Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

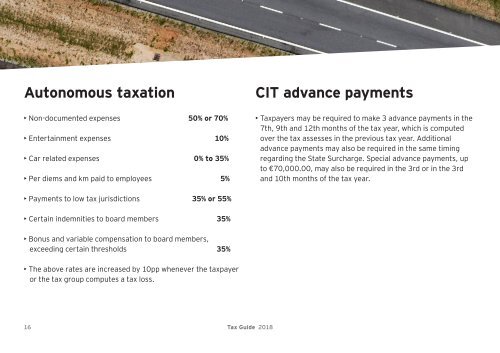

Autonomous taxation<br />

• Non-documented expenses 50% or 70%<br />

• Entertainment expenses 10%<br />

• Car related expenses 0% to 35%<br />

• Per diems and km paid to employees 5%<br />

CIT advance payments<br />

• <strong>Tax</strong>payers may be required to make 3 advance payments in the<br />

7th, 9th and 12th months of the tax year, which is computed<br />

over the tax assesses in the previous tax year. Additional<br />

advance payments may also be required in the same timing<br />

regarding the State Surcharge. Special advance payments, up<br />

to €70,000.00, may also be required in the 3rd or in the 3rd<br />

and 10th months of the tax year.<br />

• Payments to low tax jurisdictions 35% or 55%<br />

• Certain indemnities to board members 35%<br />

• Bonus and variable compensation to board members,<br />

exceeding certain thresholds 35%<br />

• The above rates are increased by 10pp whenever the taxpayer<br />

or the tax group computes a tax loss.<br />

16 <strong>Tax</strong> <strong>Guide</strong> <strong>2018</strong>