BOB_2017_SMALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

ANNUAL REPORT AND<br />

FINANCIAL STATMENTS <strong>2017</strong><br />

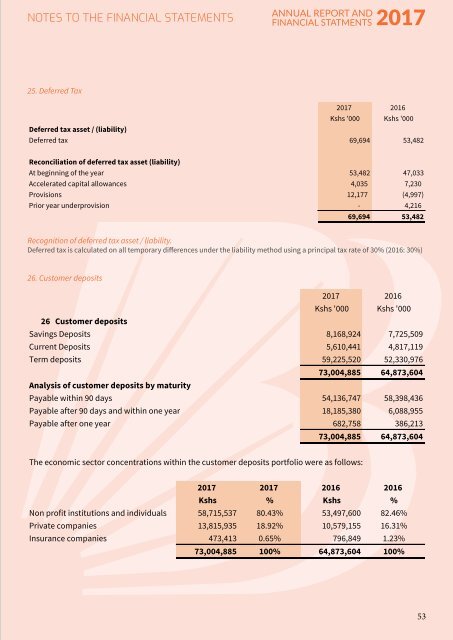

25. Deferred Tax<br />

<strong>2017</strong> 2016<br />

Kshs '000 Kshs '000<br />

deferred tax asset / (liability)<br />

Deferred tax 69,694 53,482<br />

reconciliation of deferred tax asset (liability)<br />

At beginning of the year 53,482 47,033<br />

Accelerated capital allowances 4,035 7,230<br />

Provisions 12,177 (4,997)<br />

Prior year underprovision - 4,216<br />

69,694 53,482<br />

Recognition of deferred tax asset / liability.<br />

Deferred tax is calculated on all temporary differences under the liability method using a principal tax rate of 30% (2016: 30%)<br />

26. Customer deposits<br />

<strong>2017</strong> 2016<br />

Kshs '000 Kshs '000<br />

26 customer deposits<br />

Savings Deposits 8,168,924 7,725,509<br />

Current Deposits 5,610,441 4,817,119<br />

Term deposits 59,225,520 52,330,976<br />

73,004,885 64,873,604<br />

analysis of customer deposits by maturity<br />

Payable within 90 days 54,136,747 58,398,436<br />

Payable after 90 days and within one year 18,185,380 6,088,955<br />

Payable after one year 682,758 386,213<br />

73,004,885 64,873,604<br />

The economic sector concentrations within the customer deposits portfolio were as follows:<br />

<strong>2017</strong> <strong>2017</strong> 2016 2016<br />

kshs % kshs %<br />

Non profit institutions and individuals 58,715,537 80.43% 53,497,600 82.46%<br />

Private companies 13,815,935 18.92% 10,579,155 16.31%<br />

Insurance companies 473,413 0.65% 796,849 1.23%<br />

73,004,885 100% 64,873,604 100%<br />

53