BusinessDay 11 Dec 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32 BUSINESS DAY C002D5556 Monday <strong>11</strong> <strong>Dec</strong>ember <strong>2017</strong><br />

Stocks Currencies Commodities Rates + Bonds Economics Funds Week Ahead Watchlist P.E<br />

Militancy, strikes could undermine<br />

Nigeria’s oil production target<br />

Investors lose appetite for restaurant<br />

stocks despite technology boom<br />

page 33 page 33<br />

economy<br />

Leadway’s valuation could<br />

top N58.39 billion if listed<br />

….Insurer is efficient as return on equity spikes<br />

BALA AUGIE<br />

Leadway Assurance<br />

Limited valuation<br />

could top N58.39<br />

billion based on<br />

peer valuation<br />

and the Nigerian insurer<br />

would be have been the<br />

largest insurance firm by<br />

market value if it was listed.<br />

The valuation is based<br />

on peer price to sales or<br />

premium ratio of 1.08x as<br />

a multiple of the insurer’s<br />

gross premium income of<br />

N53.32 billion as at <strong>Dec</strong>ember<br />

2016.<br />

Leadway’s Assurance’s<br />

estimated market capitalization<br />

is two times the<br />

N22.57 billion market cap of<br />

most capitalized listed firm,<br />

AXA Mansard Insurance.<br />

Leadway Assurance has<br />

utilized the resources of<br />

owners in generating higher<br />

profits as return on average<br />

equity (ROAE) spiked amid<br />

volatile and tough operating<br />

environment.<br />

The ROAE is a measure of<br />

profitability paramount to<br />

investors and shareholders<br />

of insurance stocks because<br />

it measures how many naira<br />

of profit a company generates<br />

with each naira of<br />

shareholders’ equity.<br />

For the year ended <strong>Dec</strong>ember<br />

2016, ROAE increased<br />

to 39.30 percent<br />

from 14.40 percent as at<br />

<strong>Dec</strong>ember 2015. Return on<br />

Average Asset (ROAA) rose<br />

to 7.1 percent in <strong>Dec</strong>ember<br />

2016 as against 2.60 percent<br />

as at <strong>Dec</strong>ember 2015.<br />

Analysts say if Leadway<br />

Assurance were a listed<br />

firm, investors would value<br />

its stock higher than peer<br />

rivals.<br />

The Nigerian insurer’s<br />

innovative and market<br />

penetrating products lifted<br />

premium income amid a<br />

myriad of challenges holding<br />

back the growth of operators<br />

in the industry.<br />

Gross premium income<br />

(GPI) and Net Premium<br />

Income (NPI) increased by<br />

4.87 percent and 3.30 percent<br />

to N53.65 percent and<br />

N41.25 billion respectively.<br />

Leadway Assurance<br />

controls 25.15 percent of<br />

life insurance market in<br />

Nigeria, the highest in the<br />

industry, according to a<br />

recent report by investment<br />

house Chapel Hill Denham<br />

Research Limited.<br />

According to Chapel<br />

Hill Denham Research,<br />

Nigeria’s Life insurance<br />

premium is forecast to grow<br />

12.10 percent between 2015<br />

and 2025. The investment<br />

says the forecast is based<br />

on its assumed population<br />

growth of 3.0 percent per<br />

annum.<br />

“We estimate density<br />

(consumption per capital)<br />

will rise by 8.10 percent<br />

