHAHJABANK: Q2 Un-audited – Consolidated<br />

EPS was Tk. 0.52 for April-June,<br />

2017 as against Tk. 0.43 for April-June,<br />

2016; Consolidated EPS was Tk. 1.03 for<br />

January-June, 2017 as against Tk. 0.81<br />

for January-June, 2016. Consolidated<br />

NOCFPS was Tk. (0.36) for January-June,<br />

2017 as against Tk. 3.85 for January-June,<br />

2016. Consolidated NAV per share was<br />

Tk. 19.07 as of June 30, 2017 and Tk.<br />

16.56 as of June 30, 2016.<br />

IDLC: Q2 Un-audited – Consolidated<br />

EPS was Tk. 1.62 for April-June, 2017<br />

as against Tk. 1.49 for April-June, 2016;<br />

Consolidated EPS was Tk. 3.34 for January-June,<br />

2017 as against Tk. 2.52 for January-June,<br />

2016. Consolidated NOCFPS<br />

was Tk. 3.75 for January-June, 2017 as<br />

against Tk. (4.68) for January-June, 2016.<br />

Consolidated NAV per share was Tk.<br />

30.47 as of June 30, 2017 and Tk. 23.70<br />

as of December 31, 2016. •

OPINION 7<br />

DT<br />

Sunday, July 23, 2017<br />

Want a brand following? Solve a problem<br />

How Bangladesh can use the problem-solving approach in its garment industry<br />

