Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

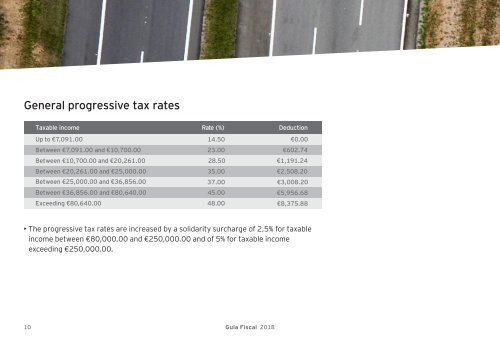

General progressive tax rates<br />

<strong>Tax</strong>able income<br />

Up to €7,091.00<br />

Between €7,091.00 and €10,700.00<br />

Between €10,700.00 and €20,261.00<br />

Between €20,261.00 and €25,000.00<br />

Between €25,000.00 and €36,856.00<br />

Between €36,856.00 and €80,640.00<br />

Exceeding €80,640.00<br />

Rate (%)<br />

14.50<br />

23.00<br />

28.50<br />

35.00<br />

37.00<br />

45.00<br />

48.00<br />

Deduction<br />

€0.00<br />

€602.74<br />

€1,191.24<br />

€2,508.20<br />

€3,008.20<br />

€5,956.68<br />

€8,375.88<br />

• The progressive tax rates are increased by a solidarity surcharge of 2,5% for taxable<br />

income between €80,000.00 and €250,000.00 and of 5% for taxable income<br />

exceeding €250,000.00.<br />

10 Guia Fiscal <strong>2018</strong>