CONTACT Magazine (Vol.18 No.2 – September 2018)

The second issue of the rebranded CONTACT Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce. This issue focuses on digitalisation and the digital imperative

The second issue of the rebranded CONTACT Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce. This issue focuses on digitalisation and the digital imperative

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This electronic financial transaction system allows users to operate in a cashless<br />

environment by using an app on their mobile phone to access and manipulate<br />

funds. From this single, central digital location, users can perform transactions that<br />

would normally require cash, such as merchant purchases, bill payments, topping up<br />

mobile phones, and even government business like paying for driver’s permits and<br />

work visas.<br />

Verification of transactions, to ensure that they are compliant, is undertaken<br />

by ECH’s sister company Global Processing Centre, the only indigenous international<br />

processing centre in the region.<br />

Persaud says: “This technology has just begun to infiltrate the Caribbean. The<br />

major driver is the millions of persons who are unbanked or underbanked, and limited<br />

to a cash-only system. This digital model has proven to be a powerful catalyst for<br />

economic growth in other developing markets.”<br />

One of SugaPay’s unique features is that its digital mobile wallet offers<br />

customers several physical touch points, including the use of an ATM card. Since<br />

its launch in Trinidad and Tobago in 2017, SugaPay has worked initially with local<br />

credit unions, which for the first time will be able to offer their members access to<br />

a fully integrated payment ecosystem.<br />

SugaPay already has a presence in Montserrat, with plans for Jamaica, Barbados,<br />

Suriname and Guyana. “Although Trinidad and Tobago has one of the highest GDPs<br />

in the Caribbean,” Persaud says, “it lags behind some of our sister islands in the<br />

adoption of technology. So introducing new fintech and building demand for a<br />

seismic shift of this nature has been challenging.”<br />

WiPay<br />

Launched in Trinidad and Tobago in 2017, WiPay allows users to convert cash to digital<br />

currency, which can be used to make electronic payments online wherever WiPay is<br />

accepted. People excluded from digital transactions because they did not have a credit<br />

card, debit card or bank account, have been the most affected so far.With operations<br />

expanding Grenada, Guyana, Haiti, Jamaica and St. Lucia, WiPay has worked with<br />

several local and regional corporations and the Trinidad and Tobago government.<br />

Payment platforms are integrated by combining the services of the regulated financial<br />

institutions with WiPay’s proprietary technology. Point-of-sales terminals can now be<br />

integrated with the most commonly used card payment terminals.<br />

WiPay also provides distinctive wristbands to facilitate contactless payments.<br />

In addition, it’s new “pay with a smile” concept allows users to combine biometrics<br />

with a 4-digit PIN in order to make payments. As part of an initiative with the<br />

judiciary in Trinidad and Tobago, CourtPay was launched in April <strong>2018</strong>, to introduce<br />

digital payments to the process of making and collecting maintenance payments,<br />

with plans to add court fines and fees.<br />

Aldwyn Wayne, WiPay’s CEO, says: “WiPay is expanding its services across the<br />

Caribbean and to other developing countries. We want to provide financial inclusion<br />

for people from all walks of life. We want to become the trusted digital financial<br />

network connecting Caribbean people as well as the diaspora.”<br />

Bitt<br />

Bitt, a fintech company based in Barbados, is focused on financial inclusion in the<br />

Caribbean, particularly for the unbanked and underbanked. By reducing the cost of<br />

payments and transfers, including remittances, Bitt can help countries reduce their<br />

reliance on the US dollar for trade, thus improving the ease of doing business in the<br />

Caribbean, and safeguarding foreign reserves.<br />

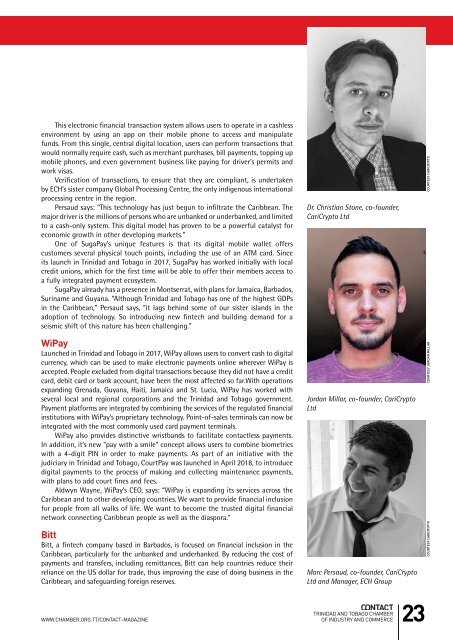

Dr. Christian Stone, co-founder,<br />

CariCrypto Ltd<br />

Jordan Millar, co-founder, CariCrypto<br />

Ltd<br />

Marc Persaud, co-founder, CariCrypto<br />

Ltd and Manager, ECH Group<br />

courtesy Caricrypto<br />

courtesy jordan millar<br />

courtesy Caricrypto<br />

www.chamber.org.tt/contact-magazine 23<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce