Due Dilligence

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

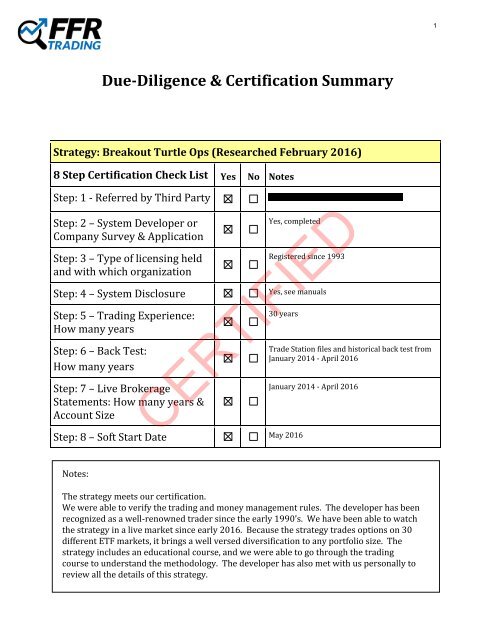

<strong>Due</strong>-Diligence & Certification Summary<br />

Strategy: Breakout Turtle Ops (Researched February 2016)<br />

8 Step Certification Check List Yes No Notes<br />

Step: 1 - Referred by Third Party<br />

Step: 2 – System Developer or<br />

Company Survey & Application<br />

Step: 3 – Type of licensing held<br />

and with which organization<br />

Step: 4 – System Disclosure<br />

Step: 5 – Trading Experience:<br />

How many years<br />

Step: 6 – Back Test:<br />

How many years<br />

Step: 7 – Live Brokerage<br />

Statements: How many years &<br />

Account Size<br />

Yes, completed<br />

Registered since 1993<br />

Yes, see manuals<br />

30 years<br />

Step: 8 – Soft Start Date May 2016<br />

Trade Station files and historical back test from<br />

January 2014 - April 2016<br />

January 2014 - April 2016<br />

CERTIFIED<br />

Notes:<br />

The strategy meets our certification.<br />

We were able to verify the trading and money management rules. The developer has been<br />

recognized as a well-renowned trader since the early 1990’s. We have been able to watch<br />

the strategy in a live market since early 2016. Because the strategy trades options on 30<br />

different ETF markets, it brings a well versed diversification to any portfolio size. The<br />

strategy includes an educational course, and we were able to go through the trading<br />

course to understand the methodology. The developer has also met with us personally to<br />

review all the details of this strategy.

Step 2 2<br />

SYSTEM STRATEGY SURVEY<br />

FFR Trading Research, Inc.<br />

SUMMARY OF SURVEY<br />

The purpose of this questionnaire survey is to help FFR Trading develop an understanding of the details of the<br />

strategy or strategies for us to make an informed decision. It also provides us with the facts and information<br />

needed to begin our due diligence process and determine whether or not the strategy and system is a good fit for<br />

our own trading. The more detailed information provided, the more efficient our process will be.<br />

DOCUMENTATION NEEDED<br />

Please provide the following documents if available. If not available please explain why. Please type in your<br />

answers in a blue font color as well as in italic, and email the survey back to us (DO NOT FAX).<br />

<br />

<br />

<br />

<br />

<br />

<br />

Is anyone on the team registered as a CTA or fund manager, please provide details on what entity name<br />

this is listed under? Russell has been registered for years since the 1980’s as a CTA and has traded his<br />

Managed fund for years.<br />

Do you have a Track/performance Record that is at least 3 years of actual real time trades in the market?<br />

We have a list of the trades that we’ve sent.<br />

We will need a back test of trading performance of no less than 3-years.<br />

Please provide a sample trading charts – high resolution. The best source for charts is the Turtle-Ops book<br />

and course.<br />

Can you provide broker statements (Personal, trading fund or client’s)? No, there are no account<br />

statements we can provide because we trade numerous markets in our large account including the<br />

Options.<br />

Please provide a Power Point Presentation of the strategy if you can provide it. The best source for this is<br />

the Turtle-Ops book and course.<br />

CONTACT INFORMATION OF DEVELOPER AND/OR TEAM<br />

Full Name of Developer: The developer, of course, is Russell.<br />

Additional Team Members: Duane Davis, Jeff Davis, Ruth Olofson, & Steve Charpentier<br />

Company Name:<br />

Physical address:<br />

Billing address:<br />

Telephone (cell and office):<br />

Email:<br />

Skype / Yahoo Messenger / MSN Messenger (if applicable):<br />

CONFIDENTIAL

Step 2<br />

3<br />

FFR Trading Research, Inc.<br />

TRADING STRATEGY<br />

1. What is the name of the strategy? Russell Sands Turtle-Ops<br />

2. What markets does the strategy trade? Options on ETFs<br />

3. Is the system based on technical or fundamentals? Technical<br />

4. Describe the trading strategy, (spreads, breakout, trend, please elaborate)? Trend based on Turtle 21<br />

Day High or Low<br />

5. Are the trading orders/suggestions limit or market orders, etc? Trade alerts are always done as limit<br />

orders for both entries and exits<br />

6. What indicators do you use on entries and exits? Turtle indicators described in the Turtle-Ops book<br />

7. Why do you use these indicators?<br />

8. How many trades on average per month? 10<br />

9. What is an average hold time per trade? 15 Days<br />

10. How many trades could be open at one given time? Perhaps 5 or 6<br />

11. What are the average non-compounded returns per year (is this hypothetical or real time)? See<br />

statistical data<br />

12. What is the average drawdown? See statistical data<br />

13. What was the biggest drawdown? Based on the hypothetical trade list, $3,851 before commission or<br />

fees<br />

14. What is the stop loss for each trade? Because we’re trading options, we don’t place stops in the<br />

market. Instead, trades are monitored during the day for possible exits. The exit strategies are<br />

explained in the Turtle-Ops book.<br />

15. What is the ratio of winners to losers? 54% wins to 46% losses<br />

16. Please describe when the strategy takes profits on each trade? This is described in the Turtle-Ops<br />

educational course, but if an option doubles in value, it’ll get closed on the first negative bar.<br />

17. Does a trader/investor need to watch the market all day in order to trade the strategy? Trade alerts<br />

are sent out during the day and auto trading is available.<br />

18. Are there email signals provided to the subscriber or access to a member’s site for subscribers? Trade<br />

alerts are sent by email.<br />

CONFIDENTIAL

Step 2<br />

4<br />

FFR Trading Research, Inc.<br />

19. Does the developer provide any educational materials for the subscriber? Yes, the Turtle-Ops book<br />

20. Is there any access to a trader or support for customer questions? Yes, basic telephone support is done<br />

by the Turtle Team. Also, questions about Turtle and questions about trades can be sent by email.<br />

21. What are the benefits of the trading strategy? Why would an investor choose the strategy/style over<br />

another? Because we know the Turtles system has been proven over the last 20+ years.<br />

22. What minimum trading account size does the developer recommend to effectively trade the system?<br />

Brokers may have their minimums, but because we will not be day trading these options, they can be<br />

traded in a small account.<br />

23. What is the maximum percent that the developer recommends exposing to risk on any single trade?<br />

For the hypothetical trade list, we used an allocation of $500 per trade, but allocations as lows as $250<br />

should be fine.<br />

THANK YOU!<br />

FFR Trading appreciates that you took the time in completing this survey. Your input is critical to the success of our<br />

mutual partnership! We will review your survey and be back in touch in setting up another conversation within<br />

the next few weeks.<br />

CONFIDENTIAL

BASIC Details<br />

Step 3<br />

5<br />

News Center Swaps Information Information for DCMs and SEFs NFA Manual File a Complaint Careers at NFA<br />

