Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

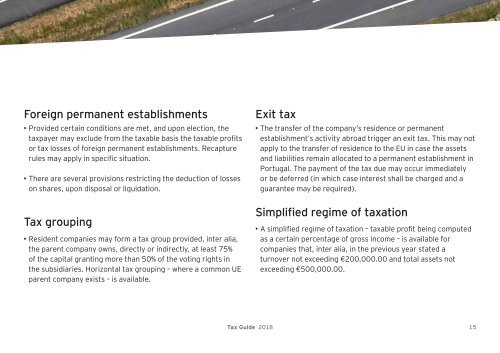

Foreign permanent establishments<br />

• Provided certain conditions are met, and upon election, the<br />

taxpayer may exclude from the taxable basis the taxable profits<br />

or tax losses of foreign permanent establishments. Recapture<br />

rules may apply in specific situation.<br />

• There are several provisions restricting the deduction of losses<br />

on shares, upon disposal or liquidation.<br />

<strong>Tax</strong> grouping<br />

• Resident companies may form a tax group provided, inter alia,<br />

the parent company owns, directly or indirectly, at least 75%<br />

of the capital granting more than 50% of the voting rights in<br />

the subsidiaries. Horizontal tax grouping – where a common UE<br />

parent company exists – is available.<br />

Exit tax<br />

• The transfer of the company’s residence or permanent<br />

establishment’s activity abroad trigger an exit tax. This may not<br />

apply to the transfer of residence to the EU in case the assets<br />

and liabilities remain allocated to a permanent establishment in<br />

Portugal. The payment of the tax due may occur immediately<br />

or be deferred (in which case interest shall be charged and a<br />

guarantee may be required).<br />

Simplified regime of taxation<br />

• A simplified regime of taxation – taxable profit being computed<br />

as a certain percentage of gross income – is available for<br />

companies that, inter alia, in the previous year stated a<br />

turnover not exceeding €200,000.00 and total assets not<br />

exceeding €500,000.00.<br />

<strong>Tax</strong> <strong>Guide</strong> <strong>2018</strong> 15