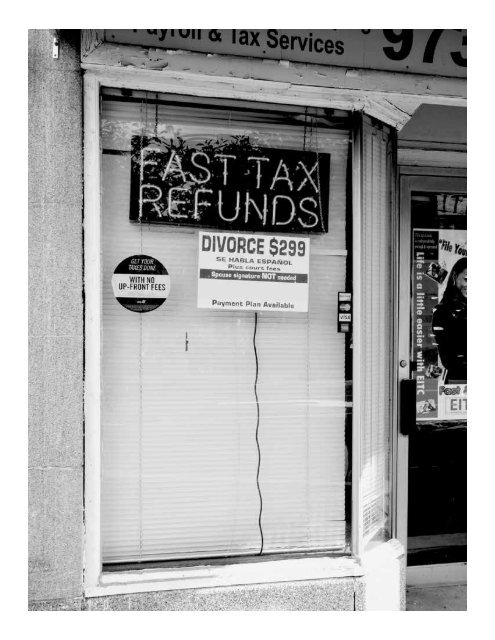

their income. <strong>The</strong> misreporting <strong>of</strong> individual business income and related self-employment taxes accounts for more than 42 percent ($194 billion) <strong>of</strong> the taxes owed in a given year that are not paid voluntarily and in a timely manner (Bruckner, 2016). <strong>Consequences</strong> Short- and long-term financial penalties: Late payment, nonpayment, or mistakes or misrepresentations on tax forms all carry financial penalties. When taxpayers are audited by the IRS, they take on additional costs including hiring a skilled tax preparation pr<strong>of</strong>essional, paying fees, and paying interest on taxes owed, dating from the day their return was due. Accidental or deliberate mistakes on tax forms can carry penalties <strong>of</strong> between 20 and 40 percent <strong>of</strong> the amount by which taxes were underestimated. In addition, unpaid taxes can damage one’s credit score. Tax evasion, or refusal to pay taxes, is a felony carrying up to a five-year prison sentence and/or fines <strong>of</strong> up to $250,000 (Lorette, 2016; Internal Revenue Service, 2016; Internal Revenue Service, 2016a; Lazarony, 2016). Lack <strong>of</strong> financial protections in contract and freelance work: Tax avoidance in some cases may increase the attraction <strong>of</strong> contract and freelance work, moving more workers into arrangements that lack standard supports and protections such as disability insurance or workplace safety regulations. <strong>The</strong> absence <strong>of</strong> those protections can leave workers susceptible to other problems in the future (Johnson, 2016; Strom & Schmitt, 2016). BROADER COSTS OF UNPAID TAXES When ALICE workers cannot pay their taxes, not only do they face a range <strong>of</strong> penalties, but the wider community must cover the monetary gap. According to the Government Accountability Office (U.S. GAO), at the end <strong>of</strong> fiscal year 2011, individuals owed a total <strong>of</strong> $258 billion in federal unpaid tax debts. When taxes go unpaid, the rest <strong>of</strong> the community must pay more to cover both the shortfall and the cost <strong>of</strong> collection efforts (U.S. Government Accountability Office (U.S. GAO), 2012; Bruckner, 2016). FUTURE TRENDS: TAXING ALICE FAMILIES Besides the cost <strong>of</strong> household basics and the level <strong>of</strong> current wages, the tax code is another factor in the evaluation <strong>of</strong> economic inequality. According to the Federal Reserve, federal taxes help make after-tax income more equal, while state taxes make it less equal (Institute on Taxation and Economic Policy (ITEP), 2015). Reductions in state tax rates – for income tax, sales tax, or payroll taxes – could increase the income ALICE families have to afford the basic <strong>Household</strong> Survival Budget. In addition, changes in the tax structure could reduce inequality between income groups. <strong>The</strong> opportunity to avoid paying taxes will increase as the gig economy grows. More than 2.5 million U.S. taxpayers are participating in the on-demand platform economy every year, and that number is set to more than double in the next few years. As family budgets get tighter, there will also be pressure to cut corners where possible. A tax code and enforcement system not designed to capture these tax liabilities will make it easier for workers to avoid taxes in the future (Bruckner, 2016). 80 UNITED WAY ALICE REPORT – THE CONSEQUENCES OF INSUFFICIENT HOUSEHOLD INCOME