Details<br />

NFA ID:<br />

Current Status<br />

•<br />

Exemptions<br />

Click the link below to view exemptions for this firm<br />

View Exemptions<br />

Regulatory Actions<br />

Agency<br />

Number<br />

NFA 0<br />

CFTC 0<br />

Exchanges 0<br />

details...<br />

Formerly Known As<br />

No other names<br />

Doing Business As<br />

No other names<br />

Listed Principals<br />

NFA Arbitration Decisions<br />

Role<br />

Number<br />

Claimant 0<br />

Respondent 0<br />

details...<br />

Business Address<br />

CFTC Reparations Cases<br />

Total 0<br />

10% or More<br />

Listed Principal Name<br />

Title<br />

Financial Interest<br />

History<br />

Status<br />

PRESIDENT<br />

YES<br />

Effective Date<br />

CERTIFIED<br />

• COMMODITY TRADING ADVISOR REGISTERED 04/26/2007<br />

• COMMODITY TRADING ADVISOR PENDING 04/26/2007<br />

• COMMODITY TRADING ADVISOR WITHDRAWN 07/05/2006<br />

• COMMODITY POOL OPERATOR WITHDRAWN 06/18/1999<br />

• NFA MEMBER WITHDRAWN 06/18/1999<br />

• COMMODITY POOL OPERATOR REGISTERED 08/05/1997<br />

• NFA MEMBER APPROVED 04/28/1997<br />

• COMMODITY TRADING ADVISOR REGISTERED 11/10/1993<br />

• COMMODITY TRADING ADVISOR PENDING 11/08/1993<br />

details...<br />

NFA is the premier independent provider of efficient and innovative regulatory programs that safeguard the integrity of the futures markets.<br />

Site Index | Contact NFA | News Center | FAQs | Career Opportunities | Industry Links | Home<br />

© 2014 National Futures Association All Rights Reserved. | Disclaimer and Privacy Policy

Step 6<br />

6<br />

Russell Sands Turtle-Ops<br />

ETF<br />

Description<br />

Entry<br />

Date<br />

No. of<br />

Contracts Expiration Option<br />

Entry<br />

Price<br />

Exit<br />

Date<br />

Exit<br />

Price<br />

Gain<br />

or Loss<br />

Cumulative<br />

Gain or Loss<br />

EEM MSCI - Emerging Markets 01/03/14 5 Feb 22, 2014 40 Put 1.15 02/06/14 1.72 $285.00 $285.00<br />

USO US Oil Fund 01/03/14 9 Feb 22, 2014 33 Put 0.60 01/15/14 0.66 $54.00 $339.00<br />

EWZ MSCI - Brazil 01/06/14 11 Feb 22, 2014 40 Put 0.50 02/06/14 0.98 $528.00 $867.00<br />

FXI Currency Shares - China 01/06/14 8 Feb 22, 2014 35 Put 0.67 01/22/14 0.35 -$256.00 $611.00<br />

GDXJ Market Vectors - Jr. Gold Miners 01/21/14 4 Mar 22, 2014 40 Call 1.40 03/11/14 2.30 $360.00 $971.00<br />

TLT Barclays 20+ Yr Treasuries 01/21/14 4 Feb 22, 2014 105 Call 1.25 02/06/14 2.12 $348.00 $1,319.00<br />

UNG US Natural Gas 01/22/14 4 Feb 22, 2014 22 Call 1.23 02/06/14 2.92 $676.00 $1,995.00<br />

OIH Market Vectors - Oil Service 01/24/14 9 Feb 22, 2014 45 Put 0.60 02/06/14 0.63 $27.00 $2,022.00<br />

XLE SPDR - Energies 01/27/14 7 Feb 22, 2014 82 Put 0.75 02/07/14 0.46 -$203.00 $1,819.00<br />

KRE SPDR - Regional Banking 02/03/14 10 Feb 22, 2014 37 Put 0.55 02/12/14 0.07 -$480.00 $1,339.00<br />

XOP SPDR - Oil & Gas Exploration 02/03/14 6 Feb 22, 2014 62 Put 0.85 02/11/14 0.17 -$408.00 $931.00<br />

GDX Market Vectors - Gold Miners 02/10/14 5 Mar 22, 2014 25 Call 1.03 03/19/14 1.14 $55.00 $986.00<br />

SLV Silver Trust 02/14/14 6 Mar 22, 2014 20 Call 0.91 02/26/14 0.87 -$24.00 $962.00<br />

SMH Market Vectors - Semiconductors 02/14/14 5 Mar 22, 2014 43 Call 0.99 03/03/14 0.85 -$70.00 $892.00<br />

XLK SPDR - Technology 02/14/14 10 Mar 22, 2014 36 Call 0.55 03/03/14 0.35 -$200.00 $692.00<br />

USO US Oil Fund 02/18/14 5 Mar 22, 2014 36 Call 1.10 03/05/14 0.93 -$85.00 $607.00<br />

VGK Vanguard - European 02/18/14 8 Mar 22, 2014 60 Call 0.65 03/03/14 0.50 -$120.00 $487.00<br />

XOP SPDR - Oil & Gas Exploration 02/18/14 3 Mar 22, 2014 70 Call 1.52 02/27/14 1.03 -$147.00 $340.00<br />

OIH Market Vectors - Oil Service 02/24/14 5 Mar 22, 2014 48 Call 0.96 03/12/14 0.60 -$180.00 $160.00<br />

XLE SPDR - Energies 02/24/14 2 Apr 19, 2014 87 Call 2.18 03/12/14 1.46 -$144.00 $16.00<br />

XRT SPDR - Retail 02/25/14 3 Mar 22, 2014 83 Call 1.53 03/13/14 3.36 $549.00 $565.00<br />

XLB SPDR - Materials 02/26/14 5 Mar 22, 2014 46 Call 0.98 03/13/14 1.41 $215.00 $780.00<br />

EPI Wisdom Tree - India 02/28/14 3 Apr 19, 2014 15 Call 2.05 04/14/14 4.20 $645.00 $1,425.00<br />

KRE SPDR - Regional Banking 02/28/14 9 Mar 22, 2014 40 Call 0.61 03/20/14 2.15 $1,386.00 $2,811.00<br />

FXY Currency Shares - Japanese Yen 03/06/14 4 Apr 19, 2014 95 Put 1.32 03/13/14 0.67 -$260.00 $2,551.00<br />

XME SPDR - Metals & Mining 03/06/14 11 Apr 19, 2014 45 Call 0.50 03/26/14 0.12 -$418.00 $2,133.00<br />

USO US Oil Fund 03/12/14 7 Apr 19, 2014 35 Put 0.73 03/21/14 0.34 -$273.00 $1,860.00<br />

EEM MSCI - Emerging Markets 03/13/14 5 Apr 19, 2014 38 Put 0.96 03/21/14 0.48 -$240.00 $1,620.00<br />

FXI Currency Shares - China 03/13/14 5 Apr 19, 2014 33 Put 0.99 03/21/14 0.46 -$265.00 $1,355.00

Step 6<br />

7<br />

GDXJ Market Vectors - Jr. Gold Miners 03/13/14 2 Apr 19, 2014 45 Call 2.40 03/18/14 1.15 -$250.00 $1,105.00<br />

SLV Silver Trust 03/19/14 8 Apr 19, 2014 20 Put 0.67 04/04/14 0.85 $144.00 $1,249.00<br />

GDX Market Vectors - Gold Miners 03/24/14 5 Apr 19, 2014 25 Put 1.07 04/04/14 0.91 -$80.00 $1,169.00<br />

GDXJ Market Vectors - Jr. Gold Miners 03/24/14 7 Apr 19, 2014 35 Put 0.75 04/09/14 0.22 -$371.00 $798.00<br />

EWZ MSCI - Brazil 03/27/14 8 Apr 19, 2014 45 Call 0.70 04/15/14 1.48 $624.00 $1,422.00<br />

EEM MSCI - Emerging Markets 03/28/14 4 Apr 19, 2014 40 Call 1.33 04/15/14 1.15 -$72.00 $1,350.00<br />

OIH Market Vectors - Oil Service 03/28/14 6 Apr 19, 2014 50 Call 0.91 04/10/14 0.68 -$138.00 $1,212.00<br />

XLE SPDR - Energies 03/28/14 5 May 17, 2014 90 Call 1.15 04/10/14 1.39 $120.00 $1,332.00<br />

XOP SPDR - Oil & Gas Exploration 03/28/14 4 May 17, 2014 73 Call 1.27 04/17/14 3.42 $860.00 $2,192.00<br />

EPI Wisdom Tree - India 04/01/14 11 May 17, 2014 20 Call 0.50 04/15/14 0.35 -$165.00 $2,027.00<br />

XLK SPDR - Technology 04/01/14 5 May 17, 2014 36 Call 1.09 04/04/14 0.84 -$125.00 $1,902.00<br />

USO US Oil Fund 04/08/14 9 May 17, 2014 37 Call 0.61 04/22/14 0.68 $63.00 $1,965.00<br />

UNG US Natural Gas 04/10/14 4 May 17, 2014 25 Call 1.29 04/21/14 1.62 $132.00 $2,097.00<br />

KRE SPDR - Regional Banking 04/11/14 6 Jun 21, 2014 37 Put 0.95 05/27/14 0.26 -$414.00 $1,683.00<br />

VGK Vanguard - European 04/22/14 8 May 17, 2014 60 Call 0.65 05/15/14 0.32 -$264.00 $1,419.00<br />

FXI Currency Shares - China 04/25/14 6 May 17, 2014 35 Put 0.94 05/12/14 0.19 -$450.00 $969.00<br />

SLV Silver Trust 04/30/14 7 May 17, 2014 20 Put 0.75 05/14/14 0.10 -$455.00 $514.00<br />

TLT Barclays 20+ Yr Treasuries 05/01/14 10 Jun 21, 2014 115 Call 0.54 05/12/14 0.28 -$260.00 $254.00<br />

EPI Wisdom Tree - India 05/09/14 7 Jun 21, 2014 20 Call 0.80 05/29/14 1.78 $686.00 $940.00<br />

XLB SPDR - Materials 05/12/14 6 Jun 21, 2014 48 Call 0.95 05/15/14 0.60 -$210.00 $730.00<br />

XLK SPDR - Technology 05/12/14 5 Jun 21, 2014 36 Call 1.08 06/20/14 2.10 $510.00 $1,240.00<br />

EEM MSCI - Emerging Markets 05/13/14 5 Jun 21, 2014 42 Call 1.15 05/30/14 1.07 -$40.00 $1,200.00<br />

FXE Currency Shares - Euro 05/13/14 6 Jun 21, 2014 135 Put 0.91 06/05/14 0.97 $36.00 $1,236.00<br />

XME SPDR - Metals & Mining 05/20/14 6 Jun 21, 2014 40 Put 0.94 06/06/14 0.70 -$144.00 $1,092.00<br />

USO US Oil Fund 05/21/14 8 Jun 21, 2014 38 Call 0.65 06/02/14 0.28 -$296.00 $796.00<br />

FXI Currency Shares - China 05/22/14 6 Jun 21, 2014 36 Call 0.92 06/19/14 1.91 $594.00 $1,390.00<br />

GDX Market Vectors - Gold Miners 05/27/14 8 Jun 21, 2014 23 Put 0.68 06/10/14 0.44 -$192.00 $1,198.00<br />

GDXJ Market Vectors - Jr. Gold Miners 05/27/14 8 Jun 21, 2014 30 Put 0.68 06/05/14 0.29 -$312.00 $886.00<br />

SMH Market Vectors - Semiconductors 05/27/14 7 Jun 21, 2014 46 Call 0.74 06/20/14 3.31 $1,799.00 $2,685.00<br />

VGK Vanguard - European 05/27/14 4 Jun 21, 2014 60 Call 1.35 06/17/14 1.00 -$140.00 $2,545.00<br />

OIH Market Vectors - Oil Service 05/29/14 5 Jul 19, 2014 53 Call 1.04 07/08/14 3.66 $1,310.00 $3,855.00<br />

FXY Currency Shares - Japanese Yen 06/04/14 6 Jul 19, 2014 95 Put 0.93 06/11/14 0.48 -$270.00 $3,585.00<br />

KRE SPDR - Regional Banking 06/05/14 9 Jul 19, 2014 40 Call 0.60 06/25/14 0.46 -$126.00 $3,459.00<br />

XOP SPDR - Oil & Gas Exploration 06/06/14 4 Jul 19, 2014 80 Call 1.18 06/25/14 2.32 $456.00 $3,915.00

Step 6<br />

8<br />

XLE SPDR - Energies 06/09/14 6 Jun 21, 2014 97 Call 0.85 06/20/14 3.60 $1,650.00 $5,565.00<br />

GDXJ Market Vectors - Jr. Gold Miners 06/10/14 6 Jul 19, 2014 38 Call 0.85 07/16/14 3.90 $1,830.00 $7,395.00<br />

XRT SPDR - Retail 06/18/14 3 Jul 19, 2014 86 Call 1.63 06/26/14 1.22 -$123.00 $7,272.00<br />

SMH Market Vectors - Semiconductors 07/01/14 7 Jul 19, 2014 50 Call 0.78 07/17/14 0.65 -$91.00 $7,181.00<br />

UNG US Natural Gas 07/02/14 3 Aug 16, 2014 25 Put 1.55 08/05/14 3.55 $600.00 $7,781.00<br />

FXI Currency Shares - China 07/03/14 5 Aug 16, 2014 38 Call 1.01 08/06/14 2.30 $645.00 $8,426.00<br />

XLB SPDR - Materials 07/03/14 6 Aug 16, 2014 50 Call 0.81 07/10/14 0.47 -$204.00 $8,222.00<br />

VGK Vanguard - European 07/10/14 3 Aug 16, 2014 60 Put 1.59 08/15/14 3.15 $468.00 $8,690.00<br />

FXE Currency Shares - Euro 07/16/14 2 Sep 20, 2014 135 Put 2.15 09/03/14 5.51 $672.00 $9,362.00<br />

KRE SPDR - Regional Banking 07/17/14 6 Aug 16, 2014 39 Put 0.92 07/30/14 0.53 -$234.00 $9,128.00<br />

TLT Barclays 20+ Yr Treasuries 07/17/14 5 Aug 16, 2014 115 Call 0.97 07/30/14 1.06 $45.00 $9,173.00<br />

EWZ MSCI - Brazil 07/18/14 4 Aug 16, 2014 50 Call 1.37 07/30/14 0.94 -$172.00 $9,001.00<br />

XLK SPDR - Technology 07/22/14 6 Aug 16, 2014 39 Call 0.94 07/31/14 0.60 -$204.00 $8,797.00<br />

USO US Oil Fund 07/31/14 8 Sep 20, 2014 36 Put 0.63 08/28/14 1.01 $304.00 $9,101.00<br />

XOP SPDR - Oil & Gas Exploration 08/01/14 5 Aug 16, 2014 70 Put 0.99 08/11/14 0.14 -$425.00 $8,676.00<br />

SLV Silver Trust 08/04/14 6 Sep 20, 2014 20 Put 0.83 08/28/14 1.22 $234.00 $8,910.00<br />

XME SPDR - Metals & Mining 08/11/14 10 Sep 20, 2014 45 Call 0.52 09/04/14 0.11 -$410.00 $8,500.00<br />

FXE Currency Shares - Euro 08/19/14 5 Sep 20, 2014 132 Put 1.15 09/16/14 4.18 $1,515.00 $10,015.00<br />

XRT SPDR - Retail 08/19/14 3 Sep 20, 2014 86 Call 1.84 09/12/14 3.19 $405.00 $10,420.00<br />

