Swing Futures Due Diligence Report-Public.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

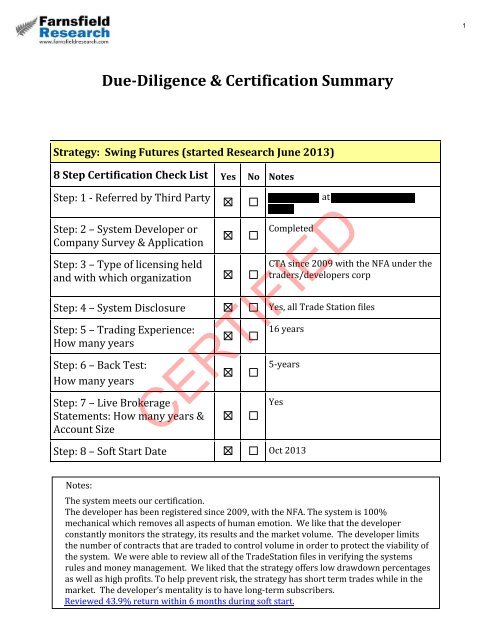

1<strong>Due</strong>-<strong>Diligence</strong> & Certification SummaryStrategy: <strong>Swing</strong> <strong>Futures</strong> (started Research June 2013)8 Step Certification Check List Yes No NotesStep: 1 - Referred by Third PartyStep: 2 – System Developer orCompany Survey & ApplicationStep: 3 – Type of licensing heldand with which organizationStep: 4 – System DisclosureStep: 5 – Trading Experience:How many yearsStep: 6 – Back Test:How many yearsStep: 7 – Live BrokerageStatements: How many years &Account SizeCompletedatCTA since 2009 with the NFA under thetraders/developers corpYes, all Trade Station files16 years5-yearsYesCERTIFIEDStep: 8 – Soft Start Date Oct 2013Notes:The system meets our certification.The developer has been registered since 2009, with the NFA. The system is 100%mechanical which removes all aspects of human emotion. We like that the developerconstantly monitors the strategy, its results and the market volume. The developer limitsthe number of contracts that are traded to control volume in order to protect the viability ofthe system. We were able to review all of the TradeStation files in verifying the systemsrules and money management. We liked that the strategy offers low drawdown percentagesas well as high profits. To help prevent risk, the strategy has short term trades while in themarket. The developer’s mentality is to have long-term subscribers.Reviewed 43.9% return within 6 months during soft start.

Farnsfield Research, Inc.SYSTEM DEVELOPER AND STRATEGY SURVEYSUMMARY OF SURVEYThe purpose of this questionnaire survey is to help Farnsfield develop an understanding of the backgroundexperience of the trading team and strategy system developer. It also provides us with the facts and informationneeded to begin our due diligence process and determine whether or not the strategy and system is a good fit forour own trading. The more detailed information provided, the more efficient our process will be.DOCUMENTATION NEEDEDPlease provide the following documents if available. If not available please explain why. Please type in youranswers in a blue font color as well as in italic, and email the survey back to us (DO NOT FAX).Is anyone on the team registered as a CTA or fund manager, please provide details on what entity namethis is listed underPhoto – formal head shot. Send 2-3 so we can choose. The photo we select will be used for your bio pageon the website. Format – high resolution .tif or .jpgTrack/performance Record – at least 3 years of actual real time trades in the marketBack test of trading performance of no less than 3-yearsSample trading charts – high resolutionBroker statements (Personal, trading fund or client’s)Professional references with contact informationTestimonials from subscribers/clientsArticles, interviews, You Tube videos, audio files, or trading reportsPower Point PresentationWebsite (if you have a website please provide)Self-Bio (Provide information on how the developer and/or team came into trading and what previousexperience was outside of trading)CONTACT INFORMATION OF DEVELOPER AND/OR TEAMFull Name of Developer: Undisclosed, Currently Under ContractAdditional Team Members: NILCompany Name:Capital ManagementPhysical address:Billing address:Telephone (cell and office): PrivateEmail: PrivateSkype / Yahoo Messenger / MSN Messenger (if applicable): NILCONFIDENTIAL Page 1 of 3

