2004 Annual Report - Benetton Group

2004 Annual Report - Benetton Group

2004 Annual Report - Benetton Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

N OTES TO TH E C O N SO LI DATE D F I NANC IAL STATE M E NTS<br />

86<br />

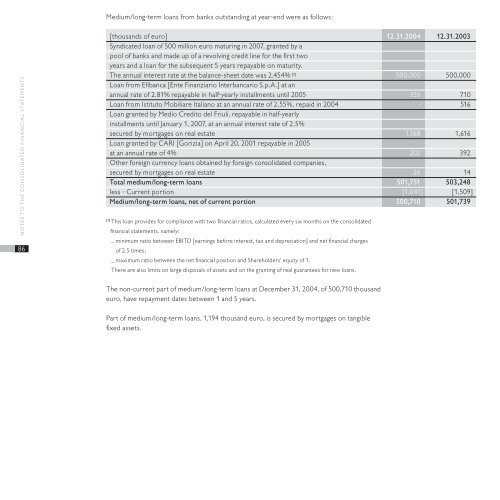

Medium/long-term loans from banks outstanding at year-end were as follows:<br />

[thousands of euro] 12.31.<strong>2004</strong> 12.31.2003<br />

Syndicated loan of 500 million euro maturing in 2007, granted by a<br />

pool of banks and made up of a revolving credit line for the first two<br />

years and a loan for the subsequent 5 years repayable on maturity.<br />

The annual interest rate at the balance-sheet date was 2.454% [1] 500,000 500,000<br />

Loan from Efibanca [Ente Finanziario Interbancario S.p.A.] at an<br />

annual rate of 2.81% repayable in half-yearly installments until 2005 355 710<br />

Loan from Istituto Mobiliare Italiano at an annual rate of 2.55%, repaid in <strong>2004</strong> - 516<br />

Loan granted by Medio Credito del Friuli, repayable in half-yearly<br />

installments until January 1, 2007, at an annual interest rate of 2.5%<br />

secured by mortgages on real estate 1,168 1,616<br />

Loan granted by CARI [Gorizia] on April 20, 2001 repayable in 2005<br />

at an annual rate of 4% 202 392<br />

Other foreign currency loans obtained by foreign consolidated companies,<br />

secured by mortgages on real estate 26 14<br />

Total medium/long-term loans 501,751 503,248<br />

less - Current portion [1,041] [1,509]<br />

Medium/long-term loans, net of current portion 500,710 501,739<br />

[1] This loan provides for compliance with two financial ratios, calculated every six months on the consolidated<br />

financial statements, namely:<br />

_ minimum ratio between EBITD [earnings before interest, tax and depreciation] and net financial charges<br />

of 2.5 times;<br />

_ maximum ratio between the net financial position and Shareholders’ equity of 1.<br />

There are also limits on large disposals of assets and on the granting of real guarantees for new loans.<br />

The non-current part of medium/long-term loans at December 31, <strong>2004</strong>, of 500,710 thousand<br />

euro, have repayment dates between 1 and 5 years.<br />

Part of medium/long-term loans, 1,194 thousand euro, is secured by mortgages on tangible<br />

fixed assets.