You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Proven Futures Trading Methods<br />

Based on Science and Reality<br />

Call for your free copy of our catalog today.<br />

We feature books, systems and Easy Language<br />

software available nowhere else.<br />

Reality Based Trading Company<br />

1731 Howe Avenue PMB-149<br />

Sacramento CA 95825-2209<br />

1-800-999-2827 or 1-530-677-7562<br />

Website: www.rb-trading.com<br />

E-mail: info@rb-trading.com<br />

Continuing The Bruce Babcock Legacy<br />

For more information circle No. 19<br />

time trend targets.<br />

The practical trading strategy will fi rst recognize the signal<br />

on the larger time frame and the trade will be executed on the<br />

smaller time frame to reduce capital exposure for the trade.<br />

In our next example, the initial trade set-up will be a go-short<br />

signal on the 60-minute data and the trade will then be executed<br />

on the next signal on the 15-minute data.<br />

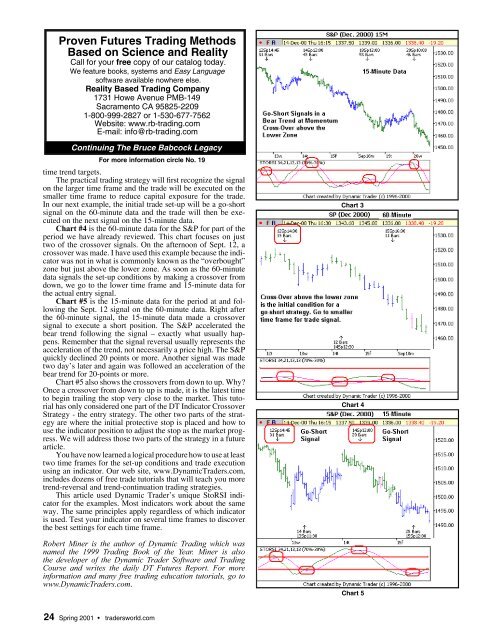

Chart #4 is the 60-minute data for the S&P for part of the<br />

period we have already reviewed. This chart focuses on just<br />

two of the crossover signals. On the afternoon of Sept. 12, a<br />

crossover was made. I have used this example because the indicator<br />

was not in what is commonly known as the “overbought”<br />

zone but just above the lower zone. As soon as the 60-minute<br />

data signals the set-up conditions by making a crossover from<br />

down, we go to the lower time frame and 15-minute data for<br />

the actual entry signal.<br />

Chart #5 is the 15-minute data for the period at and following<br />

the Sept. 12 signal on the 60-minute data. Right after<br />

the 60-minute signal, the 15-minute data made a crossover<br />

signal to execute a short position. The S&P accelerated the<br />

bear trend following the signal – exactly what usually happens.<br />

Remember that the signal reversal usually represents the<br />

acceleration of the trend, not necessarily a price high. The S&P<br />

quickly declined 20 points or more. Another signal was made<br />

two day’s later and again was followed an acceleration of the<br />

bear trend for 20-points or more.<br />

Chart #5 also shows the crossovers from down to up. Why?<br />

Once a crossover from down to up is made, it is the latest time<br />

to begin trailing the stop very close to the market. This tutorial<br />

has only considered one part of the DT Indicator Crossover<br />

Strategy - the entry strategy. The other two parts of the strategy<br />

are where the initial protective stop is placed and how to<br />

use the indicator position to adjust the stop as the market progress.<br />

We will address those two parts of the strategy in a future<br />

article.<br />

You have now learned a logical procedure how to use at least<br />

two time frames for the set-up conditions and trade execution<br />

using an indicator. Our web site, www.DynamicTraders.com,<br />

includes dozens of free trade tutorials that will teach you more<br />

trend-reversal and trend-continuation trading strategies.<br />

This article used Dynamic Trader’s unique StoRSI indicator<br />

for the examples. Most indicators work about the same<br />

way. The same principles apply regardless of which indicator<br />

is used. Test your indicator on several time frames to discover<br />

the best settings for each time frame.<br />

Robert Miner is the author of Dynamic Trading which was<br />

named the 1999 Trading Book of the Year. Miner is also<br />

the developer of the Dynamic Trader Software and Trading<br />

Course and writes the daily DT Futures Report. For more<br />

information and many free trading education tutorials, go to<br />

www.DynamicTraders.com.<br />

24 Spring 2001 tradersworld.com<br />

Chart 3<br />

Chart 4<br />

Chart 5