SMH Market Vectors - Semiconductors 08/21/14 7 Sep 20, 2014 51 Call 0.79 09/10/14 0.85 $42.00 $10,462.00<br />

XLK SPDR - Technology 08/21/14 11 Sep 20, 2014 40 Call 0.46 09/04/14 0.49 $33.00 $10,495.00<br />

EWZ MSCI - Brazil 08/26/14 8 Sep 20, 2014 53 Call 0.63 09/08/14 0.79 $128.00 $10,623.00<br />

XOP SPDR - Oil & Gas Exploration 08/29/14 3 Oct 18, 2014 80 Call 1.56 09/04/14 1.06 -$150.00 $10,473.00<br />

FXY Currency Shares - Japanese Yen 09/02/14 9 Oct 18, 2014 90 Put 0.61 10/02/14 2.45 $1,656.00 $12,129.00<br />

GDX Market Vectors - Gold Miners 09/04/14 7 Oct 18, 2014 23 Put 0.71 10/22/14 3.47 $1,932.00 $14,061.00<br />

GDXJ Market Vectors - Jr. Gold Miners 09/04/14 6 Oct 18, 2014 35 Put 0.81 10/08/14 2.45 $984.00 $15,045.00<br />

XME SPDR - Metals & Mining 09/09/14 9 Oct 18, 2014 40 Put 0.57 09/25/14 2.61 $1,836.00 $16,881.00<br />

USO US Oil Fund 09/10/14 4 Oct 18, 2014 35 Put 1.22 09/16/14 0.70 -$208.00 $16,673.00<br />

KRE SPDR - Regional Banking 09/11/14 8 Oct 18, 2014 40 Call 0.62 09/22/14 0.41 -$168.00 $16,505.00<br />

SLV Silver Trust 09/11/14 4 Oct 18, 2014 19 Put 1.21 10/09/14 2.18 $388.00 $16,893.00<br />

OIH Market Vectors - Oil Service 09/12/14 10 Oct 18, 2014 50 Put 0.54 10/01/14 2.11 $1,570.00 $18,463.00<br />

XLE SPDR - Energies 09/12/14 4 Nov 22, 2014 90 Put 1.46 10/21/14 5.13 $1,468.00 $19,931.00<br />

FXE Currency Shares - Euro 09/19/14 5 Oct 18, 2014 127 Put 1.15 10/08/14 2.01 $430.00 $20,361.00<br />

XOP SPDR - Oil & Gas Exploration 09/19/14 5 Oct 18, 2014 70 Put 1.04 10/06/14 4.30 $1,630.00 $21,991.00

Step 6<br />

9<br />

EWZ MSCI - Brazil 09/22/14 4 Oct 18, 2014 45 Put 1.24 10/06/14 0.88 -$144.00 $21,847.00<br />

EEM MSCI - Emerging Markets 09/23/14 6 Oct 18, 2014 40 Put 0.87 10/17/14 2.18 $786.00 $22,633.00<br />

KRE SPDR - Regional Banking 09/23/14 6 Oct 18, 2014 39 Put 0.81 10/16/14 2.69 $1,128.00 $23,761.00<br />

VGK Vanguard - European 09/23/14 5 Oct 18, 2014 57 Put 1.03 10/14/14 4.95 $1,960.00 $25,721.00<br />

FXI Currency Shares - China 10/01/14 6 Oct 18, 2014 38 Put 0.87 10/08/14 0.32 -$330.00 $25,391.00<br />

TLT Barclays 20+ Yr Treasuries 10/01/14 5 Nov 22, 2014 120 Call 1.01 10/23/14 1.45 $220.00 $25,611.00<br />

XLB SPDR - Materials 10/01/14 6 Nov 22, 2014 48 Put 0.91 10/21/14 0.84 -$42.00 $25,569.00<br />

FXY Currency Shares - Japanese Yen 10/03/14 7 Nov 22, 2014 85 Put 0.77 10/07/14 0.32 -$315.00 $25,254.00<br />

GDX Market Vectors - Gold Miners 10/07/14 9 Nov 22, 2014 20 Put 0.60 11/12/14 1.92 $1,188.00 $26,442.00<br />

XME SPDR - Metals & Mining 10/09/14 7 Nov 22, 2014 32 Put 0.71 10/21/14 0.43 -$196.00 $26,246.00<br />

SMH Market Vectors - Semiconductors 10/10/14 4 Nov 22, 2014 45 Put 1.20 10/17/14 0.84 -$144.00 $26,102.00<br />

OIH Market Vectors - Oil Service 10/14/14 5 Nov 22, 2014 40 Put 1.10 10/21/14 0.33 -$385.00 $25,717.00<br />

USO US Oil Fund 10/14/14 7 Nov 22, 2014 30 Put 0.79 11/24/14 1.47 $476.00 $26,193.00<br />

UNG US Natural Gas 10/20/14 6 Nov 22, 2014 20 Put 0.91 10/29/14 0.97 $36.00 $26,229.00<br />

EWZ MSCI - Brazil 10/23/14 5 Nov 22, 2014 37 Put 0.97 10/22/14 0.89 -$40.00 $26,189.00<br />

GDXJ Market Vectors - Jr. Gold Miners 10/27/14 5 Nov 22, 2014 29 Put 1.07 11/11/14 3.19 $1,060.00 $27,249.00<br />

FXI Currency Shares - China 10/28/14 6 Nov 22, 2014 39 Call 0.91 11/07/14 0.70 -$126.00 $27,123.00<br />

KRE SPDR - Regional Banking 10/29/14 4 Nov 22, 2014 38 Call 1.28 11/10/14 2.60 $528.00 $27,651.00<br />

XRT SPDR - Retail 10/29/14 2 Dec 20, 2014 87 Call 2.31 12/04/14 5.90 $718.00 $28,369.00<br />

SLV Silver Trust 10/30/14 10 Nov 22, 2014 16 Put 0.51 11/14/14 0.83 $320.00 $28,689.00<br />

DXJ Wisdom Tree - Japan 10/31/14 1 Nov 22, 2014 50 Call 3.83 11/21/14 4.91 $108.00 $28,797.00<br />

SMH Market Vectors - Semiconductors 10/31/14 4 Nov 22, 2014 51 Call 1.25 11/20/14 2.04 $316.00 $29,113.00<br />

XLK SPDR - Technology 10/31/14 5 Dec 20, 2014 40 Call 1.07 12/08/14 1.73 $330.00 $29,443.00<br />

SMH Market Vectors - Semiconductors 11/03/14 2 Dec 20, 2014 51 Call 2.20 12/15/14 3.13 $186.00 $29,629.00<br />

FXY Currency Shares - Japanese Yen 11/05/14 9 Dec 20, 2014 83 Put 0.58 12/10/14 1.38 $720.00 $30,349.00<br />

FXE Currency Shares - Euro 11/06/14 6 Nov 22, 2014 120 Put 0.84 11/14/14 0.28 -$336.00 $30,013.00<br />

XLB SPDR - Materials 11/11/14 7 Dec 20, 2014 49 Call 0.80 11/28/14 1.12 $224.00 $30,237.00<br />

USO US Oil Fund 11/13/14 10 Dec 20, 2014 27 Put 0.54 11/24/14 1.68 $1,140.00 $31,377.00<br />

TLT Barclays 20+ Yr Treasuries 11/25/14 3 Dec 20, 2014 120 Call 1.51 12/17/14 6.45 $1,482.00 $32,859.00<br />

OIH Market Vectors - Oil Service 11/26/14 8 Dec 20, 2014 40 Put 0.66 12/19/14 2.97 $1,848.00 $34,707.00<br />

XLE SPDR - Energies 11/28/14 5 Dec 20, 2014 77 Put 1.04 12/17/14 1.49 $225.00 $34,932.00<br />

XME SPDR - Metals & Mining 11/28/14 8 Jan 17, 2015 32 Put 0.67 12/31/14 1.43 $608.00 $35,540.00<br />

