Financial Statement - Banco Mercantil

Financial Statement - Banco Mercantil

Financial Statement - Banco Mercantil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

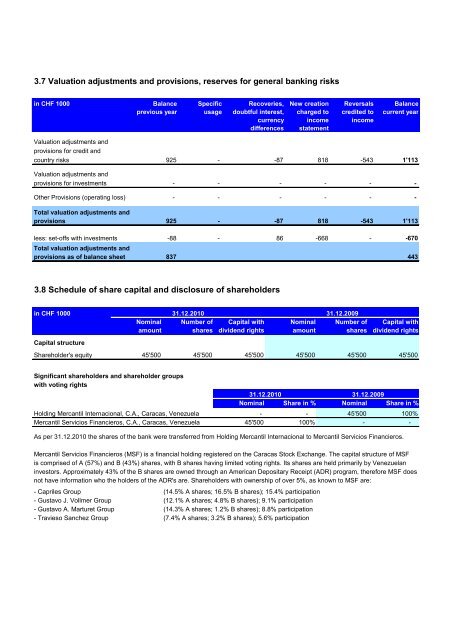

3.7 Valuation adjustments and provisions, reserves for general banking risks<br />

in CHF 1000 Balance<br />

previous year<br />

Valuation adjustments and<br />

provisions for credit and<br />

country risks 925<br />

Specific<br />

usage<br />

Recoveries,<br />

doubtful interest,<br />

currency<br />

differences<br />

- -87<br />

New creation<br />

charged to<br />

income<br />

statement<br />

818<br />

Reversals<br />

credited to<br />

income<br />

-543<br />

Balance<br />

current year<br />

Valuation adjustments and<br />

provisions for investments - - - - - -<br />

Other Provisions (operating loss) - - - - - -<br />

Total valuation adjustments and<br />

provisions 925<br />

less: set-offs with investments -88<br />

Total valuation adjustments and<br />

provisions as of balance sheet 837<br />

- -87<br />

- 86<br />

3.8 Schedule of share capital and disclosure of shareholders<br />

in CHF 1000<br />

Capital structure<br />

Nominal<br />

amount<br />

Shareholder's equity 45'500<br />

Significant shareholders and shareholder groups<br />

with voting rights<br />

Number of<br />

shares<br />

Capital with<br />

dividend rights<br />

Nominal<br />

amount<br />

818<br />

-668<br />

31.12.2010 31.12.2009<br />

45'500<br />

45'500<br />

45'500<br />

-543<br />

Number of<br />

shares<br />

45'500<br />

1'113<br />

1'113<br />

- -670<br />

443<br />

Capital with<br />

dividend rights<br />

45'500<br />

31.12.2010 31.12.2009<br />

Nominal Share in % Nominal Share in %<br />

Holding <strong>Mercantil</strong> Internacional, C.A., Caracas, Venezuela - - 45'500<br />

100%<br />

<strong>Mercantil</strong> Servicios Financieros, C.A., Caracas, Venezuela 45'500<br />

100% - -<br />

As per 31.12.2010 the shares of the bank were transferred from Holding <strong>Mercantil</strong> Internacional to <strong>Mercantil</strong> Servicios Financieros.<br />

<strong>Mercantil</strong> Servicios Financieros (MSF) is a financial holding registered on the Caracas Stock Exchange. The capital structure of MSF<br />

is comprised of A (57%) and B (43%) shares, with B shares having limited voting rights. Its shares are held primarily by Venezuelan<br />

investors. Approximately 43% of the B shares are owned through an American Depositary Receipt (ADR) program, therefore MSF does<br />

not have information who the holders of the ADR's are. Shareholders with ownership of over 5%, as known to MSF are:<br />

- Capriles Group (14.5% A shares; 16.5% B shares); 15.4% participation<br />

- Gustavo J. Vollmer Group (12.1% A shares; 4.8% B shares); 9.1% participation<br />

- Gustavo A. Marturet Group (14.3% A shares; 1.2% B shares); 8.8% participation<br />

- Travieso Sanchez Group (7.4% A shares; 3.2% B shares); 5.6% participation