European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ThoughT leadership<br />

not entitled to claim treaty relief under the double tax treaty<br />

between Russia and Cyprus (beneficial ownership approach).<br />

Since the double CyprusCo structure involves CyprusCo I<br />

receiving a loan which is then pushed down to CyprusCo<br />

II as equity and Cyprus Co II, in turn, then grants a loan to<br />

the Russian project company, the Russian tax authorities<br />

should find it difficult to apply the beneficial ownership<br />

approach to this structure, since CyprusCo II will indeed<br />

receive interest income but may legitimately claim that it<br />

has no matching interest expense, since CyprusCo II pays<br />

dividends, but no interest, to CyprusCo I.<br />

It should also be noted that the currency employed<br />

throughout the whole investment structure should be the<br />

same, i.e. Russian roubles. There are two reasons for this.<br />

Firstly, it is likely that any feed-in tariffs or subsidies will be<br />

fixed in roubles. Secondly, the tax-deductibility of interest<br />

payments on rouble-denominated loans is potentially more<br />

generous than for that on loans in other currencies.<br />

Unfortunately, this is not tax efficient for all types of<br />

investors. German and Austrian investors, in particular,<br />

would potentially face the risk of so-called CFC taxation.<br />

The German controlled foreign company rules (CFC rules)<br />

could prohibit ordinary corporate investors and private<br />

individuals from claiming beneficial tax rates on the<br />

income generated. Moreover, those rules would probably<br />

have a negative impact on insurers’ liquidity positions.<br />

To allow such investors to participate in the fund in an<br />

optimal manner we recommend that a separate share<br />

class be created for them. Special structures should be<br />

incorporated into this share class in order to obviate<br />

these risks.<br />

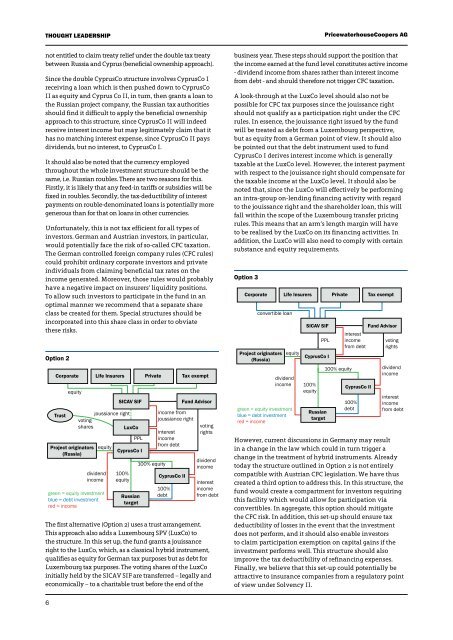

Option 2<br />

6<br />

Corporate<br />

Trust<br />

equity<br />

Project originators<br />

(Russia)<br />

joussiance right<br />

voting<br />

shares<br />

LuxCo<br />

green = equity investment<br />

blue = debt investment<br />

red = income<br />

Life Insurers Private Tax exempt<br />

equity<br />

dividend<br />

income<br />

SICAV SIF Fund Advisor<br />

100%<br />

equity<br />

PPL<br />

CyprusCo I<br />

Russian<br />

target<br />

100% equity<br />

income from<br />

joussiance right<br />

interest<br />

income<br />

from debt<br />

CyprusCo II<br />

100%<br />

debt<br />

voting<br />

rights<br />

dividend<br />

income<br />

interest<br />

income<br />

from debt<br />

The first alternative (Option 2) uses a trust arrangement.<br />

This approach also adds a Luxembourg SPV (LuxCo) to<br />

the structure. In this set up, the fund grants a jouissance<br />

right to the LuxCo, which, as a classical hybrid instrument,<br />

qualifies as equity for German tax purposes but as debt for<br />

Luxembourg tax purposes. The voting shares of the LuxCo<br />

initially held by the SICAV SIF are transferred – legally and<br />

economically – to a charitable trust before the end of the<br />

business year. These steps should support the position that<br />

the income earned at the fund level constitutes active income<br />

- dividend income from shares rather than interest income<br />

from debt - and should therefore not trigger CFC taxation.<br />

A look-through at the LuxCo level should also not be<br />

possible for CFC tax purposes since the jouissance right<br />

should not qualify as a participation right under the CFC<br />

rules. In essence, the jouissance right issued by the fund<br />

will be treated as debt from a Luxembourg perspective,<br />

but as equity from a German point of view. It should also<br />

be pointed out that the debt instrument used to fund<br />

CyprusCo I derives interest income which is generally<br />

taxable at the LuxCo level. However, the interest payment<br />

with respect to the jouissance right should compensate for<br />

the taxable income at the LuxCo level. It should also be<br />

noted that, since the LuxCo will effectively be performing<br />

an intra-group on-lending financing activity with regard<br />

to the jouissance right and the shareholder loan, this will<br />

fall within the scope of the Luxembourg transfer pricing<br />

rules. This means that an arm’s length margin will have<br />

to be realised by the LuxCo on its financing activities. In<br />

addition, the LuxCo will also need to comply with certain<br />

substance and equity requirements.<br />

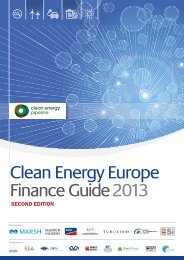

Option 3<br />

Corporate<br />

convertible loan<br />

Project originators<br />

(Russia)<br />

green = equity investment<br />

blue = debt investment<br />

red = income<br />

Life Insurers Private Tax exempt<br />

equity<br />

dividend<br />

income<br />

SICAV SIF Fund Advisor<br />

PPL<br />

interest<br />

income voting<br />

from debt rights<br />

CyprusCo I<br />

100%<br />

equity<br />

Russian<br />

target<br />

pricewaterhouseCoopers ag<br />

100% equity<br />

CyprusCo II<br />

100%<br />

debt<br />

dividend<br />

income<br />

interest<br />

income<br />

from debt<br />

However, current discussions in Germany may result<br />

in a change in the law which could in turn trigger a<br />

change in the treatment of hybrid instruments. Already<br />

today the structure outlined in Option 2 is not entirely<br />

compatible with Austrian CFC legislation. We have thus<br />

created a third option to address this. In this structure, the<br />

fund would create a compartment for investors requiring<br />

this facility which would allow for participation via<br />

convertibles. In aggregate, this option should mitigate<br />

the CFC risk. In addition, this set-up should ensure tax<br />

deductibility of losses in the event that the investment<br />

does not perform, and it should also enable investors<br />

to claim participation exemption on capital gains if the<br />

investment performs well. This structure should also<br />

improve the tax deductibility of refinancing expenses.<br />

Finally, we believe that this set-up could potentially be<br />

attractive to insurance companies from a regulatory point<br />

of view under Solvency II.