NHEG-Magazine-September-October

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.NewHeightsEducation.org<br />

www.NewHeightsEducation.org<br />

Clarifying that student loan borrowers should be allowed by trustees to make full loan payments during the chapter 13 repayment<br />

period, which typically lasts five years<br />

Student Loan<br />

Debt is Getting<br />

Ugly<br />

Agreeing to discharge the tax bill that a borrower in a federal student loan repayment program could face in 25 years for<br />

forgiven debt<br />

Encouraging lawyers to join nonprofit groups that represent student loan borrowers for free<br />

While many of these judicial debt-relief strategies provide some benefit to those who have gone through the courts, by and<br />

large, the effects represent only a trivial nibbling around the edges of a much, much bigger problem.<br />

The Government Is the Problem<br />

The bigger problem is that the U.S. government is in the business of making student loans in the first place, where it has<br />

cumulatively borrowed more than a trillion dollars to be in that business. Because of its own massive borrowing, Uncle<br />

Sam cannot afford to let many student loan borrowers off the federal hook.<br />

That’s why when the government has provided relief to its stressed student loan borrowers, it has done so in the form<br />

of income-based repayment plans, which trade regular student loan payments for what amounts to a special additional<br />

income tax levied on the borrower.<br />

By Craig Eyermann<br />

Tuesday, June 26, 2018<br />

On May 31, 2018, the total public debt outstanding of the U.S. government stood at $21.145 trillion dollars. Of that amount,<br />

$1.211 trillion was borrowed so that Uncle Sam could be in the business of making student loans.<br />

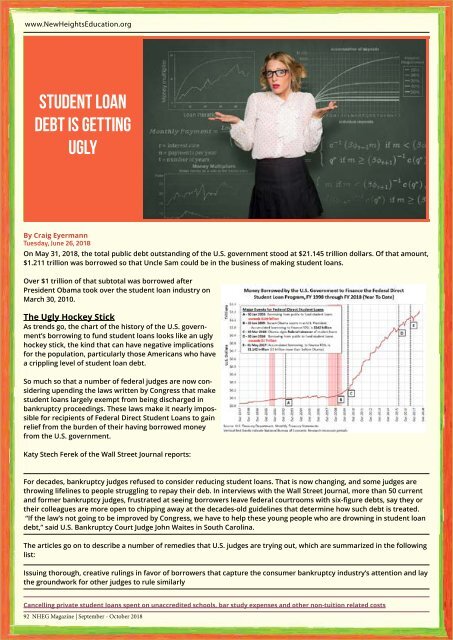

Over $1 trillion of that subtotal was borrowed after<br />

President Obama took over the student loan industry on<br />

March 30, 2010.<br />

The Ugly Hockey Stick<br />

As trends go, the chart of the history of the U.S. government’s<br />

borrowing to fund student loans looks like an ugly<br />

hockey stick, the kind that can have negative implications<br />

for the population, particularly those Americans who have<br />

a crippling level of student loan debt.<br />

So much so that a number of federal judges are now considering<br />

upending the laws written by Congress that make<br />

student loans largely exempt from being discharged in<br />

bankruptcy proceedings. These laws make it nearly impossible<br />

for recipients of Federal Direct Student Loans to gain<br />

relief from the burden of their having borrowed money<br />

from the U.S. government.<br />

There is a solution. The U.S. government can return the student loan business to the private sector, allowing lenders and<br />

academic institutions to assume the primary risks for when their students might default on their loans.<br />

At the same time, Congress should rewrite the nation’s laws to once again make student loans fully dischargeable through<br />

bankruptcy proceedings. Just like almost every other kind of debt.<br />

Until it does, that ugly hockey stick is only going to get uglier.unschooler, but after writing back and forth to the girl, he<br />

realized that he liked both the girl and the writing! He became increasingly passionate about writing, ultimately majoring<br />

in journalism in college and becoming a successful journalist.<br />

When learning is connected to living, it is meaningful. It is not something that occurs at certain times, in certain places,<br />

with certain people. It occurs all the time, everywhere, and with everyone around us. Unschooling allows natural learning<br />

to occur by providing the time, space, support, and opportunity for interests to emerge and talents to sprout.<br />

With unschooling, reading, writing, and arithmetic become purposeful activities connected to personal interests and<br />

motivations.<br />

Writing letters is enjoyable and important when it is necessary for your own purposes. Writing letters when someone else<br />

tells you to—when it is forced—may not be so fun or helpful. As Plato warns: "Knowledge which is acquired under compulsion<br />

obtains no hold on the mind."<br />

Source: The Foundation for Economic Education (FEE)<br />

https://fee.org/<br />

Katy Stech Ferek of the Wall Street Journal reports:<br />

For decades, bankruptcy judges refused to consider reducing student loans. That is now changing, and some judges are<br />

throwing lifelines to people struggling to repay their deb. In interviews with the Wall Street Journal, more than 50 current<br />

and former bankruptcy judges, frustrated at seeing borrowers leave federal courtrooms with six-figure debts, say they or<br />

their colleagues are more open to chipping away at the decades-old guidelines that determine how such debt is treated.<br />

“If the law’s not going to be improved by Congress, we have to help these young people who are drowning in student loan<br />

debt,” said U.S. Bankruptcy Court Judge John Waites in South Carolina.<br />

The articles go on to describe a number of remedies that U.S. judges are trying out, which are summarized in the following<br />

list:<br />

Issuing thorough, creative rulings in favor of borrowers that capture the consumer bankruptcy industry’s attention and lay<br />

the groundwork for other judges to rule similarly<br />

Cancelling private student loans spent on unaccredited schools, bar study expenses and other non-tuition related costs<br />

92 <strong>NHEG</strong> <strong>Magazine</strong> | <strong>September</strong> - <strong>October</strong> 2018<br />

<strong>September</strong> - <strong>October</strong> 2018 | <strong>NHEG</strong> <strong>Magazine</strong> 93