annual_repport_staatsolie_2016_lr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual REPORT<br />

Confidence in Our Own Abilities 69<br />

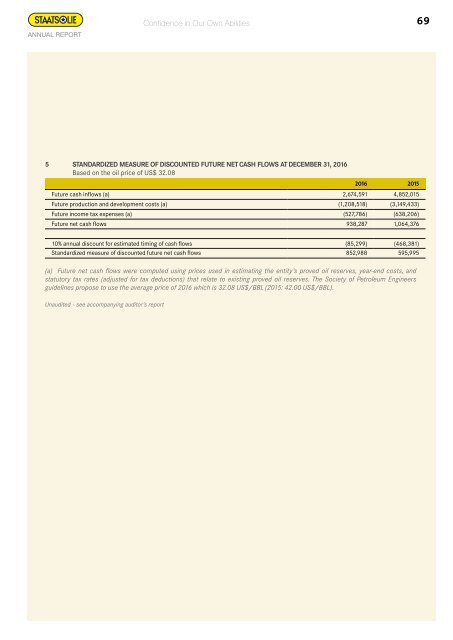

5 Standardized measure of discounted future net cash flows at December 31, <strong>2016</strong><br />

Based on the oil price of US$ 32.08<br />

<strong>2016</strong> 2015<br />

Future cash inflows (a) 2,674,591 4,852,015<br />

Future production and development costs (a) (1,208,518) (3,149,433)<br />

Future income tax expenses (a) (527,786) (638,206)<br />

Future net cash flows 938,287 1,064,376<br />

10% <strong>annual</strong> discount for estimated timing of cash flows (85,299) (468,381)<br />

Standardized measure of discounted future net cash flows 852,988 595,995<br />

(a) Future net cash flows were computed using prices used in estimating the entity’s proved oil reserves, year‐end costs, and<br />

statutory tax rates (adjusted for tax deductions) that relate to existing proved oil reserves. The Society of Petroleum Engineers<br />

guidelines propose to use the average price of <strong>2016</strong> which is 32.08 US$/BBL (2015: 42.00 US$/BBL).<br />

Unaudited ‐ see accompanying auditor’s report