XOP SPDR - Oil & Gas Exploration 11/28/14 4 Dec 20, 2014 50 Put 1.47 12/17/14 3.80 $932.00 $36,472.00<br />

EEM MSCI - Emerging Markets 12/01/14 6 Jan 17, 2015 40 Put 0.81 12/22/14 1.05 $144.00 $36,616.00

Step 6<br />

10<br />

KRE SPDR - Regional Banking 12/01/14 7 Dec 20, 2014 39 Put 0.73 12/05/14 0.16 -$399.00 $36,217.00<br />

UNG US Natural Gas 12/02/14 5 Dec 20, 2014 20 Put 0.96 12/15/14 0.99 $15.00 $36,232.00<br />

EWZ MSCI - Brazil 12/08/14 9 Jan 17, 2015 35 Put 0.61 12/18/14 1.12 $459.00 $36,691.00<br />

XLB SPDR - Materials 12/10/14 9 Jan 17, 2015 46 Put 0.60 12/19/14 0.46 -$126.00 $36,565.00<br />

GDX Market Vectors - Gold Miners 12/15/14 5 Jan 17, 2015 18 Put 1.16 01/02/15 0.52 -$320.00 $36,245.00<br />

GDXJ Market Vectors - Jr. Gold Miners 12/15/14 7 Jan 17, 2015 20 Put 0.72 01/02/15 0.19 -$371.00 $35,874.00<br />

FXE Currency Shares - Euro 12/19/14 6 Jan 17, 2015 120 Put 0.94 02/03/15 3.75 $1,686.00 $37,560.00<br />

USO US Oil Fund 12/29/14 7 Jan 17, 2015 20 Put 0.78 01/14/15 1.81 $721.00 $38,281.00<br />

TLT Barclays 20+ Yr Treasuries 01/05/15 2 Feb 20, 2015 130 Call 2.17 02/04/15 4.44 $454.00 $38,735.00<br />

IEF Barclays 7-10 Yr Treasuries 01/06/15 4 Mar 20, 2015 108 Call 1.25 02/05/15 1.58 $132.00 $38,867.00<br />

KRE SPDR - Regional Banking 01/06/15 4 Feb 20, 2015 38 Put 1.22 01/22/15 0.70 -$208.00 $38,659.00<br />

FXI Currency Shares - China 01/08/15 3 Feb 20, 2015 42 Call 1.59 01/16/15 1.39 -$60.00 $38,599.00<br />

OIH Market Vectors - Oil Service 01/12/15 4 Feb 20, 2015 32 Put 1.47 01/22/15 0.64 -$332.00 $38,267.00<br />

XME SPDR - Metals & Mining 01/13/15 5 Feb 20, 2015 28 Put 1.01 02/03/15 0.43 -$290.00 $37,977.00<br />

EPI Wisdom Tree - India 01/15/15 7 Feb 20, 2015 23 Call 0.74 01/30/15 0.95 $147.00 $38,124.00<br />

GDX Market Vectors - Gold Miners 01/20/15 4 Feb 20, 2015 23 Call 1.17 01/28/15 0.54 -$252.00 $37,872.00<br />

FXI Currency Shares - China 01/21/15 4 Feb 20, 2015 43 Call 1.30 01/28/15 0.64 -$264.00 $37,608.00<br />

SLV Silver Trust 01/21/15 6 Feb 20, 2015 17 Call 0.88 01/29/15 0.27 -$366.00 $37,242.00<br />

FXE Currency Shares - Euro 01/23/15 4 Feb 20, 2015 110 Put 1.50 02/02/15 0.57 -$372.00 $36,870.00<br />

XLB SPDR - Materials 02/03/15 4 Mar 20, 2015 49 Call 1.24 03/04/15 2.35 $444.00 $37,314.00<br />

KRE SPDR - Regional Banking 02/05/15 4 Mar 20, 2015 39 Call 1.33 03/02/15 1.72 $156.00 $37,470.00<br />

DXJ Wisdom Tree - Japan 02/06/15 3 Mar 20, 2015 50 Call 1.80 03/17/15 5.65 $1,155.00 $38,625.00<br />

EWZ MSCI - Brazil 02/10/15 3 Mar 20, 2015 34 Put 1.69 02/18/15 0.91 -$234.00 $38,391.00<br />

XLK SPDR - Technology 02/10/15 5 Mar 20, 2015 41 Call 1.12 03/03/15 2.20 $540.00 $38,931.00<br />

FXY Currency Shares - Japanese Yen 02/11/15 7 Mar 20, 2015 80 Put 0.80 02/13/15 0.40 -$280.00 $38,651.00<br />

QQQ Nasdaq 100 Trust 02/11/15 3 Mar 20, 2015 105 Call 1.96 03/04/15 3.76 $540.00 $39,191.00<br />

SMH Market Vectors - Semiconductors 02/12/15 4 Mar 20, 2015 56 Call 1.45 03/06/15 1.35 -$40.00 $39,151.00<br />

GDX Market Vectors - Gold Miners 02/17/15 6 Mar 20, 2015 20 Put 0.81 02/26/15 0.32 -$294.00 $38,857.00<br />

SLV Silver Trust 02/17/15 7 Mar 20, 2015 16 Put 0.71 02/26/15 0.52 -$133.00 $38,724.00<br />

GDXJ Market Vectors - Jr. Gold Miners 02/23/15 5 Mar 20, 2015 25 Put 1.00 03/19/15 1.70 $350.00 $39,074.00<br />

FXE Currency Shares - Euro 02/26/15 4 Apr 17, 2015 110 Put 1.46 03/20/15 4.10 $1,056.00 $40,130.00<br />

EPI Wisdom Tree - India 03/02/15 6 Apr 17, 2015 24 Call 0.89 03/06/15 0.50 -$234.00 $39,896.00<br />

OIH Market Vectors - Oil Service 03/06/15 4 Apr 17, 2015 34 Put 1.30 03/20/15 1.42 $48.00 $39,944.00<br />

XLE SPDR - Energies 03/06/15 3 Apr 17, 2015 75 Put 1.86 03/18/15 1.15 -$213.00 $39,731.00

Step 6<br />

11<br />

XME SPDR - Metals & Mining 03/06/15 3 Apr 17, 2015 27 Put 1.86 03/23/15 0.91 -$285.00 $39,446.00<br />

XOP SPDR - Oil & Gas Exploration 03/09/15 2 Apr 17, 2015 48 Put 2.25 03/26/15 1.07 -$236.00 $39,210.00<br />

EEM MSCI - Emerging Markets 03/10/15 6 Apr 17, 2015 38 Put 0.82 03/18/15 0.21 -$366.00 $38,844.00<br />

FXI Currency Shares - China 03/10/15 8 Apr 17, 2015 40 Put 0.70 03/16/15 0.32 -$304.00 $38,540.00<br />

KRE SPDR - Regional Banking 03/12/15 4 Apr 17, 2015 41 Call 1.23 03/25/15 0.44 -$316.00 $38,224.00<br />

EWZ MSCI - Brazil 03/13/15 4 Apr 17, 2015 29 Put 1.24 03/18/15 0.49 -$300.00 $37,924.00<br />

USO US Oil Fund 03/13/15 5 Apr 17, 2015 17 Put 1.13 03/25/15 0.62 -$255.00 $37,669.00<br />

XLB SPDR - Materials 03/17/15 5 Apr 17, 2015 49 Put 1.02 04/06/15 0.36 -$330.00 $37,339.00<br />

IEF Barclays 7-10 Yr Treasuries 03/18/15 6 Apr 17, 2015 108 Call 0.85 04/09/15 0.40 -$270.00 $37,069.00<br />

TLT Barclays 20+ Yr Treasuries 03/18/15 2 Apr 17, 2015 131 Call 2.31 04/06/15 0.88 -$286.00 $36,783.00<br />

