European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ThoughT leadership green rhino energy<br />

Cost:<br />

In solar PV systems, the single most important cost item is<br />

the upfront capital expenditure. In the graphical depiction,<br />

it is assumed that 1600€/kWp is the minimum, which<br />

receives maximum score. Cost drivers are the choice of<br />

modules, mounting system (fixed vs. tracking system),<br />

transport, installation, as well as land rental.<br />

The other two dimensions relate to the context of the<br />

project as follows:<br />

Country risk:<br />

The success of a project and its prospects for investment<br />

very much depend on country-specific aspects, particularly<br />

political and credit risk. In the graph, we score 10/10 for<br />

countries with a high level of political stability and a top<br />

credit rating. In this crude and simple tool, the score is<br />

naturally subjective. It should capture both risk and the<br />

impact of existing mitigation strategies.<br />

Infrastructure:<br />

Key to a successful project is the presence and accessibility<br />

of appropriate infrastructure, specifically road access and<br />

grid access (or connection of off-grid consumers). This is<br />

a separate dimension, as in most instances it presents a<br />

third-party dependency. Whilst projects may not compete<br />

for land, they often compete for resources to build the<br />

required lines to the injection point or to strengthen the<br />

grid. This may be obvious for offshore wind projects, but<br />

it is equally important for utility-scale solar projects,<br />

particularly in remote desert areas that may have the<br />

desired irradiation, but not much else.<br />

One dimension that we have deliberately omitted is size<br />

of the project. Of course, size is important, not least because<br />

of economies of scale and financing options. For instance,<br />

non-recourse project finance is only available for large<br />

projects. Size may affect the quality of a project indirectly<br />

via size-dependant tariff bands, costs or lack of available<br />

risk mitigation options (such as political insurance), but is<br />

not an independent dimension.<br />

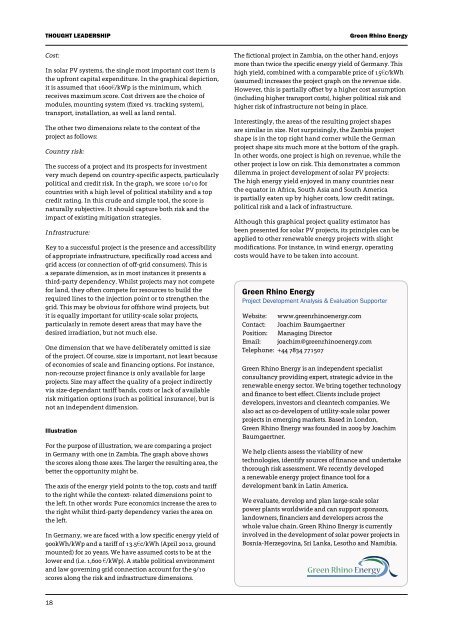

Illustration<br />

For the purpose of illustration, we are comparing a project<br />

in Germany with one in Zambia. The graph above shows<br />

the scores along those axes. The larger the resulting area, the<br />

better the opportunity might be.<br />

The axis of the energy yield points to the top, costs and tariff<br />

to the right while the context- related dimensions point to<br />

the left. In other words: Pure economics increase the area to<br />

the right whilst third-party dependency varies the area on<br />

the left.<br />

In Germany, we are faced with a low specific energy yield of<br />

900kWh/kWp and a tariff of 13.5€c/kWh (April <strong>2012</strong>, ground<br />

mounted) for 20 years. We have assumed costs to be at the<br />

lower end (i.e. 1,600 €/kWp). A stable political environment<br />

and law governing grid connection account for the 9/10<br />

scores along the risk and infrastructure dimensions.<br />

18<br />

The fictional project in Zambia, on the other hand, enjoys<br />

more than twice the specific energy yield of Germany. This<br />

high yield, combined with a comparable price of 15€c/kWh<br />

(assumed) increases the project graph on the revenue side.<br />

However, this is partially offset by a higher cost assumption<br />

(including higher transport costs), higher political risk and<br />

higher risk of infrastructure not being in place.<br />

Interestingly, the areas of the resulting project shapes<br />

are similar in size. Not surprisingly, the Zambia project<br />

shape is in the top right hand corner while the German<br />

project shape sits much more at the bottom of the graph.<br />

In other words, one project is high on revenue, while the<br />

other project is low on risk. This demonstrates a common<br />

dilemma in project development of solar PV projects:<br />

The high energy yield enjoyed in many countries near<br />

the equator in Africa, South Asia and South America<br />

is partially eaten up by higher costs, low credit ratings,<br />

political risk and a lack of infrastructure.<br />

Although this graphical project quality estimator has<br />

been presented for solar PV projects, its principles can be<br />

applied to other renewable energy projects with slight<br />

modifications. For instance, in wind energy, operating<br />

costs would have to be taken into account.<br />

Green Rhino <strong>Energy</strong><br />

Project Development Analysis & Evaluation Supporter<br />

Website:<br />

Contact:<br />

Position:<br />

Email:<br />

Telephone:<br />

www.greenrhinoenergy.com<br />

Joachim Baumgaertner<br />

Managing Director<br />

joachim@greenrhinoenergy.com<br />

+44 7834 771507<br />

Green Rhino <strong>Energy</strong> is an independent specialist<br />

consultancy providing expert, strategic advice in the<br />

renewable energy sector. We bring together technology<br />

and finance to best effect. Clients include project<br />

developers, investors and cleantech companies. We<br />

also act as co-developers of utility-scale solar power<br />

projects in emerging markets. Based in London,<br />

Green Rhino <strong>Energy</strong> was founded in 2009 by Joachim<br />

Baumgaertner.<br />

We help clients assess the viability of new<br />

technologies, identify sources of finance and undertake<br />

thorough risk assessment. We recently developed<br />

a renewable energy project finance tool for a<br />

development bank in Latin America.<br />

We evaluate, develop and plan large-scale solar<br />

power plants worldwide and can support sponsors,<br />

landowners, financiers and developers across the<br />

whole value chain. Green Rhino <strong>Energy</strong> is currently<br />

involved in the development of solar power projects in<br />

Bosnia-Herzegovina, Sri Lanka, Lesotho and Namibia.<br />

Green Rhino <strong>Energy</strong>