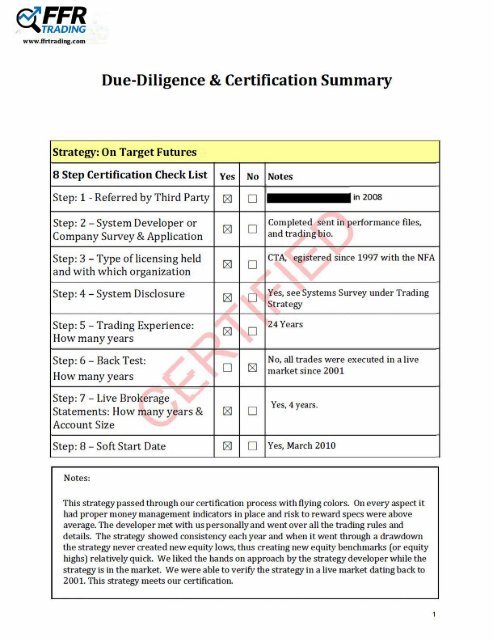

OnTarget Futures Trading Due Diligence

Futures trading strategy that's shown proven results for over 15 years.

Futures trading strategy that's shown proven results for over 15 years.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Step 2<br />

FFR <strong>Trading</strong><br />

SYSTEM DEVELOPER AND STRATEGY SURVEY<br />

SUMMARY OF SURVEY<br />

The purpose of this questionnaire survey is to help FarnsField develop an understanding of the background<br />

experience of the trading team and strategy system developer. It also provides us with the facts and information<br />

needed to begin our due diligence process and determine whether or not the strategy and system is a good fit for<br />

our own trading. The more detailed information provided, the more efficient our process will be.<br />

DOCUMENTATION NEEDED<br />

Please provide the following documents if available. If not available please explain why. Please type in your<br />

answers in a blue font color as well as in italic, and email the survey back to us (DO NOT FAX).<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Is anyone on the team registered as a CTA or fund manager, please provide details on what entity name<br />

this is listed under<br />

Photo – formal head shot. Send 2-3 so we can choose. The photo we select will be used for your bio page<br />

on the website. Format – high resolution .tif or .jpg<br />

Track/performance Record – at least 3 years of actual real time trades in the market<br />

Back test of trading performance of no less than 3-years<br />

Sample trading charts – high resolution<br />

Broker statements (Personal, trading fund of client’s)<br />

Professional references with contact information<br />

Testimonials from subscribers/clients<br />

Articles, interviews, You Tube videos, audio files, or trading reports<br />

Power Point Presentation<br />

Website (if you have a website please provide)<br />

Self-Bio (Provide information on how the developer and/or team came into trading and what previous<br />

experience was outside of trading<br />

CONTACT INFORMATION OF DEVElOPER AND/OR TEAM<br />

Full Name of Developer: Editor & Publisher, PTA Publications, Inc.<br />

Additional Team Members:<br />

Company Name: PTA Publications, Inc.<br />

Physical address: (Undisclosed)<br />

Billing address: (Undisclosed)<br />

Telephone (cell and office): (Undisclosed)<br />

Email: (Undisclosed)<br />

CERIFIED<br />

Skype / Yahoo Messenger / MSN Messenger (if applicable): N/A<br />

CONFIDENTIAL<br />

2

Step 2<br />

FFR <strong>Trading</strong><br />

TRADING BACKGROUND<br />

How many years of trading experience do the developer or strategy team have?<br />

24 years<br />

How did the developer or team get involved in trading? My Navy platoon buddy advised me to meet his<br />

brother after we returned from deployment. He traded stock options from a variety of 50 of the best<br />

volume traded companies available at that time. At the end of the next year, I learned to trade commodity<br />

futures and had the privilege to meet – who is still my teacher, mentor, and friend to this day – Larry<br />

Williams. Larry’s guidance early on catapulted my trading and learning curve, but most of all<br />

CONFIDENCE.<br />

What are the biggest strengths does the developer or strategy team have? My biggest strengths as a trader is<br />

being able to research my strategies to find trading parameters to accommodate what I learned early on in<br />

this business, and that is to take ALL TRADES with the trend. I have no problem “pulling the trigger”<br />

with my exclusive signals because every trade has history and statistics behind it.<br />

