European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

European Clean Energy Investment Guide 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MarkeT aNalysis<br />

<strong>European</strong> Venture Capital<br />

<strong>Investment</strong> Analysis<br />

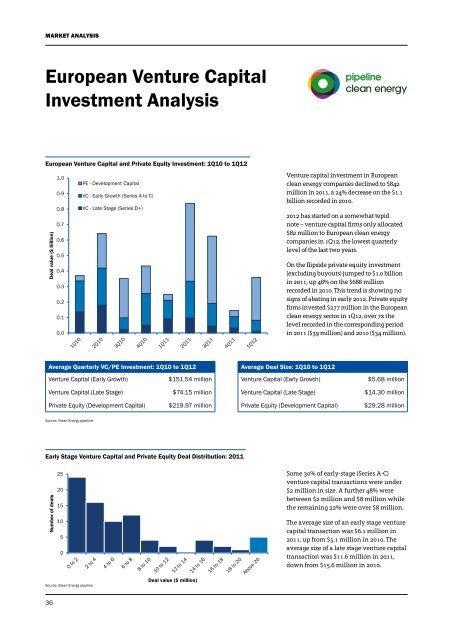

<strong>European</strong> Venture Capital and Private Equity <strong>Investment</strong>: 1Q10 to 1Q12<br />

Deal value ($ billion)<br />

36<br />

1.0<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

PE - Development Capital<br />

VC - Early Growth (Series A to C)<br />

VC - Late Stage (Series D+)<br />

Average Quarterly VC/PE <strong>Investment</strong>: 1Q10 to 1Q12<br />

Venture Capital (Early Growth) $151.54 million<br />

Venture Capital (Late Stage) $74.15 million<br />

Private Equity (Development Capital) $219.97 million<br />

Source: <strong>Clean</strong> <strong>Energy</strong> pipeline<br />

Early Stage Venture Capital and Private Equity Deal Distribution: 2011<br />

Number of deals<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Source: <strong>Clean</strong> <strong>Energy</strong> pipeline<br />

Deal value ($ million)<br />

Venture capital investment in <strong>European</strong><br />

clean energy companies declined to $842<br />

million in 2011, a 24% decrease on the $1.1<br />

billion recorded in 2010.<br />

<strong>2012</strong> has started on a somewhat tepid<br />

note – venture capital firms only allocated<br />

$82 million to <strong>European</strong> clean energy<br />

companies in 1Q12, the lowest quarterly<br />

level of the last two years.<br />

On the flipside private equity investment<br />

(excluding buyouts) jumped to $1.0 billion<br />

in 2011, up 48% on the $688 million<br />

recorded in 2010. This trend is showing no<br />

signs of abating in early <strong>2012</strong>. Private equity<br />

firms invested $277 million in the <strong>European</strong><br />

clean energy sector in 1Q12, over 7x the<br />

level recorded in the corresponding period<br />

in 2011 ($39 million) and 2010 ($34 million).<br />

Average Deal Size: 1Q10 to 1Q12<br />

Venture Capital (Early Growth) $5.68 million<br />

Venture Capital (Late Stage) $14.30 million<br />

Private Equity (Development Capital) $29.28 million<br />

Some 30% of early-stage (Series A-C)<br />

venture capital transactions were under<br />

$2 million in size. A further 48% were<br />

between $2 million and $8 million while<br />

the remaining 22% were over $8 million.<br />

The average size of an early stage venture<br />

capital transaction was $6.1 million in<br />

2011, up from $5.1 million in 2010. The<br />

average size of a late stage venture capital<br />

transaction was $11.6 million in 2011,<br />

down from $15.6 million in 2010.