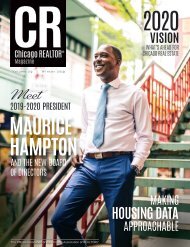

CR Magazine – Autumn 2018

The official publication of the Chicago Association of REALTORS®.

The official publication of the Chicago Association of REALTORS®.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Structuring Your Business<br />

Starting a real estate business can be intimidating. Setting your<br />

business up for success starts by setting up your business. Here are<br />

some considerations to make before stepping off on your own.<br />

Define Your Objectives<br />

Why are you creating your own company instead of working for<br />

someone else? What will make your brokerage stand apart? Are you<br />

prepared to walk into a lawyer’s office and set up your company?<br />

The main differences between them are how commissions are<br />

handled and how employees are treated for tax implications.<br />

Traditional brokerages are the most common among REALTORS ® ,<br />

with nearly three-quarters splitting a commission between the agent<br />

and the brokerage, as of 2015. 100% Commission, a brokerage type<br />

where agents pay a monthly fee to the brokerage and keep the full<br />

commission, makes up 1 in 5 brokerages in the country, according to<br />

2015 NAR data.<br />

Chicago attorney Adam Wilde, Wilde Law Group, LLC, said having<br />

these ideas in mind is a great start.<br />

“The first thing I would recommend is a clear objective of ownership,”<br />

Wilde said.<br />

Wilde said a beginning broker should ask themselves if they’re<br />

looking to establish a sole ownership, develop into a team or have<br />

employees.<br />

“A broker should also consider any assets they want to put into the<br />

business, start-up capital, insurance transfers, account transfers,<br />

vehicle registration transfers [and] lease assignability (if they have<br />

their own workspace or office),” he said.<br />

Types of Brokerage<br />

Decide if your brokerage structure goes hand-in-hand with your<br />

objective of ownership. Will your firm franchise or not franchise?<br />

According to the National Association of REALTORS ® , the vast<br />

majority of firms in the U.S. are independent and non-franchised.<br />

NAR breaks down brokerage models into four common categories:<br />

• Traditional<br />

• Flat Fee<br />

• A La Carte<br />

• 100% Commission<br />

Traditional and 100% Commission brokerages typically treat agents<br />

as independent contractors, which affects a brokerage’s tax liability.<br />

Nearly 86 percent of REALTORS ® affiliated with a firm are treated<br />

as independent contractors, according to 2017 NAR data. Laws<br />

vary by state on how agents are classified and what constitutes<br />

an independent contractor. In Illinois, beginning brokers should<br />

ensure they’re conforming to the requirements of the Real Estate<br />

License Act of 2000 and any other laws that apply, like the Fair Labor<br />

Standards Act.<br />

Consider Tax Structure<br />

Speaking of tax classification, your brokerage will have different<br />

tax liabilities depending on its structure. Some common business<br />

organizations include limited liability companies (LLCs), corporations<br />

and S corporations.<br />

Wilde recommends that REALTORS ® consider setting up their<br />

business as a single-member LLC.<br />

“If you’re set up as an LLC, you have the option of electing to be<br />

treated as an S Corporation for Federal tax purposes,” Wilde said.<br />

“If you do not elect this option, the default for a single-member LLC<br />

is to report your taxes as a sole proprietor on Schedule C of your<br />

personal tax return. Both structures serve as pass-through income<br />

when considering the new tax laws enacted under the Tax Cuts and<br />

Jobs Act.”