What are the biggest weaknesses? I have recently overcome my biggest weakness I had as a trader<br />

which was “skipping” trades based on the recent volatility of the market – far. Most of the time there<br />

were no trades following high-volatility days, but when there were, I missed some good trades thinking<br />

I was “doing the right thing” by protecting equity. I’ll divulge how I accomplished this in comments<br />

below…<br />

What was a trading experience where the developer learned a valuable lesson about the markets and yourself?<br />

19 years ago I took my biggest trading loss when I veered away from my trading plan. It should have been<br />

my biggest trading “win” to that date, but there were two of us trading one account. BIG MISTAKE.<br />

So I forced myself to do more research on my trading strategy and documented it on paper for reference<br />

(documenting your work in a journal is powerful as some of you already know). When you write your<br />

rules down you tend to stick to them with better conviction. I have reinforced my trading strategies based<br />

upon this lesson.<br />

What are the developers and teams trading expertise (Stocks, <strong>Futures</strong>, Forex, Options, ETF’s, etc.) I have<br />

been strictly trading commodity futures (and options) for 24 years now.<br />

How would the develope describe the trading style of your strategy (intraday, swing trading, long-term, trend)?<br />

The core of my trading style is trend-following, but I do not commit to any position for any longer than I<br />

have to, so I look to take advantage of the swings of the market as well – swing-trading. Finally, my<br />

trading style is more mechanically inclined with strict rules and parameters than discretionary in nature.<br />

TRADING STRATEGY<br />

CERIFIED<br />

Is the system based on technical or fundamentals? My trend following trading strategy utilizes specific entry<br />

& exit signals based on price structure, market volatility, and trading psychology. Once a trade is placed<br />

and I am in the market, a protective “stop-loss” is automatically utilized. My trading strategy’s goal is to<br />

buy the dips and sell the rallies and to remain in the market as long as the market (and my position) is<br />

trading in the direction of the overall trend.<br />

What are the benefits of the trading strategy? Why would an investor choose the strategy/style over another?<br />

The benefits of this trading strategy, and why an investor/trader would choose my style is because if a<br />

market is trending, then chances are I will be in that market with a position. The only way to make money<br />

in the marketplace is to be in the market. Even when the market is experiencing high volatility, I have<br />

restructured my trading strategies to have a maximum dollar stop-loss, as well as target prices for EACH<br />

CONFIDENTIAL<br />

3

Step 2<br />

FFR <strong>Trading</strong><br />

TRADE – allowing me to take the maximum number of trades and to be “in the market” with fear, or<br />

hesitation. I am trading according to the winning statistics I researched long ago.<br />

How many trades are made on average each per month? For the $25K portfolio of markets: 18-23 For the<br />

$50K portfolio of markets: 33-38<br />

What are the average non-compounded returns per year? For the $25K portfolio: 194.77% and for the<br />

$50K portfolio: 184.299% (based on actual fills reported by accommodating brokers and $10 “all in”<br />

round-turn commission rate).<br />

What is the average drawdown? For 1 years record, the $25K portfolio: 10-12% For the $50K portfolio:<br />

10-12%<br />

What is the stop loss for each trade? It varies with each market and with each individual trade on a<br />

daily basis, but each market has a maximum dollar stop loss to prevent unforeseeable “runaway”<br />

trades.<br />

What is the ratio of winners to losers?<br />

For the $25K portfolio: 47% accuracy with a 1.5 profit loss ratio which is exactly the same with the<br />

$50K portfolio.<br />

When does the strategy take profits on each trade? There are three ways; two of which can be objective:<br />

1) when the mechanics of the trading strategy stop us out; 22) when an “Ultimate Profit Objective” is<br />

reached. The third method requires on sight market supervision to visually “see” when a market is<br />

unable to hold its gains (when long), or a weak market making an unexpected come-back higher (when<br />

short) which only happens few and far between. These are the three ways.<br />

Does a trader/investor need to watch the market all day in order to trade the strategy? No, not at all. But if<br />

the trader/investor would like to be notified of any intra-day change in the trading plan, I am happy to<br />

add to my e-mail distribution list notifying of a change to the plan.<br />

TRADING ACCOUNT<br />

CERIFIED<br />

What minimum trading accou t size does the developer recommend to effectively trade the system? There are<br />

two main trading strategies: the $25K & $50K suggested trading portfolios. This is the minimum<br />

suggested trading amount for both, and there are also variations of these two portfolios that denote the<br />

minimum amounts with the exception of the $10K & $15K portfolios – I would suggest $2,500 more<br />

minimum for these two.<br />

What are the developer’s thoughts on money management? Money management is the key to a successful<br />

trading experience with longevity. Money management must come first before all else. This is why each<br />

trade has specific parameters such as mandatory protective stops, a maximum dollar stop loss, as well as<br />

an ultimate target objective to anticipate when the markets become unexpectedly volatile.<br />

