Marketing and innovation

New opportunities hit global investors' radar screens Global Investor, 02/2005 Credit Suisse

New opportunities hit global investors' radar screens

Global Investor, 02/2005

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

numbers of possible drugs. Third, mass screening techniques<br />

allow this plethora of possible drugs to be subjected to at<br />

least a preliminary testing of their effectiveness in a very short<br />

time span. Processes of this kind are only preliminary, but they<br />

prevent a large number of dead-ends very quickly so that the<br />

much more expensive <strong>and</strong> time-consuming phase of full testing<br />

focuses on putative drugs, for which the chance of success is<br />

reasonably high. The result is that the number of diseases for<br />

which a cure may be found has risen substantially <strong>and</strong> continues<br />

to grow.<br />

Reflecting these advances, an increase in the number of<br />

early stage R&D projects (phase I <strong>and</strong> II, see Figure 4) provides<br />

some reasons to be hopeful in the coming years. GlaxoSmithKline<br />

could be the focal point for the industry on this front. The company<br />

expects to report phase II results for 15 new drugs as soon<br />

as 2005.<br />

GLOBAL INVESTOR 2.05 Healthcare—23<br />

The future belongs to innovators<br />

Typical analyses of the industry tend to focus on the decline<br />

of new product launches, but we believe that these analyses<br />

very often exclude biotechnological products. If we include the<br />

approvals of products from biotechnology <strong>and</strong> smaller pharma<br />

companies, we arrive at a positive trend over the last years (see<br />

Figure 6). What is more, the importance of biotechnology companies<br />

is gaining significance in terms of new product output.<br />

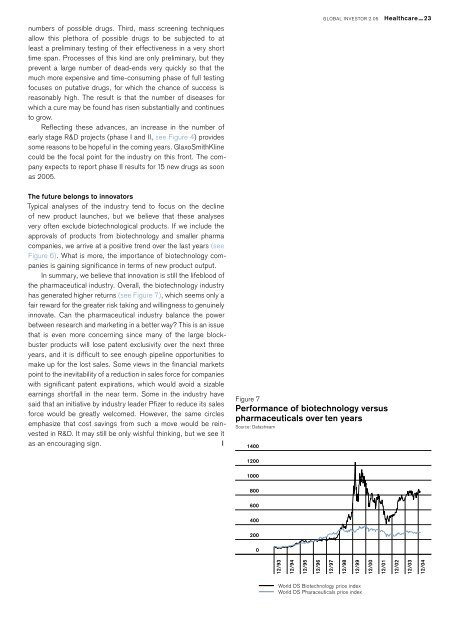

In summary, we believe that <strong>innovation</strong> is still the lifeblood of<br />

the pharmaceutical industry. Overall, the biotechnology industry<br />

has generated higher returns (see Figure 7), which seems only a<br />

fair reward for the greater risk taking <strong>and</strong> willingness to genuinely<br />

innovate. Can the pharmaceutical industry balance the power<br />

between research <strong>and</strong> marketing in a better way? This is an issue<br />

that is even more concerning since many of the large blockbuster<br />

products will lose patent exclusivity over the next three<br />

years, <strong>and</strong> it is difficult to see enough pipeline opportunities to<br />

make up for the lost sales. Some views in the financial markets<br />

point to the inevitability of a reduction in sales force for companies<br />

with significant patent expirations, which would avoid a sizable<br />

earnings shortfall in the near term. Some in the industry have<br />

said that an initiative by industry leader Pfizer to reduce its sales<br />

force would be greatly welcomed. However, the same circles<br />

emphasize that cost savings from such a move would be reinvested<br />

in R&D. It may still be only wishful thinking, but we see it<br />

as an encouraging sign. |<br />

Figure 7<br />

Performance of biotechnology versus<br />

pharmaceuticals over ten years<br />

Source: Datastream<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

12/93<br />

12/94<br />

12/95<br />

12/96<br />

12/97<br />

12/98<br />

12/99<br />

12/00<br />

12/01<br />

12/02<br />

12/03<br />

12/04<br />

World DS Biotechnology price index<br />

World DS Pharaceuticals price index