SLV Silver Trust 03/23/15 6 May 15, 2015 16 Call 0.85 04/08/15 0.41 -$264.00 $36,519.00<br />

SMH Market Vectors - Semiconductors 03/26/15 3 May 15, 2015 53 Put 1.55 04/07/15 0.75 -$240.00 $36,279.00<br />

FXI Currency Shares - China 03/30/15 4 May 15, 2015 45 Call 1.30 04/30/15 6.44 $2,056.00 $38,335.00<br />

EEM MSCI - Emerging Markets 04/02/15 5 May 15, 2015 41 Call 1.11 04/30/15 2.09 $490.00 $38,825.00<br />

XLE SPDR - Energies 04/15/15 2 May 15, 2015 82 Call 2.17 05/06/15 0.64 -$306.00 $38,519.00<br />

DXJ Wisdom Tree - Japan 04/21/15 3 Jun 19, 2015 57 Call 1.95 04/30/15 1.31 -$192.00 $38,327.00<br />

SLV Silver Trust 04/22/15 5 Jun 19, 2015 16 Put 1.16 04/27/15 0.78 -$190.00 $38,137.00<br />

QQQ Nasdaq 100 Trust 04/23/15 3 Jun 19, 2015 110 Call 1.93 04/30/15 1.27 -$198.00 $37,939.00<br />

XLK SPDR - Technology 04/23/15 4 Jun 19, 2015 42 Call 1.44 05/06/15 0.95 -$196.00 $37,743.00<br />

EPI Wisdom Tree - India 04/24/15 6 Jun 19, 2015 22 Put 0.85 05/04/15 0.66 -$114.00 $37,629.00<br />

XLB SPDR - Materials 04/27/15 4 Jun 19, 2015 50 Call 1.48 05/07/15 1.50 $8.00 $37,637.00<br />

GDX Market Vectors - Gold Miners 04/28/15 4 Jun 19, 2015 20 Call 1.35 05/07/15 0.87 -$192.00 $37,445.00<br />

TLT Barclays 20+ Yr Treasuries 04/29/15 6 Jun 19, 2015 120 Put 0.87 05/26/15 1.20 $198.00 $37,643.00<br />

GDXJ Market Vectors - Jr. Gold Miners 05/13/15 3 Jun 19, 2015 26 Call 1.80 05/26/15 0.75 -$315.00 $37,328.00<br />

KRE SPDR - Regional Banking 05/13/15 6 Jun 19, 2015 42 Call 0.87 06/18/15 2.55 $1,008.00 $38,336.00<br />

SLV Silver Trust 05/13/15 7 Jun 19, 2015 16 Call 0.71 05/26/15 0.42 -$203.00 $38,133.00<br />

SMH Market Vectors - Semiconductors 05/18/15 4 Jun 19, 2015 57 Call 1.40 06/05/15 1.12 -$112.00 $38,021.00<br />

FXY Currency Shares - Japanese Yen 05/19/15 11 Jun 19, 2015 80 Put 0.50 06/10/15 1.10 $660.00 $38,681.00<br />

XLE SPDR - Energies 05/19/15 2 Jul 17, 2015 80 Put 2.66 07/08/15 7.16 $900.00 $39,581.00<br />

XOP SPDR - Oil & Gas Exploration 05/19/15 2 Jul 17, 2015 50 Put 2.59 07/08/15 6.82 $846.00 $40,427.00<br />

DXJ Wisdom Tree - Japan 05/22/15 4 Jun 19, 2015 59 Call 1.26 06/08/15 0.93 -$132.00 $40,295.00<br />

EWZ MSCI - Brazil 05/22/15 2 Jul 17, 2015 35 Put 2.21 06/10/15 2.20 -$2.00 $40,293.00<br />

GDX Market Vectors - Gold Miners 05/26/15 7 Jul 17, 2015 19 Put 0.78 07/14/15 2.25 $1,029.00 $41,322.00<br />

XME SPDR - Metals & Mining 05/26/15 6 Jul 17, 2015 27 Put 0.86 06/03/15 0.64 -$132.00 $41,190.00

Step 6<br />

12<br />

XLK SPDR - Technology 05/27/15 5 Jun 19, 2015 43 Call 1.01 06/05/15 0.41 -$300.00 $40,890.00<br />

TLT Barclays 20+ Yr Treasuries 06/03/15 3 Jul 17, 2015 115 Put 1.65 06/16/15 0.81 -$252.00 $40,638.00<br />

EEM MSCI - Emerging Markets 06/04/15 5 Jul 17, 2015 40 Put 0.99 06/18/15 0.72 -$135.00 $40,503.00<br />

SLV Silver Trust 06/04/15 6 Jul 17, 2015 16 Put 0.83 06/18/15 0.72 -$66.00 $40,437.00<br />

EPI Wisdom Tree - India 06/08/15 8 Jul 17, 2015 21 Put 0.70 06/18/15 0.30 -$320.00 $40,117.00<br />

KRE SPDR - Regional Banking 06/16/15 8 Jul 17, 2015 45 Call 0.68 06/30/15 0.44 -$192.00 $39,925.00<br />

OIH Market Vectors - Oil Service 06/18/15 8 Jul 17, 2015 36 Put 0.70 07/16/15 2.60 $1,520.00 $41,445.00<br />

XLE SPDR - Energies 06/19/15 6 Jul 17, 2015 75 Put 0.81 07/16/15 1.75 $564.00 $42,009.00<br />

XOP SPDR - Oil & Gas Exploration 06/19/15 4 Jul 17, 2015 48 Put 1.37 07/16/15 5.06 $1,476.00 $43,485.00<br />

XLB SPDR - Materials 06/24/15 7 Jul 17, 2015 50 Put 0.78 07/14/15 1.90 $784.00 $44,269.00<br />

GDX Market Vectors - Gold Miners 06/25/15 5 Jul 17, 2015 19 Put 0.97 07/16/15 2.82 $925.00 $45,194.00<br />

XME SPDR - Metals & Mining 06/25/15 6 Jul 17, 2015 26 Put 0.82 07/16/15 3.80 $1,788.00 $46,982.00<br />

SMH Market Vectors - Semiconductors 06/26/15 4 Aug 21, 2015 55 Put 1.40 07/27/15 4.20 $1,120.00 $48,102.00<br />

FXI Currency Shares - China 06/29/15 3 Aug 21, 2015 45 Put 1.94 08/10/15 3.65 $513.00 $48,615.00<br />

GDXJ Market Vectors - Jr. Gold Miners 06/29/15 5 Aug 21, 2015 24 Put 1.04 08/07/15 4.82 $1,890.00 $50,505.00<br />

VGK Vanguard - European 06/29/15 3 Aug 21, 2015 54 Put 1.60 07/07/15 2.27 $201.00 $50,706.00<br />

XLK SPDR - Technology 06/29/15 5 Aug 21, 2015 42 Put 1.08 07/13/15 0.87 -$105.00 $50,601.00<br />

FXE Currency Shares - Euro 07/01/15 7 Aug 21, 2015 105 Put 0.80 07/27/15 0.18 -$434.00 $50,167.00<br />

USO US Oil Fund 07/01/15 4 Aug 21, 2015 20 Put 1.46 08/19/15 6.55 $2,036.00 $52,203.00<br />

EWZ MSCI - Brazil 07/06/15 4 Aug 21, 2015 32 Put 1.43 08/21/15 6.65 $2,088.00 $54,291.00<br />

EEM MSCI - Emerging Markets 07/07/15 5 Aug 21, 2015 38 Put 1.08 07/16/15 0.49 -$295.00 $53,996.00<br />

SLV Silver Trust 07/07/15 6 Aug 21, 2015 15 Put 0.91 07/31/15 0.99 $48.00 $54,044.00<br />

DXJ Wisdom Tree - Japan 07/08/15 2 Aug 21, 2015 55 Put 2.42 07/15/15 0.43 -$398.00 $53,646.00<br />

OIH Market Vectors - Oil Service 07/22/15 4 Aug 21, 2015 32 Put 1.47 08/06/15 1.14 -$132.00 $53,514.00<br />

XLE SPDR - Energies 07/22/15 3 Aug 21, 2015 71 Put 1.53 08/12/15 2.51 $294.00 $53,808.00<br />

XOP SPDR - Oil & Gas Exploration 07/22/15 3 Aug 21, 2015 40 Put 1.79 08/12/15 1.75 -$12.00 $53,796.00<br />

XLB SPDR - Materials 07/27/15 5 Aug 21, 2015 45 Put 1.08 08/05/15 0.47 -$305.00 $53,491.00<br />

USO US Oil Fund 08/03/15 8 Sep 18, 2015 15 Put 0.67 08/28/15 1.58 $728.00 $54,219.00<br />

FXY Currency Shares - Japanese Yen 08/05/15 3 Sep 18, 2015 79 Put 1.70 08/12/15 1.27 -$129.00 $54,090.00<br />

GDX Market Vectors - Gold Miners 08/05/15 7 Sep 18, 2015 13 Put 0.75 08/10/15 0.51 -$168.00 $53,922.00<br />

EWZ MSCI - Brazil 08/06/15 4 Sep 18, 2015 27 Put 1.23 08/26/15 2.65 $568.00 $54,490.00<br />

XME SPDR - Metals & Mining 08/07/15 5 Sep 18, 2015 20 Put 1.16 08/28/15 1.21 $25.00 $54,515.00<br />

EEM MSCI - Emerging Markets 08/11/15 5 Sep 18, 2015 36 Put 1.04 08/20/15 2.39 $675.00 $55,190.00<br />

FXE Currency Shares - Euro 08/12/15 3 Sep 18, 2015 109 Call 1.83 08/27/15 2.20 $111.00 $55,301.00

Step 6<br />

13<br />

FXI Currency Shares - China 08/18/15 5 Sep 18, 2015 39 Put 1.16 09/09/15 2.47 $655.00 $55,956.00<br />

SMH Market Vectors - Semiconductors 08/19/15 5 Sep 18, 2015 49 Put 1.15 08/31/15 1.45 $150.00 $56,106.00<br />

VGK Vanguard - European 08/19/15 3 Sep 18, 2015 55 Put 1.87 09/16/15 3.12 $375.00 $56,481.00<br />

DXJ Wisdom Tree - Japan 08/20/15 3 Sep 18, 2015 55 Put 1.58 09/17/15 3.41 $549.00 $57,030.00<br />

KRE SPDR - Regional Banking 08/20/15 5 Sep 18, 2015 42 Put 1.03 09/08/15 1.72 $345.00 $57,375.00<br />

TLT Barclays 20+ Yr Treasuries 08/20/15 3 Sep 18, 2015 125 Call 1.76 08/26/15 0.95 -$243.00 $57,132.00<br />

XLK SPDR - Technology 08/20/15 6 Sep 18, 2015 41 Put 0.81 09/09/15 1.08 $162.00 $57,294.00<br />

OIH Market Vectors - Oil Service 08/21/15 4 Sep 18, 2015 28 Put 1.25 08/28/15 0.56 -$276.00 $57,018.00<br />

UNG US Natural Gas 08/21/15 9 Sep 18, 2015 13 Put 0.56 09/03/15 0.47 -$81.00 $56,937.00<br />

XLE SPDR - Energies 08/21/15 3 Sep 18, 2015 64 Put 1.95 09/17/15 0.88 -$321.00 $56,616.00<br />

XOP SPDR - Oil & Gas Exploration 08/21/15 3 Sep 18, 2015 35 Put 1.81 08/31/15 0.97 -$252.00 $56,364.00<br />

FXY Currency Shares - Japanese Yen 08/24/15 4 Sep 18, 2015 82 Call 1.25 09/01/15 0.55 -$280.00 $56,084.00<br />

GDXJ Market Vectors - Jr. Gold Miners 08/26/15 4 Sep 18, 2015 19 Put 1.36 08/31/15 0.78 -$232.00 $55,852.00<br />

SLV Silver Trust 08/26/15 7 Sep 18, 2015 14 Put 0.78 09/03/15 0.31 -$329.00 $55,523.00<br />

EWZ MSCI - Brazil 09/21/15 4 Oct 16, 2015 23 Put 1.35 09/24/15 2.75 $560.00 $56,083.00<br />

XME SPDR - Metals & Mining 09/22/15 5 Oct 16, 2015 18 Put 1.11 09/25/15 1.20 $45.00 $56,128.00<br />

HYG High Yield 09/24/15 4 Oct 16, 2015 85 Put 1.25 09/30/15 2.39 $456.00 $56,584.00<br />

XLV SPDR - HealthCare 09/25/15 5 Oct 16, 2015 65 Put 1.03 09/28/15 2.11 $540.00 $57,124.00<br />

UNG US Natural Gas 09/29/15 5 Oct 16, 2015 13 Put 1.16 10/08/15 1.52 $180.00 $57,304.00<br />

XLU SPDR - Utilities 10/05/15 6 Nov 20, 2015 44 Call 0.94 10/23/15 1.09 $90.00 $57,394.00<br />

XLP SPDR - Consumer Staples 10/05/15 6 Nov 20, 2015 49 Call 0.86 10/14/15 0.71 -$90.00 $57,304.00<br />

XLK SPDR - Technology 10/15/15 6 Dec 18, 2015 42 Call 0.95 11/09/15 2.29 $804.00 $58,108.00<br />

XLY SPDR - Consumer Discretionary 10/19/15 5 Nov 20, 2015 79 Call 1.02 11/09/15 1.70 $340.00 $58,448.00<br />

FXE Currency Shares - Euro 10/22/15 4 Dec 18, 2015 108 Put 1.34 11/06/15 3.29 $780.00 $59,228.00<br />

KRE SPDR - Regional Banking 10/23/15 5 Dec 18, 2015 43 Call 1.15 11/12/15 2.40 $625.00 $59,853.00<br />

FXY Currency Shares - Japanese Yen 10/23/15 4 Nov 20, 2015 81 Put 1.50 11/06/15 2.20 $280.00 $60,133.00<br />

GLD Gold Trust 11/03/15 3 Dec 18, 2015 107 Put 1.94 11/12/15 4.15 $663.00 $60,796.00<br />

SLV Silver Trust 11/03/15 7 Dec 18, 2015 15 Put 0.73 12/04/15 1.18 $315.00 $61,111.00<br />

TLT Barclays 20+ Yr Treasuries 11/03/15 3 Dec 18, 2015 120 Put 1.89 11/12/15 2.72 $249.00 $61,360.00<br />

GDX Market Vectors - Gold Miners 11/04/15 5 Dec 18, 2015 15 Put 1.02 11/19/15 1.39 $185.00 $61,545.00<br />

EWC MSCI - Canada 11/06/15 6 Dec 18, 2015 24 Put 0.90 11/16/15 1.15 $150.00 $61,695.00<br />

FXI Currency Shares - China 11/09/15 4 Dec 18, 2015 38 Put 1.26 11/20/15 0.91 -$140.00 $61,555.00<br />

HYG High Yield 11/09/15 5 Dec 18, 2015 84 Put 1.09 12/02/15 1.02 -$35.00 $61,520.00<br />

XME SPDR - Metals & Mining 11/11/15 5 Dec 18, 2015 17 Put 1.16 12/01/15 1.02 -$70.00 $61,450.00

Step 6<br />

14<br />

XRT SPDR - Retail 11/12/15 4 Dec 18, 2015 44 Put 1.30 11/16/15 2.06 $304.00 $61,754.00<br />

XLE SPDR - Energies 12/03/15 2 Jan 15, 2016 64 Put 2.41 12/08/15 4.91 $500.00 $62,254.00<br />

XOP SPDR - Oil & Gas Exploration 12/03/15 4 Jan 15, 2016 33 Put 1.32 12/08/15 2.42 $440.00 $62,694.00<br />

OIH Market Vectors - Oil Service 12/07/15 3 Jan 15, 2016 28 Put 1.51 12/23/15 1.45 -$18.00 $62,676.00<br />

FXY Currency Shares - Japanese Yen 12/09/15 6 Jan 15, 2016 80 Call 0.82 12/14/15 1.01 $114.00 $62,790.00<br />

FXI Currency Shares - China 12/10/15 4 Jan 15, 2016 35 Put 1.22 12/14/15 1.54 $128.00 $62,918.00<br />

XME SPDR - Metals & Mining 12/14/15 6 Jan 15, 2016 15 Put 0.90 12/22/15 0.50 -$240.00 $62,678.00<br />

EWC MSCI - Canada 12/14/15 4 Jan 15, 2016 22 Put 1.20 01/04/16 0.97 -$92.00 $62,586.00<br />

XLY SPDR - Consumer Discretionary 01/04/16 3 Feb 19, 2016 75 Put 1.70 01/26/16 2.29 $177.00 $62,763.00<br />

EEM MSCI - Emerging Markets 01/04/16 6 Feb 19, 2016 31 Put 0.94 01/14/16 1.74 $480.00 $63,243.00<br />

FXE Currency Shares - Euro 01/05/16 4 Feb 19, 2016 105 Put 1.41 01/07/16 0.84 -$228.00 $63,015.00<br />

EWZ MSCI - Brazil 01/07/16 5 Feb 19, 2016 19 Put 1.01 01/26/16 1.59 $290.00 $63,305.00<br />

XOP SPDR - Oil & Gas Exploration 01/07/16 2 Feb 19, 2016 29 Put 2.23 01/21/16 3.37 $228.00 $63,533.00<br />

XLE SPDR - Energies 01/07/16 2 Feb 19, 2016 56 Put 2.26 01/21/16 3.91 $330.00 $63,863.00<br />

GDX Market Vectors - Gold Miners 01/07/16 7 Feb 19, 2016 14 Call 0.76 01/11/16 0.72 -$28.00 $63,835.00<br />

XLV SPDR - HealthCare 01/07/16 4 Feb 19, 2016 67 Put 1.40 01/21/16 1.84 $176.00 $64,011.00<br />

XLP SPDR - Consumer Staples 01/08/16 8 Feb 19, 2016 48 Put 0.69 01/21/16 0.91 $176.00 $64,187.00<br />

TLT Barclays 20+ Yr Treasuries 01/13/16 3 Feb 19, 2016 125 Call 2.07 01/21/16 2.23 $48.00 $64,235.00<br />

XRT SPDR - Retail 01/13/16 6 Feb 19, 2016 40 Put 0.93 01/21/16 1.18 $150.00 $64,385.00<br />

GLD Gold Trust 01/26/16 3 Feb 19, 2016 107 Call 1.81 02/09/16 6.83 $1,506.00 $65,891.00<br />

XLU SPDR - Utilities 02/01/16 6 Mar 18, 2016 46 Call 0.92 02/11/16 1.05 $78.00 $65,969.00<br />

FXE Currency Shares - Euro 02/03/16 4 Mar 18, 2016 109 Call 1.49 02/12/16 2.23 $296.00 $66,265.00<br />

SLV Silver Trust 02/03/16 5 Mar 18, 2016 13 Call 1.08 02/16/16 1.70 $310.00 $66,575.00<br />

GDX Market Vectors - Gold Miners 02/11/16 5 Mar 18, 2016 19 Call 1.07 3/9/2016 2.14 $535.00 $67,110.00<br />

GDXJ Market Vectors - Jr. Gold Miners 02/11/16 3 Mar 18, 2016 20 Call 1.76 3/1/2016 1.97 $63.00 $67,173.00<br />

XLP SPDR - Consumer Staples 02/25/16 5 Mar 18, 2016 51 Call 1.03 2/26/2016 0.77 -$130.00 $67,043.00<br />

XLB SPDR - Materials 03/01/16 5 Apr 15, 2016 43 Call 1.15 4/6/2016 1.63 $240.00 $67,283.00<br />

XLK SPDR - Technology 03/01/16 5 Apr 15, 2016 42 Call 0.96 4/5/2016 2.30 $670.00 $67,953.00<br />

XME SPDR - Metals & Mining 03/01/16 7 Apr 15, 2016 17 Call 0.76 3/8/2016 2.27 $1,057.00 $69,010.00<br />

XLY SPDR - Consumer Discretionary 03/03/16 3 Apr 15, 2016 77 Call 1.51 4/5/2016 1.61 $30.00 $69,040.00<br />

XRT SPDR - Retail 03/03/16 3 Apr 15, 2016 44 Call 1.61 3/23/2016 1.48 -$39.00 $69,001.00<br />

XLU SPDR - Utilities 03/08/16 8 Apr 15, 2016 48 Call 0.62 4/5/2016 1.03 $328.00 $69,329.00<br />

EEM MSCI - Emerging Markets 03/11/16 5 Apr 15, 2016 33 Call 0.98 4/4/2016 1.01 $15.00 $69,344.00<br />

QQQ Nasdaq 100 Trust 03/16/16 4 Apr 15, 2016 108 Call 1.48 4/11/2016 1.37 -$44.00 $69,300.00

Step 6<br />

15<br />

XLE SPDR - Energies 03/16/16 4 Apr 15, 2016 63 Call 1.47 3/23/2016 0.94 -$212.00 $69,088.00<br />

XLP SPDR - Consumer Staples 03/30/16 5 May 20, 2016 53 Call 1.04 4/13/2016 0.69 -$175.00 $68,913.00<br />

XLV SPDR - HealthCare 04/04/16 5 May 20, 2016 70 Call 1.06 04/28/16 1.83 $385.00 $69,298.00<br />

FXY Currency Shares - Japanese Yen 04/05/16 4 May 20, 2016 88 Call 1.24 4/20/2016 1.25 $4.00 $69,302.00<br />

GDXJ Market Vectors - Jr. Gold Miners 04/08/16 3 May 20, 2016 30 Call 2.07 4/22/2016 4.00 $579.00 $69,881.00<br />

XOP SPDR - Oil & Gas Exploration 04/12/16 2 May 20, 2016 33 Call 2.13 4/28/2016 4.22 $418.00 $70,299.00<br />

EWZ MSCI - Brazil 04/12/16 3 May 20, 2016 28 Call 1.92 4/21/2016 1.38 -$162.00 $70,137.00<br />

XME SPDR - Metals & Mining 04/12/16 3 May 20, 2016 21 Call 1.55 4/25/2016 2.06 $153.00 $70,290.00<br />

XLB SPDR - Materials 04/13/16 6 May 20, 2016 46 Call 0.88 5/3/2016 1.04 $96.00 $70,386.00<br />

XLY SPDR - Consumer Discretionary 04/19/16 4 May 20, 2016 80 Call 1.24 4/28/2016 0.61 -$252.00 $70,134.00<br />

QQQ Nasdaq 100 Trust 04/28/16 3 May 20, 2016 106 Put 1.53 5/6/2016 1.90 $111.00 $70,245.00<br />

Trades are based on a $10,000 account with $500 allocated per trade.<br />

Totals<br />

Averages<br />

Trades 312 $ 70,245.00 $ 225.14<br />

Wins 170 54.49% $ 100,975.00 $ 593.97<br />

Losses 142 45.51% $ (30,730.00) $ (216.41)<br />

Ratio 3.29<br />

Largest Win $ 2,088.00<br />

Largest Loss $ (480.00)<br />

Stock and option trading have large potential rewards, but also large potential risks.<br />

You must be aware of the risks and willing to accept them in order to invest in the market.<br />

Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to buy/sell any stock.