Step 23TRADING BACKGROUNDHow many years of trading experience do the developer or strategy team have? 16 YearsHow did the developer or team get involved in trading?What are the biggest strengths do the developer or strategy team have?What are the biggest weaknesses?FarnsField Research, Inc.What was a trading experience where the developer learned a valuable lesson about the markets and yourself?What are the developers and teams trading expertise (Stocks, <strong>Futures</strong>, Forex, Options, ETF’s, etc.) <strong>Futures</strong>How would the developer describe the trading style of your strategy (intraday, swing trading, long-term, trend)?Intraday, Trending and <strong>Swing</strong> StrategiesTRADING STRATEGYIs the system based on technical or fundamentals? TechnicalHow would the developer describe the trading strategy, (scalping, spreads, breakout, trend, etc.)? TrendingAre the trading orders/suggestions limit or market orders, etc? Market OrdersWhat indicators do you use on entries and exits and why do you use these indicators?How many trades do you make on average per month? 15What is an average hold time per trade? On the <strong>Swing</strong> trades about 2-weeksHow many trades could be open at one given time? 10What are the average non-compounded returns per year (is this hypothetical or real time)? 115.81% over 5-yearsWhat is the average drawdown?What was the biggest drawdown? 23.31%What is the stop loss for each trade?What is the ratio of winners to losers? 51/50When does the strategy take profits on each trade?CERTIFIEDDoes a trader/investor need to watch the market all day in order to trade the strategy? NO, it is 100%automated and mechanicalDo the developer and team provide/email signals or access to a member’s site for subscribers? No, it is 100%mechanical and cannot provide signals do to coding factors.Does the developer provide any educational materials for the subscriber? NoCONFIDENTIAL Page 2 of 3

Step 2 4FarnsField Research, Inc.What are the benefits of the trading strategy? Why would an investor choose the strategy/style over another?Our goal is to provide investors with trading strategies that provide consistent outsized returns whilekeeping losses and drawdowns contained. To achieve this goal we offer very short term tradingstrategies that put a relatively small amount of capital at risk and are in the market only whenperceived opportunity is the greatest.TRADING ACCOUNTWhat minimum trading account size does the developer recommend to effectively trade the system? $10,000 -$50,000 depending on which portfolio is traded.What are the developer’s thoughts on money management? Money Management is key when entering themarket, which is why we have hand-picked the specific Index markets to ensure portfoliodiversification, and include a disciplined form of money-management by providing amongst thehighest rated profit factor (Wins vs. Losses) markets traded, with markets that demand some of thelowest initial margin required.What is the maximum percent that the developer recommends exposing to risk on any single trade? Using atleast double the margin requirements per position. Stop losses are about 5% of the overall account size.COMPETITIONWhich traders/websites are the developer’s main competitors? NILSUPPORTING DOCUMENTS (FarnsField may want to utilize or republish for marketing purposes)Has the developer or team written any articles or reports that we may review? NoDoes the developer or team have any videos or audio interviews? NOPROFESSIONAL RELATIONSHIPSDoes the developer or team have a marketing relationship now and if so, with who? NoDoes the developer have a broker relationship set up where your trades clear through and with whom? Yes,Progressive Trading Group, Striker, OEC, Dorman, FOXDoes the developer have brokers currently marketing the system?THANK YOU!CERTIFIEDFarnsField appreciates that you took the time in completing this survey. Your input is critical to the success of ourmutual partnership! We will review your survey and be back in touch in setting up another conversation withinthe next few weeks.CONFIDENTIAL Page 3 of 3

BASIC Details1 of 1Step 35News Center Swaps Information Information for DCMs and SEFs NFA Manual File a Complaint Careers at NFADetailsNFA ID:Current Status• NFA MEMBER APPROVED• COMMODITY TRADING ADVISOR REGISTEREDExemptionsClick the link below to view exemptions for this firmView ExemptionsFirm Activity StatusFirm has on-exchange futures and/or options customer accountsYesFirm is soliciting customersYesFirm manages futures or options customer accountsYesFirm operates commodity poolsNoFirm is engaged in retail off-exchange foreign currency futures and/or optionsNoRegulatory ActionsAgencyNumberNFA 0CFTC 0Exchanges 0details...Formerly Known AsNFA Arbitration DecisionsCFTC Reparations CasesRoleNumber Total 0Claimant 0details...Respondent 0details...Business AddressNo other names.Doing Business AsNo other namesListed PrincipalsCERTIFIEDListed Principal NameTitlePRESIDENT10% or MoreFinancial InterestYESHistoryStatusEffective Date• COMMODITY POOL OPERATOR WITHDRAWN 03/14/2012• NFA MEMBER APPROVED 03/05/2009• COMMODITY TRADING ADVISOR REGISTERED 03/05/2009• COMMODITY POOL OPERATOR REGISTERED 03/05/2009• NFA MEMBER PENDING 02/03/2009• COMMODITY TRADING ADVISOR PENDING 02/03/2009• COMMODITY POOL OPERATOR PENDING 02/03/2009NFA is the premier independent provider of efficient and innovative regulatory programs that safeguard the integrity of the futures markets.Site Index | Contact NFA | News Center | FAQs | Career Opportunities | Industry Links | Home© 2014 National <strong>Futures</strong> Association All Rights Reserved. | Disclaimer and Privacy Policy

