annual_repport_staatsolie_2016_lr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual REPORT<br />

Confidence in Our Own Abilities<br />

60<br />

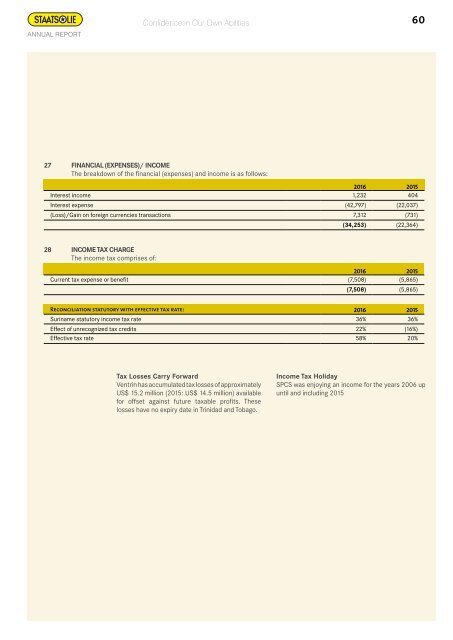

27 Financial (expenses)/ income<br />

The breakdown of the financial (expenses) and income is as follows:<br />

<strong>2016</strong> 2015<br />

Interest income 1,232 404<br />

Interest expense (42,797) (22,037)<br />

(Loss)/Gain on foreign currencies transactions 7,312 (731)<br />

(34,253) (22,364)<br />

28 Income tax charge<br />

The income tax comprises of:<br />

<strong>2016</strong> 2015<br />

Current tax expense or benefit (7,508) (5,865)<br />

(7,508) (5,865)<br />

Reconciliation statutory with effective tax rate: <strong>2016</strong> 2015<br />

Suriname statutory income tax rate 36% 36%<br />

Effect of unrecognized tax credits 22% (16%)<br />

Effective tax rate 58% 20%<br />

Tax Losses Carry Forward<br />

Ventrin has accumulated tax losses of approximately<br />

US$ 15.2 million (2015: US$ 14.5 million) available<br />

for offset against future taxable profits. These<br />

losses have no expiry date in Trinidad and Tobago.<br />

Income Tax Holiday<br />

SPCS was enjoying an income for the years 2006 up<br />

until and including 2015