Etex-AR2017-WEBSITE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6.1<br />

Financial report<br />

Consolidated financial statements<br />

<strong>Etex</strong> Annual Report 2017<br />

Financial report<br />

Consolidated financial statements<br />

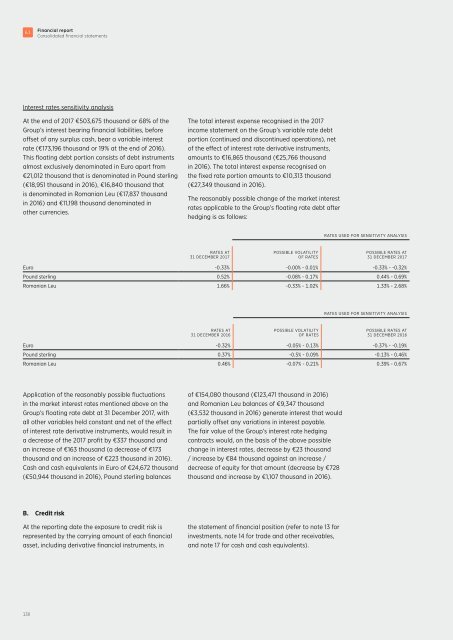

Interest rates sensitivity analysis<br />

At the end of 2017 €503,675 thousand or 68% of the<br />

Group’s interest bearing financial liabilities, before<br />

offset of any surplus cash, bear a variable interest<br />

rate (€173,196 thousand or 19% at the end of 2016).<br />

This floating debt portion consists of debt instruments<br />

almost exclusively denominated in Euro apart from<br />

€21,012 thousand that is denominated in Pound sterling<br />

(€18,951 thousand in 2016), €16,840 thousand that<br />

is denominated in Romanian Leu (€17,837 thousand<br />

in 2016) and €11,198 thousand denominated in<br />

other currencies.<br />

The total interest expense recognised in the 2017<br />

income statement on the Group’s variable rate debt<br />

portion (continued and discontinued operations), net<br />

of the effect of interest rate derivative instruments,<br />

amounts to €16,865 thousand (€25,766 thousand<br />

in 2016). The total interest expense recognised on<br />

the fixed rate portion amounts to €10,313 thousand<br />

(€27,349 thousand in 2016).<br />

The reasonably possible change of the market interest<br />

rates applicable to the Group’s floating rate debt after<br />

hedging is as follows:<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

C. Funding and long term liquidity risk<br />

Maturity schedule<br />

At 31 December 2017 the contractual maturities of financial liabilities, including interest payments, are the following:<br />

IN THOUSANDS OF EUR<br />

Non-derivative financial liabilities<br />

CARRYING<br />

AMOUNT<br />

CONTRACTUAL<br />

CASH FLOWS<br />

1 YEAR OR LESS 1-2 YEARS 2-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

Bank loans 537,041 551,812 22,792 191,234 177,078 160,708<br />

Other financial loans 201,484 203,139 32,744 170,183 102 110<br />

Obligations under finance leases 4,379 5,692 515 623 1,540 3,014<br />

Trade and other liabilities 703,444 677,630 677,625 5 - -<br />

Derivative financial liabilities<br />

Interest rates swaps 21,600 22,675 7,356 7,650 7,671 -<br />

Foreign exchange contracts 4,434 4,434 4,434 - - -<br />

Total 1,472,382 1,465,382 745,466 369,695 186,391 163,832<br />

RATES AT<br />

31 DECEMBER 2017<br />

POSSIBLE VOLATILITY<br />

OF RATES<br />

POSSIBLE RATES AT<br />

31 DECEMBER 2017<br />

Euro -0.33% -0.00% - 0.01% -0.33% - -0.32%<br />

Pound sterling 0.52% -0.08% - 0.17% 0.44% - 0.69%<br />

Romanian Leu 1.66% -0.33% - 1.02% 1.33% - 2.68%<br />

RATES AT<br />

31 DECEMBER 2016<br />

POSSIBLE VOLATILITY<br />

OF RATES<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

POSSIBLE RATES AT<br />

31 DECEMBER 2016<br />

Euro -0.32% -0.05% - 0.13% -0.37% - -0.19%<br />

Pound sterling 0.37% -0.5% - 0.09% -0.13% - 0.46%<br />

Romanian Leu 0.46% -0.07% - 0.21% 0.39% - 0.67%<br />

Application of the reasonably possible fluctuations<br />

in the market interest rates mentioned above on the<br />

Group’s floating rate debt at 31 December 2017, with<br />

all other variables held constant and net of the effect<br />

of interest rate derivative instruments, would result in<br />

a decrease of the 2017 profit by €337 thousand and<br />

an increase of €163 thousand (a decrease of €173<br />

thousand and an increase of €223 thousand in 2016).<br />

Cash and cash equivalents in Euro of €24,672 thousand<br />

(€50,944 thousand in 2016), Pound sterling balances<br />

of €154,080 thousand (€123,471 thousand in 2016)<br />

and Romanian Leu balances of €9,347 thousand<br />

(€3,532 thousand in 2016) generate interest that would<br />

partially offset any variations in interest payable.<br />

The fair value of the Group’s interest rate hedging<br />

contracts would, on the basis of the above possible<br />

change in interest rates, decrease by €23 thousand<br />

/ increase by €84 thousand against an increase /<br />

decrease of equity for that amount (decrease by €728<br />

thousand and increase by €1,107 thousand in 2016).<br />

Bank loans are shown according to their contractual maturity date, rather than their interest and roll-over date.<br />

At 31 December 2016 the contractual maturities of financial liabilities, including interest payments, were the following:<br />

IN THOUSANDS OF EUR<br />

Non-derivative financial liabilities<br />

CARRYING<br />

AMOUNT<br />

CONTRACTUAL<br />

CASH FLOWS<br />

1 YEAR OR LESS 1-2 YEARS 2-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

Bank loans 483,277 502,612 93,722 22,565 225,692 160,633<br />

Redeemable preference shares 6,814 6,814 3,407 3,407 - -<br />

Retail bond 399,692 420,000 420,000 - - -<br />

Other financial loans 30,301 30,158 29,632 526 - -<br />

Obligations under finance leases 1,857 1,940 194 182 285 1,279<br />

Trade and other liabilities 658,307 646,011 645,435 - 4 572<br />

Derivative financial liabilities<br />

Interest rates swaps 28,488 30,430 7,602 7,644 15,184 -<br />

Foreign exchange contracts 1,814 1,814 1,814 - - -<br />

Total 1,610,550 1,639,779 1,201,806 34,324 241,165 162,484<br />

D. Capital risk<br />

The Group monitors capital using the debt<br />

covenant specifications as outlined in the latest<br />

syndicated loan agreement signed on 24 January<br />

2014. The Group targets to maintain a debt<br />

covenant ratio between 1.5 and 2.5 in the long term.<br />

For example, the adjusted net financial debt (for bank<br />

covenant purposes) to recurring EBITDA ratio amounts<br />

to 1.5 at 31 December 2017 (1.6 at 31 December 2016),<br />

well below the bank covenant of 3.<br />

B. Credit risk<br />

At the reporting date the exposure to credit risk is<br />

represented by the carrying amount of each financial<br />

asset, including derivative financial instruments, in<br />

the statement of financial position (refer to note 13 for<br />

investments, note 14 for trade and other receivables,<br />

and note 17 for cash and cash equivalents).<br />

130 131