BusinessDay 07 Nov 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14<br />

BUSINESS DAY<br />

COMPANIES & MARKETS<br />

C002D5556<br />

Tuesday <strong>07</strong> <strong>Nov</strong>ember <strong>2017</strong><br />

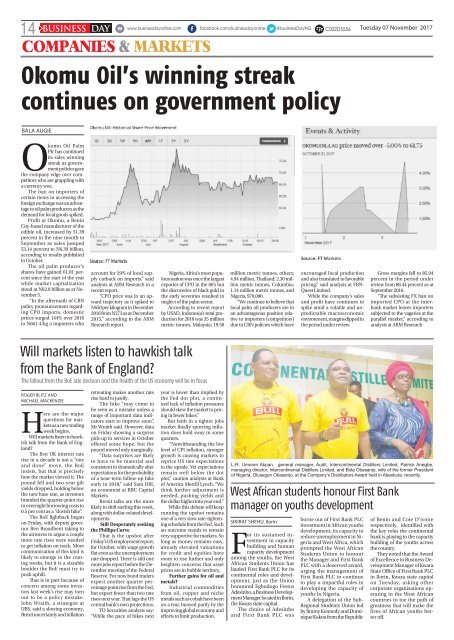

Okomu Oil’s winning streak<br />

continues on government policy<br />

BALA AUGIE<br />

Okomu Oil Palm<br />

Plc has continued<br />

its sales winning<br />

streak as government<br />

policies gave<br />

the company edge over competitors<br />

who are grappling with<br />

a currency woe.<br />

The ban on importers of<br />

certain items in accessing the<br />

foreign exchange was an advantage<br />

to oil palm producers as the<br />

demand for local goods spiked.<br />

Profit at Okomu, a Benin<br />

City-based manufacturer of the<br />

edible oil, increased by 51.39<br />

percent in the nine month to<br />

September as sales jumped<br />

53.14 percent to N6.39 billion,<br />

according to results published<br />

in October.<br />

The oil palm producer’s<br />

shares have gained 61.81 percent<br />

since the start of the year<br />

while market capitalization<br />

stood at N62.0 billion as at <strong>Nov</strong>ember<br />

5.<br />

“In the aftermath of CBN<br />

policy pronouncement regarding<br />

CPO imports, domestic<br />

prices surged 144% over 2016<br />

to N661.4/kg a importers who<br />

account for 29% of local supply<br />

cutback on imports,” said<br />

analysts at ARM Research in a<br />

recent report.<br />

“CPO price was in an upward<br />

trajectory as it spiked to<br />

N650 per kilogram in December<br />

2016 from N273 as at December<br />

2015,” according to the ARM<br />

Research report.<br />

Nigeria, Africa’s most populous<br />

nation was once the largest<br />

exporter of CPO in the 60’s but<br />

the discoveries of black gold in<br />

the early seventies resulted in<br />

neglect of the palm sector.<br />

According to recent report<br />

by USAD, Indonesia’s total production<br />

for 2016 was 35 million<br />

metric tonnes, Malaysia; 19.50<br />

million metric tonnes, others;<br />

4.94 million, Thailand; 2.30 million<br />

metric tonnes, Columbia;<br />

1.14 million metric tonnes, and<br />

Nigeria, 970,000.<br />

“We continue to believe that<br />

local palm oil producers are in<br />

an advantageous position relative<br />

to importers (competitors)<br />

due to CBN policies which have<br />

encouraged local production<br />

and also translated to favorable<br />

pricing,” said analysts at FBN-<br />

Quest Limited.<br />

While the company’s sales<br />

and profit have continues to<br />

spike amid a volatile and unpredictable<br />

macroeconomic<br />

environment, margins dipped in<br />

the period under review.<br />

Gross margins fell to 85.04<br />

percent in the period under<br />

review from 88.44 percent as at<br />

September 2016.<br />

“The subsisting FX ban on<br />

imported CPO at the interbank<br />

market leaves importers<br />

subjected to the vagaries at the<br />

parallel market,” according to<br />

analysts at ARM Research<br />

Will markets listen to hawkish talk<br />

from the Bank of England?<br />

The fallout from the BoE rate decision and the health of the US economy will be in focus<br />

Roger Blitz and<br />

Michael Mackenzie<br />

Here are the major<br />

questions for markets<br />

as a new trading<br />

week begins.<br />

Will markets listen to hawkish<br />

talk from the Bank of England?<br />

The first UK interest rate<br />

rise in a decade is not a “one<br />

and done” move, the BoE<br />

insists, but that is precisely<br />

how the market viewed it. The<br />

pound fell and two-year gilt<br />

yields dropped, holding below<br />

the new base rate, as investors<br />

branded the quarter-point rise<br />

in overnight borrowing costs to<br />

0.5 per cent as a “dovish hike”.<br />

The BoE fightback began<br />

on Friday, with deputy governor<br />

Ben Broadbent taking to<br />

the airwaves to argue a couple<br />

more rate rises were needed<br />

to get inflation on track. More<br />

communication of this kind is<br />

likely to emerge in the coming<br />

weeks, but it is a sizeable<br />

boulder the BoE must try to<br />

push uphill.<br />

That is in part because of<br />

concern among some investors<br />

last week’s rise may turn<br />

out to be a policy mistake.<br />

John Wraith, a strategist at<br />

UBS, said a slowing economy,<br />

Brexit uncertainty and inflation<br />

retreating makes another rate<br />

rise hard to justify.<br />

The hike “may come to<br />

be seen as a mistake unless a<br />

range of important data indicators<br />

start to improve soon”,<br />

Mr Wraith said. However, data<br />

on Friday showing a surprise<br />

pick-up in services in October<br />

offered some hope, but the<br />

pound moved only marginally.<br />

“Data surprises are likely<br />

to have to be material and<br />

consistent to dramatically alter<br />

expectations for the probability<br />

of a near-term follow-up hike<br />

early in 2018,” said Sam Hill,<br />

an economist at RBC Capital<br />

Markets.<br />

Brexit talks are the more<br />

likely to shift sterling this week,<br />

along with dollar-related developments.<br />

Still Desperately seeking<br />

the Phillips Curve<br />

That is the upshot after<br />

Friday’s US employment report,<br />

for October, with wage growth<br />

flat even as the unemployment<br />

rate dropped. There is still one<br />

more jobs report before the December<br />

meeting of the Federal<br />

Reserve. For now bond traders<br />

expect another quarter percentage<br />

point rise from the Fed,<br />

but expect fewer than two rate<br />

rises next year. That lags the US<br />

central bank’s own projections.<br />

TD Securities analysts say:<br />

“While the pace of hikes next<br />

year is lower than implied by<br />

the Fed dot plot, a continued<br />

lack of inflation pressures<br />

should skew the market to pricing<br />

in fewer hikes.’’<br />

But faith in a tighter jobs<br />

market finally spurring inflation<br />

does hold sway in some<br />

quarters.<br />

“Notwithstanding the low<br />

level of CPI inflation, stronger<br />

growth is causing markets to<br />

reprice US rate expectations<br />

to the upside. Yet expectations<br />

remain well below the dot<br />

plot,” caution analysts at Bank<br />

of America Merrill Lynch. “We<br />

think further adjustment is<br />

needed, pushing yields and<br />

the dollar higher into year end.”<br />

While this debate will keep<br />

running the upshot remains<br />

one of a very slow rate-tightening<br />

schedule from the Fed. Such<br />

an outcome stands to remain<br />

very supportive for markets. So<br />

long as money remains easy,<br />

already elevated valuations<br />

for credit and equities have<br />

room to rise further and only<br />

heighten concerns that asset<br />

prices are in bubble territory.<br />

Further gains for oil and<br />

metals?<br />

Industrial commodities<br />

from oil, copper and niche<br />

metals such as cobalt have been<br />

on a tear, buoyed partly by the<br />

improving global economy and<br />

efforts to limit production.<br />

L-R: Umoren Akpan, general manager, Audit, Intercontinental Distillers Limited; Patrick Anegbe,<br />

managing director, Intercontinental Distillers Limited, and Bola Obasanjo, wife of the former President<br />

of Nigeria, Olusegun Obasanjo, at the Company’s Distributors Award held in Abeokuta, recently.<br />

West African students honour First Bank<br />

manager on youths development<br />

SIKIRAT SHEHU, Ilorin<br />

For its sustained investment<br />

in capacity<br />

building and human<br />

capacity development<br />

among the youths, the West<br />

African Students Union has<br />

lauded First Bank PLC for its<br />

continental roles and development,<br />

just as the Union<br />

honoured Egbodogo Festus<br />

Adesinbo, a Business Development<br />

Manager located in Ilorin,<br />

the Kwara state capital.<br />

The choice of Adesinbo<br />

and First Bank PLC was<br />

borne out of First Bank PLC<br />

investment in African youths<br />

development, its capacity to<br />

reduce unemployment in Nigeria<br />

and West Africa, which<br />

prompted the West African<br />

Students Union to honour<br />

the Manager and First Bank<br />

PLC with a deserved award,<br />

urging the management of<br />

First Bank PLC to continue<br />

to play a impactful roles in<br />

developing the capacity of<br />

youths in Nigeria.<br />

A delegation of the Sub-<br />

Regional Students Union led<br />

by Jimmy Kennedy and Dominique<br />

Kakou from the Republic<br />

of Benin and Cote D’ivoire<br />

respectively, identified with<br />

the key roles the continental<br />

bank is playing in the capacity<br />

building of the youths across<br />

the country.<br />

They noted that the Award<br />

of Excellence to Business Development<br />

Manager of Kwara<br />

State Office of First Bank PLC<br />

in Ilorin, Kwara state capital<br />

on Tuesday, asking other<br />

corporate organisations operating<br />

in the West African<br />

countries to toe the path of<br />

greatness that will make the<br />

lives of African youths better<br />

off.