BOB_2017_SMALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GENERAL INFORMATION<br />

BOARD COMMITTEES<br />

ANNUAL REPORT AND<br />

FINANCIAL STATMENTS <strong>2017</strong><br />

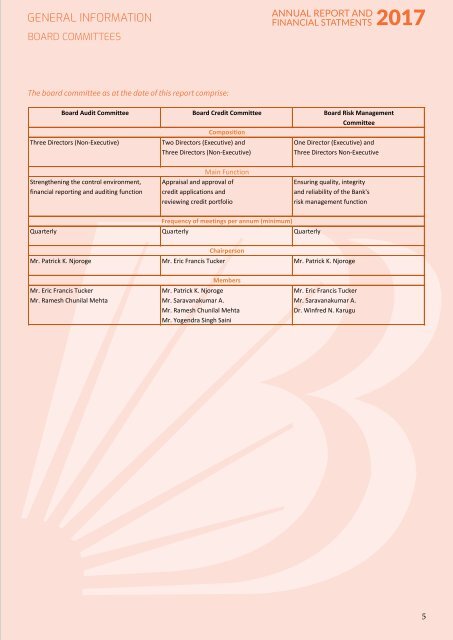

The board committee as at the date of this report comprise:<br />

Board Audit Committee Board Credit Committee Board Risk Management<br />

Committee<br />

Composition<br />

Three Directors (Non-Executive) Two Directors (Executive) and One Director (Executive) and<br />

Three Directors (Non-Executive)<br />

Three Directors Non-Executive<br />

Main Function<br />

Strengthening the control environment, Appraisal and approval of Ensuring quality, integrity<br />

financial reporting and auditing function credit applications and and reliability of the Bank's<br />

reviewing credit portfolio<br />

risk management function<br />

Frequency of meetings per annum (minimum)<br />

Quarterly Quarterly Quarterly<br />

Chairperson<br />

Mr. Patrick K. Njoroge Mr. Eric Francis Tucker Mr. Patrick K. Njoroge<br />

Members<br />

Mr. Eric Francis Tucker Mr. Patrick K. Njoroge Mr. Eric Francis Tucker<br />

Mr. Ramesh Chunilal Mehta Mr. Saravanakumar A. Mr. Saravanakumar A.<br />

Mr. Ramesh Chunilal Mehta<br />

Dr. Winfred N. Karugu<br />

Mr. Yogendra Singh Saini<br />

5