BOB_2017_SMALL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

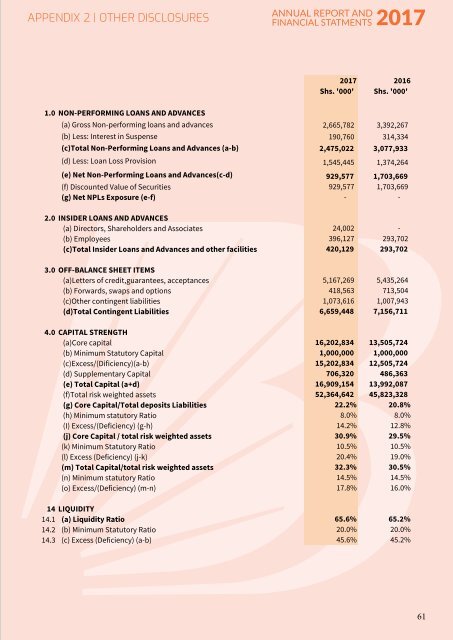

APPENDIX 2 | OTHER DISCLOSURES<br />

ANNUAL REPORT AND<br />

FINANCIAL STATMENTS <strong>2017</strong><br />

<strong>2017</strong> 2016<br />

Shs. '000' Shs. '000'<br />

1.0 non-Performing loanS and advanceS<br />

(a) Gross Non-performing loans and advances 2,665,782 3,392,267<br />

(b) Less: Interest in Suspense 190,760 314,334<br />

(c)total non-Performing loans and advances (a-b) 2,475,022 3,077,933<br />

(d) Less: Loan Loss Provision 1,545,445 1,374,264<br />

(e) net non-Performing loans and advances(c-d) 929,577 1,703,669<br />

(f) Discounted Value of Securities 929,577 1,703,669<br />

(g) net nPls exposure (e-f) - -<br />

2.0 inSider loanS and advanceS<br />

(a) Directors, Shareholders and Associates 24,002 -<br />

(b) Employees 396,127 293,702<br />

(c)total insider loans and advances and other facilities 420,129 293,702<br />

3.0 off-balance Sheet itemS<br />

(a)Letters of credit,guarantees, acceptances 5,167,269 5,435,264<br />

(b) Forwards, swaps and options 418,563 713,504<br />

(c)Other contingent liabilities 1,073,616 1,007,943<br />

(d)total contingent liabilities 6,659,448 7,156,711<br />

4.0 caPital Strength<br />

(a)Core capital 16,202,834 13,505,724<br />

(b) Minimum Statutory Capital 1,000,000 1,000,000<br />

(c)Excess/(Dificiency)(a-b) 15,202,834 12,505,724<br />

(d) Supplementary Capital 706,320 486,363<br />

(e) total capital (a+d) 16,909,154 13,992,087<br />

(f)Total risk weighted assets 52,364,642 45,823,328<br />

(g) core capital/total deposits liabilities 22.2% 20.8%<br />

(h) Minimum statutory Ratio 8.0% 8.0%<br />

(I) Excess/(Deficiency) (g-h) 14.2% 12.8%<br />

(j) core capital / total risk weighted assets 30.9% 29.5%<br />

(k) Minimum Statutory Ratio 10.5% 10.5%<br />

(l) Excess (Deficiency) (j-k) 20.4% 19.0%<br />

(m) total capital/total risk weighted assets 32.3% 30.5%<br />

(n) Minimum statutory Ratio 14.5% 14.5%<br />

(o) Excess/(Deficiency) (m-n) 17.8% 16.0%<br />

14 liQuidity<br />

14.1 (a) liquidity ratio 65.6% 65.2%<br />

14.2 (b) Minimum Statutory Ratio 20.0% 20.0%<br />

14.3 (c) Excess (Deficiency) (a-b) 45.6% 45.2%<br />

61