BizBahrain Magazine July-August 2018

Bahrain's leading online business news magazine about Real estate , Banking, Technology , Government , Telecom and Technology sector.

Bahrain's leading online business news magazine about Real estate , Banking, Technology , Government , Telecom and Technology sector.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Focus Feature | Economic Development<br />

competitiveness of small players.<br />

While the government is making key<br />

efforts to boost SMEs, access to credit<br />

remains a challenge. According to Oxford<br />

Business Group’s Business Barometer:<br />

Bahrain CEO Survey, released in March<br />

208, nearly 30% of executives surveyed<br />

described access to credit as difficult or<br />

very difficult. A 2016 study undertaken<br />

by the Bahrain Chamber of Commerce<br />

and Industry similarly found lack of<br />

fi n a n c e t o b e o n e o f t h e m a i n f a c t o r s<br />

hindering SME development, while the<br />

World Bank’s latest ‘Doing Business’<br />

report cited credit access as a key issue<br />

affecting private sector growth. Although<br />

Bahrain ranked 66th out of 190 countries<br />

in the <strong>2018</strong> ease of doing business index,<br />

it ranked 105th in getting credit.<br />

The country, however, has stepped<br />

in with a series of initiatives to bail<br />

out SMEs. In March last year the<br />

Bahrain Bourse established the Bahrain<br />

Investment Market (BIM), a platform<br />

focusing on SMEs. To attract growing<br />

companies, the BIM has more relaxed<br />

listing requirements, including lower<br />

minimum capital limits and fees.<br />

Businesses looking to list on the<br />

platform also only need a minimum of<br />

three shareholders, compared to 100<br />

on the main exchange. Furthermore,<br />

the Bahrain Development Bank, which<br />

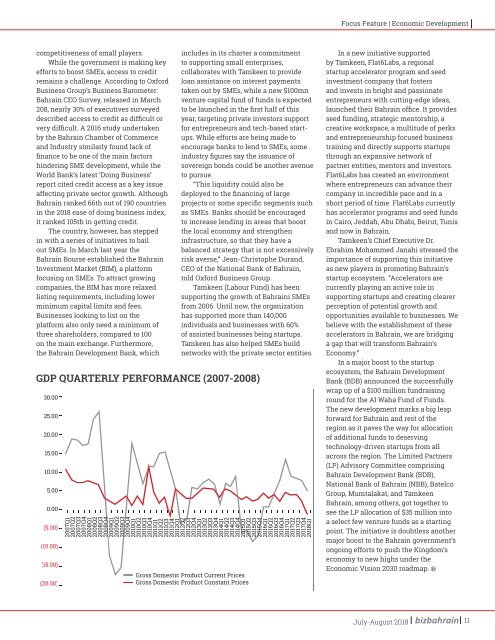

30.00<br />

25.00<br />

20.00<br />

15.00<br />

10.00<br />

5.00<br />

0.00<br />

(5.00)<br />

(10.00)<br />

(15.00)<br />

(20.00)<br />

2007Q1<br />

2007Q2<br />

2007Q3<br />

2007Q4<br />

2008Q1<br />

2008Q2<br />

includes in its charter a commitment<br />

to supporting small enterprises,<br />

collaborates with Tamkeen to provide<br />

loan assistance on interest payments<br />

taken out by SMEs, while a new $100mn<br />

venture capital fund of funds is expected<br />

to be launched in the first half of this<br />

year, targeting private investors support<br />

for entrepreneurs and tech-based startups.<br />

While efforts are being made to<br />

encourage banks to lend to SMEs, some<br />

industry figures say the issuance of<br />

sovereign bonds could be another avenue<br />

to pursue.<br />

“This liquidity could also be<br />

deployed to the financing of large<br />

projects or some specific segments such<br />

as SMEs. Banks should be encouraged<br />

to increase lending in areas that boost<br />

the local economy and strengthen<br />

infrastructure, so that they have a<br />

balanced strategy that is not excessively<br />

risk averse,” Jean-Christophe Durand,<br />

CEO of the National Bank of Bahrain,<br />

told Oxford Business Group.<br />

Tamkeen (Labour Fund) has been<br />

supporting the growth of Bahraini SMEs<br />

from 2006. Until now, the organization<br />

has supported more than 140,000<br />

