Long Range Financial Plan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

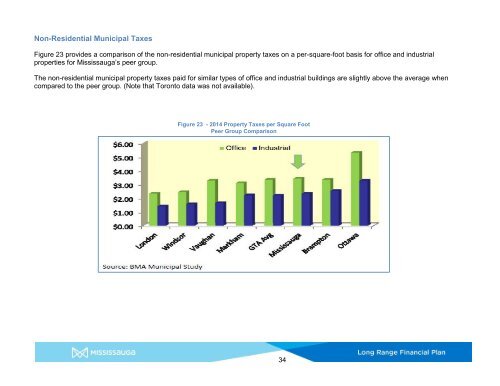

Non-Residential Municipal Taxes<br />

Figure 23 provides a comparison of the non-residential municipal property taxes on a per-square-foot basis for office and industrial<br />

properties for Mississauga’s peer group.<br />

The non-residential municipal property taxes paid for similar types of office and industrial buildings are slightly above the average when<br />

compared to the peer group. (Note that Toronto data was not available).<br />

Figure 23 - 2014 Property Taxes per Square Foot<br />

Peer Group Comparison<br />

34