Step 46System Survey and Details, based in , was formed in 2009. Since inception,primary business is to provide fully automated trading systems to institutional and retail clients. All systemsare computer programmed with specific rules for entry and exit signals.Copyright © 2009-2014. All rights reserved.Hi, my name is . I am the owner and system developer. I love creating profitable trading systems andsharing them! I want others to benefit from the expertise I have attained through years of trading systemdevelopment. I have been studying and trading the futures markets since 1997 and trading with fullyautomated mechanical systems since 2001.My formal education includes a Bachelor of Architectural Engineering from Oklahoma State University in 1992and a Master of Science in Structural Engineering from Arizona State University in 1999.I am an NFA (National <strong>Futures</strong> Association) member as Principal of an NFA registered CTA (Commodity TradingAdvisor), which manages all trading in the investor's futures account pursuant to a specified program. The CTAandare separate and distinct entities.is not a CTA and does not make trades in a customer's account, eachcustomer isresponsible for trading in their account.Strategy detailsEach of the system portfolios and strategies were developed with diversification in mind. There are a total often different strategies that focus primarily on three market categories, S&P 500 emini, Russell 2000 emini,and S&P 400 midcap emini which have large liquidity levels. We look at taking advantage of the smallinteraction between the counter-trend strategy of our swing strategies and the trend-following nature of ourintraday strategies. This means that we trade different asset types and normally do not perform in the samemanner. When we see that the returns on some asset types are declining, the returns on others weredeclining less, or indeed actually gaining. This diversification has obvious benefits: If poor performance in oneinvestment can be offset by better (or even good) performance in another, extreme losses in an overallportfolio will be rarer than otherwise, and the capital will grow more in the long run.Money managementCERTIFIEDhas three different portfolios that utilize many different strategies such as <strong>Swing</strong> Trading, DayTrading and <strong>Swing</strong> Reversion that trade various futures markets. The markets that we have put our focustowards are the Russell 2000, Emini S&P 500 and the Emini S&P MidCap 400. Each system is broken down bythe number of strategies that it trades, adding more diversification and protection from adverse movements inthe markets.Money Management is key when entering the market, which is why we have hand-picked the specific Indexmarkets to ensure portfolio diversification, and include a disciplined form of money-management by providing

Step 47amongst the highest rated profit factor (Wins vs. Losses) markets traded, with markets that demand some ofthe lowest initial margin required.The various strategies that we use have protective stop-loss orders (the smaller of a volatility based stop or aspecific dollar money management stop) and we apply market or stop market orders to ensure real-timetrades will be filled.DIVERSIFICATIONDepending on whichsystem is used, you will need a minimum of $10,000 to $50,000 totrade. will use a basic model of diversification. As you move up to and, the portfolios will offer a wide range of diversification with trading several strategies on severalmarket categories. We add more markets and strategies in and , which aregiving us a wide range of diversification to capture more opportunity and be more risk adverse.The rationale behind this technique contends that a portfolio of different kinds of investments will, on average,yield higher returns and pose a lower risk than any individual investment found within the portfolio.Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance ofsome investments will neutralize the negative performance of others.STRATEGYOur Day strategies use indicators such as trend-following, momentum, daily volatility analysis and the currentvalue of the VIX in its decision making process in determining when to get in out of the markets as well whento buy or sell in a long or short position. Using the day strategies we only trade on days that statistically aremore robust and can trade one to three times per day. All of our suggestions are either market orders or stopmarket orders to ensure that real-time trades will be filled. Because we are trading intraday, there are notrades held overnight. We set a specific stop loss where we are only willing to risk a minimum dollar amountper suggestion.CERTIFIEDWe utilize two <strong>Swing</strong> strategies that react differently in the market. Our <strong>Swing</strong> Reversion strategies basicallyare used as countertrends that we have designed specifically for stock indices. These strategies’ utilize twentyhigh-probability signals and takes a position when a sufficient number of them are long or short. It averages 1trade per month per market with the average trade lasting 5 trading days. The strategy has a protectivetrailing stop-loss order (the smaller of a volatility based trailing stop or fixed money management trailing stop)and uses market or stop market orders to ensure real-time trades will be filled.The several CB<strong>Swing</strong> strategies that we apply to the market are a countertrend swing strategy designed forstock indices, and they use the exact same code for every market. These strategies follow the adage of "do notgo against the Central Bank". The strategy will not go long when the Central Bank is selling and will not goshort when the Central Bank is buying. The various strategies we use have protective stop-loss orders (thesmaller of a volatility based stop or fixed money management stop) and uses market or stop market orders toensure real-time trades will be filled.