individuals and businesses with 60%<br />

of assisted businesses being startups.<br />

Tamkeen has also helped SMEs build<br />

networks with the private sector entities.<br />

GDP QUARTERLY PERFORMANCE (2007-2008)<br />

2008Q3<br />

2008Q4<br />

2009Q1<br />

2009Q2<br />

2009Q3<br />

2009Q4<br />

2010Q1<br />

2010Q2<br />

2010Q3<br />

2010Q4<br />

2011Q1<br />

2011Q2<br />

2011Q3<br />

2011Q4<br />

2012Q1<br />

2012Q2<br />

2012Q3<br />

2012Q4<br />

2013Q1<br />

2013Q2<br />

2013Q3<br />

2013Q4<br />

2014Q1<br />

2014Q2<br />

2014Q3<br />

2014Q4<br />

2015Q1<br />

2015Q2<br />

2015Q3<br />

2015Q4<br />

2016Q1<br />

2016Q2<br />

2016Q3<br />

2016Q4<br />

2017Q1<br />

2017Q2<br />

2017Q3<br />

2017Q4<br />

<strong>2018</strong>Q1<br />

Gross Domestic Product Current Prices<br />

Gross Domestic Product Constant Prices<br />

In a new initiative supported<br />

by Tamkeen, Flat6Labs, a regional<br />

startup accelerator program and seed<br />

investment company that fosters<br />

and invests in bright and passionate<br />

entrepreneurs with cutting-edge ideas,<br />

launched their Bahrain office. It provides<br />

seed funding, strategic mentorship, a<br />

creative workspace, a multitude of perks<br />

and entrepreneurship focused business<br />

training and directly supports startups<br />

through an expansive network of<br />

partner entities, mentors and investors.<br />

Flat6Labs has created an environment<br />

where entrepreneurs can advance their<br />

company in incredible pace and in a<br />

short period of time. Flat6Labs currently<br />

has accelerator programs and seed funds<br />

in Cairo, Jeddah, Abu Dhabi, Beirut, Tunis<br />

and now in Bahrain.<br />

Tamkeen’s Chief Executive Dr.<br />

Ebrahim Mohammed Janahi stressed the<br />

importance of supporting this initiative<br />

as new players in promoting Bahrain’s<br />

startup ecosystem. “Accelerators are<br />

currently playing an active role in<br />

supporting startups and creating clearer<br />

perception of potential growth and<br />

opportunities available to businesses. We<br />

believe with the establishment of these<br />

accelerators in Bahrain, we are bridging<br />

a gap that will transform Bahrain’s<br />

Economy.”<br />

In a major boost to the startup<br />

ecosystem, the Bahrain Development<br />

Bank (BDB) announced the successfully<br />

wrap up of a $100 million fundraising<br />

round for the Al Waha Fund of Funds.<br />

The new development marks a big leap<br />

forward for Bahrain and rest of the<br />

region as it paves the way for allocation<br />

of additional funds to deserving<br />

technology-driven startups from all<br />

across the region. The Limited Partners<br />

(LP) Advisory Committee comprising<br />

Bahrain Development Bank (BDB),<br />

National Bank of Bahrain (NBB), Batelco<br />

Group, Mumtalakat, and Tamkeen<br />

Bahrain, among others, got together to<br />

see the LP allocation of $35 million into<br />

a select few venture funds as a starting<br />

point. The initiative is doubtless another<br />

major boost to the Bahrain government’s<br />

ongoing efforts to push the Kingdom’s<br />

economy to new highs under the<br />

Economic Vision 2030 roadmap.<br />

<strong>July</strong>-<strong>August</strong> <strong>2018</strong><br />

11