Annual Report 2003 - Modern Times Group MTG AB

Annual Report 2003 - Modern Times Group MTG AB

Annual Report 2003 - Modern Times Group MTG AB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes<br />

60<br />

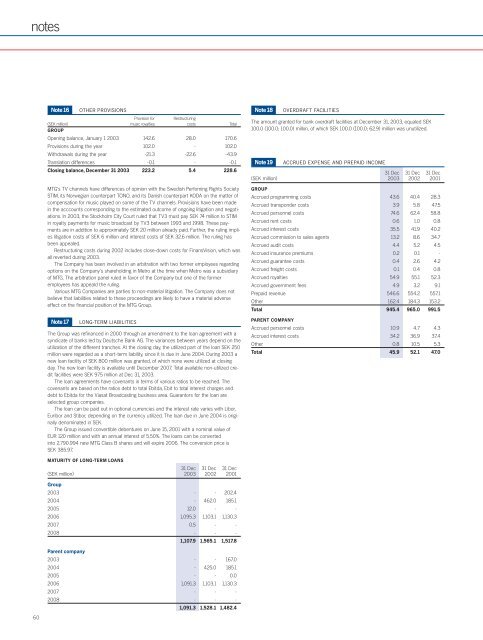

Note 16 OTHER PROVISIONS<br />

Provision for Restructuring<br />

(SEK million)<br />

GROUP<br />

music royalties costs Total<br />

Opening balance, January 1 <strong>2003</strong> 142.6 28.0 170.6<br />

Provisions during the year 102.0 - 102.0<br />

Withdrawals during the year -21.3 -22.6 -43.9<br />

Translation differences -0.1 - -0.1<br />

Closing balance, December 31 <strong>2003</strong> 223.2 5.4 228.6<br />

<strong>MTG</strong>’s TV channels have differences of opinion with the Swedish Perfoming Rights Society<br />

STIM, its Norwegian counterpart TONO, and its Danish counterpart KODA on the matter of<br />

compensation for music played on some of the TV channels. Provisions have been made<br />

in the acccounts corresponding to the estimated outcome of ongoing litigation and negotiations.<br />

In <strong>2003</strong>, the Stockholm City Court ruled that TV3 must pay SEK 74 million to STIM<br />

in royalty payments for music broadcast by TV3 between 1993 and 1998. These payments<br />

are in addition to approximately SEK 20 million already paid. Further, the ruling implies<br />

litigation costs of SEK 6 million and interest costs of SEK 32.6 million. The ruling has<br />

been appealed.<br />

Restructuring costs during 2002 includes close-down costs for FinansVision, which was<br />

all reverted during <strong>2003</strong>.<br />

The Company has been involved in an arbitration with two former employees regarding<br />

options on the Company’s shareholding in Metro at the time when Metro was a subsidiary<br />

of <strong>MTG</strong>. The arbitration panel ruled in favor of the Company but one of the former<br />

employees has appeald the ruling.<br />

Various <strong>MTG</strong> Companies are parties to non-material litigation. The Company does not<br />

believe that liabilities related to these proceedings are likely to have a material adverse<br />

effect on the financial position of the <strong>MTG</strong> <strong>Group</strong>.<br />

Note 17 LONG-TERM LI<strong>AB</strong>ILITIES<br />

The <strong>Group</strong> was refinanced in 2000 through an amendment to the loan agreement with a<br />

syndicate of banks led by Deutsche Bank AG. The variances between years depend on the<br />

utilization of the different tranches. At the closing day, the utilized part of the loan SEK 250<br />

million were regarded as a short-term liability, since it is due in June 2004. During <strong>2003</strong> a<br />

new loan facility of SEK 800 million was granted, of which none were utilized at closing<br />

day. The new loan facility is available until December 2007. Total available non-utilized credit<br />

facilities were SEK 975 million at Dec 31, <strong>2003</strong>.<br />

The loan agreements have covenants in terms of various ratios to be reached. The<br />

covenants are based on the ratios debt to total Ebitda, Ebit to total interest charges and<br />

debt to Ebitda for the Viasat Broadcasting business area. Guarantors for the loan are<br />

selected group companies.<br />

The loan can be paid out in optional currencies and the interest rate varies with Libor,<br />

Euribor and Stibor, depending on the currency utilized. The loan due in June 2004 is originally<br />

denominated in SEK.<br />

The <strong>Group</strong> issued convertible debentures on June 15, 2001 with a nominal value of<br />

EUR 120 million and with an annual interest of 5.50%. The loans can be converted<br />

into 2.790.994 new <strong>MTG</strong> Class B shares and will expire 2006. The conversion price is<br />

SEK 385.97.<br />

MATURITY OF LONG-TERM LOANS<br />

31 Dec 31 Dec 31 Dec<br />

(SEK million)<br />

<strong>Group</strong><br />

<strong>2003</strong> 2002 2001<br />

<strong>2003</strong> - - 202.4<br />

2004 - 462.0 185.1<br />

2005 12.0 - -<br />

2006 1,095.3 1,103.1 1,130.3<br />

2007 0.5 - -<br />

2008 - - -<br />

1,107.9 1,565.1 1,517.8<br />

Parent company<br />

<strong>2003</strong> - - 167.0<br />

2004 - 425.0 185.1<br />

2005 - - 0.0<br />

2006 1,091.3 1,103.1 1,130.3<br />

2007 - - -<br />

2008 - - -<br />

1,091.3 1,528.1 1,482.4<br />

Note 18 OVERDRAFT FACILITIES<br />

The amount granted for bank overdraft facilities at December 31, <strong>2003</strong>, equaled SEK<br />

100.0 (100.0; 100.0) millon, of which SEK 100.0 (100.0; 62.9) million was unutilized.<br />

Note 19 ACCRUED EXPENSE AND PREPAID INCOME<br />

31 Dec 31 Dec 31 Dec<br />

(SEK million) <strong>2003</strong> 2002 2001<br />

GROUP<br />

Accrued programming costs 43.6 40.4 28.3<br />

Accrued transponder costs 3.9 5.8 47.5<br />

Accrued personnel costs 74.6 62.4 58.8<br />

Accrued rent costs 0.6 1.0 0.8<br />

Accrued interest costs 35.5 41.9 40.2<br />

Accrued commission to sales agents 13.2 8.6 34.7<br />

Accrued audit costs 4.4 5.2 4.5<br />

Accrued insurance premiums 0.2 0.1 -<br />

Accrued guarantee costs 0.4 2.6 4.2<br />

Accrued freight costs 0.1 0.4 0.8<br />

Accrued royalties 54.9 55.1 52.3<br />

Accrued government fees 4.9 3.2 9.1<br />

Prepaid revenue 546.6 554.2 557.1<br />

Other 162.4 184.3 153.2<br />

Total 945.4 965.0 991.5<br />

PARENT COMPANY<br />

Accrued personnel costs 10.9 4.7 4.3<br />

Accrued interest costs 34.2 36.9 37.4<br />

Other 0.8 10.5 5.3<br />

Total 45.9 52.1 47.0