THE lAST<br />

WORD<br />

• Tim Worstall<br />

The clothing tag on a boy's shirt at a store in Encinitas, California<br />

The validity, the worth, of the brand comes from the worth of that<br />

solution, people associating the value added of the solution with the<br />

name of the brand. That is, a brand is emergent from the activity, not<br />

something created in and of itself<br />

Bangladesh should play off its<br />

already known strengths in the<br />

garment industry and attempt<br />

to capture more of the value in<br />

the entire chain by developing<br />

brands which are sold directly to<br />

a more affluent segment of global<br />

consumers.<br />

So we’re told in a report in this<br />

newspaper and the idea seems just<br />

fine as a general ambition.<br />

The devil, as ever in such plans,<br />

is in the detail. Brands are, for<br />

example, difficult things to create<br />

and expensive too – there are long<br />

lists of western designers who<br />

have tried and then spiralled into<br />

bankruptcy as they failed.<br />

The biggest difficulty perhaps<br />

being that a brand isn’t something<br />

created so much as something<br />

emergent.<br />

In the US the two big long running<br />

brands of soup are Heinz and<br />

Campbells; both started out in the<br />

19th century, at a time when the<br />

new technology of canning wasn’t<br />

entirely understood.<br />

There were a number of distressing<br />

incidents involving people<br />

dying due to badly canned foods:<br />

An entire British expedition to the<br />

Arctic died because of such failures<br />

and we still get the occasional<br />

case of botulism poisoning today<br />

from other manufacturers.<br />

I exaggerate, of course, but not<br />

by much, when I say that the initial<br />

success of Heinz and Campbell’s<br />

comes down to their poisoning<br />

fewer consumers and this becoming<br />

known. Almost to the point<br />

that people would note they’d<br />

been eating the brand for a month,<br />

no one at the table was dead, why<br />

not keep using this brand?<br />

In fact, if we go back one step<br />

further to the mid 19th century in<br />

Britain this really was when brands<br />

started and how.<br />

The newly massive urban populations,<br />

along with a better understanding<br />

of chemistry, had meant<br />

both a demand for and availability<br />

of processed foods that came from<br />

far away farms, and also the ability<br />

to adulterate it in interesting ways.<br />

Those who determined to produce<br />

unadulterated food gained a<br />

reputation and thereby established<br />

their brands. So much so that food<br />

adulteration was pretty much<br />

beaten before the first major laws<br />

against it were enacted in the 1870s.<br />

Food is different from clothing<br />

of course but the basic underlying<br />

lesson still holds. A brand is<br />

emergent from solving some other<br />

problem, not quite something<br />

established just by stating “Look!<br />

I’m a brand!”<br />

Food that doesn’t kill the eater<br />

is solving quite a problem.<br />

Zara, many of whose products<br />

are now made in Bangladesh, really<br />

worked initially by not running<br />

clothing in a “season.” Instead of<br />

four sets of clothes a year there<br />

was a constant stream of designs<br />

through the shops. Perhaps not a<br />

huge change but it was enough to<br />

start that process of brand creation.<br />

Thus, if a brand is to be created,<br />

the question becomes, well, what<br />

is it that is going to be different?<br />

It would be entirely possible to<br />

say: “Look, you’re buying direct,<br />

we pay the workers more,” and<br />

have some people buy your stuff<br />

purely because of that. Fairtrade<br />

works very much along these lines<br />

and that does gain some small<br />

portion of the market.<br />

That’s not, quite, the way to the<br />

bulk market though and that’s the<br />

problem that needs to be solved.<br />

What is it that will be different<br />

so as to create a brand? No, I’m not<br />

an expert in the industry itself so<br />

I’m going to be of no use as to divining<br />

that “what,” but I can point<br />

out that there must be a “what” in<br />

there somewhere.<br />

One idea can be drawn from the<br />

general structure of the European<br />

industry today. Much of the<br />

Inditex etc stock is produced in<br />

Bangladesh, some smaller fraction<br />

of it in Northern Portugal and<br />

Spain. What happens is that the<br />

major orders are placed with you,<br />

then those items which sell out<br />

are produced quickly, at greater<br />

expense, closer to the marketplace.<br />

If production turnaround<br />

times could be reduced, shipping<br />

times improved, then some more<br />

of that Iberian production could be<br />

captured in Bangladesh.<br />

Something I was laughed at for<br />

asking at a BGMEA meet was about<br />

t-shirts. There is a thriving business<br />

in taking Bangladesh-produced<br />

shirts and optimising them for certain<br />

groups. Screen printing them,<br />

embroidering them perhaps, with<br />

a club badge, or “Tommy’s Stag<br />

Trip,” or Vote Jeremy and the like.<br />

The shirts are made in their<br />

thousands in Bangladesh, then<br />

small production runs, perhaps a<br />

dozen, perhaps a score, produced<br />

for each group. That local optimisation<br />

is done locally to the buyers<br />

for no producer in Bangladesh<br />

would ever dream of handling an<br />

order so small.<br />

Well, perhaps that would be one<br />

way to create a brand. Solve those<br />

logistical problems which prevent<br />

a quick turnaround and the creation<br />

of small runs of optimised<br />

products.<br />

It’s equally possible that the<br />

BGMEA people were right to laugh<br />

at my naiveté. That’s not really my<br />

point though. Rather, a brand is<br />

Reuters<br />

created by solving some problem.<br />

The validity, the worth, of the<br />

brand comes from the worth of<br />

that solution, people associating<br />

the value added of the solution<br />

with the name of the brand. That<br />

is, a brand is emergent from the<br />

activity, not something created in<br />

and of itself.<br />

It’s entirely true that creating<br />

brands which operate directly<br />

from Bangladesh will increase the<br />

amount of the value in the garment<br />

trade operating chain which<br />

is captured by Bangladeshis. But<br />

the creation of the brand itself is<br />

through solving some problem<br />

that others have not as yet.<br />

When food kills people, making<br />

food that doesn’t kill seems like<br />

a pretty good method of brand<br />

establishment. But with clothing,<br />

finding that problem to solve<br />

might be a little more difficult.<br />

Then again, it is still true that<br />

the next successful brands will<br />

be those that solve some problem<br />

that no one else is solving at<br />

present. The value of the brand,<br />

and thus the margins that can be<br />

charged for it, will depend upon<br />

the value to consumers of that<br />

problem being solved.<br />

Hopefully, one or some of you<br />

will manage to do it. •<br />

Tim Worstall is a Senior Fellow at the<br />

Adam Smith Institute in London.