Etex-AR2017-WEBSITE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6.1<br />

Financial report<br />

Consolidated financial statements<br />

<strong>Etex</strong> Annual Report 2017<br />

Financial report<br />

Consolidated financial statements<br />

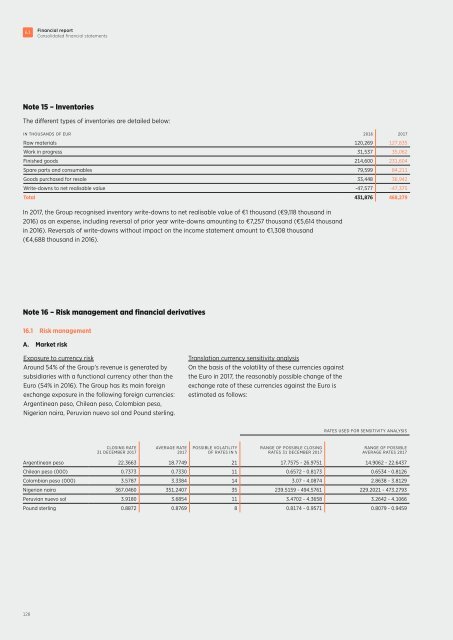

Note 15 – Inventories<br />

The different types of inventories are detailed below:<br />

IN THOUSANDS OF EUR 2016 2017<br />

Raw materials 120,269 127,835<br />

Work in progress 31,537 35,062<br />

Finished goods 214,600 231,604<br />

Spare parts and consumables 79,599 84,211<br />

Goods purchased for resale 33,448 36,942<br />

Write-downs to net realisable value -47,577 -47,375<br />

Total 431,876 468,279<br />

In 2017, the Group recognised inventory write-downs to net realisable value of €1 thousand (€9,118 thousand in<br />

2016) as an expense, including reversal of prior year write-downs amounting to €7,257 thousand (€5,614 thousand<br />

in 2016). Reversals of write-downs without impact on the income statement amount to €1,308 thousand<br />

(€4,688 thousand in 2016).<br />

As a comparison, the reasonably possible change of exchange rate of these currencies against the Euro was<br />

estimated as follows for 2016:<br />

CLOSING RATE<br />

31 DECEMBER 2016<br />

AVERAGE RATE<br />

2016<br />

POSSIBLE VOLATILITY<br />

OF RATES IN %<br />

RANGE OF POSSIBLE CLOSING<br />

RATES 31 DECEMBER 2016<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

RANGE OF POSSIBLE<br />

AVERAGE RATES 2016<br />

Argentinean peso 16.6978 16.3206 22 12.9416 - 20.454 12.6492 - 19.9919<br />

Chilean peso (000) 0.7057 0.7491 13 0.615 - 0.7964 0.6528 - 0.8453<br />

Colombian peso (000) 3.1631 3.3817 18 2.6021 - 3.724 2.782 - 3.9815<br />

Nigerian naira 332.3050 283.4324 47 177.0455 - 487.5645 151.0071 - 415.8577<br />

Peruvian nuevo sol 3.5376 3.7365 14 3.0287 - 4.0464 3.199 - 4.2739<br />

Pound sterling 0.8562 0.8178 11 0.7639 - 0.9484 0.7297 - 0.9059<br />

If the Euro had weakened or strengthened during 2017<br />

by the above estimated possible changes against the<br />

listed currencies with all other variables held constant,<br />

the 2017 profit would have been €16,522 thousand<br />

(11%) higher or €10,873 thousand (-7%) lower while<br />

equity would have been €60,492 thousand (6%) higher<br />

or €32,553 thousand (-3%) lower. In 2016, if the<br />

Euro had weakened or strengthened the profit<br />

would have been €18,543 thousand (14%) higher<br />

or €13,651 thousand (-11%) lower while equity<br />

would have been €66,008 thousand (7%) higher or<br />

€34,275 thousand (-4%) lower.<br />

2017<br />

Note 16 – Risk management and financial derivatives<br />

IN THOUSANDS OF EUR<br />

IF EURO WEAKENS<br />

IF EURO STRENGTHENS<br />

16.1 Risk management<br />

A. Market risk<br />

Exposure to currency risk<br />

Around 54% of the Group’s revenue is generated by<br />

subsidiaries with a functional currency other than the<br />

Euro (54% in 2016). The Group has its main foreign<br />

exchange exposure in the following foreign currencies:<br />

Argentinean peso, Chilean peso, Colombian peso,<br />

Nigerian naira, Peruvian nuevo sol and Pound sterling.<br />

Translation currency sensitivity analysis<br />

On the basis of the volatility of these currencies against<br />

the Euro in 2017, the reasonably possible change of the<br />

exchange rate of these currencies against the Euro is<br />

estimated as follows:<br />

PROFIT EQUITY PROFIT EQUITY<br />

Argentinean peso 4,462 9,837 -2,937 -6,475<br />

Chilean peso -663 12,715 533 -3,545<br />

Colombian peso 446 7,142 -335 -5,364<br />

Nigerian naira 5,432 26,247 -2,631 -12,711<br />

Peruvian nuevo sol 1,033 10,167 -821 -8,081<br />

Pound sterling 5,812 -5,616 -4,682 3,623<br />

Total 16,522 60,492 -10,873 -32,553<br />

2016<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

IN THOUSANDS OF EUR<br />

IF EURO WEAKENS<br />

IF EURO STRENGTHENS<br />

CLOSING RATE<br />

31 DECEMBER 2017<br />

AVERAGE RATE<br />

2017<br />

POSSIBLE VOLATILITY<br />

OF RATES IN %<br />

RANGE OF POSSIBLE CLOSING<br />

RATES 31 DECEMBER 2017<br />

RANGE OF POSSIBLE<br />

AVERAGE RATES 2017<br />

Argentinean peso 22.3663 18.7749 21 17.7575 - 26.9751 14.9062 - 22.6437<br />

Chilean peso (000) 0.7373 0.7330 11 0.6572 - 0.8173 0.6534 - 0.8126<br />

Colombian peso (000) 3.5787 3.3384 14 3.07 - 4.0874 2.8638 - 3.8129<br />

Nigerian naira 367.0460 351.2407 35 239.5159 - 494.5761 229.2021 - 473.2793<br />

Peruvian nuevo sol 3.9180 3.6854 11 3.4702 - 4.3658 3.2642 - 4.1066<br />

Pound sterling 0.8872 0.8769 8 0.8174 - 0.9571 0.8079 - 0.9459<br />

PROFIT EQUITY PROFIT EQUITY<br />

Argentinean peso -2,706 9,137 1,712 -5,781<br />

Chilean peso 3,544 11,767 -2,736 -9,089<br />

Colombian peso 1,770 9,899 -1,237 -6,917<br />

Nigerian naira 2,348 35,820 -853 -13,007<br />

Peruvian nuevo sol 7,149 13,257 -5,351 -9,923<br />

Pound sterling 6,438 -13,872 -5,186 10,442<br />

Total 18,543 66,008 -13,651 -34,275<br />

128 129