What is the maximum percent that the developer recommends exposing to risk on any single trade? As far as<br />

the maximum percent exposing on any single trade… this strategy is one of the few that is MORE<br />

conservative than using a straight percent as my peers. The mechanics of the actual trading strategy<br />

CONFIDENTIAL<br />

4

Step 2<br />

FFR <strong>Trading</strong><br />

require the market (price structure, volatility, and history) to determine where the risk is going to be at<br />

any given moment of the open trade.<br />

Is the developer willing to offer a guarantee? Yes, if the customer is not completely satisfied at the end of the<br />

subscription service-term – for any reason – I will invite the customer to continue trading with me in<br />

three-month increments until the subscription fee and a minimum 12% profit has been realized<br />

(excluding commissions). This is why the customer must negotiate with the variety of recommended<br />

brokers as low a commission rate as possible. I pay $10 per “all in” round-turn fee. For traders<br />

positioned with $25K accounts sizes or less, expect as low as $12-15 “all in” rates with some of<br />

recommended brokers.<br />

COMPETITION<br />

Which traders/websites are the developer’s main competitors? I only compete with my inner-psyche. I have<br />

learned others see me as their competition when I was a World Cup Advisor top-trader. <br />

SUPPORTING DOCUMENTS (FFR <strong>Trading</strong> may want to utilize or republish for marketing purposes)<br />

Has the developer or team written any articles or reports that we may review? I have a World Cup Advisor<br />

website snapshot of my standing with them and their traders dated September 9 th 2009 you are welcome<br />

to use provided you block out my name and image (World Cup won like it but they do not respect<br />

copyright laws anyway). You will see “Chuck Hughes” stock option program that was added a couple of<br />

months before this date. Investors needed a $150K minimum sized account in order to realize those<br />

profits - $35K with mine.<br />

Is there anything else that the developer would like to add? Before working with FFR <strong>Trading</strong>, I was a<br />

trader with a new program at World Cup Advisor. After the end of the first year, my $50K (they were<br />

allowing customers with $35K) portfolio climbed on the top and surpassed ALL OTHER TRADERS<br />

AND THEIR PROGRAMS DOLLAR FOR DOLLAR. My unique strategy stayed at the #1 position for the<br />

next 3.5 years and my only reason for leaving them was promotion of other traders programs when mine<br />

was in a drawdown phase. Even during these periods, no other trader surpassed my strategy’s<br />

cumulative profits.<br />

THANK YOU!<br />

FFR <strong>Trading</strong> appreciates that you took the time in completing this survey. Your input is critical to the success of<br />

our mutual partnership! We will review your survey and be back in touch in setting up another conversation<br />

within the next few weeks.<br />

CERIFIED<br />

CONFIDENTIAL<br />

5

1 of 2 2/26/2014 3:08 PM<br />

BASIC Details<br />

Step 3<br />

https://www.nfa.futures.org/basicnet/Details.aspx?entityid=UUe8ySPbas...<br />

News Center Swaps Information Information for DCMs and SEFs NFA Manual File a Complaint Careers at NFA<br />

