Fortune

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FOCUS<br />

INVEST<br />

or the 2011 toppling of Muammar Qaddafi<br />

in Libya—stock markets typically recover<br />

within five days. Still, geopolitics become a<br />

financial threat when they create stressful<br />

long-term conditions that hurt companies’<br />

profits and discourage investment. That’s why,<br />

of all the items on the global-strife laundry<br />

list, analysts worry most about trade wars.<br />

Most economists agree that restrictive tarifs<br />

hurt growth—and could do more damage<br />

today, when more companies rely on global<br />

sales and supply chains to sustain profits. The<br />

restrictions often backfire on the industries<br />

they’re designed to protect: In the 1980s, for<br />

example, the U.S. placed tarifs on steel from<br />

Japan, but 10 of the 11 largest U.S. steel producers<br />

saw negative equity returns from 1982<br />

to 1986, according to the Brookings Institution.<br />

The current environment has an added<br />

wrinkle, notes Tina Fordham, chief global<br />

political analyst at Citi: Countries have considered<br />

microtargeting sanctions at specific companies<br />

or subsectors. It isn’t hard to envision,<br />

for example, China retaliating against Trump<br />

administration tarifs by punishing Boeing,<br />

which got 13% of its sales from China last year.<br />

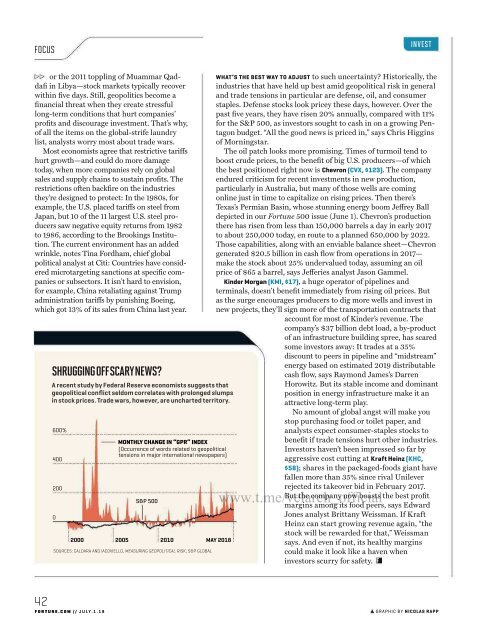

SHRUGGINGOFFSCARYNEWS?<br />

A recent study by Federal Reserve economists suggests that<br />

geopolitical conflict seldom correlates with prolonged slumps<br />

in stock prices. Trade wars, however, are uncharted territory.<br />

600%<br />

400<br />

200<br />

0<br />

MONTHLY CHANGE IN “GPR” INDEX<br />

(Occurrence of words related to geopolitical<br />

tensions in major international newspapers)<br />

S&P 500<br />

2000 2005 2010 MAY 2018<br />

SOURCES: CALDARA AND IACOVIELLO, MEASURING GEOPOLITICAL RISK; S&P GLOBAL<br />

WHAT’S THE BEST WAY TO ADJUST to such uncertainty? Historically, the<br />

industries that have held up best amid geopolitical risk in general<br />

and trade tensions in particular are defense, oil, and consumer<br />

staples. Defense stocks look pricey these days, however. Over the<br />

past five years, they have risen 20% annually, compared with 11%<br />

for the S&P 500, as investors sought to cash in on a growing Pentagon<br />

budget. “All the good news is priced in,” says Chris Higgins<br />

of Morningstar.<br />

The oil patch looks more promising. Times of turmoil tend to<br />

boost crude prices, to the benefit of big U.S. producers—of which<br />

the best positioned right now is Chevron (CVX, $123). The company<br />

endured criticism for recent investments in new production,<br />

particularly in Australia, but many of those wells are coming<br />

online just in time to capitalize on rising prices. Then there’s<br />

Texas’s Permian Basin, whose stunning energy boom Jefrey Ball<br />

depicted in our<strong>Fortune</strong> 500 issue (June 1). Chevron’s production<br />

there has risen from less than 150,000 barrels a day in early 2017<br />

to about 250,000 today, en route to a planned 650,000 by 2022.<br />

Those capabilities, along with an enviable balance sheet—Chevron<br />

generated $20.5 billion in cash flow from operations in 2017—<br />

make the stock about 25% undervalued today, assuming an oil<br />

price of $65 a barrel, says Jeferies analyst Jason Gammel.<br />

Kinder Morgan (KMI, $17), a huge operator of pipelines and<br />

terminals, doesn’t benefit immediately from rising oil prices. But<br />

as the surge encourages producers to dig more wells and invest in<br />

new projects, they’ll sign more of the transportation contracts that<br />

account for most of Kinder’s revenue. The<br />

company’s $37 billion debt load, a by-product<br />

of an infrastructure building spree, has scared<br />

some investors away: It trades at a 35%<br />

discount to peers in pipeline and “midstream”<br />

energy based on estimated 2019 distributable<br />

cash flow, says Raymond James’s Darren<br />

Horowitz. But its stable income and dominant<br />

position in energy infrastructure make it an<br />

attractive long-term play.<br />

No amount of global angst will make you<br />

stop purchasing food or toilet paper, and<br />

analysts expect consumer-staples stocks to<br />

benefit if trade tensions hurt other industries.<br />

Investors haven’t been impressed so far by<br />

aggressive cost cutting at Kraft Heinz (KHC,<br />

$58); shares in the packaged-foods giant have<br />

fallen more than 35% since rival Unilever<br />

rejected its takeover bid in February 2017.<br />

But the company now boasts the best profit<br />

www.t.me/velarch_official<br />

margins among its food peers, says Edward<br />

Jones analyst Brittany Weissman. If Kraft<br />

Heinz can start growing revenue again, “the<br />

stock will be rewarded for that,” Weissman<br />

says. And even if not, its healthy margins<br />

could make it look like a haven when<br />

investors scurry for safety.<br />

42<br />

FORTUNE.COM<br />

// JULY.1.18<br />

GRAPHIC BY NICOLAS RAPP