p.a to N1.36 by 2025, indicating<br />

a possible 2.60<br />

times expansion of life insurance<br />

premium income<br />

to N320.68 billion,” said<br />

analysts at the investment<br />

house.<br />

Further analysis of the financial<br />

statement of Leadway<br />

Assurance shows the<br />

insurer recorded an underwriting<br />

profit of N10.53 billion<br />

as at <strong>Dec</strong>ember 2016,<br />

thanks to a 75.55 percent<br />

reduction in underwriting<br />

expenses to N9.51 billion<br />

in the period under review.<br />

Leadway Assurance has<br />

an efficient underwriting<br />

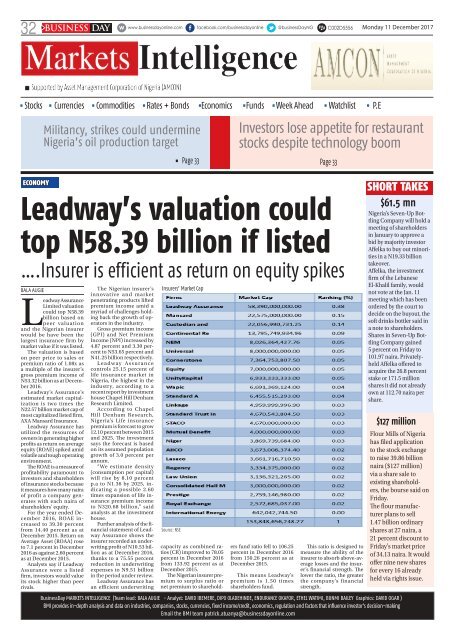

Insurers’ Market Cap<br />

Source: NSE<br />

capacity as combined ratios<br />

(CR) improved to 78.05<br />

percent in <strong>Dec</strong>ember 2016<br />

from 133.92 percent as at<br />

<strong>Dec</strong>ember 2015.<br />

The Nigerian insurer premium<br />

to surplus ratio or<br />

net premium to shareholders<br />

fund ratio fell to 106.25<br />

percent in <strong>Dec</strong>ember 2016<br />

from 150.26 percent as at<br />

<strong>Dec</strong>ember 2015.<br />

This means Leadway’s<br />

premium is 1.50 times<br />

shareholders fund.<br />

This ratio is designed to<br />

measure the ability of the<br />

insurer to absorb above-average<br />

losses and the insurer’s<br />

financial strength. The<br />

lower the ratio, the greater<br />

the company’s financial<br />

strength.<br />

SHORT TAKES<br />

$61.5 mn<br />

Nigeria’s Seven-Up Bottling<br />

Company will hold a<br />

meeting of shareholders<br />

in January to approve a<br />

bid by majority investor<br />

Affelka to buy out minorities<br />

in a N19.33 billion<br />

takeover.<br />

Affelka, the investment<br />

firm of the Lebanese<br />

El-Khalil family, would<br />

not vote at the Jan. <strong>11</strong><br />

meeting which has been<br />

ordered by the court to<br />

decide on the buyout, the<br />

soft drinks bottler said in<br />

a note to shareholders.<br />

Shares in Seven-Up Bottling<br />

Company gained<br />

5 percent on Friday to<br />

101.97 naira. Privatelyheld<br />

Affelka offered to<br />

acquire the 26.8 percent<br />

stake or 171.5 million<br />

shares it did not already<br />

own at <strong>11</strong>2.70 naira per<br />

share.<br />

$127 million<br />

Flour Mills of Nigeria<br />

has filed application<br />

to the stock exchange<br />

to raise 39.86 billion<br />

naira ($127 million)<br />

via a share sale to<br />

existing shareholders,<br />

the bourse said on<br />

Friday.<br />

The flour manufacturer<br />

plans to sell<br />

1.47 billion ordinary<br />

shares at 27 naira, a<br />

21 percent discount to<br />

Friday’s market price<br />

of 34.13 naira. It would<br />

offer nine new shares<br />

for every 16 already<br />

held via rights issue.<br />

<strong>BusinessDay</strong> MARKETS INTELLIGENCE (Team lead: BALA AUGIE - Analyst: DAVID IBEMERE, Dipo Oladehinde, ENDURANCE OKAFOR, ETHEL WATIMI, BUNMI BAILEY Graphics: David Ogar )<br />

BMI provides in-depth analysis and data on industries, companies, stocks, currencies, fixed income/credit, economics, regulation and factors that influence investor’s decision-making<br />

Email the BMI team patrick.atuanya@businessdayonline.com