UNITED WAY ALICE REPORT – THE CONSEQUENCES OF INSUFFICIENT HOUSEHOLD INCOME 81

- Page 1 and 2:

ALICE: THE CONSEQUENCES OF INSUFFIC

- Page 3 and 4:

THE ALICE RESEARCH TEAM The United

- Page 5 and 6:

ALICE: BRINGING HARDSHIP INTO FOCUS

- Page 7 and 8:

TABLE OF CONTENTS INTRODUCTION ....

- Page 9 and 10:

...AND FOR ALL FAMILIES IMPACT ON T

- Page 11 and 12:

• The ALICE Threshold - a bare-mi

- Page 13 and 14:

The purpose of this report is to pr

- Page 15 and 16:

Figure 3. Monthly Housing Costs and

- Page 17 and 18:

In 2014, the U.S. states with the h

- Page 19 and 20:

No mother ever envisions finding he

- Page 21 and 22:

Long-term effects on health and wel

- Page 23 and 24:

friends grew to 7.7 million people

- Page 25 and 26:

twice as much as redevelopment of i

- Page 27 and 28:

UNITED WAY ALICE REPORT - THE CONSE

- Page 29 and 30:

Figure 5. Monthly Child Care Costs

- Page 31 and 32:

and accredited child care center fo

- Page 33 and 34:

Having a child with special needs h

- Page 35 and 36: The slow progress in national enrol

- Page 37 and 38: Loss of education advancement: Near

- Page 39 and 40: Strategy 8: Drop out of High School

- Page 41 and 42: time students and 76 percent of par

- Page 43 and 44: • Closing the education achieveme

- Page 45 and 46: UNITED WAY ALICE REPORT - THE CONSE

- Page 47 and 48: Figure 7. Monthly Food Costs and Pe

- Page 49 and 50: • For children, lack of sufficien

- Page 51 and 52: Stigma: For many families, using pu

- Page 53 and 54: FUTURE TRENDS: FEEDING ALICE More y

- Page 55 and 56: UNITED WAY ALICE REPORT - THE CONSE

- Page 57 and 58: $26,960 annually (if full time, yea

- Page 59 and 60: Difficulty accessing health care: U

- Page 61 and 62: Despite working full time (and havi

- Page 63 and 64: Additional costs of longer commutes

- Page 65 and 66: UNITED WAY ALICE REPORT - THE CONSE

- Page 67 and 68: • Health and financial stability

- Page 69 and 70: of seniors living in poverty have h

- Page 71 and 72: educational consequences of untreat

- Page 73 and 74: survey said cost was the primary re

- Page 75 and 76: had to use their own money or modif

- Page 77 and 78: others, such as caregivers of elder

- Page 79 and 80: the minimum income required to rece

- Page 81 and 82: UNITED WAY ALICE REPORT - THE CONSE

- Page 83 and 84: In the states with the most regress

- Page 85: children under the age of 18 make u

- Page 89 and 90: • Assistance. Public and nonprofi

- Page 91 and 92: UNITED WAY ALICE REPORT - THE CONSE

- Page 93 and 94: Aron, L., Honberg, R., & Duckworth,

- Page 95 and 96: Carnevale, A., Rose, S., & Cheah, B

- Page 97 and 98: Cunningham, A., & Kienzl, G. (2011)

- Page 99 and 100: Glover, R., Miller, J., & Sadowski,

- Page 101 and 102: Johnson, R. (2015). Housing Costs a

- Page 103 and 104: Mayer, C., & Pence, K. (2008). Subp

- Page 105 and 106: Perez, G. (2016). Latino State of E

- Page 107 and 108: Stetser, M., & Stillwell, R. (2014,

- Page 109 and 110: United Way ALICE Project. (2016). 2