Etex-AR2017-WEBSITE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6.1<br />

Financial report<br />

Consolidated financial statements<br />

<strong>Etex</strong> Annual Report 2017<br />

Financial report<br />

Consolidated financial statements<br />

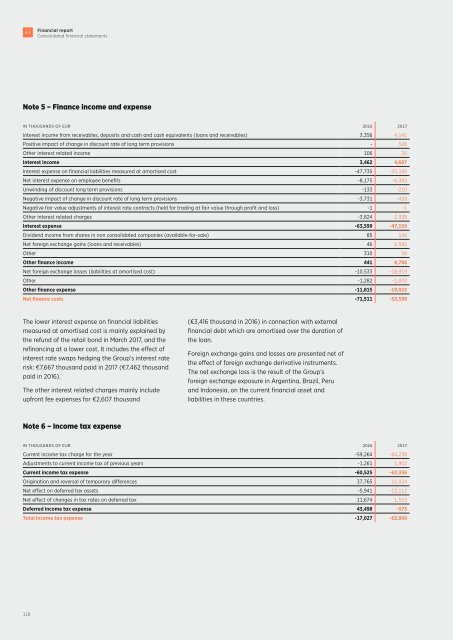

Note 5 – Finance income and expense<br />

IN THOUSANDS OF EUR 2016 2017<br />

Interest income from receivables, deposits and cash and cash equivalents (loans and receivables) 3,356 4,141<br />

Positive impact of change in discount rate of long term provisions - 526<br />

Other interest related income 106 20<br />

Interest income 3,462 4,687<br />

Interest expense on financial liabilities measured at amortised cost -47,735 -35,190<br />

Net interest expense on employee benefits -8,175 -8,383<br />

Unwinding of discount long term provisions -133 -210<br />

Negative impact of change in discount rate of long term provisions -3,731 -428<br />

Negative fair value adjustments of interest rate contracts (held for trading at fair value through profit and loss) -1 -1<br />

Other interest related charges -3,824 -2,938<br />

Interest expense -63,599 -47,150<br />

Dividend income from shares in non consolidated companies (available-for-sale) 85 136<br />

Net foreign exchange gains (loans and receivables) 46 8,592<br />

Other 310 58<br />

Other finance income 441 8,786<br />

Net foreign exchange losses (liabilities at amortised cost) -10,533 -18,919<br />

Other -1,282 -1,003<br />

Other finance expense -11,815 -19,922<br />

Net finance costs -71,511 -53,599<br />

The lower interest expense on financial liabilities<br />

measured at amortised cost is mainly explained by<br />

the refund of the retail bond in March 2017, and the<br />

refinancing at a lower cost. It includes the effect of<br />

interest rate swaps hedging the Group’s interest rate<br />

risk: €7,667 thousand paid in 2017 (€7,462 thousand<br />

paid in 2016).<br />

The other interest related charges mainly include<br />

upfront fee expenses for €2,607 thousand<br />

(€3,416 thousand in 2016) in connection with external<br />

financial debt which are amortised over the duration of<br />

the loan.<br />

Foreign exchange gains and losses are presented net of<br />

the effect of foreign exchange derivative instruments.<br />

The net exchange loss is the result of the Group’s<br />

foreign exchange exposure in Argentina, Brazil, Peru<br />

and Indonesia, on the current financial asset and<br />

liabilities in these countries.<br />

The reconciliation between the effective income tax<br />

expense and the theoretical income tax expense is<br />

summarised below. The theoretical income tax expense<br />

is calculated by applying the domestic nominal tax rate<br />

IN THOUSANDS OF EUR 2016 2017<br />

Profit before income tax and before share of profit in equity accounted investees 104,879 215,023<br />

Theoretical income tax expense (nominal rates) -22,217 -56,859<br />

Weighted average nominal tax rate % 21.2% 26.4%<br />

Tax impact of<br />

of each Group entity to their contribution to the Group<br />

profit before income tax and before share of the profit<br />

in equity accounted investees.<br />

Non deductible expenses -11,750 -11,284<br />

Tax on profit distribution inside the Group -2,566 -3,647<br />

Tax-free gains/losses on investments - 12,856<br />

Other tax deductions 8,712 7,493<br />

Unrecognised deferred tax assets on current year losses -19,404 -17,190<br />

Recognition of previously unrecognised deferred tax assets 23,985 14,913<br />

Derecognition of previously recognised deferred tax assets -4,088 -10,835<br />

Net effect of changes in tax rates on deferred tax 11,674 1,515<br />

Adjustments to prior year income tax -1,261 1,902<br />

Other tax adjustments -111 -1,774<br />

Income tax expense recognised in the income statement -17,027 -62,909<br />

Effective tax rate % 16.2% 29.3%<br />

In 2017 and 2016, the unrecognised deferred tax<br />

assets on current year losses are mainly impacted<br />

by restructuring. The recognition of previously<br />

unrecognised deferred tax assets relates mainly to<br />

improved profitability expectation in some companies.<br />

In 2017 the net effect of changes in tax rates is mainly<br />

impacted by the decrease in tax rate applied to most<br />

of the Belgian deferred tax liability. In 2016 the net<br />

effect changes in tax rates were mainly impacted by<br />

the decrease in tax rate applied to most of the French<br />

deferred tax liability.<br />

Income tax recognised directly in equity is related to:<br />

Note 6 – Income tax expense<br />

IN THOUSANDS OF EUR 2016 2017<br />

Current income tax charge for the year -59,264 -64,238<br />

Adjustments to current income tax of previous years -1,261 1,902<br />

Current income tax expense -60,525 -62,336<br />

Origination and reversal of temporary differences 37,765 11,024<br />

Net effect on deferred tax assets -5,941 -13,112<br />

Net effect of changes in tax rates on deferred tax 11,674 1,515<br />

Deferred income tax expense 43,498 -573<br />

Total income tax expense -17,027 -62,909<br />

IN THOUSANDS OF EUR 2016 2017<br />

Actuarial gains (losses) on post employment benefit plans 21,187 -14,247<br />

Gains (losses) on financial instruments - cash flow hedging -316 -3,353<br />

Total 20,871 -17,600<br />

118 119