BANCO MERCANTIL (SCHWEIZ) AG ZURICH Report of the Group ...

BANCO MERCANTIL (SCHWEIZ) AG ZURICH Report of the Group ...

BANCO MERCANTIL (SCHWEIZ) AG ZURICH Report of the Group ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

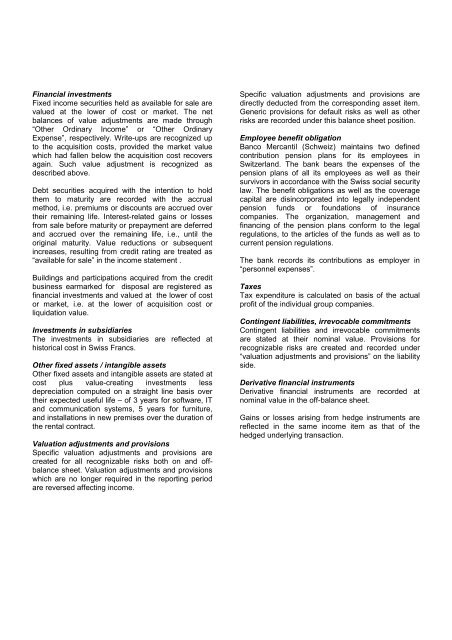

Financial investments<br />

Fixed income securities held as available for sale are<br />

valued at <strong>the</strong> lower <strong>of</strong> cost or market. The net<br />

balances <strong>of</strong> value adjustments are made through<br />

“O<strong>the</strong>r Ordinary Income” or “O<strong>the</strong>r Ordinary<br />

Expense”, respectively. Write-ups are recognized up<br />

to <strong>the</strong> acquisition costs, provided <strong>the</strong> market value<br />

which had fallen below <strong>the</strong> acquisition cost recovers<br />

again. Such value adjustment is recognized as<br />

described above.<br />

Debt securities acquired with <strong>the</strong> intention to hold<br />

<strong>the</strong>m to maturity are recorded with <strong>the</strong> accrual<br />

method, i.e. premiums or discounts are accrued over<br />

<strong>the</strong>ir remaining life. Interest-related gains or losses<br />

from sale before maturity or prepayment are deferred<br />

and accrued over <strong>the</strong> remaining life, i.e., until <strong>the</strong><br />

original maturity. Value reductions or subsequent<br />

increases, resulting from credit rating are treated as<br />

“available for sale” in <strong>the</strong> income statement .<br />

Buildings and participations acquired from <strong>the</strong> credit<br />

business earmarked for disposal are registered as<br />

financial investments and valued at <strong>the</strong> lower <strong>of</strong> cost<br />

or market, i.e. at <strong>the</strong> lower <strong>of</strong> acquisition cost or<br />

liquidation value.<br />

Investments in subsidiaries<br />

The investments in subsidiaries are reflected at<br />

historical cost in Swiss Francs.<br />

O<strong>the</strong>r fixed assets / intangible assets<br />

O<strong>the</strong>r fixed assets and intangible assets are stated at<br />

cost plus value-creating investments less<br />

depreciation computed on a straight line basis over<br />

<strong>the</strong>ir expected useful life – <strong>of</strong> 3 years for s<strong>of</strong>tware, IT<br />

and communication systems, 5 years for furniture,<br />

and installations in new premises over <strong>the</strong> duration <strong>of</strong><br />

<strong>the</strong> rental contract.<br />

Valuation adjustments and provisions<br />

Specific valuation adjustments and provisions are<br />

created for all recognizable risks both on and <strong>of</strong>fbalance<br />

sheet. Valuation adjustments and provisions<br />

which are no longer required in <strong>the</strong> reporting period<br />

are reversed affecting income.<br />

Specific valuation adjustments and provisions are<br />

directly deducted from <strong>the</strong> corresponding asset item.<br />

Generic provisions for default risks as well as o<strong>the</strong>r<br />

risks are recorded under this balance sheet position.<br />

Employee benefit obligation<br />

Banco Mercantil (Schweiz) maintains two defined<br />

contribution pension plans for its employees in<br />

Switzerland. The bank bears <strong>the</strong> expenses <strong>of</strong> <strong>the</strong><br />

pension plans <strong>of</strong> all its employees as well as <strong>the</strong>ir<br />

survivors in accordance with <strong>the</strong> Swiss social security<br />

law. The benefit obligations as well as <strong>the</strong> coverage<br />

capital are disincorporated into legally independent<br />

pension funds or foundations <strong>of</strong> insurance<br />

companies. The organization, management and<br />

financing <strong>of</strong> <strong>the</strong> pension plans conform to <strong>the</strong> legal<br />

regulations, to <strong>the</strong> articles <strong>of</strong> <strong>the</strong> funds as well as to<br />

current pension regulations.<br />

The bank records its contributions as employer in<br />

“personnel expenses”.<br />

Taxes<br />

Tax expenditure is calculated on basis <strong>of</strong> <strong>the</strong> actual<br />

pr<strong>of</strong>it <strong>of</strong> <strong>the</strong> individual group companies.<br />

Contingent liabilities, irrevocable commitments<br />

Contingent liabilities and irrevocable commitments<br />

are stated at <strong>the</strong>ir nominal value. Provisions for<br />

recognizable risks are created and recorded under<br />

“valuation adjustments and provisions” on <strong>the</strong> liability<br />

side.<br />

Derivative financial instruments<br />

Derivative financial instruments are recorded at<br />

nominal value in <strong>the</strong> <strong>of</strong>f-balance sheet.<br />

Gains or losses arising from hedge instruments are<br />

reflected in <strong>the</strong> same income item as that <strong>of</strong> <strong>the</strong><br />

hedged underlying transaction.