Details<br />

NFA ID:<br />

Current Status<br />

• ALSO SEE NFA ID<br />

• NFA ASSOCIATE MEMBER PENDING<br />

• ASSOCIATED PERSON REGISTERED<br />

• PRINCIPAL APPROVED<br />

Regulatory Actions<br />

NFA Arbitration Decisions<br />

Agency<br />

Number<br />

NFA 0<br />

CFTC 0<br />

Exchanges 0<br />

details...<br />

Formerly Known As<br />

No other names<br />

Doing Business As<br />

No other names<br />

History<br />

Status<br />

• ALSO SEE NFA ID<br />

ATLAS FUTURES INC<br />

Role<br />

Number<br />

Claimant 0<br />

Respondent 0<br />

details...<br />

CFTC Rep ratio s Cases<br />

Security <strong>Futures</strong> Profic ency Training<br />

No pr ficiency nformation available<br />

Total 0<br />

Effective Date<br />

• ASSOCIATED PERSON WITHDRAWN 01/09/1997<br />

CERIFIED<br />

• NFA ASSOCIATE MEMBER WITHDRAWN 01/09/1997<br />

• ASSOCIATED PERSON REGISTERED 05/06/1996<br />

• NFA ASSOCIATE MEMBER APPROVED 05/06/1996<br />

• ASSOCIATED PERSON PENDING 02/27/1996<br />

• NFA ASSOCIATE MEMBER PENDING 02/27/1996<br />

OPPORTUNITIES IN OPTIONS<br />

• ASSOCIATED PERSON WITHDRAWN 01/09/1997<br />

• NFA ASSOCIATE MEMBER WITHDRAWN 01/09/1997<br />

• ASSOCIATED PERSON REGISTERED 05/06/1996<br />

• NFA ASSOCIATE MEMBER APPROVED 05/06/1996<br />

• PRINCIPAL PENDING STATUS WITHDRAWN 03/21/1996<br />

• ASSOCIATED PERSON PENDING 03/13/1996<br />

• NFA ASSOCIATE MEMBER PENDING 03/13/1996<br />

• PRINCIPAL PENDING 02/27/1996<br />

details...<br />

• PRINCIPAL WITHDRAWN 04/04/2003<br />

• PRINCIPAL APPROVED 01/30/1997<br />

• PRINCIPAL PENDING 01/21/1997<br />

• ASSOCIATED PERSON WITHDRAWN 12/22/2000<br />

• NFA ASSOCIATE MEMBER WITHDRAWN 12/22/2000<br />

• PRINCIPAL WITHDRAWN 12/22/2000<br />

6

1 of 1 2/26/2014 3:07 PM<br />

BASIC Details<br />

Step 3<br />

https://www.nfa.futures.org/BasicNet/Details.aspx?entityid=uJ3hUu9eF7s=<br />

News Center Swaps Information Information for DCMs and SEFs NFA Manual File a Complaint Careers at NFA<br />

Details<br />

NFA ID:<br />

Current Status<br />

• NFA MEMBER PENDING<br />

• COMMODITY TRADING ADVISOR REGISTERED<br />

Exemptions<br />

Click the link below to view exemptions for this firm<br />

View Exemptions<br />

Regulatory Actions<br />

Agency<br />

Number<br />

NFA 0<br />

CFTC 0<br />

Exchanges 0<br />

details...<br />

Formerly Known As<br />

No other names<br />

Doing Business As<br />

No other names<br />

NFA Arbitration Decisions<br />

CFTC Repara ions Cases<br />

Role<br />

Listed Principals<br />

Listed Principal Name<br />

itle<br />

History<br />

Status<br />

Number<br />

Claimant 0<br />

Respondent 0<br />

PRESIDENT<br />

details...<br />

Business Address<br />

Total 0<br />

CERIFIED<br />

10% or More<br />

Financial Interest<br />

YES<br />

Effective Date<br />

• INTRODUCING BROKER PENDING STATUS WITHDRAWN 01/19/2014<br />

• INTRODUCING BROKER PENDING 04/26/2013<br />

• NFA MEMBER PENDING 04/26/2013<br />

• NFA MEMBER WITHDRAWN 02/01/2013<br />

• NFA MEMBER APPROVED 12/21/2010<br />

• NFA MEMBER PENDING 12/03/2010<br />

• NFA MEMBER WITHDRAWN 10/05/2008<br />

• NFA MEMBER APPROVED 10/16/2007<br />

• COMMODITY TRADING ADVISOR REGISTERED 10/16/2007<br />

• NFA MEMBER PENDING 05/16/2007<br />

• COMMODITY TRADING ADVISOR PENDING 05/09/2007<br />

details...<br />

NFA is the premier independent provider of efficient and innovative regulatory programs that safeguard the integrity of the futures markets.<br />

Site Index | Contact NFA | News Center | FAQs | Career Opportunities | Industry Links | Home<br />

© 2014 National <strong>Futures</strong> Association All Rights Reserved. | Disclaimer and Privacy Policy<br />

