Credit Management September 2018

The CICM magazine for consumer and commercial credit professionals

The CICM magazine for consumer and commercial credit professionals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

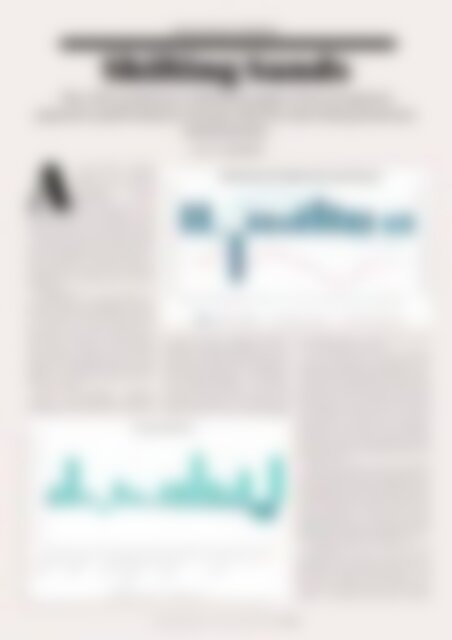

EXCLUSIVE REPORT<br />

Shifting Sands<br />

The UK economy is showing signs of inconsistent<br />

payment performance across sectors and rising business<br />

insolvencies.<br />

AUTHOR – Nalanda Matia<br />

AS the global economy<br />

trudges on scattered<br />

with uncertainties and<br />

headwinds, growth<br />

performance of the<br />

UK economy had been<br />

broadly positive. The competitive value<br />

of the pound has boosted UK exports and<br />

inbound tourism, in turn giving a boost<br />

to overall UK GDP growth that should<br />

continue through <strong>2018</strong> and possibly 2019.<br />

Dun & Bradstreet’s forecast for year-onyear<br />

(YoY) growth in real GDP remains at<br />

a stable rate of 1.4 percent and 1.6 percent<br />

through the end of this year and in 2019<br />

respectively.<br />

Unemployment is also expected to<br />

drop and remain at manageable levels for<br />

the UK economy, with inflation expected<br />

to inch down and take some pressure off<br />

the economy as a whole. However, the<br />

Eurozone economy has slowed recently.<br />

Any further escalation of international<br />

trade tensions involving the new tariff<br />

barriers that businesses around the world<br />

involved in cross-border trade are being<br />

subject to could dampen global growth in<br />

2019 and beyond.<br />

Some forward-looking indicators<br />

continue to ease, signalling a somewhat<br />

challenging macroeconomic environment<br />

in the year ahead. Eurostat's Industrial<br />

Confidence Indicator dropped to just 0.1<br />

in March, only narrowly above the neutral<br />

0-points line and the lowest reading since<br />

October 2016. Furthermore, consumers are<br />

still curtailing spending – a consequence<br />

of the elevated inflation rate. Several<br />

insolvencies among retail chains and<br />

increasing problems for so-called 'casual<br />

dining' chains in recent weeks highlight<br />

the elevated levels of credit risk in some<br />

parts of the British economy.<br />

On a positive note, the UK Government<br />

has been successful in pushing the EU<br />

Withdrawal Bill through Parliament in June.<br />

A last-minute compromise with rebels from<br />

within the Government meant that the law<br />

passed with a narrow majority and received<br />

royal assent on 26 June. The bill will repeal<br />

the European Communities Act from 1972<br />

and provides the legal base for Brexit.<br />

Although the adoption of the Withdrawal<br />

Bill creates more clarity about the Brexit<br />

roadmap, it remains unclear what the EU-UK<br />

trade and investment relationship will look<br />

like after Brexit.<br />

Given the divisions within Parliament<br />

(and indeed between the Government's inner<br />

core of ministers) it seems unlikely that any<br />

swift progress on the issue will be made. Dun<br />

& Bradstreet expects some progress towards<br />

the EU summit in October, as this is the<br />

final opportunity for a deal, given that any<br />

agreement will have to be voted on by the<br />

British and the European Parliament before<br />

the UK leaves the EU on 29 March 2019.<br />

Switching from the state of the<br />

macroeconomy to that of the micro, it’s<br />

important to consider the percent of prompt<br />

payments by major industry groups – and<br />

how these industries have fared in this<br />

respect over the past year and the previous<br />

quarter. It seems that the past 12 months<br />

The Recognised Standard / www.cicm.com / <strong>September</strong> <strong>2018</strong> / PAGE 42