ENERGY Caribbean Yearbook (2013-14)

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Countries<br />

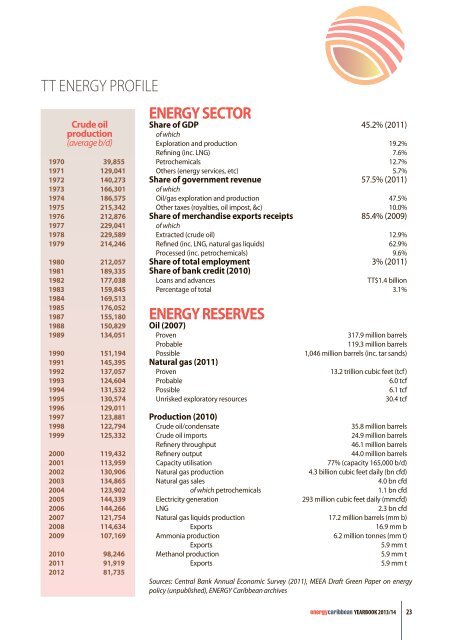

TT energy profile<br />

Crude oil<br />

production<br />

(average b/d)<br />

1970 39,855<br />

1971 129,041<br />

1972 <strong>14</strong>0,273<br />

1973 166,301<br />

1974 186,575<br />

1975 215,342<br />

1976 212,876<br />

1977 229,041<br />

1978 229,589<br />

1979 2<strong>14</strong>,246<br />

1980 212,057<br />

1981 189,335<br />

1982 177,038<br />

1983 159,845<br />

1984 169,513<br />

1985 176,052<br />

1987 155,180<br />

1988 150,829<br />

1989 134,051<br />

1990 151,194<br />

1991 <strong>14</strong>5,395<br />

1992 137,057<br />

1993 124,604<br />

1994 131,532<br />

1995 130,574<br />

1996 129,011<br />

1997 123,881<br />

1998 122,794<br />

1999 125,332<br />

2000 119,432<br />

2001 113,959<br />

2002 130,906<br />

2003 134,865<br />

2004 123,902<br />

2005 <strong>14</strong>4,339<br />

2006 <strong>14</strong>4,266<br />

2007 121,754<br />

2008 1<strong>14</strong>,634<br />

2009 107,169<br />

2010 98,246<br />

2011 91,919<br />

2012 81,735<br />

<strong>ENERGY</strong> SECTOR<br />

Share of GDP 45.2% (2011)<br />

of which<br />

Exploration and production 19.2%<br />

Refining (inc. LNG) 7.6%<br />

Petrochemicals 12.7%<br />

Others (energy services, etc) 5.7%<br />

Share of government revenue 57.5% (2011)<br />

of which<br />

Oil/gas exploration and production 47.5%<br />

Other taxes (royalties, oil impost, &c) 10.0%<br />

Share of merchandise exports receipts 85.4% (2009)<br />

of which<br />

Extracted (crude oil) 12.9%<br />

Refined (inc. LNG, natural gas liquids) 62.9%<br />

Processed (inc. petrochemicals) 9.6%<br />

Share of total employment 3% (2011)<br />

Share of bank credit (2010)<br />

Loans and advances<br />

TT$1.4 billion<br />

Percentage of total 3.1%<br />

<strong>ENERGY</strong> RESERVES<br />

Oil (2007)<br />

Proven<br />

Probable<br />

Possible<br />

Natural gas (2011)<br />

Proven<br />

Probable<br />

Possible<br />

Unrisked exploratory resources<br />

317.9 million barrels<br />

119.3 million barrels<br />

1,046 million barrels (inc. tar sands)<br />

13.2 trillion cubic feet (tcf)<br />

6.0 tcf<br />

6.1 tcf<br />

30.4 tcf<br />

Production (2010)<br />

Crude oil/condensate<br />

35.8 million barrels<br />

Crude oil imports<br />

24.9 million barrels<br />

Refinery throughput<br />

46.1 million barrels<br />

Refinery output<br />

44.0 million barrels<br />

Capacity utilisation<br />

77% (capacity 165,000 b/d)<br />

Natural gas production<br />

4.3 billion cubic feet daily (bn cfd)<br />

Natural gas sales<br />

4.0 bn cfd<br />

of which petrochemicals<br />

1.1 bn cfd<br />

Electricity generation<br />

293 million cubic feet daily (mmcfd)<br />

LNG<br />

2.3 bn cfd<br />

Natural gas liquids production 17.2 million barrels (mm b)<br />

Exports<br />

16.9 mm b<br />

Ammonia production 6.2 million tonnes (mm t)<br />

Exports<br />

5.9 mm t<br />

Methanol production<br />

5.9 mm t<br />

Exports<br />

5.9 mm t<br />

Sources: Central Bank Annual Economic Survey (2011), MEEA Draft Green Paper on energy<br />

policy (unpublished), <strong>ENERGY</strong> <strong>Caribbean</strong> archives<br />

energycaribbean YEARBOOK <strong>2013</strong>/<strong>14</strong><br />

23