7

On Target <strong>Futures</strong> <strong>Trading</strong> 7-Market Portfolio<br />

Markets:<br />

Kansas City Wheat, Sugar, Cotton, Soymeal, Corn, Wheat, Mini Gold<br />

<strong>Trading</strong> Period, From date 01/03/2001, To date 08/31/2017,<br />

Total Net Profit: $652,316 Profit Factor: 1.58<br />

Total Trades: 5,680 Winning Percentage: 42.60%<br />

Account Size: $20,000 Return Pct: 3261.58%<br />

Percent in the Market: 21.50%<br />

Winning Trades<br />

Losing Trades<br />

Total Winners: 2,421 Total Losers: 3,259<br />

Average Win: $733 Average Loss: ($344)<br />

Largest Win: $7,653 Largest Loss: ($2,445)<br />

Avg Drawdown in Win: ($102) Avg Peak in Loss: $189<br />

Avg Run Up in Win: $985 Avg Run Up in Loss: $189<br />

Avg Run Down in Win: ($102) Avg Run Down in Loss: ($364)<br />

Most Consec Wins: 9 Avg # of Consec Losses: 2.56<br />

Average Monthly Profit: $3,245 Annualized Sharpe Ratio: 1.96<br />

Average Monthly %: 16.20%<br />

Average Annual Profit: $38,940<br />

Average Annual %: 194.70%<br />

Past performance is not necessarily indicative of future results<br />

8

Equity Curve 01/03/2001 - 08/31/2017<br />

Past performance is not necessarily indicative of future results<br />

U.S. GOVERNMENT REQUIRED DISCLAIMER - COMMODITY FUTURES TRADING COMMISSION. FOREX, FUTURES AND<br />

OPTIONS TRADING HAVE LARGE POTENTIAL REWARDS, BUT ALSO LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE<br />

RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES AND OPTIONS MARKETS. DON'T TRADE<br />

WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS EMAIL IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES<br />

OR OPTIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR<br />

LOSSES SIMILAR TO THOSE DISCUSSED ON THIS EMAIL. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR<br />

METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. TRADING INVOLVES HIGH RISKS AND YOU CAN<br />

LOSE A LOT OF MONEY. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH<br />

ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE<br />

PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN<br />

HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR<br />

TRADING PROGRAM ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY<br />

PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK,<br />

AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL<br />

TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE<br />

OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE<br />

NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC<br />

TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE<br />

RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.<br />

9

On Target <strong>Futures</strong> <strong>Trading</strong> 13-Market Portfolio<br />

Markets:<br />

Cotton, Kansas City Wheat, Soybeans, Sugar, Soymeal, Coffee, Corn, Wheat,<br />

Feeder Cattle, Lean Hogs, Soybean Oil, Gold, Copper<br />

<strong>Trading</strong> Period, From date 01/03/2001, To date 08/31/2017,<br />

Total Net Profit: $1,234,765 Profit Factor: 1.58<br />

Total Trades: 9,104 Winning Percentage: 42.40%<br />

Account Size: $40,000 Return Pct: 3086.90%<br />

Percent in the Market: 20.80%<br />

Winning Trades<br />

Losing Trades<br />

Total Winners: 3,858 Total Losers: 5,246<br />

Average Win: $871 Average Loss: ($405)<br />

Largest Win: $7,653 Largest Loss: ($2,445)<br />

Avg Drawdown in Win: ($112) Avg Peak in Loss: $234<br />

Avg Run Up in Win: $1,182 Avg Run Up in Loss: $234<br />

Avg Run Down in Win: ($112) Avg Run Down in Loss: ($427)<br />

Most Consec Wins: 12 Avg # of Consec Losses: 2.6<br />

Average Monthly Profit: $6,143 Annualized Sharpe Ratio: 2.4<br />

Average Monthly %: 15.30%<br />

Average Annual Profit: $73,716<br />

Average Annual %: 184.29%<br />

Past performance is not necessarily indicative of future results<br />

10

Equity Curve 01/03/2001 - 08/31/2017<br />

Past performance is not necessarily indicative of future results<br />

U.S. GOVERNMENT REQUIRED DISCLAIMER - COMMODITY FUTURES TRADING COMMISSION. FOREX, FUTURES AND<br />

OPTIONS TRADING HAVE LARGE POTENTIAL REWARDS, BUT ALSO LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE<br />

RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES AND OPTIONS MARKETS. DON'T TRADE<br />

WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS EMAIL IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL<br />

FUTURES OR OPTIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE<br />

PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS EMAIL. THE PAST PERFORMANCE OF ANY TRADING SYSTEM<br />

OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. TRADING INVOLVES HIGH RISKS AND YOU CAN<br />

LOSE A LOT OF MONEY. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH<br />

ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE<br />

PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN<br />

HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR<br />

TRADING PROGRAM ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY<br />

PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL<br />

RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN<br />

ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM<br />

IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS.<br />

THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY<br />

SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL<br />

PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.<br />

11

13

14

Step 7<br />

ACCOUNT NUMBER<br />

DATE DEC 31, 2010<br />

* * * * * * * * * * * * * * Y O U R A C T I V I T Y T H I S M O N T H * * * * * * * * * * * * * * * * * * * *<br />

DATE AT LONG/BUY SHRT/SELL DESCRIPTION PRICE/LEGND CC DEBIT CREDIT<br />

12/01/0 F1 1 1 MAR 11 CBOT CORN 01 5.54 /4 US .00<br />

GLOBEX TRADE<br />

12/01/0 F1 1 MAR 11 CBOT CORN 01 5.54 3/4 US 8.42<br />

GLOBEX TRADE<br />

12/01/0 F1 RESIDUAL ON 0001-JAN 11 CBT BE US 1.17<br />

12/01/0 F1 1 JAN 11 CBT BEAN MEAL 01 34 90 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/02/0 F1 1 MAR 11 ICEUS SUGAR11 0 28.61 US 9.36<br />

ICE PLATFORM<br />

12/02/0 F1 RESIDUAL ON 0001-MAR 1 KC WHE US 5.88<br />

12/02/0 F1 1 1 MAR 11 KC WHEAT 08 8.12 US 3,062.50<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/02/0 F1 1 MAR 11 KC WHEAT 08 8.12 US 8.41<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/03/0 F1 1 MAR 11 BOT CO N 01 5.67 US 8.42<br />

GLOBEX TRADE<br />

12/03/0 F1 1 1 MAR 1 ICEUS SUGAR11 06 29.50 US 996.80<br />

ICE PLA FORM<br />

12/03/0 F1 1 MAR 11 ICEU SUGAR11 06 29.50 US 9.36<br />

ICE PLATFORM<br />

12/06/0 F1 RESIDUAL ON 0001-JAN 11 CBT BE US 4.70<br />

12/06/0 F1 1 1 AN 11 CBT BEAN MEAL 01 352.10 US 820.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/06/0 F1 1 JAN 11 CBT BEAN MEAL 01 352.10 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/07/0 F1 1 1 MAR 11 CBOT CORN 01 5.57 1/2 US 475.00<br />

GLOBEX TRADE<br />

12/07/0 F1 1 MAR 11 CBOT CORN 01 5.57 1/2 US 8.42<br />

GLOBEX TRADE<br />

12/10/0 F1 RESIDUAL ON 0001-MAR 11 CBOT W US 7.29<br />

12/10/0 F1 1 1 MAR 11 CBOT WHEAT 01 7.80 US 687.50<br />

GLOBEX TRADE<br />

12/10/0 F1 1 1 MAR 11 CBOT WHEAT 01 7.80 US 16.84<br />

GLOBEX TRADE<br />

12/10/0 F1 RESIDUAL ON 0001-MAR 11 KC WHE US 7.24<br />

12/10/0 F1 RESIDUAL ON 0001-MAR 11 KC WHE US 7.24<br />

CERIFIED<br />

15

Step 7<br />

ACCOUNT NUMBER<br />

DATE DEC 31, 2010<br />

DATE AT LONG/BUY SHRT/SELL DESCRIPTION PRICE/LEGND CC DEBIT CREDIT<br />

12/10/0 F1 1 1 MAR 11 KC WHEAT 08 8.31 1/4 US 375.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/10/0 F1 1 1 MAR 11 KC WHEAT 08 8.31 1/4 US 16.82<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/13/0 F1 RESIDUAL ON 0001-MAR 11 CBOT C US 10.15<br />

12/13/0 F1 1 MAR 11 CBOT CORN 01 5.8 /2 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/13/0 F1 RESIDUAL ON 0001-JAN 11 BT BE US 5.78<br />

