BusinessDay 06 April 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

BUSINESS DAY<br />

C002D5556<br />

Friday <strong>06</strong> <strong>April</strong> <strong>2018</strong><br />

IMPACT INVESTING<br />

In Association With<br />

The state of Impact Investing in Nigeria (1)<br />

Innocent Unah<br />

& Uju Ikedionu<br />

Nigeria has joined the<br />

rest of the world to<br />

grow keen interest towards<br />

the increase<br />

and effectiveness of<br />

impact investing globally. The impact<br />

investing landscape is growing in Nigeria,<br />

leading the way for other countries<br />

in West Africa as the region saw<br />

28 active impact investors in 2015.<br />

This growth is fuelled by a variety<br />

of sources of capital, mostly available<br />

in the manufacturing and services<br />

sectors, which could be tapped for<br />

impact investing. Even though the<br />

impact investing sector in Nigeria<br />

outperforms that of other countries in<br />

West Africa, it still remains low relative<br />

to the size of the global market.<br />

Who are the Impact Investors<br />

in Nigeria<br />

28 active impact investors have<br />

been identified to be in Nigeria. These<br />

consist of eight Development Finance<br />

Institutions (DFIs) and 20 non-DFI<br />

investors. The non-DFIs include fund<br />

managers with 17 investors, institutional<br />

investors with one investor,<br />

and foundations with two investors).<br />

Some the Institutions which play in<br />

the impact investing space in Nigeria<br />

include Shell Foundation, FMO,<br />

Tony Elumelu Foundation, the IFC,<br />

Proparco, Alitheia, Aspire Nigeria,<br />

Dorteo Partners, Sahel Capital Fund,<br />

among others.<br />

What is the level impact investing<br />

capital in Nigeria?<br />

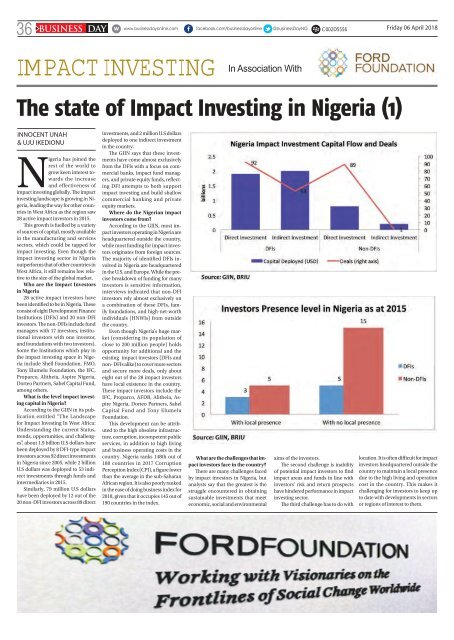

According to the GIIN in its publication<br />

entitled “The Landscape<br />

for Impact Investing In West Africa:<br />

Understanding the current Status,<br />

trends, opportunities, and challenges”,<br />

about 1.9 billion U.S dollars have<br />

been deployed by 8 DFI-type impact<br />

investors across 92 direct investments<br />

in Nigeria since 2005, while 2 billion<br />

U.S dollars was deployed to 53 indirect<br />

investments through funds and<br />

intermediaries in 2015.<br />

Similarly, 79 million U.S dollars<br />

have been deployed by 12 out of the<br />

20 non-DFI investors across 89 direct<br />

investments, and 2 million U.S dollars<br />

deployed to one indirect investment<br />

in the country.<br />

The GIIN says that these investments<br />

have come almost exclusively<br />

from the DFIs with a focus on commercial<br />

banks, impact fund managers,<br />

and private equity funds, reflecting<br />

DFI attempts to both support<br />

impact investing and build shallow<br />

commercial banking and private<br />

equity markets.<br />

Where do the Nigerian impact<br />

investors come from?<br />

According to the GIIN, most impact<br />

investors operating in Nigeria are<br />

headquartered outside the country,<br />

while most funding for impact investors<br />

originates from foreign sources.<br />

The majority of identified DFIs involved<br />

in Nigeria are headquartered<br />

in the U.S. and Europe. While the precise<br />

breakdown of funding for many<br />

investors is sensitive information,<br />

interviews indicated that non-DFI<br />

investors rely almost exclusively on<br />

a combination of these DFIs, family<br />

foundations, and high-net-worth<br />

individuals (HNWIs) from outside<br />

the country.<br />

Even though Nigeria’s huge market<br />

(considering its population of<br />

close to 200 million people) holds<br />

opportunity for additional and the<br />

existing impact investors (DFIs and<br />

non- DFIs alike) to cover more sectors<br />

and secure more deals, only about<br />

eight out of the 28 impact investors<br />

have local existence in the country.<br />

These impact investors include the<br />

IFC, Proparco, AFDB, Alitheia, Aspire<br />

Nigeria, Dorteo Partners, Sahel<br />

Capital Fund and Tony Elumelu<br />

Foundation.<br />

This development can be attributed<br />

to the high obsolete infrastructure,<br />

corruption, incompetent public<br />

services, in addition to high living<br />

and business operating costs in the<br />

country. Nigeria ranks 148th out of<br />

180 countries in 2017 Corruption<br />

Perception Index (CPI), a figure lower<br />

than the average in the sub-Saharan<br />

African region. It is also poorly ranked<br />

in the ease of doing business index for<br />

<strong>2018</strong>, given that it occupies 145 out of<br />

190 countries in the index.<br />

What are the challenges that impact<br />

investors face in the country?<br />

There are many challenges faced<br />

by impact investors in Nigeria, but<br />

analysts say that the greatest is the<br />

struggle encountered in obtaining<br />

sustainable investments that meet<br />

economic, social and environmental<br />

aims of the investors.<br />

The second challenge is inability<br />

of potential impact investors to find<br />

impact areas and funds in line with<br />

investors’ risk and return prospects<br />

have hindered performance in impact<br />

investing sector.<br />

The third challenge has to do with<br />

location. It is often difficult for impact<br />

investors headquartered outside the<br />

country to maintain a local presence<br />

due to the high living and operation<br />

cost in the country. This makes it<br />

challenging for investors to keep up<br />

to date with developments in sectors<br />

or regions of interest to them.