Step 68Performance SummaryTotal Net Profit: $520,802.50 Max Drawdown: ($20,975.00)Gross Profit: $1,070,622.50 As % of Initial Equity: 23.31%Gross Loss: ($549,820.00) As % of Total Equity: 5.70%Profit Factor: 1.947 Max Drawdown Date: 12/19/2011Pessimistic RR: 1.840 Longest Drawdown: 117 (78) daysTotal Trades: 2527Recovery Factor: 24.83Winning Trades: 1272 Max Runup: $526,662.50Losing Trades: 1241 As % of Initial Equity: 585.18%Even Trades: 14 As % of Total Equity: 608.01%% Profitable: 50.34% Max Runup Date: 9/9/2013Longest Runup:1,825 (1,265) daysAvg. Trade Net Profit: $206.10Avg. Winning Trade: $841.68 Return on Initial Capital: 578.67%Avg. Losing Trade: ($443.05) Annual Rate of Return: 115.81%Payoff Ratio: 1.9 Avg. Monthly Return: $8,685.99, 9.65%Monthly Std. Deviation: $13,239.95Largest Win: $8,300.00, 0.78% % Profitable Months: 80.00%Largest Loss: ($5,890.00), 1.07%CERTIFIEDMax Cons. Winners: 18 Sharpe Ratio: 2.27Max Cons. Losers: 24 Sortino Ratio: 5.61Sterling Ratio: 3.69Trading Period: 4 years, 11 months, 29 days MAR Ratio: 4.9710/1/2008 - 9/30/2013 Efficiency Factor: 0.49Total Trading Days: 1,266Longest Flat Period: 50 (34) days Total Commission: $50,540.00Max Shares/Contracts: 9 Total Slippage: $72,600.00

Step 69Periodical Returns - AnnualPeriod Net Profit Return on IE Return on TE # Trades # Exits Profit Factor % Profitable2013 $30,665.00 34.07% 5.30% 255 253 1.75 45.06%2012 $51,720.00 57.47% 9.81% 397 393 1.57 48.60%2011 $136,480.00 151.64% 34.93% 681 677 1.80 49.04%2010 $63,130.00 70.14% 19.27% 526 524 1.61 52.86%2009 $106,297.50 118.11% 48.03% 501 497 2.18 51.91%2008 $131,295.00 145.88% 145.88% 186 183 3.50 54.64%Daily EquityCERTIFIED

Step 6 10Closed Trade EquityMonthly Net ProfitCERTIFIED

Step 6 11Accumulative Monthly Net ProfitU.S. Government Required Disclaimer - Commodity <strong>Futures</strong> Trading Commission. Forex, <strong>Futures</strong> and Options trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order toinvest in the futures and options markets. Don't trade with money you can't afford to lose. This email is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profitsor losses similar to those discussed on this email. The past performance of any trading system or methodology is not necessarily indicative of future results. Trading involves high risks and you can lose a lot of money. HYPOTHETICAL PERFORMANCERESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE AREFREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCERESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THEIMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECTACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OFHYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.CERTIFIED

Step 712CERTIFIED

Step 7 13CERTIFIED

Step 7 14CERTIFIED

Step 715CERTIFIED

Step 7 16CERTIFIED

Step 7 17CERTIFIED

Step 7 18CERTIFIED

Step 7 19CERTIFIED

Step 7 20CERTIFIED

Step 721CERTIFIED

Step 7 22CERTIFIED

Step 723CERTIFIED