12/13/0 F1 1 JAN 11 CBT BEAN MEAL 1 342.60 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/14/0 F1 RESIDUAL ON 0001-MAR 11 CBOT W US 1.04<br />

12/14/0 F1 RESIDUAL ON 0001- AR 11 CBOT W US 1.04<br />

12/14/0 F1 1 1 MAR 11 CBOT WHEAT 01 7.70 3/4 US 250.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/14/0 F1 1 1 MAR 1 CBOT WHEAT 01 7.75 3/4 US 16.84<br />

GLOBEX TR DE<br />

APS TRA E<br />

12/14/0 F1 RESIDUAL N 0001-MAR 11 KC WHE US 3.29<br />

12/14/0 F1 1 1 MAR 11 KC WHEAT 08 8.18 3/4 US 612.50<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/14/0 F1 1 1 MAR 11 KC WHEAT 08 8.18 3/4 US 17.82<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/15/0 F1 1 1 MAR 11 CBOT CORN 01 5.81 3/4 US 137.50<br />

GLOBEX TRADE<br />

12/15/0 F1 1 MAR 11 CBOT CORN 01 5.81 3/4 US 8.42<br />

GLOBEX TRADE<br />

12/15/0 F1 RESIDUAL ON 0001-JAN 11 CBT BE US 6.31<br />

12/15/0 F1 1 1 JAN 11 CBT BEAN MEAL 01 341.40 US 120.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/15/0 F1 1 JAN 11 CBT BEAN MEAL 01 341.40 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/15/0 F1 RESIDUAL ON 0001-MAR 11 CBT BE US 5.26<br />

12/15/0 F1 1 MAR 11 CBT BEAN MEAL 01 344.50 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/15/0 F1 1 MAR 11 ICEUS SUGAR11 06 31.03789470 US 8.11<br />

APS TRADE<br />

CERIFIED<br />

16

Step 7<br />

ACCOUNT NUMBER<br />

DATE DEC 31, 2010<br />

DATE AT LONG/BUY SHRT/SELL DESCRIPTION PRICE/LEGND CC DEBIT CREDIT<br />

12/16/0 F1 1 1 MAR 11 ICEUS SUGAR11 06 31.10 US 69.56<br />

ICE PLATFORM<br />

12/16/0 F1 1 MAR 11 ICEUS SUGAR11 06 31 10 US 9.36<br />

ICE PLATFORM<br />

12/16/0 F1 RESIDUAL ON 0001-MAR 11 KC WHE 3.29<br />

12/16/0 F1 RESIDUAL ON 0001-MAR 11 KC WHE US 7.89<br />

12/16/0 F1 1 1 MAR 11 KC WHEAT 08 8 02 3/ US 425.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/16/0 F1 1 1 MAR 11 KC WHEAT 0 8.02 3/4 US 16.82<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/17/0 F1 RESIDUAL ON 0001-MAR 11 CBT BE US 8.42<br />

12/17/0 F1 1 1 MAR 11 CBT BEAN MEAL 01 350.30 US 580.00<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/17/0 F1 1 MAR 11 CBT BEAN MEAL 01 350.30 US 8.42<br />

GLOBEX TRADE<br />

APS TRADE<br />

12/27/0 F1 CK375 16 BRIAN SCHAD ( CHK ISS US 1,141.67<br />

CHECK ISSUED<br />

**USD-SEG 1.25 F1)** ** CONVERTED TOTAL *<br />

BEGINNING BALANCE 50,825.28 50,825.28<br />

THIS MONTH'S ACTIVITY 25.28- 825.28-<br />

ENDING BALANCE 50 000.00 50,000.00<br />

CERIFIED<br />

ACCOUNT VALUE AT MARKET 50,000.00 50,000.00<br />

CONVERTED MARKET VALUE 50,000.00 50,000.00<br />

TOTAL COMMISSIONS 169.00- 169.00-<br />

TOTAL CLEARING FEES 1.60- 1.60-<br />

TOTAL EXCHANGE FEES 44.90- 44.90-<br />

TOTAL REGULATORY FEES .26- .26-<br />

TOTAL OTHER FEES 6.60- 6.60-<br />

*** CURRENT MONTH *** *** YEAR-TO-DATE ***<br />

FUTURES PROFIT/LOSS US 316.39 26,141.67<br />

17