Marketing and innovation

New opportunities hit global investors' radar screens Global Investor, 02/2005 Credit Suisse

New opportunities hit global investors' radar screens

Global Investor, 02/2005

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Europe are 1) the decreasing attractiveness of investments in<br />

Europe due to low dem<strong>and</strong> growth in the region, delocalization<br />

of customer industries, high production costs <strong>and</strong> highly regulated<br />

environment; 2) the decline in R&D spending in the region<br />

(see Figure 2); <strong>and</strong> 3) an eroding skill base (according to<br />

CEFIC, the number of graduates in the field of chemicals in the<br />

EU is estimated to decrease by 10% per annum between 1996<br />

<strong>and</strong> 2007).<br />

Strategies of European companies to remain competitive<br />

p Expansion to Asia … The importance of the Asian markets for<br />

the chemicals industry is well known, <strong>and</strong> for virtually all companies<br />

under our research coverage, expansion to Asia is a key point<br />

in their strategy. Between 2001 <strong>and</strong> 2005, BASF, for example, is<br />

investing approximately 20% – 25% of the group’s total capital<br />

expenditure, or USD 5.6 billion (including USD 2 billion in China),<br />

in Asia. European companies follow diverse strategies in Asia, but<br />

it is clear that their activities in the region are not confined to<br />

production, in order to reduce costs or to be closer to the chemical<br />

consumer markets. They also include the formation of R&D<br />

centers. Ciba Specialty Chemicals, for example, has just opened<br />

a new R&D center in Shanghai.<br />

p … <strong>and</strong> differentiation through <strong>innovation</strong>. The other pillar of<br />

the strategy currently followed by the industry to remain competitive<br />

is product differentiation through <strong>innovation</strong> <strong>and</strong> improving<br />

customer relationships. We observe a strong trend in the sector<br />

toward <strong>innovation</strong>, driven by the need of providing solutions to<br />

customers. Clariant, for example, is able to offer color systems<br />

for every element in the interior of a car. The “Clariant Color Concept”<br />

for the automotive industry enables the harmonization of<br />

colors of textiles, leather, plastics <strong>and</strong> aluminum inside the car.<br />

This process takes place mainly in collaboration with customers,<br />

which means that R&D <strong>and</strong> marketing efforts come together to<br />

ensure the market relevance of new products <strong>and</strong> services. Specialty<br />

chemical companies aim to have a proportion of approximately<br />

25% new products (products less than five years old) in<br />

their portfolios.<br />

Despite the focus on <strong>innovation</strong>, R&D expenses as a percentage<br />

of sales have remained more or less stable during the past<br />

ten years (see Figure 3). The fact that the focus on <strong>innovation</strong> as<br />

a key for competitiveness does not translate into higher R&D<br />

expenses as a percentage of sales is due to several factors. First,<br />

R&D expenses do not necessarily correlate with productivity of<br />

R&D. Second, the most important trend in R&D seems to be the<br />

necessity of focusing on a smaller number of projects with potential<br />

for quick commercialization, rather than following a large<br />

number of projects in parallel.<br />

Besides in-house research <strong>and</strong> collaborations with companies<br />

with new technologies <strong>and</strong> academic groups, a possibility to<br />

drive <strong>innovation</strong> is the acquisition of technologies or smaller firms<br />

with expertise in specific fields (see Figure 4). BASF, for example,<br />

invests in start-up companies through its BASF Venture Capital<br />

GmbH subsidiary.<br />

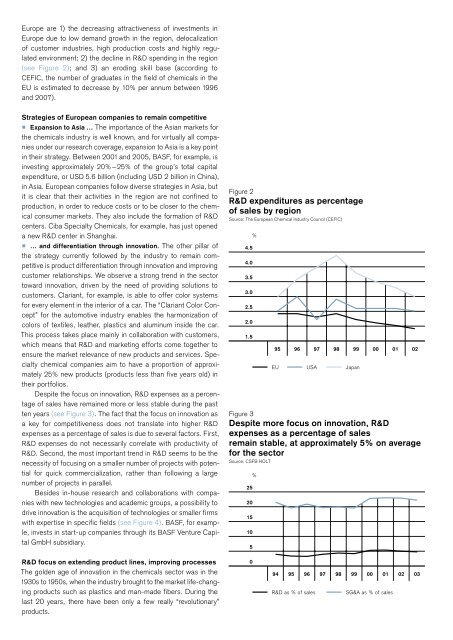

Figure 2<br />

R&D expenditures as percentage<br />

of sales by region<br />

Source: The European Chemical Industry Council (CEFIC)<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

25<br />

20<br />

15<br />

10<br />

5<br />

%<br />

95 96 97 98 99 00 01 02<br />

EU USA Japan<br />

Figure 3<br />

Despite more focus on <strong>innovation</strong>, R&D<br />

expenses as a percentage of sales<br />

remain stable, at approximately 5% on average<br />

for the sector<br />

Source: CSFB HOLT<br />

%<br />

R&D focus on extending product lines, improving processes<br />

The golden age of <strong>innovation</strong> in the chemicals sector was in the<br />

1930s to 1950s, when the industry brought to the market life-changing<br />

products such as plastics <strong>and</strong> man-made fibers. During the<br />

last 20 years, there have been only a few really “revolutionary”<br />

products.<br />

0<br />

94 95 96 97 98 99 00 01 02 03<br />

R&D as % of sales<br />

SG&A as % of sales