BOB_2017_SMALL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

ANNUAL REPORT AND<br />

FINANCIAL STATMENTS <strong>2017</strong><br />

Risk measurement and control<br />

Interest rate, currency, credit, liquidity and other risks are actively managed by management to ensure compliance with the<br />

bank’s risk limits. The bank’s risk limits are assessed regularly to ensure their appropriateness given its objectives and strategies<br />

and current market conditions. A variety of techniques are used by the bank in measuring the risks inherent in its trading and<br />

non-trading positions.<br />

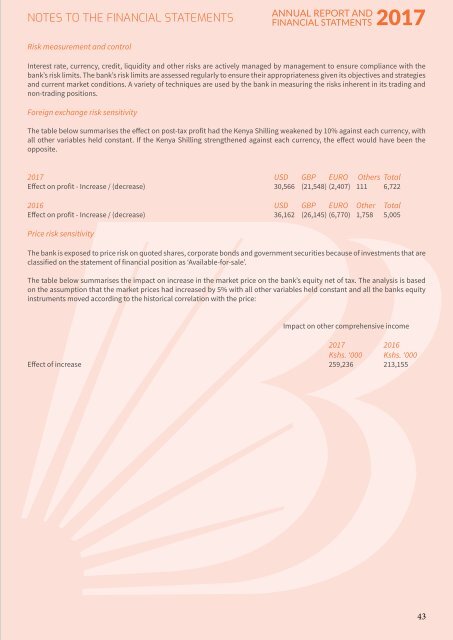

Foreign exchange risk sensitivity<br />

The table below summarises the effect on post-tax profit had the Kenya Shilling weakened by 10% against each currency, with<br />

all other variables held constant. If the Kenya Shilling strengthened against each currency, the effect would have been the<br />

opposite.<br />

<strong>2017</strong> USD GBP EURO Others Total<br />

Effect on profit - Increase / (decrease) 30,566 (21,548) (2,407) 111 6,722<br />

2016 USD GBP EURO Other Total<br />

Effect on profit - Increase / (decrease) 36,162 (26,145) (6,770) 1,758 5,005<br />

Price risk sensitivity<br />

The bank is exposed to price risk on quoted shares, corporate bonds and government securities because of investments that are<br />

classified on the statement of financial position as ‘Available-for-sale’.<br />

The table below summarises the impact on increase in the market price on the bank’s equity net of tax. The analysis is based<br />

on the assumption that the market prices had increased by 5% with all other variables held constant and all the banks equity<br />

instruments moved according to the historical correlation with the price:<br />

Impact on other comprehensive income<br />

<strong>2017</strong> 2016<br />

Kshs. ‘000 Kshs. ‘000<br />

Effect of increase 259,236 213,155<br />

43